Private Equity Secondaries Ready to Ride Rough Markets

Private Equity Secondaries Ready To Ride Rough Markets

- Increase seen in deal flow across both LP interest and GP-led transactions coming to market expected to further accelerate in coming quarters with backlog already building

- With liquidity at a premium, average pricing levels have continued to soften in recent months with discounts at levels not seen in years, creating a compelling environment for secondary buyers to deploy capital to targeted GP exposure

- Successfully sourcing high-quality small- and mid-cap assets requires long-standing GP relationships and fundamental knowledge of their portfolios and key value drivers

The difficult macro-economic environment of 2022 has taken its toll on public equity markets. The effects are starting to be felt in private markets too, and this holds out the promise of a significant backlog of more attractively-priced opportunities in private equity secondary markets. Indeed, this backlog has already started building. While transaction volume for 2022 is likely to be below 2021, the drivers for continued growth towards $150bn or above in 2023 and well over $250bn over the next few years are very much there.

“We are seeing more and more motivated sellers of private equity LP interests,” says Kristof Van Overloop, Managing Director at Flexstone Partners, an affiliate of Natixis Investment Managers. “These are not distressed sellers, but LPs looking to de-risk and lock in unrealised paper gains and who realise they won’t get last year’s prices in the current market environment. In contrast with the larger LP portfolio deals, where activity levels have decreased more meaningfully due to the significant bid-ask spreads, activity levels in the small- and mid-market segments have remained more robust.”

The uncertain economic environment is not the only motivation to sell assets. The roiled public markets, together with stubbornly stable private markets’ buyout valuations mean many LPs have become overweight private equity and need to sell private equity holdings to rebalance their portfolios. With traditional exit activity and LP distributions slowing down and many GPs coming back to market raising successor funds sooner than anticipated, LP liquidity is at a premium right now. “Well-capitalized secondary buyers like Flexstone can provide that liquidity. However, we are not in a rush to deploy and with our disciplined fund sizes we can remain highly selective and only pursue those transactions that fit our sweet spot strategy and provide the best relative value out there,” Van Overloop says.

GP-led secondary transaction volume is poised for continued growth too in an environment of slowing exit activity and increased LP appetite for liquidity. This is increasingly driving GPs to approach the secondary market and launch continuation funds to deliver liquidity options to their LPs while maintaining ownership of trophy assets they know intimately and that have performed well. “We are seeing interesting deal flow across both LP interest and GP-led transaction types coming to the market at more attractive pricing levels than we’ve seen in a long time, so it will be an interesting time for secondary investors to deploy capital,” Van Overloop adds.

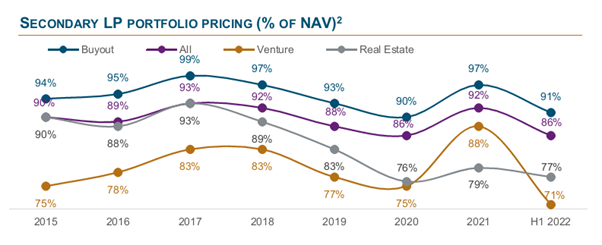

The increased macroeconomic uncertainty and market dislocations have been impacting average pricing for LP transactions across different strategies, falling from 92% of NAV in 2021 to 86% in the first half of 2022. Prices continued to soften in Q3 2022 as buyers grew increasingly sceptical of private company valuations. The average pricing level masks considerable underlying dispersion, with a renewed flight to quality – similar to the Covid crisis – towards more-established GPs with a successful track record of investing through market cycles. For high-quality, recent vintages (2018 or newer) with some remaining unfunded capital, prices are down considerably less compared to older, less-diversified funds where remaining companies are already substantially revalued and there is limited value uplift going forward.

Source: Jefferies Global Secondary Market Review, July 2022.

High quality trumps large discounts

In the current environment, Flexstone believes it is more critical than ever to focus on buying high-quality assets managed by proven GPs with an established track record of investing throughout market cycles and avoid lower-quality funds even if these come with larger optical discounts.

For Flexstone, growth is an important component of assessing quality. Van Overloop says: “If you buy exposure to assets that can continue to grow their earnings in the low- to mid-teens annually, you are less concerned about volatile environments and slower liquidity, as these companies will compound earnings growth over a longer holding period. The impact on IRRs of delayed exits is likely to be offset by a higher Multiple of Investment Capital reflecting the longer hold period. Clearly you get a very different story if you’re buying exposure where that growth element is not present.”

Inflation considerations are also a key part of Flexstone’s underwriting process. Flexstone considers the strength of each of the key companies’ market positioning, their USP, and how defensible these are. Similar to its co-investment strategy, Flexstone targets companies where the products or services it provides are critical, but only account for a small part of the overall cost base of their customers, allowing strong pricing power. “If a product only represents 2%-3% of customers’ cost bases then there is likely to be little push back on price increases,” notes Van Overloop.

Low leverage is another key attribute to quality. Companies with overleveraged capital structures can be left highly exposed to rising interest rates that can materially impact their ability to invest for future growth. This tends to be less of a concern for Flexstone given its focus on the small- and mid-cap buyout segment, where average leverage levels are lower versus the larger buyout segment and more of the value creation comes from growth, margin uplift and strategic repositioning. Valuation multiples for smaller companies typically are also at higher discounts to listed peers, providing an additional layer of potential value creation and downside protection for small- to mid-cap secondary market investors.

“We think it is important to have the discipline to stick to our small- and mid-cap focused strategy, where we can fully leverage the strength and breadth of our primary platform and comprehensive set of GP relationships,” Van Overloop says. With typical transaction ticket sizes between €10m-€25m, Flexstone is active in a less crowded market segment with lower competition and more opportunities to exploit information asymmetry. It maintains a disciplined investment approach, only pursuing a small share of the transactions it reviews.

“The focused strategy and resulting low selection rate do pay off in terms of a strong conversion rate on the opportunities we do pursue” Van Overloop adds.

Visibility and liquidity

Investing in PE funds that are several years (typically between three and eight years) into their life has a number of advantages. Funds will be largely to fully invested and provide strong visibility on the exposure and further value creation potential of the underlying portfolio companies. The fact that the performance of these companies can be analyzed and benchmarked against the original GP case provides a lot of data points that tend to be valuable in a fundamental, bottom-up driven underwriting approach.

In addition, the shorter duration profile means secondary buyers can expect to see the first divestments within 12 to 18 months of the purchase, as the GP starts to look at exiting more mature assets. This allows to partially de-risk the secondary transaction early on and helps to lock in a strong IRR.

Some remaining unfunded capital at the GP’s disposal may actually be positive in times of economic uncertainty, as this can be used to support existing portfolio companies that may be impacted. Or the capital could be used for new platform investments or opportunistic bolt-on acquisitions at more attractive entry valuations. “Given our focus on leading small- and mid-cap GPs with established track records, we do not consider a limited unfunded component as true blind pool risk,” notes Van Overloop.

Relationships key to sourcing and accessing best-in-class transactions

Having a differentiated sourcing strategy is critical to success in secondary investing. Flexstone’s secondary strategy leverages its longstanding primary platform, which deploys €600m+ a year to small- and mid-cap GPs. “This is still a very relationship-driven business,” says Van Overloop. With more than 500 funds in its primary portfolio and over 100 advisory board seats, Flexstone has the ability to perform comprehensive diligence on underlying portfolios in a timely manner and build conviction around funds that it believes are best positioned for future value creation. Having direct access to the relevant deal leads at the GPs can be instrumental in this.

GP relationships are also key to getting access to oversubscribed GP-led transactions, as they have been adopted by GPs in the small-and mid-cap segment too in recent years. Total single-asset continuation vehicle (CV) transaction volume grew by more than 15 times between 2018 and 2021. Van Overloop says: “There used to be a stigma around end-of-life assets, which were often regarded as troubled.” This has changed in recent years with a fundamental shift towards CVs with “crown jewel” assets sourced from more recent vintage funds that have performed very well, and where the GP believes it opportune to provide a liquidity option to the existing fund LPs. At the same time, the GP wants to remain invested as it sees scope for further value creation that can even be accelerated with additional capital. “These transactions have become a significant component of the secondary market and Flexstone has been quite active in that segment too,” says Van Overloop.

Single-asset transactions are underwritten to a different return hurdle as investors need to be compensated for the concentration risk. However, Flexstone is convinced there is a role for these transactions, which are complementary to more diversified LP interest transactions. “That’s why we’ll continue to take an opportunistic approach selecting attractive secondary transactions and seeking the best relative value at any point in time, regardless of the transaction type,” Van Overloop says.

The key tenets of Flexstone’s investment approach and targeted GP exposure are also relevant for the GP-led segment where it focuses its efforts on transactions where it has longstanding relationships with the GPs and often has been monitoring the asset for years.

And with the market dynamics having clearly shifted towards a buyer’s market in the past several quarters, high-quality GP-led transactions can be accessed at substantially more attractive entry valuations.

Conclusion: getting a head start

Secondaries in times of market dislocation can represent highly-attractive investment opportunities on a risk-adjusted basis. At the moment, it is possible to buy LP interests in diversified, high-quality portfolios at a 15%-20% discount. Van Overloop says: “That means you start off with an immediate uplift at closing with the prospect of meaningful further value creation over the medium term.”

Published in January 2023.

An affiliate of Natixis Investment Managers

Flexstone Partners, SAS – Paris

Investment management company regulated by the Autorité des Marchés Financiers. It is a simplified stock corporation under French law with a share capital of 1,000,000 euros Under n° GP-07000028 –Trade register n°494 738 750 (RCS Paris)

5/7, rue Monttessuy,

75007 Paris

www.flexstonepartners.com

Flexstone Partners, SàRL – Geneva

A manager of collective assets regulated by the Swiss Financial Market Supervisory Authority (“FINMA”). It is a limited liability company with a share capital of 750 000 CHF.

Trade register n° CH-112-212.153

8 chemin de Blandonnet

Vernier 1214 Geneva

Switzerland

Flexstone Partners, LLC - New York

Delaware corporation, registered with the United States Securities and Exchange Commission as an investment adviser

575 Fifth Avenue, 22nd Floor

New York, NY 10017

Flexstone Partners, PTE Ltd - Singapore

OUE Downtown 2 #24-12

6 Shenton Way Singapore 068809

Natixis Investment Managers

RCS Paris 453 952 681

Share Capital: €178 251 690

43 avenue Pierre Mendès France

75013 Paris

www.im.natixis.com

This communication is for information only and is intended for investment service providers or other Professional Clients. The analyses and opinions referenced herein represent the subjective views of the author as referenced unless stated otherwise and are subject to change. There can be no assurance that developments will transpire as may be forecasted in this material.

Copyright © 2023 Natixis Investment Managers S.A. – All rights reserved

Private Equity: Reducing Uncertainty

Private Equity: Reducing Uncertainty

How to Hit the Buyout Sweet Spot

How to Hit the Buyout Sweet Spot

Flexstone Partners Sweet Spot Proprietary Framework

Flexstone Partners Sweet Spot Proprietary Framework