Real Assets: Invest In What You Want, How You Want

Highlights

- Real assets are appealing to investors with long-horizon liabilities, but investing in real assets can take time and investors often can’t purchase assets that closely match their risk profile and liabilities.

- The solution is to source assets through a bank with a large pipeline of deals, allied to an asset management capability that can manage each of those deals. In this way, investors can tailor their real asset exposures.

- There is sometimes a conflict of interest risk when sourcing loans from multiple banks. When partnering with a single bank which has “skin in the game”, and will remain a lender for the duration of the loan, conflict of interest risk is diminished.

Investing in real assets can take time. Too much time for many investors. And even after the wait for assets to come along, many investors still can’t purchase the assets they really want, those that match their risk profile and liabilities. There has to be a way for investors to get closer to the originators of deals, choose the assets they really need and play a part in how those assets are structured. There is.

Why real assets?

First, let’s take a step back. The financing of real assets – such as real estate and infrastructure – has only moved onto the radar of investors in the last decade. Before that, real asset owners borrowed almost exclusively from the banking sector. The financial crisis severely curtailed the ability of banks to lend to asset owners, with regulatory obstacles and more constrained balance sheets forcing banks to retrench both in terms of assets and geography.

Yet, real assets still need to be financed. Investors and investment firms have increasingly stepped into the breach, willing and ready to replace banks and simultaneously providing themselves with a yield solution to their long-dated liabilities. Real asset debt – which is effectively investing in real assets, only with more security – potentially offers these investors excess risk-adjusted returns allied to lower volatility than bonds.

Investing in real assets and real asset debt requires considerable competence. It is rarely attempted by individual institutional investors – although a handful of the world’s largest insurers have real asset portfolio management capabilities. So most investors rely on the services of an asset manager. The asset manager will typically offer capabilities including an asset selection process, risk measurement, the monitoring and valuation of assets. Some perform these tasks better than others, but the formula is essentially the same.

Given that these tasks are beyond the capabilities of most institutional investors, the asset management route has become entrenched as the main access point for real asset investing. The problem is, this misses a key part of the jigsaw, the part where considerable value can be added to investors’ portfolios. Namely, the sourcing of the assets.

A better way – the bespoke approach

Funds that invest in real assets tend to face sourcing challenges. In theory, there is a wide variety of real assets to invest in, matching the varying needs of investors. In practice, some funds have limited capacity to source a wide variety of assets. Investors in those funds have access to only a relatively small selection of assets which may or may not match their risk and return needs. In addition, the assets tend to only become available sporadically, meaning investors can, at times, be left frustrated that a large chunk of cash cannot be put to work for relatively long periods. To counter the possibility of slow deployment of their money, some investors source real asset deals directly from investment banks. There are limitations to this route too. Firstly, the investor needs very deep pockets. But, more importantly, the bank will not always be able to manage the assets, leaving open the question as to how to manage them.

The potential solution to these difficulties is to source assets through a bank with a large pipeline of deals, allied to an asset management capability that can manage each of those deals. Because of its ability to empower the investor and simplify the complex process of sourcing and managing real assets, this is really a tailor-made approach. It sounds intuitive, but it’s actually a very rare, if not unique, offering in the real asset marketplace.

How does the bespoke approach work?

It is about a combination of banking and asset management. While many banks have asset management arms, few actually work with them in any meaningful way to create bespoke investment strategies. Why? Because both the bank and the asset management arm need to have complementary capabilities that are individually valuable. The bank, for instance, needs to be highly “active”. To source real asset deals, it should ideally have a global footprint and be able to originate transactions across various geographies and sectors. It probably, as is the case with Natixis, needs to have a long track record in investing in real assets on its own behalf. So it can not only source assets, but can select them for creditworthiness and structure them to generate outsized returns.

Long experience of sourcing and structuring deals helps to sniff out things that can go wrong, how to deal with deals that turn sour and turn them round quickly. With such large, long-term deals, it’s the flexibility to avoid individual losses that ensures overall success. If a strong and active originating bank can then combine with an asset manager which, as in the case of Ostrum Asset Management, has decades of experience in debt markets, a large dedicated team and robust processes tested over time, you have a rare combination.

Timely access to the right exposures

This combination gives real asset investors a better control over their investments and provides them with the exposures they want, not the ones an asset manager (often constrained by consensual and rigid guidelines) or banks (not necessarily ready to perfectly accommodate investor demand) would be inclined to. By allowing access to a wide array of transactions ahead of their final structuring, the bespoke approach allows investors to actively influence their investment and build a uncompromised portfolio. This is little short of revolutionary for many investors. By being part of the decision to precisely determine how an asset manager selects, sizes and structures assets, investors can achieve a tailored risk-return for their portfolios. The range of real assets that can be accessed is considerable across asset class, geography and legal framework.

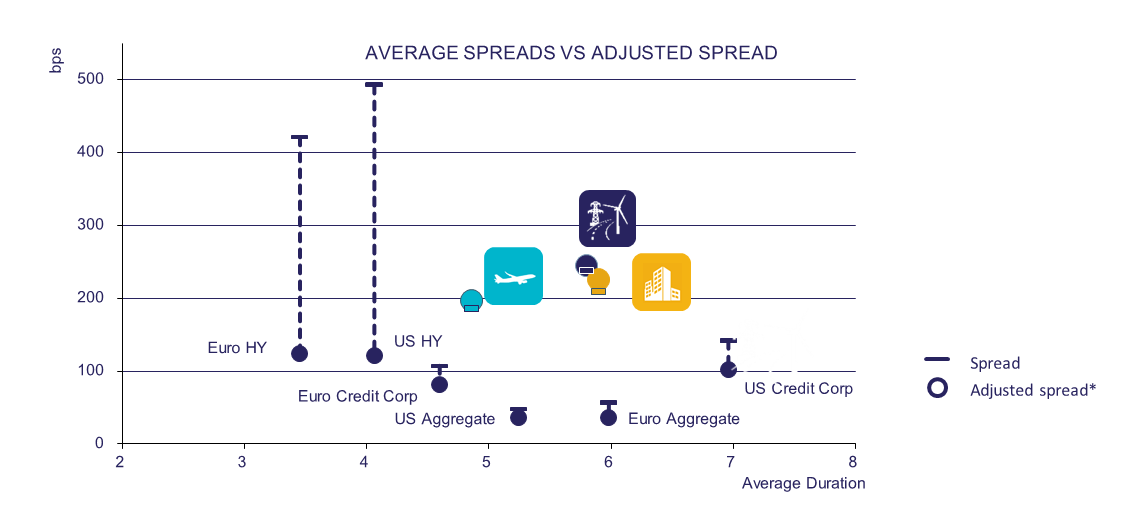

At the same time, the asset idiosyncrasies and complexity of transactions, which for many years were controlled solely by banks, have maintained opacity for outside investors, who have only been able to access real asset debt in the last five to 10 years. It is therefore little surprise that yields on this asset class show great heterogeneity, ranging from high double digit spreads above Libor (or Euribor) for high- quality quasi-sovereign risk PPP transactions to spreads superior to 300bps for infrastructure financing in less-developed countries.

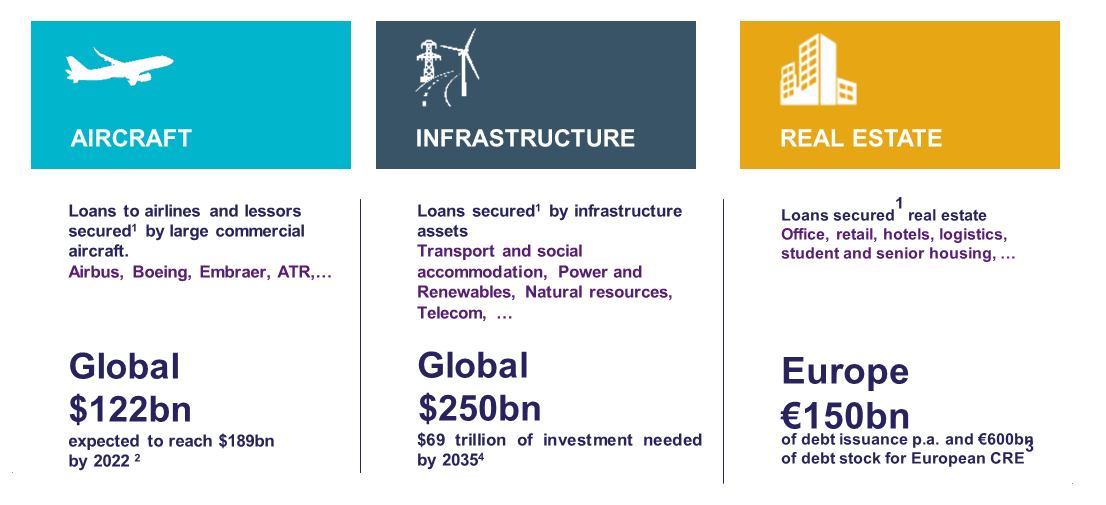

Within such a wide range of return, each asset class offers investors the opportunity to select the duration, risk level and amortisation schedule that best match the investor’s need. Real estate senior loans, for instance, tend to have a duration of seven to 10 years, given that these loans are in bullet format, and offer investors a Euribor floor protection (useful given the current negative rate environment in Europe) and LTVs of 35%-60%. Infrastructure senior secured loans offer investor longer duration despite the amortization. The 10-20 year lifespan of infrastructure projects can be helpful in matching the very long liabilities of some insurers and pension funds. Aircraft loan duration is lower (typically 6 to 7 years) with LTVs around 85%, which is well below the 99% average recovery rate for the asset class over the last 10 years. Besides the more mobile nature of the asset (which can be repossessed from a failing airline or aircraft lessor), forecast growth in air traffic of 4.4% a year over the next 20 years provides additional comfort.

Extra-risk layers

Partnering with both an asset manager and a bank offers distinctive risk management benefits. The proximity to the bank that sources the assets helps ensure that the right asset is selected. Both the asset manager and the bank are aware of the needs and risk tolerances of the investor and can help source assets which match these. This process can help investors avoid particular assets or geographies they are concerned about or which duplicate exposures in the wider portfolio. Monitoring of the asset’s performance is robust. A bond, unlike a loan, needs maintenance since it’s a bilateral agreement containing specific clauses. Because the originating bank keeps part of each deal on its balance sheet, it will monitor the asset for its own account. It may ask for extra security and bigger access to cash deposits if key ratios deteriorate. Through SLAs, the bank will also perform these tasks on behalf of the asset manager.

In addition, the asset manager will conduct its own monitoring, on behalf of clients, using its asset management expertise. The result: two layers of monitoring from teams with complementary capabilities. There is a potential conflict of interest risk when sourcing loans from multiple banks. That is, that the banks sell to investors only the lower quality loans it does not wish to keep for its own trading account. When partnering with a single bank which has “skin in the game” and will remain a lender for the duration of the loan, this conflict of interest risk is virtually eliminated.

What kind of investor is the bespoke approach for?

The bespoke approach is particularly appealing to investors who are attracted to real assets but frustrated that they can’t access the assets they need. They are typically investors who have already dipped a toe into the market, either through funds or through direct investment with banks, but are not entirely satisfied with the process or outcome. The bespoke way is to listen to investor needs in terms of liabilities, duration, risk tolerance, covenants and so on, and find them appropriate assets. In this respect, it is a highly bespoke investment and involves none of the compromises that are inherent in off-the-shelf real asset investing. The strategy is attractive to investors who are looking for precision asset liability matching rather than substantial upside. It's all about cashflows, rather than outperforming a given benchmark.

Conclusion

The disintermediation of banks is good news for investors. But the skills to take advantage of disintermediation are challenging. A solution which packages high-quality banking and asset management skills probably offers the most likely route to success. Let’s sum up what you get with a bespoke approach:

- Access to assets and execution

- Control over how the asset is structured

- Economies of scale

- Alignment of interests

- Active monitoring

- Reduced need for expensive personnel inhouse to manage the strategy

Ostrum Asset Management

An affiliate of Natixis Investment Managers

French Public Limited liability company with board of Directors

Share capital €27 772 359

Regulated by the Autorité des Marchés Financiers (AMF) under no. GP 18000014

RCS Paris n° 525 192 753

43 avenue Pierre Mendès France

75013 Paris

www.ostrum.com

Natixis

Limited liability company

Capital € 5 019 776 380,80

RCS Paris n°542 044 524

Regulated in France by the ACPR - Autorité de Contrôle Prudentiel et de Résolution

30, avenue Pierre Mendès-France

75013 Paris

www.natixis.com

Natixis Investment Managers

RCS Paris 453 952 681

Share Capital: €178 251 690

43 avenue Pierre Mendès France

75013 Paris

www.im.natixis.com

Copyright © 2018 Natixis Investment Managers S.A. – All rights reserved

Private Debt Investing, With a Twist

Private Debt Investing, With a Twist

It's Time for Real Assets

It's Time for Real Assets