Aligning Investment Goals with Targeted Solutions for Better Outcomes

Access a Broad Spectrum of Investment Capabilities

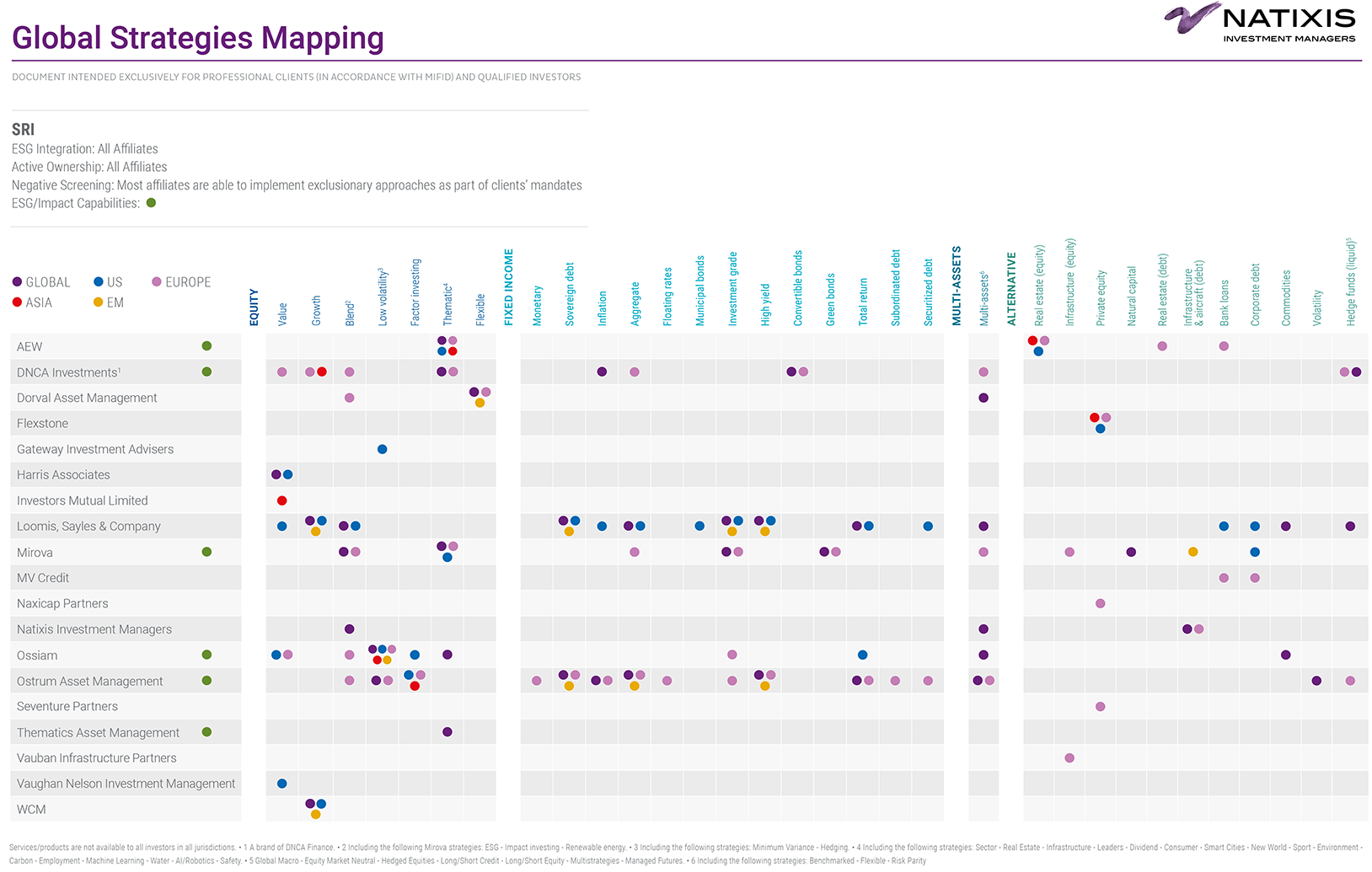

Our multi-affiliate model offers active investment solutions from over 20 high-conviction investment managers. Providing institutional clients with access to a range of managers, each with its own unique process and culture, helps capitalize on the diverse and unconventional thinking that can lead to alpha generation.- More than 20 independent investment managers in the Americas, UK, and Asia

- 200-plus investment strategies

- More than 150 investment strategies positively rated by global investment consultants1

Document intended exclusively for professional clients (in accordance with mifid) and qualified investors. Services/products are not available to all investors in all jurisdictions. • 1 A brand of DNCA Finance. • 2 Including the following Mirova strategies: ESG - Impact investing - Renewable energy. • 3 Including the following strategies: Minimum Variance - Hedging. • 4 Including the following strategies: Sector - Real Estate - Infrastructure - Leaders - Dividend - Consumer - Smart Cities - New World - Sport - Environment - Carbon - Employment - Machine Learning - Water - AI/Robotics - Safety. • 5 Equity and fixed income strategies benchmarked but have no Tracking Error constraint. They are exposed to currencies and potentially use a high level of leverage. • 6 Global Macro - Equity Market Neutral - Hedged Equities - Long/Short Credit - Long/Short Equity - Multistrategies - Managed Futures. • 7 Including the following strategies: Benchmarked - Flexible - Risk Parity

Document intended exclusively for professional clients (in accordance with mifid) and qualified investors. Services/products are not available to all investors in all jurisdictions. • 1 A brand of DNCA Finance. • 2 Including the following Mirova strategies: ESG - Impact investing - Renewable energy. • 3 Including the following strategies: Minimum Variance - Hedging. • 4 Including the following strategies: Sector - Real Estate - Infrastructure - Leaders - Dividend - Consumer - Smart Cities - New World - Sport - Environment - Carbon - Employment - Machine Learning - Water - AI/Robotics - Safety. • 5 Equity and fixed income strategies benchmarked but have no Tracking Error constraint. They are exposed to currencies and potentially use a high level of leverage. • 6 Global Macro - Equity Market Neutral - Hedged Equities - Long/Short Credit - Long/Short Equity - Multistrategies - Managed Futures. • 7 Including the following strategies: Benchmarked - Flexible - Risk ParityComplex Times Call for Innovative Portfolio Solutions

Challenging markets, new regulatory constraints, and shifting demographics are making institutional investors ask more of their asset managers. At Natixis, our innovative mindset combined with our wide range of investment expertise across more than 20 affiliated managers enables us to deliver active investment solutions designed to meet your specific challenges.Our institutional clients are supported through all market environments, with single or multiple asset class solutions, a best-in-class multi-affiliate model, and targeted portfolio construction to address both liabilities and assets. Clients may use our broad array of solutions in isolation or in any number of combinations. Every investment solution has been created with one aim only: to produce better investment outcomes.

Investment solutions provided to our international clients' accounts represent more than $100 billion in assets.2

2 Source: Natixis Investment Managers, as of March 31, 2020, including $45+ Bn under advisory.