Mirova Energy Transition: Opportunities in Next-Generation Energy Infrastructure

ESG and Sustainable Investing

Responsible investment can make a difference, driving risk and financial performance, positive social and environmental change

Investing in the energy transition is not just beneficial: it is essential! Developing renewable energy, low carbon transportation and energy efficiency are the main levers that will help meet the goals set by the Paris Agreement. Institutional investors have a key role to play in financing the energy transition, which requires huge amount of capital.

Financing the energy transition means investing in tangible assets in power generation infrastructure such as wind farms, solar power plants, hydroelectric infrastructure and all associated storage solutions, as well as in energy use infrastructure: electric or hydrogen vehicle and fleets, as well as all the deployment of charging stations.

Energy transition infrastructure can offer access to a predictable, inflation-linked and stable cash flows with a low correlation to the economic cycles and financial markets. In a low interest rate environment, they can offer an attractive yield and k since building and commissioning times are much shorter than traditional infrastructures, they can offer a quicker return on investment. These investments are therefore an attractive tool for diversifying institutional clients’ portfolios.

There are massive requirements for financing: between now and 2030, nearly 1,700 billion euros are expected to be invested in Europe3. There are already a wide range of assets associated with energy transition infrastructure What’s more, with of the shift to low carbon mobility, there are a variety of different types of infrastructure and new energy technologies meaning this asset base is likely to become even more diversified.

Mirova is one of the top energy transition infrastructure investors in Europe3, with 20 years of experience in managing investment funds dedicated to the energy transition. Mirova manage 3.5 billion euros of assets invested on behalf of leading institutional investors in wind farms, solar plants, hydroelectric power, biomass, biogas, storage, electric mobility and soon in green hydrogen.

A Wide Range of Investment Opportunities

Involved from the very beginning in the financing of renewable-sourced energy production infrastructures, Mirova has a unique perspective on this market, contributing to projects that are new, whether in terms of technology, maturity or geography.

Mirova Energy Transition in a Nutshell

- A transition in motion:

- An evolving industry:

2) Innovation: growing number of solutions to the energy transmission, distribution & storage challenges enable integration of existing & emerging renewable technologies in energy systems.

3) Financing: mature renewable energy technologies allow a sound cash flow predictability.

- A diversifying asset class

Long-term investments in tangible assets with relatively steady, low volatile, inflation-linked cash flows.

- Favorable treatment under Solvency II:

Experienced investment team

- 20+ years experience in structuring & managing energy transition infrastructure fund: one of the longest track records in Europe through 5 investment funds successfully raised and deployed amounting to 3.5B€ of AUM

- 1,000+ projects financed, representing 5.8GW of installed capacity financed in 19 European & OECD countries

- All team members have a robust background in energy transition, core skills in financing, sourcing, structuring and in asset management

Pioneer in energy transition projects

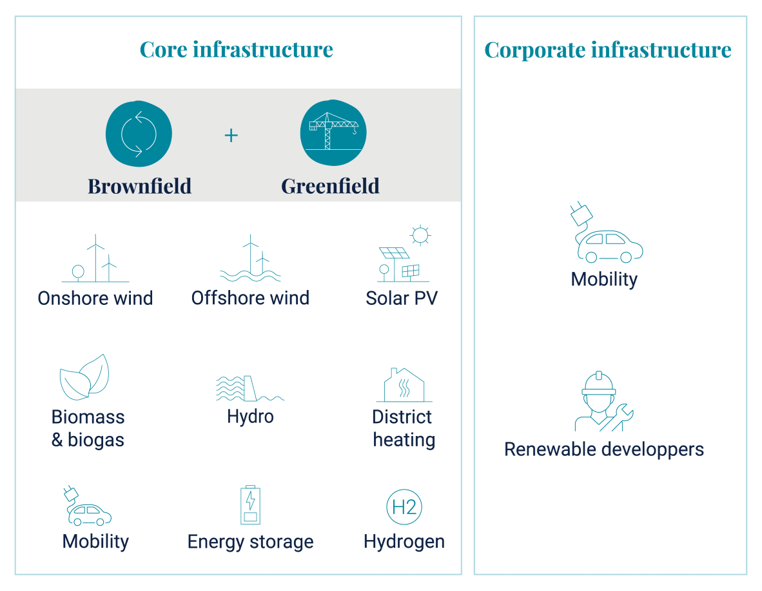

- Exposure to Core – Greenfield/ Brownfield infrastructure – and to corporate infrastructure through mobility or renewable developers, mainly in Europe

- Long-term partnerships & co-investing with industrials to create a strong alignment of interests & secure proprietary deal flow

- Responsive & flexible approach to deal structuring to best match the project developer’s expectations: equity and/or mezzanine

- J curve mitigation through investments in quickly operational greenfield projects blended with operating brownfield assets or through mezzanine that enables quick value enhancement & cash flow generation allowing early repayment to investors

- Merchant exposure managed through a diversified approach of electricity market mechanisms and securing regulated or private offtake agreements (PPA)

- Mix of yield-driven & value creation performance (revenues from the asset ongoing operation ; investments sold within 7-10 years)

- Hands-on approach to asset management: renegotiation of maintenance and operating contracts, refinancing capabilities, representation on the governing bodies of the project companies

An impact-driven approach

- Build a 100% low-carbon, climate resilient (compatible with a 2°C1 climate scenario2) & maximising job creations

- Pioneering lifecycle approach to environmental, social & biodiversity risks/opportunities assessment

- Innovative opt-in impact scheme to finance non-profit projects related to fight against energy poverty & energy access & sponsor biodiversity research programmes

- Affiliate: Mirova

- Type: Illiquid

- Asset type: Assets (60%-70%) & Corporate Infrastructure (30%-40%)

- Region: Europe and residually (max 15%) in other OECD countries

- Sector diversification: • Assets, Corporate Infrastructure

- Maturity: 12 years (+2 years)

- Main risks: Capital loss, economic, market, liquidity, project, credit, electricity network, operational, regulatory, counterparty & compliance, sustainability risks

• Sectors: Solar PV, Hydro, Onshore & Offshore Wind, Biomass & Biogas, Mobility, Energy storage, Hydrogen & e-fuels, Energy efficiency

• Geographies: Mainly Europe, opportunistically Asia-Pacific (local presence)

Discover the Thinking of Mirova on the Energy Transition:

2 https://www.infrastructureinvestor.com/ii-50-infras-resilience-shines-through-in-its-fundraising/

3 Based on financial assumptions. These do not constitute a contractual commitment from Mirova and shall not engage its responsibility. Investments in real asset portfolios are reserved for specific investors, as defined by their respective regulatory documentation, and are mainly subject to loss of capital risk. Mirova reserves the right to modify the information presented at any time without notice, and in particular anything relating to the description of the investment process, which under no circumstances constitutes a commitment from Mirova.

Published in September 2023.

Mirova

Affiliate of Natixis Investment Managers French Public Limited liability company

Share Capital: €8,813,860

Regulated by the Autorité des Marchés Financiers (AMF) under n° GP 02014.

RCS Paris n° 394 648 216

59 avenue Pierre Mendès France

www.mirova.com

Natixis Investment Managers

RCS Paris 453 952 681

Share Capital: €178 251 690

43 avenue Pierre Mendès France

75013 Paris

www.im.natixis.com

This communication is for information only and is intended for investment service providers or other Professional Clients. The analyses and opinions referenced herein represent the subjective views of the author as referenced unless stated otherwise and are subject to change. There can be no assurance that developments will transpire as may be forecasted in this material.

Copyright © 2023 Natixis Investment Managers S.A. – All rights reserved