Our Clients

Established Relationships Worldwide

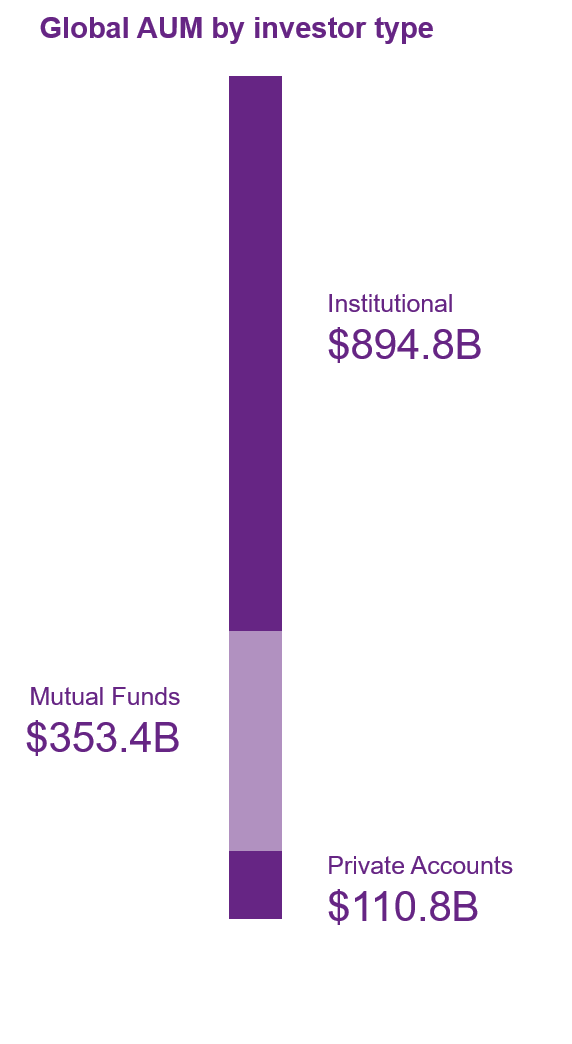

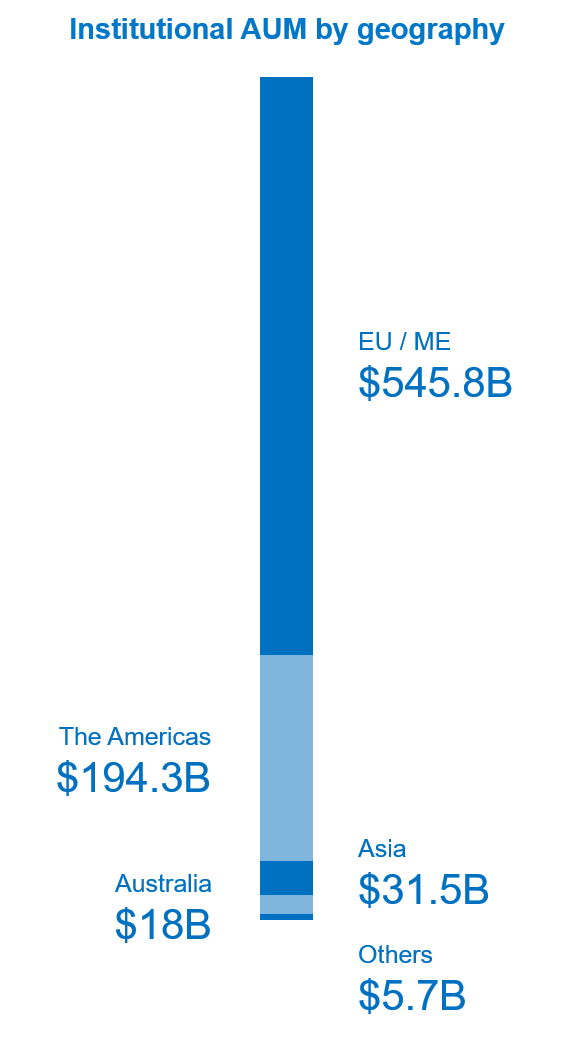

All types of institutional investors rely on our partnership, resources, and wide spectrum of investment solutions to help them optimize risk and returns in portfolios, as well as manage current assets and meet future liabilities.

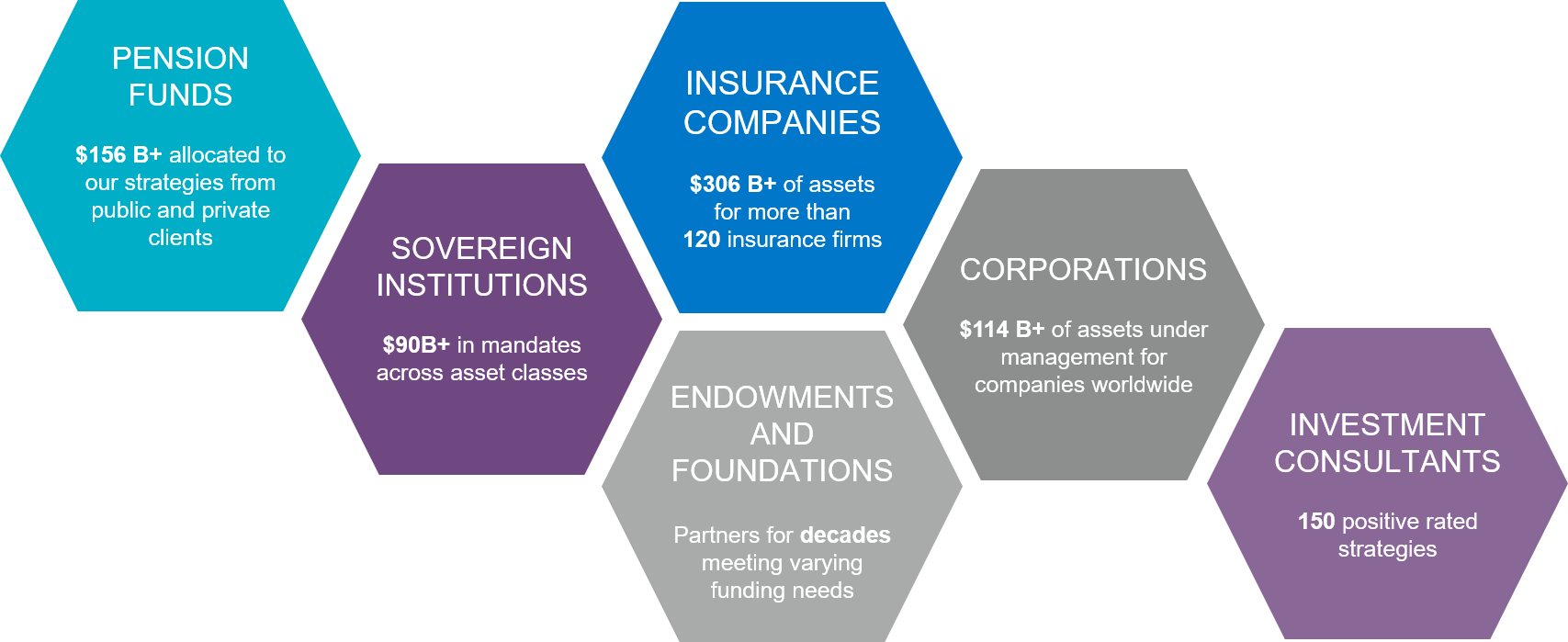

With in-depth knowledge of both defined benefit and defined contribution plans, public and private pension clients currently allocate more than $156B+ to our strategies.

Understanding financial, accounting and regulatory complexities is key to helping insurers achieve their goals. Today, we manage $306B+ of assets for more than 120 insurance firms.

Eight of the ten world’s largest sovereign wealth funds and central banks have awarded us mandates across asset classes. Government-related entities globally have invested $90B+ in our strategies.

For decades, investors with long-term goals partner with us to establish and meet their varying funding needs.

Collaborating closely with companies worldwide enables us to help them match short-term and long-term investment needs with strategies that fit their risk tolerance. As of today, we manage more than $114B+ of assets for corporates.

Strong relationships with investment consultants and their clients globally have been established from our extensive number of positive product and strategy ratings. Mandates include traditional “best advice”, discretionary, advisory, and fiduciary.