Private Assets: Making the Retail Revolution a Reality

ELTIF 2.0 has opened the door, it is up to the financial sector to help retail investors walk through it.

Highlights

- Retail investors have traditionally been excluded from private markets, even though these markets represent more than 80% of the economy and offer higher long term returns1 on average than publicly-listed assets.

- With the introduction of ELTIF 2.0 in 2024, there’s now an efficient route for retail investors to tap private markets for the first time, with the potential for evergreen funds, which are closer to the UCITS structures retail investors are familiar with.

- Retail investors expect a range of different private asset types and strategies to diversify their allocations. But few investment firms can offer the right combination of specialized and highly focused management teams, or centralised structuring capabilities that can address the diversity of retail demand over a vast spectrum of private asset classes.

Most retail investors have traditionally been locked out of private markets, not only because of regulatory limits, but because of a lack of knowledge and investments structured entirely to suit large organisations. There are good reasons for this: the asset classes are more complex, the amounts invested are much higher and the transactions take place in private, based on trust and an ability to act fast. But it also represents a massive, missed opportunity. Something recent regulation seeks to redress.

As Nicolas Audhoui-Darthenay, Head of Private Assets Product at Natixis Investment Managers (Natixis IM) points out: “The reality is that more than 80% of the economy is made up of companies which are not quoted or traded on public markets. This is a huge chunk of assets which individual investors haven’t been able to access until now. That’s a missed opportunity, not only for those investors, but also for economic development.”

Why private assets should be in investors’ crosshairs

Innovations, including those addressing ESG challenges, are often driven by fast-growing and dynamic companies that are privately-held. These companies are typically only accessible by institutional and, to some extent, ultra-high-net-worth investors, through private asset funds.

“While the risks are higher, these kinds of companies often offer higher returns,” says Audhoui-Darthenay. In addition to rapidly-growing companies, this higher return profile2 can be attributed to a complexity premium (additional yield required to place complex products due to the lower number of potential buyers) and an illiquidity premium (additional yield required to place illiquid products due to the lower number of potential buyers). The addition of private assets to a portfolio can also provide diversification benefits, reducing overall volatility and downside risk.

The challenges of offering private assets to individual investors

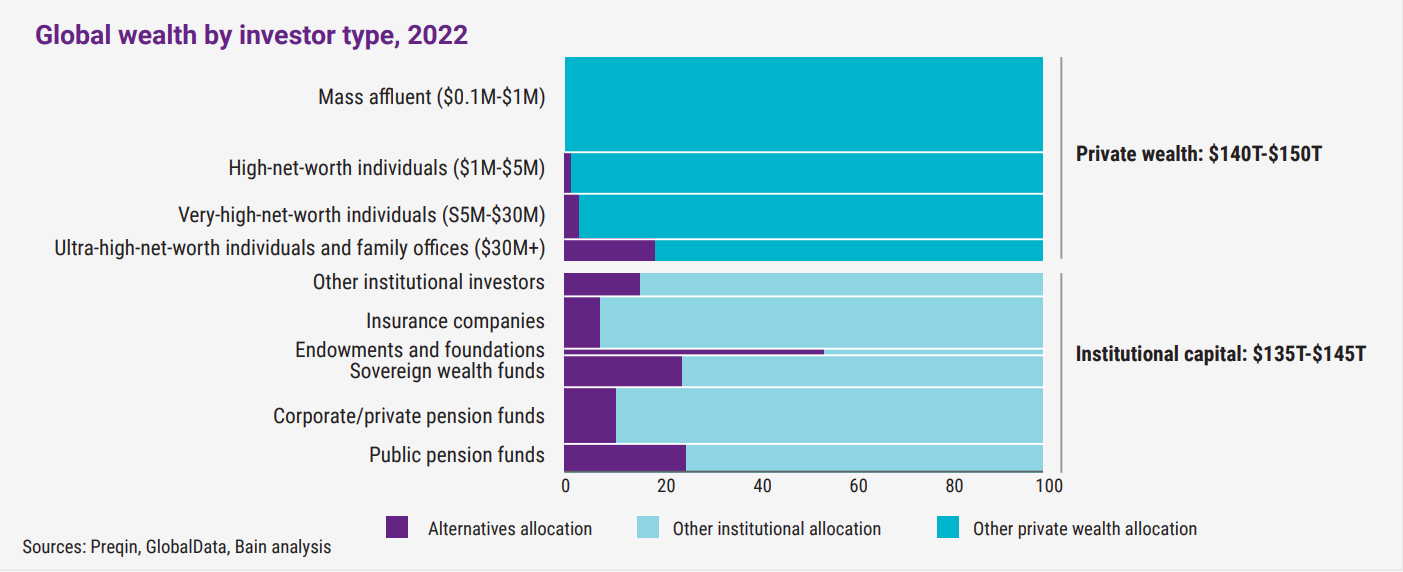

While some family offices and high-net-worth individuals (to a lesser extent) have allocations to private assets, retail exposure (including mass affluent) is statistically zero.

Audhoui-Darthenay says: “That is incredible. If you put all pension and institutional money together, it’s the same as the sum of all private wealth. That means that half of the world’s capital is effectively being forced to sit on the sidelines, unable to invest in the companies that make up the bulk of the economy.”

Education is a significant challenge, as most individual investors understanding of both the risks and opportunities afforded by private assets is low. But the other a key hurdle has been the lack of funds adapted to individual investors. Among the deterrence are closed-ended structures, capital calls and minimum tickets.

For instance, mass affluent investors prefer to retain some access to their savings “just in case” – even for their long-term investments – but typical closed-ended private asset funds do not meet this requirement. Similarly, high minimum tickets has been a barrier.

Another deterrence is that money earmarked for private assets is often not deployed immediately. Instead, it is only called to fund a project or asset purchase when the opportunity arises. “Individual investors are not set up to get a stream of significant capital calls at short notice,” says Audhoui-Darthenay.

Asset managers have a central role to play to offer suitable solutions, with evergreen funds for mass affluent and/or closed-ended structures fitted for high-net-worth individuals, to drive this enormous financing capacity to innovative projects and companies, helping to solve challenges such as re-industrialization or social and environmental impacts.

The changing private assets landscape

The landscape is changing with regulations and fund structures moving in favour of individual investors.

An eye-catching shift is the relaunch of the EU’s European Long-Term Investment Funds (ELTIFs). ELTIF 2.0 provides a way for retail investors to tap private markets on a large scale for the first time.

ELTIFs originally appeared in 2015, with the aim of financing the real economy by channelling non-institutional capital to long-term projects and SMEs. However, they have raised less than 10 billion Euros to date from individual investors and were marketed in just a handful of EU countries. In particular, the requirement for ELTIF to be close-ended without any exit, even in exceptional circumstances, combined with harsh guidelines, made the ELTIF 1.0 fail its initial target.

ELTIF 2.0, which went live in January 2024, solved for most of these issues. The €10,000 threshold was removed, as was the 10% exposure cap for investors with less than €500,000 in financial assets, which made it more complex for distributors.

In principle, retail investors can invest in private assets without any minimum ticket, while the strong investor protections of ELTIF 1.0 are still in place, since ELTIF 2.0 aligns to the investor protection tenets established in MiFiD II.

The new and improved ELTIF regime allows for the launch of evergreen funds, which are closer to the UCITS structures retail investors are familiar with. Unlike traditional close-ended private asset vehicles, evergreen funds have more liquidity windows and regularly updated NAVs, meaning investors have frequent opportunities to invest and withdraw money – in a similar vein to UCITS funds. With an evergreen fund, investors’ capital is also at work from day one, without having to wait for burdensome capital calls. Track record and historical performance are also easier to read, which is a key success factor for a category of investors requiring both education and simplicity.

Towards a UCITS-like experience

Distribution of private asset funds to retail investors requires careful consideration. High-net-worth individuals are often served by private banks and financial advisors, which assess the suitability and allocation, and provide access to strategies. As such, they have a key role to play, in particular in bringing innovation from asset managers to their client together with advice and education on private assets, structures and potentially tax breaks available.

It is incumbent on asset managers to ensure that the retail segment also benefits from a process which is largely frictionless and efficient: liquidity windows, money at work immediately, simplicity of subscription and redemption, transparent and synthetic reporting...

“The aim is to provide a UCITS-like experience,” says Audhoui-Darthenay. “Investing in private assets should be a simple process: the investor pays cash and immediately gets exposure to the targeted private asset class”. Any complexities like deployment, cash drag, liquidity and flow management are to be managed by the asset manager, leveraging its expertise, access to transactions (buy or sale), its modelling capabilities and the pooling of assets and investors which makes it all possible.

Retail investors demand range of asset types

Alongside their UCITS investments, retail investors expect a range of different private asset types and strategies in order to diversify their allocations.

“The emergence of retail investors as a major allocation force in private markets will benefit investment houses that can package a range of private assets and offer diversified portfolios,” says Audhoui-Darthenay.

Multi-affiliate investment firms like Natixis IM will have an advantage, he believes. Audhoui-Darthenay points to Natixis IM’s expertise in global private equity, private debt, infrastructure, real estate or nature-based projects.

“As an asset manager, you need technical excellence in each of the private asset classes, with access to the best opportunities and a network of trusted partners and providers. This is exactly what Natixis IM bring with their strong focus and identity in each of their respective strategies. You also need the structuring and modelling skills to design the right cash-flow and/or liquidity profile, together with in depth tax, legal and regulatory knowledge.”

Next wave is on the way

For those wondering when retail investors can finally allocate to private assets, the answer is: now.

"The last two or three years have seen an increase in high-net-worth investors allocating to private assets"3, Audhoui-Darthenay says, and asset managers such as Natixis IM are ready for the next wave.

“High-net-worth allocations are still in their formative stages. In the next five years, we expect these allocations to be turbo-boosted by cash from mass retail investors, who are likely to be the drivers of private markets for decades to come.”

Published in April 2024

2 Idem – see footnote 1.

3 Preqin Global Data ; Bain Analysis.

Natixis Investment Managers

RCS Paris 453 952 681

Share Capital: €178 251 690

43 avenue Pierre Mendès France

75013 Paris

www.im.natixis.com

This communication is for information only and is intended for investment service providers or other Professional Clients. The analyses and opinions referenced herein represent the subjective views of the author as referenced unless stated otherwise and are subject to change. There can be no assurance that developments will transpire as may be forecasted in this material.

Copyright © 2024 Natixis Investment Managers S.A. – All rights reserved

ELTIF 2.0: Bigger and Better

ELTIF 2.0: Bigger and Better

Together At Last: DC Schemes and Private Assets

Together At Last: DC Schemes and Private Assets

LTAF Masterclass: Embracing Private Markets in DC Pensions

LTAF Masterclass: Embracing Private Markets in DC Pensions

Solving The Private Markets Conundrum for UK DC

Solving The Private Markets Conundrum for UK DC