How to Hit the Buyout Sweet Spot

Key Takeaways:

- General Partners have usually established a track-record based on an expertise focusing on certain geographies, industry sectors or type of transactions. These parameters define the “sweet spot” of a lead investor.

- In practise, many buyout deals that get done are opportunistic deals, meaning they are not in the “sweet spot” of the lead investor. This increases the risk of underperforming or failed deals.

- Flexstone, a co-investment specialist, has developed a proprietary selection tool which filters out all deals that are not in the sponsor’s sweet spot. This frees up time and resources which co-investors can spend on due diligence.

- A systematic sweet spot framework helps avoid strategy drift, spare resources, and produce more accurate decision-making. Deals which fall within a GP’s sweet spot significantly outperform opportunistic transactions.

Resources

That is, co-investors need to be plugged deep into the buyout market in order to access deal flow. Co-investors often only have days or, at most weeks, to accept or decline a deal so reactivity is critical in order to make a rapid and accurate assessment.

And in order to react swiftly they need an efficient selection process. Many deals are opportunistic, meaning they are not in the “sweet spot” of the lead investor – that is, where the investor has a specific proven skillset. This increases the risk of an underperforming or failed deal.

To mitigate this risk, Flexstone, an affiliate of Natixis Investment Managers, has developed a proprietary selection tool which systematically filters out all deals that are not in the sponsor’s sweet spot. This frees up time and resources which co-investors can better spend on other aspects of the deal.

The building blocks of a sweet spot filter

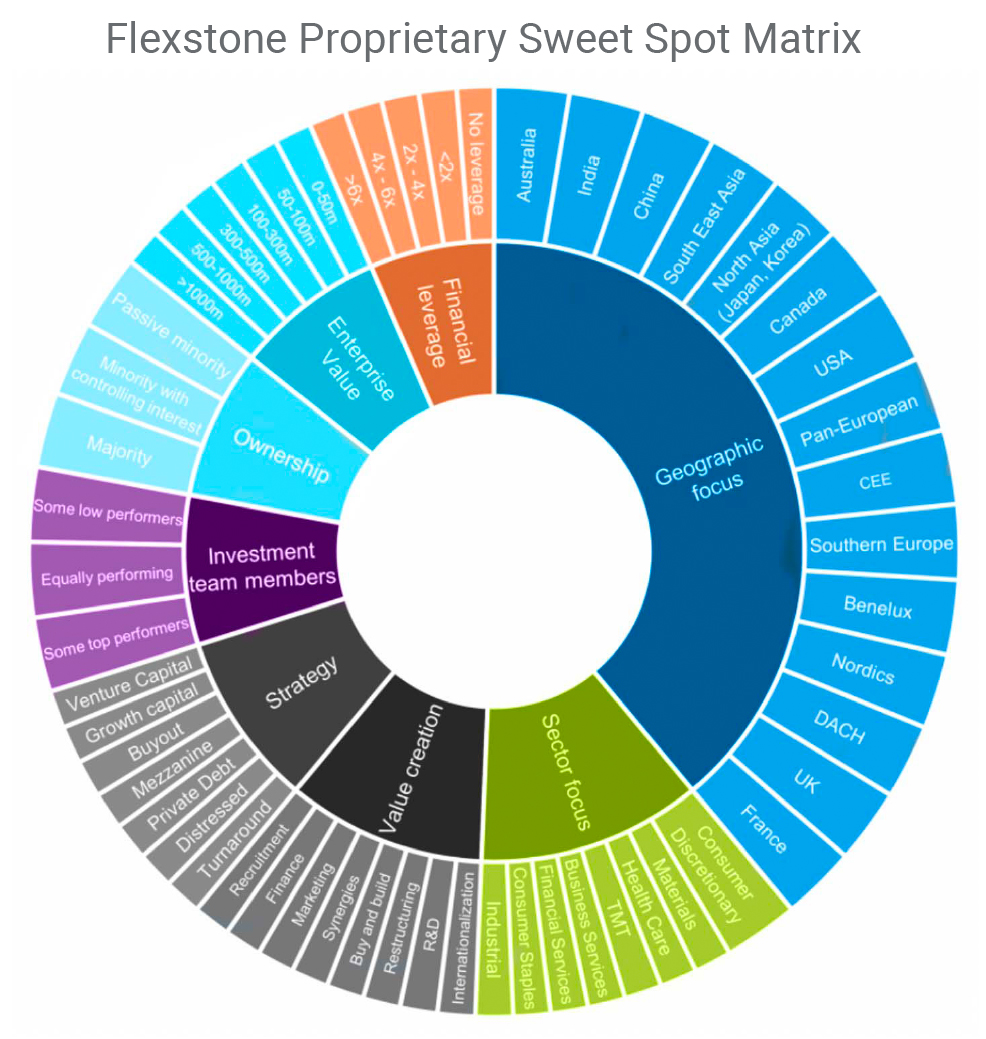

Many buyout deals offered to co-investors are risky because they are not in the lead investor’s sweet spot. Flexstone, a co-investment specialist, applies eight criteria to identify the sweet spot of buyout investors and mitigate deal selection risk:

- Geographic focus. Deals should be within countries and regions where the lead investor has executed most of its transactions.

- Sector focus. Deals should be in industries where the lead has done most of its deals.

- Value creation. In which type of value creation is the lead investor specialized: acquisitions, leverage, shared platforms, or strengthening portfolio company management?

- Strategy. Does the lead investor specialise in a single strategy such as buyouts, turnarounds and venture capital?

- Investment team members. Aim to identify the members of the buyout team who have executed most transactions and have the strongest track record. “We sit on many GPs’ advisory boards, so we get to know individual team members well and can add considerable value to our portfolios by assessing the value of each,” says Eric Deram, a managing partner at Flexstone Partners.

- Ownership. Some GPs are adept at majority deals, but are less familiar with being a minority partner. Minority deals entail different skillsets, requiring deft people management and the creation of legal documentation that protects against bigger players in the deal.

- Enterprise value. A GP’s sweet spot is usually in a particular size range. “If a GP operates in the $300m-$500m size range and suddenly announces it is doing a $5bn deal, that is clearly not in its sweet spot,” says Deram. The risk is that the GP cannot handle the size and complexity of large deals.

- Financial leverage. While some investors always use leverage, others use little. The use of leverage is a special skill and requires a dedicated finance team to negotiate with lenders, structure loan agreements, gain access to capital markets, issue bonds and so on.

Each of these criteria is backed by a multi-faceted scoring system driven by qualitative and quantitative data. The scoring system rates each GP, enabling Flexstone to assess, in a systematic way, whether a GP has a specific, proven skillset confirmed by a track record.

Flexstone then inputs these criteria into a matrix to create a sweet spot profile for every GP it partners with. Whenever Flexstone sources a co-investment opportunity the characteristics of the deals are determined and compared to the sweet spot matrix of the GP to evaluate the fit, or otherwise.

Based on whether a deal is a sweet spot fit, Flexstone’s investment team will either decline a co-investment opportunity or move ahead with further due diligence, allowing it to give a decision to GPs in a timely, efficient manner.

“This is a competitive market and you need to move fast,” says Deram. “What matters to a sponsor is that you respond quickly, whether that response is positive or negative. If the lead sponsor loses three weeks because you are slow responding, your deal flow will dry up.”

The sweet spot framework allows Flexstone to systematically trim potential deals from 100 to 20, saving considerable time and resources. “We know then we have 20 good deals from good managers,” says Deram. “That gives us time and space to perform further due diligence and select the deals we actually want to go ahead with.”

Sweet spot transactions outperform opportunistic deals

Deals which fall within a GP’s sweet spot consistently and significantly outperform opportunistic transactions that stray from the sweet spot.

Research has shown that, when a buyout fund makes an investment which is close to its sweet spot, average returns are 2.2x the price that is paid for purchasing it. When the fund strays from the sweet spot, returns are just 1.3x the price paid.

“We aim to achieve at least 2x returns,” says Deram. “The systematic filter is a major component in helping us to get there. We might miss the odd 10x deal but consistency is our goal, not occasional spectacular performance.”

Conclusion: a powerful tool for co-investments

The concept of a sweet spot may not sound like a practical idea. But put a framework and metrics around the concept and suddenly it becomes a powerful tool. A systematic sweet spot framework helps avoid style drift, conserve resources, and produce more accurate decision-making. And all this, of course, increases the chances that buyout co-investment performance meets investors’ expectations.

Flexstone Partners

An affiliate of Natixis Investment Managers

Flexstone Partners, SAS – Paris

Investment management company regulated by the Autorité des Marchés Financiers. It is a simplified stock corporation under French law with a share capital of 1,000,000 euros Under n° GP-07000028 –Trade register n°494 738 750 (RCS Paris)

5/7, rue Monttessuy,

75007 Paris

www.flexstonepartners.com

Flexstone Partners, SàRL – Geneva

Independent (unregulated) asset manager, under Swiss Federal Act on Collective Investment Schemes (“CISA”), supervised by Commission de haute surveillance de la prévoyance professionnelle (“CHS PP” and regulated by the Swiss Financial Market Supervisory Authority (“FINMA”) under Anti Money Laundering requirements. It is a limited liability company with a share capital of 750 000 CHF.

Trade register n° CH-660-0180005-1

8 chemin de Blandonnet

Vernier 1214 Geneva

Switzerland

Flexstone Partners, LLC – New York

Delaware corporation, registered with the United States Securities and Exchange Commission as an investment adviser

28th floor of 745 Fifth Avenue, New York, NY 10151.

Flexstone Partners, PTE Ltd – Singapore

61 Robinson Road, #08-01A Robinson Centre

Singapore 068893

Natixis Investment Managers

RCS Paris 453 952 681

Share Capital: €178 251 690

43 avenue Pierre Mendès France

75013 Paris

www.im.natixis.com

This communication is for information only and is intended for investment service providers or other Professional Clients. The analyses and opinions referenced herein represent the subjective views of the author as referenced unless stated otherwise and are subject to change. There can be no assurance that developments will transpire as may be forecasted in this material.

Copyright © 2020 Natixis Investment Managers S.A. – All rights reserved

How Well Will the Private Equity Markets Withstand the Crisis?

How Well Will the Private Equity Markets Withstand the Crisis?

Flexstone Partners Sweet Spot Proprietary Framework

Flexstone Partners Sweet Spot Proprietary Framework

Private Assets: Making the Retail Revolution a Reality

Private Assets: Making the Retail Revolution a Reality