Committed to Building Better Portfolios

To further this mission, and provide professional investors with a deeper level of portfolio insight, Natixis Investment Institute was established in 2017. It builds on the behavioral research of our Center for Investor Insight, the in-depth portfolio research and analytics of the Portfolio Research & Consulting Group and more general market trend analysis and forecasting to provide you with an in-depth understanding of the relationships between investor sentiment and investment decision-making.

Natixis Investment Institute helps put insight into action

- Unique insights into investor sentiment, behavior, and tolerance of risk is captured and shared with clients by our Center for Investor Insight. Since 2010, it has compiled data from more than 50,000 survey respondents, from institutional to individual investors, in 31 countries.

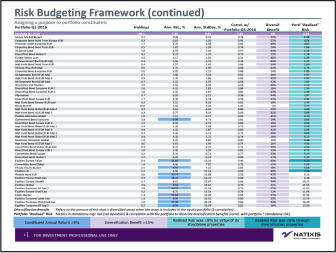

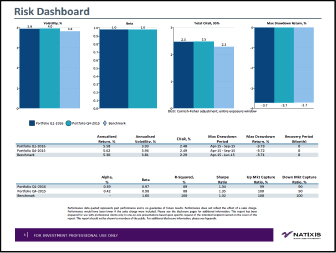

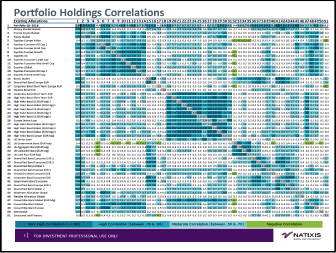

- Our experts provide a risk-based analysis of client portfolios with the aim of making them more resilient, especially during times of heightened volatility. Institutional clients receive objective analysis and insight on their portfolio allocations through this free, customized service. Sophisticated analytic tools along with collaborative guidance helps support clients’ investment decisions. Understanding your risk exposures may help you improve diversification and achieve better returns with lower overall volatility.