Real Asset Debt: Crisis Expands Opportunity for Tailor-made Mandates

Key Takeaways:

- In 2020, investors in real asset private debt really understood the value of the asset class. Real asset debt, due to a lien to robust assets and strong creditworthiness of issuers, maintained a steady revenue stream which was largely immune from volatility.

- One of the consequences of the COVID-19 crisis is private debt has become even more relevant to investor portfolios. With the volume of private debt expected to expand, investors have more opportunity to create tailor-made mandates.

- A tailored approach to real asset private debt investing is particularly relevant to institutions in Asia. Asian economies tend to have younger populations, so the retirement horizon is much longer. This requires considerably longer-dated assets for insurance companies, endowments, or public and private pension funds

Illiquidity premium exceeds pre-pandemic levels

Private debt secured on real assets is not completely decorrelated to broader credit markets and liquid markets. Just as listed equities and bonds slumped in the first part of 2020 when Covid-19 side-swiped markets, one could have expected considerable volatility in the value of real assets.

However, although nervous investors initially drove down the illiquidity premium in private debt assets, the premium was quickly re-established. In fact, the illiquidity premium is now higher than it was before the 2020 crisis started, driving up the appeal for real assets.

“In 2020 investors in real asset private debt really understood the importance of the asset class,” says Denis Prouteau, Private Debt Chief Investment Officer, Natixis Investment Managers International. “We maintained positive returns throughout the crisis.”

How were returns maintained? In a word: cashflows. Real asset debt, due to the robust nature of the assets and strong creditworthiness of its issuers, kept on providing a steady revenue stream which was largely immune from volatility. “The way deals are structured in the initial transaction provides huge security to investors,” says Prouteau.

And because real asset debt is nearly always a long-term transaction, the potential impact of credit cycles is already embedded into the structuring of the deal and baked into the price and the projected returns. “That’s not to say we anticipated the pandemic,” says Prouteau, “but assessment of cash reserves and depreciation take into account the possibility of such crises.”

Crisis likely to spur allocations to real assets

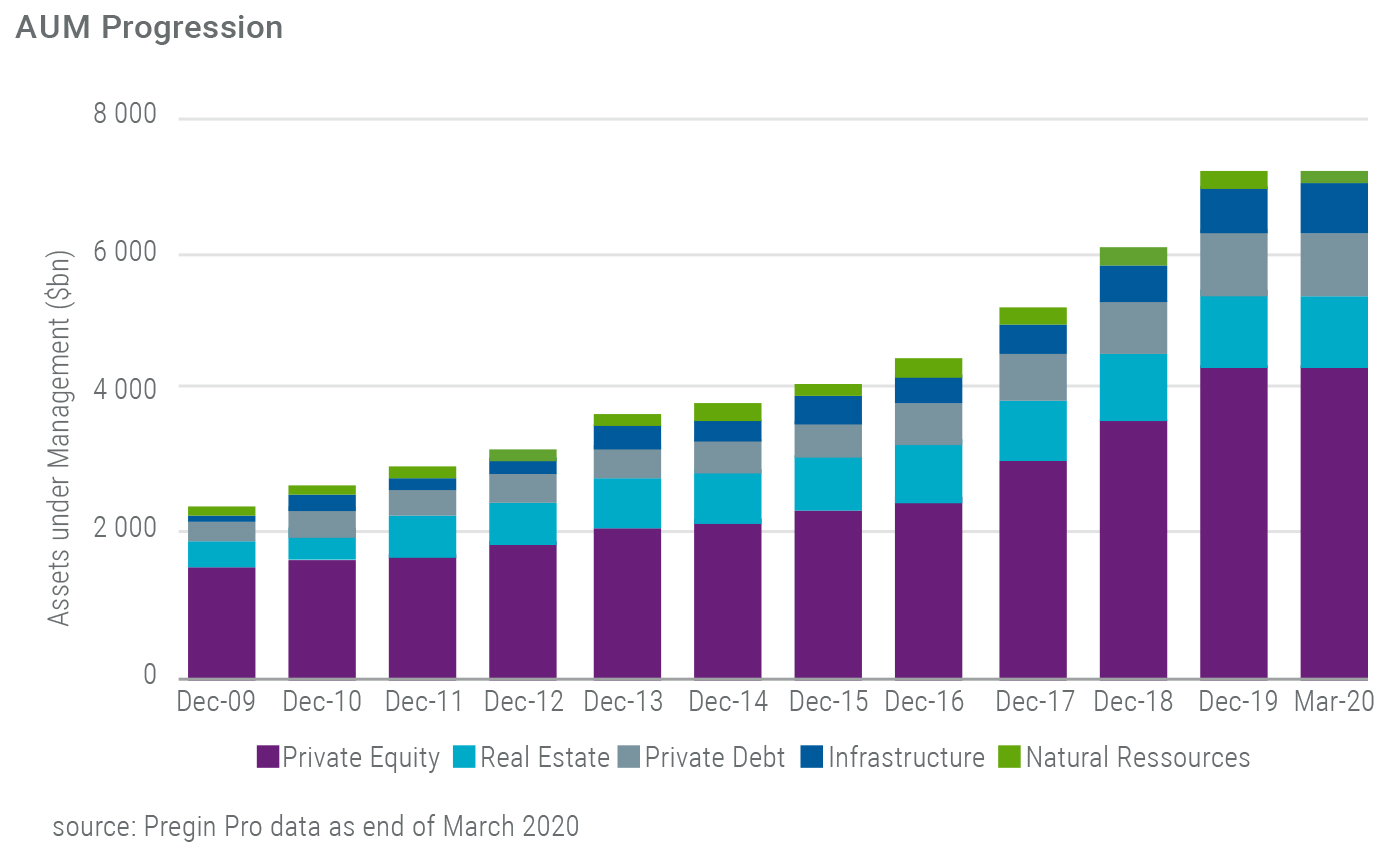

It is no exaggeration to say that investment in real assets has rocketed since the Great Financial Crisis, more than tripling real assets in that time. Investment in private debt has increased most of all, rising from $263bn to $847bn over the period.

The financing of real assets – such as buildings, bridges, roads and hospitals – has only moved onto the radar of investors in the last decade. The Great Financial Crisis severely curtailed the ability of banks to lend to asset owners, so investors stepped into the breach, replacing banks in deals and providing themselves with a yield solution to their long-dated liabilities.

One of the likely consequences of the COVID-19 crisis is that private debt will become even more relevant to investor portfolios. A survey of investors by Preqin1, an alternative assets data provider, underlines why. Investors in the survey say that private capital asset classes have largely delivered the returns investors expected over the past 12 months. This is particularly true of private debt, where 74% of investors say returns have met expectations.

As a result nearly half (48%) of investors say they will increase their commitments to private debt in the coming year.

Market dynamics offer tailor-made opportunities

With the real asset private debt proof of concept well and truly established, and the volume of private debt expanding fast, investors now have greater opportunity to create tailor-made mandates which match their idiosyncratic cashflow needs.

Tailor-made approaches can be about restrictions, but they can involve any amount of variations, depending on need. “One of our investors wants to allocate specifically to the French telecoms sector because they believe in that market and they like the way it is regulated,” says Prouteau. “We found them the assets they needed.”

Like many French insurers, it owns plenty of real estate equity, but little real estate debt. The insurer needs an extremely niche, tailor-made approach for its real estate debt portfolio. It only invests in central Paris real estate and is happy to take ownership of the building in the case of debt default. It does, however, need the services of an asset management to manage buildings in the case of defaults and that’s where Natixis Investment Managers comes in.

Natixis Investment Managers structured a French-specific vehicle, transferring the insurer’s existing debt investments into the vehicle, and carrying out reporting, monitoring, transactions and cashflows for the insurer through the vehicle. Although the insurer is experienced in real estate it has less experience of real estate debt and uses the extensive network of Natixis’s bank to source and analyse new deals for the vehicle.

Tailoring assets can in practice only be achieved through the close collaboration of banks, which originate deals, and asset managers, which optimise the asset and provide expertise in key areas such as sustainability. “A strong and active originating bank such as Natixis combining with an experienced real asset manager such as Natixis Investment Managers, is a rare combination,” Prouteau adds.

When co-mingled funds are the answer

Tailor made needn’t always mean niche. First-time real asset investors, for instance, may want broad exposure to the asset class, which gives them as much diversification as possible without tying themselves to a narrow segment.

For them, the tailor-made solution may be co-mingled funds, in which there is a diverse range of infrastructure, real estate, aircraft and other debt.

Co-mingled funds may also be the answer for an investor wishing, say, to allocate to emerging markets for the first time. Given the increased risks inherent in emerging markets investment, a broadly-diversified co-mingled fund with assets spread across many Asian geographies and industrial sectors can reduce risk and provide investors with the comfort they need.

Matching long-dated liabilities in Asia

A tailored approach to real asset private debt investing is particularly relevant to institutions in Asia, many of which have different liability profiles to Western institutions. Asian economies tend to have younger populations, so the retirement horizon is much longer. This requires considerably longer-dated assets.

The problem is that few such assets exist locally. So pension funds, endowments and insurance companies in Asia often find themselves with a significant mismatch between liabilities and assets.

The first is a mono-sourcing service for the company’s own balance sheet. This service sources assets through Natixis’s large pipeline of deals in Asia and allies this to Natixis IM’s asset management capability in Hong Kong. The relationship creates co-investment lending opportunities too.

The second service is an energy transition strategy for third-party investors. The requirement was for a fund format which would invest in global assets in any currency, but receive cashflows in US dollars. The conglomerate wanted the strategy to have a recognised energy transition label (The French Greenfin label was selected) and be incorporated into the company’s existing stable of Luxembourg-domiciled funds.

This “green yield” strategy invests only in sustainable assets. Underlying investments include fibre optics, subway lines, windfarms and solar. The strategy allocates to a combination of senior and mezzanine instruments to potentially deliver higher returns to t investors. The tailored ESG approach and risk-return profile will, the conglomerate calculates, differentiate its offering in the Japanese market.

Private real asset debt, with its substantial spread above government yields and built-in security is a viable alternative. Real asset debt has increasing benefits for Asian-based insurers, since regulation in Asia is harmonising with that of the European Union. Under the EU’s Solvency II rules, private debt receives preferential treatment. So the amount of capital that an insurer must set aside against risk is much smaller than for similar-rated corporate debt issuance.

Lower volatility and more predictable cashflows

At a time when many traditional liquid investments are either underperforming or highly volatile, private real asset debt is increasingly sought by investors wishing to reduce volatility and maintain long-term cashflows.

As investors dip their toes into the asset class they may find not only that volatility is lowered, but that their desired cashflows can be better matched than by investing in equities and bonds.

Published in April 2021.

Natixis Investment Managers International

French Public Limited liability company with board of Directors (Société Anonyme).

Share capital : €51 371 060,28. RCS Paris : 329 450 738.

Regulated by the Autorité des Marchés Financiers (AMF) under no. GP 90-009. 43 avenue Pierre Mendès France 75013 Paris.

www.im.natixis.com

Natixis Investment Managers

RCS Paris 453 952 681

Share Capital: €178 251 690

43 avenue Pierre Mendès France

75013 Paris

www.im.natixis.com

This communication is for information only and is intended for investment service providers or other Professional Clients. The analyses and opinions referenced herein represent the subjective views of the author as referenced unless stated otherwise and are subject to change. There can be no assurance that developments will transpire as may be forecasted in this material.

Copyright © 2021 Natixis Investment Managers S.A. – All rights reserved

Real Assets: Invest In What You Want, How You Want

Real Assets: Invest In What You Want, How You Want

Secure Income and Green Infrastructure: An Unlikely Marriage?

Secure Income and Green Infrastructure: An Unlikely Marriage?