Secure Income and Green Infrastructure: An Unlikely Marriage?

Key Takeaways:

- Institutional investors must secure sustainable income while meeting increasingly demanding ESG expectations. The challenge to meet both objectives is considerable.

- From 2017 through 2035, the world will need $69 trillion of investment in infrastructure. The global market for infrastructure debt reached $280bn in 2018, with more than 900 transactions.

- Infrastructure debt based on renewables has expanded by a factor of 9 since 2005, and is likely to grow further, leading to more green mobility projects and energy-efficient public buildings.

If you feel under pressure to find secure and sustainable income streams, you are far from alone. As stewards of institutional assets, you may also be under growing pressure to source those income streams under tight ESG constraints.

Let’s take a moment to consider what this means. The underlying beneficiaries of the assets you manage need secure income that is stable even as markets rock and roll through financial cycles. But because those beneficiaries, and society at large, now expect assets to be managed according to (some version of) ESG principles, investments should also enhance society and the environment. Or at least not do harm to them.

Infrastructure debt provides an opportunity to meet both objectives. If investors lend to ESG-focused infrastructure projects which represent secure credits and are operated well, they can receive returns which both match long-term liabilities and improve society, the workplace and the environment.

Green assets are a growing part of infrastructure

Infrastructure refers to anything that is built and operated: it includes road, rail, hospitals, schools, and energy (both conventional and renewable). Infrastructure debt finances the projects required to build, operate and maintain these assets. From 2017 through 2035, the world will need a total of $69 trillion of investment in infrastructure to support current economic growth projections1. Governments have limited resources to fund these needs. Therefore, private resources will have an important role to play. Banks, that were historically major players in the financing of infrastructure, now face more and more regulatory constraints, especially as far as long-term maturity loans are concerned. This creates a huge opportunity for institutional investors to enter this global, deep and stable market comprising over $200 billion transactions every year2.

Infrastructure is a diverse market, focused primarily on the dynamic regions of Europe and the Americas, which make up 70% of the market. However, Asia is the fastest-growing region. Renewables in particular is a growth sector, having expanded by a factor of 9 since 2005.

The opportunity in renewables and green assets is likely to grow, driven by market demand, regulation and government’s target. As energy and transport are the biggest contributors to CO2 emissions3 (69% of the total CO2 fuel combustion), it is likely that renewable energy, green mobility and energy-efficient building will offer sizeable opportunities for investors.

The French Energy and Ecological Transition for Climate (EETC) label4, launched at the end of 2015 in the wake of the Paris Climate Agreement, is indicative of the direction of travel for governments and regulators. The EETC label requires that the majority of investments in a portfolio contribute to the financing of a greener economy. It also requires measurement of the environmental footprint of the portfolio, encompassing impact assessments on climate change, natural resources (including water) and biodiversity.

Investing in oil, gas, coal and nuclear sectors is prohibited by the label, which places considerable emphasis on energy transition, particularly the development of solar, wind, hydro, tidal, smart meter, batteries, waste to energy, heating network and biofuels. The law is also designed to have impact beyond the energy sector, extending to efficient and green transport, buildings, water and telecoms.

Reducing the financial risks of green assets

Green assets, and especially renewables, represent a growing part of the infrastructure universe, with a potential for high returns. However, some investors worry that renewables have to take high risks for the returns they produce.

In reality, investing in renewables doesn’t have to be high risk. “The best way to earn money is not to lose any,” says Celine Tercier, Head of Infrastructure Finance at Ostrum Asset Management, an affiliate of Natixis Investment Managers.

One way to invest in infrastructure while reducing the risk of losing money is by investing in the financing of infrastructure. Quite simply, debt is less risky than equity. If the debt instrument used is senior secured debt, then the protection is at its strongest; investors in senior secured loans have first call on the asset if something goes wrong. And with pure infrastructure project finance, as long as the covenants and agreements has been properly structured, the protections are far stronger than for corporate bonds.

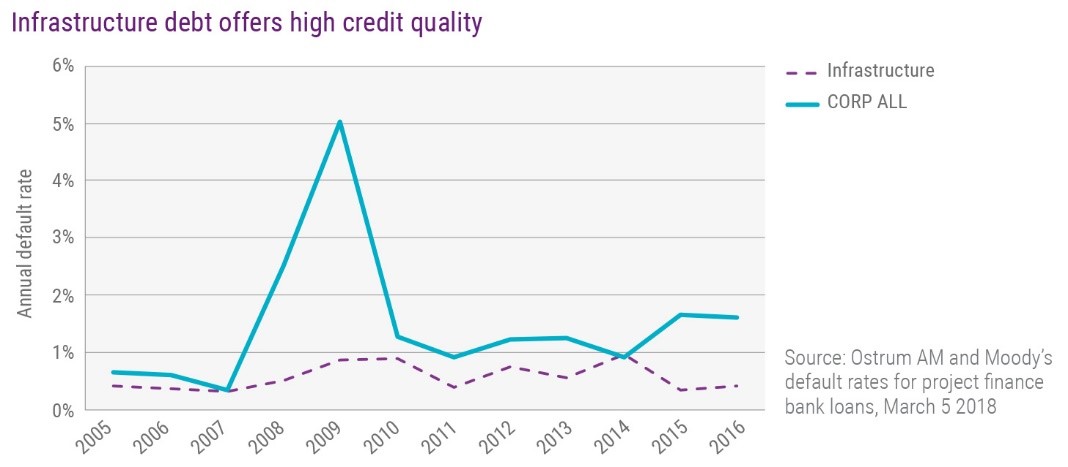

Default rates in infrastructure debt are extremely low, averaging just 0.56% a year since 2005 and suffering no spikes even during the financial crisis.

The recovery rate when a loan defaults is 77%. Even though this implies a loss of 23%, the low default rate ensures that overall losses are minimised and risk-adjusted returns increased.

In fact, the recovery rate of Ostrum AM’s infrastructure debt managers is 100% over some two decades. The reason for this, says Tercier, is careful structuring and close monitoring. “Our credit documentation asks that the borrower inform us of all problems, proposes remedial plans, allows us to work with them on remedial plans, validate the plans and monitor ongoing progress,” says Tercier. “We select transactions with strong covenants to control and protect our investment. And if there is a problem, we have a strong security package (especially pledge of the borrower’s shares, contracts or bank account) to solve it,” she adds.

Another way to protect capital and income is by investing only in essential assets. No matter the state of the economy, there will always be need for energy, for schools, for hospitals. For example, Ostrum AM’s strategy invests in many forms of transportation infrastructure (including roads, seaports, and railways), but excludes non-essential assets, such as parking lots, which are not strategic.

In the renewables sector, Ostrum AM considers all assets as essential, including solar farms, wind farms, biomass and energy from waste. All conventional power and natural resources assets are excluded. In the social accommodation sector, while healthcare and education facilities are part of Ostrum Infrastructure scope, senior housing is not, because of a large component of real estate risk.

Countries need essential services as part of their sustainable development plans so all parties have a strong interest in defending essential assets that encounter problems. This is not always the case with non-essential assets. “Our experience shows that when things go wrong, we can find a solution if it’s an essential asset,” says Tercier.

The next line of defence against capital loss is to be credit-focused and conservative. In the renewables sector in particular, a technology must be commercially-proven to protect capital over the life of the transaction. In addition, the minimum internal scoring for a transaction to be included in Ostrum AM’s portfolio is BB and the overall strategy must have an investment grade internal scoring.

Diversification of risk factors is important to avoid sector or asset-type concentration. Diversification is achievable given the depth of assets available in infrastructure. In fact, the difficulty lies in transaction selection and being sufficiently stringent in transaction analysis. “We select only 4% of the global pipeline, favouring the most attractive risk-return transactions,” says Tercier.

Balancing risk against returns

Risk management is more than the reduction of risk. The key is to manage risk to optimise returns. For this reason, Ostrum divides risks into two buckets: risk reducers, and return enhancers. The managers dip into each of these buckets to create a risk profile that targets risk-adjusted returns that are superior to investment grade corporate bonds.

Assets in core countries such as Germany, France, the US, and Canada, for instance, are seen as risk reducers and reside in the first bucket. Assets in the periphery, often in southern European countries such as Spain and Italy, are considered as return enhancers because of their less certain business, political and legal environment, and are in the second bucket.

Similarly, core sectors such as solar, roads and hospitals, are risk reducers because of the relative lack of complexity involved in operating the assets. For instance, it is fairly straightforward to operate a school – the operator is responsible for providing a sturdy building with light and power (but not responsible for the trickier task of teaching children). On the other hand, offshore wind is a return enhancer, because it will typically have to be assembled in the deep sea, where weather conditions might prohibit easy maintenance.

Nature of cashflows is also considered. Schools and hospitals normally have long-term agreements and therefore long-term and stable income streams, so are risk reducers. But cashflows from broadband networks, for example, may depend on shorter-term contracts with operators and ultimately with individuals, so are less secure. Broadband networks are return enhancers.

Construction risks are also distributed across the two buckets. Brownfield assets have already been built, so there is no construction risk involved and this reduces the strategy’s overall risk. The Ostrum AM strategy is focused predominantly on brownfield. However, Ostrum AM is able to finance projects from scratch and this, when managed robustly, enhances returns.

Overall, the key is to balance the risk reducers with a good amount of return enhancing projects that should justify the extra risks taken on board.

Transparency helps to deal with ESG risks

Financial risks are a critical consideration when investing in infrastructure debt but there are also ESG risks: primarily the risk that transactions are less green than they first appear to be. A strategy based on project finance transactions, rather than on investments in corporate bonds, enables better control of this risk. Ostrum AM selects transactions where the issuer must stick to the terms agreed. A solar project, for example, must produce green electricity and nothing else. If the asset operator wants to change its business model, it has an obligation to ask the lender.

The project finance structure therefore provides useful transparency. “We can be sure that 100% of the turnover of the portfolio is from eco-friendly sources,” says Tercier. It also provides controls on any adverse material events relating to ESG issues over the transaction life. In addition, environmental studies should be carried out to assess the effectiveness of each project and, in France, precise carbon measurements must be produced to comply with EETC.

Access to deals

Unlike buying listed assets, infrastructure loan origination requires deep sourcing and structuring capabilities to ensure access to transactions with high relative value. The sourcing network for this asset class includes industry and financial sponsors and a variety of banking activities operating across many different regions and sectors. The breadth of the network helps gain access deals of all sizes, diversifying the infrastructure debt portfolio. Experience is essential to successful sourcing. Ostrum AM’s former lending-side bankers have over 20 years of experience each, structuring over 300 transactions with only five defaults and a 100% recovery rate over two decades. The team was a pioneer of infrastructure debt mandates for investors with over $5 billion of committed capital.

An illiquid strategy with flexibility

The strategy suits institutions looking to match very long-term liabilities and which have a liability profile which allows for considerable illiquidity. Investing in infrastructure debt can also help reduce volatility in the overall portfolio. The strategy particularly suits investors willing to allocate to assets that can have a significant and positive effect on energy transition, and therefore a beneficial climate change impact.

While the strategy typically matches durations of around 10 years, it is possible to match even longer duration liabilities. Ostrum AM’s active approach to portfolio construction allows it to reinvest repaid loans in order to maintain institutions’ invested capital at a maximum. This can lead to longer-horizon returns, enabling investors – where required – to match liabilities of longer than 10 years. Reinvestment also allows the strategy to benefit from potential rises in interest rates over time. In addition, the strategy allocates a limited bucket to floating rate loans in order to minimise interest rate risk. As a result, the gross target return is 3% in Euros and 5% Hedged against USD5.

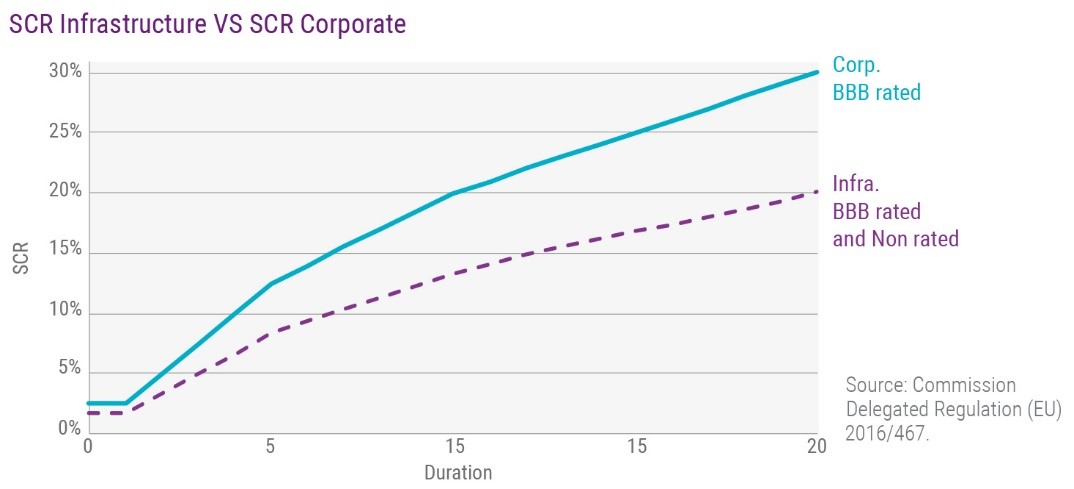

For European insurers, the strategy offers favourable treatment under Solvency II, with a SCR spread reduction of at least 30% compared with investing in corporate issuers.

A marriage made in heaven?

Opinion on the green sector is split, with some investors seeing a great opportunity, while others remain wary. The fact is that green investments are growing faster than most other asset classes, and governments and investors alike are pushing investment firms and their clients towards more sustainable practices.

Even in the US, the move among individual States and investment firms towards renewables and other sustainable investments is gathering speed. With a robust, methodical approach, investors should benefit from the continued expansion of the asset class, of which infrastructure debt is a pivotal element. It inherently delivers stable cashflows and naturally gravitates towards sustainable assets. “Infrastructure debt should increasingly appeal to investors requiring both consistent income and ESG-compliant assets,” says Tercier. “Infrastructure debt naturally responds to both these needs.”

Main risks related to Ostrum’s infrastructure debt strategy: Loss of capital, no assurance of investment return; illiquidity; performance of assets (especially linked to construction risk, nature of cash flow risk) incl. general counterparty risk, general economic and market conditions, changes in general law and regulation and taxation, risks associated with the deployment of the strategy.

2 Source: Infrastructure Journal

3 Source: CO2 emissions from fuel combustion, International Energy Agency 2018

4 Source : www.ecologique-solidaire.gouv.fr

5 This target return is not a forecast of future performance. It only aims at illustrating mechanisms of your investment over the investment period. Valuation (up or down) may fluctuate and deviate from this target return.

Published in April 2019

Ostrum Asset Management

An affiliate of Natixis Investment Managers

French Public Limited liability company with board of Directors

Share capital €27 772 359

Regulated by the Autorité des Marchés Financiers (AMF) under no. GP 18000014

RCS Paris n° 525 192 753

43 avenue Pierre Mendès France

75013 Paris

www.ostrum.com

Natixis Investment Managers

RCS Paris 453 952 681

Share Capital: €178 251 690

43 avenue Pierre Mendès France

75013 Paris

www.im.natixis.com

This communication is for information only and is intended for investment service providers or other Professional Clients. The analyses and opinions referenced herein represent the subjective views of the author as referenced unless stated otherwise and are subject to change. There can be no assurance that developments will transpire as may be forecasted in this material.

Copyright © 2019 Natixis Investment Managers S.A. – All rights reserved

Real Assets: Invest In What You Want, How You Want

Real Assets: Invest In What You Want, How You Want

Green Finance, A Way to Transform the Economy Towards a More Sustainable Model

Green Finance, A Way to Transform the Economy Towards a More Sustainable Model

Equity Infrastructure: Decorrelated, Long-term Income

Equity Infrastructure: Decorrelated, Long-term Income