The Five Myths of “Illiquids”

Key Takeaways:

- Liquidity needs are unique to each DC scheme or arrangement, and a meaningful allocation in a default fund to private markets should not be overlooked.

- Illiquid investments shouldn’t be perceived as being any more complex than publicly traded financial securities.

- The risks of investing in private equity, for example and how these risks are approached – are more or less the same as investing in publicly-listed companies.

- If UK DC schemes can manage to overcome their perceived challenges, there’s an opportunity to access real, income-producing assets which can produce risk-adjusted returns that are greater than those available in public markets.

Resources

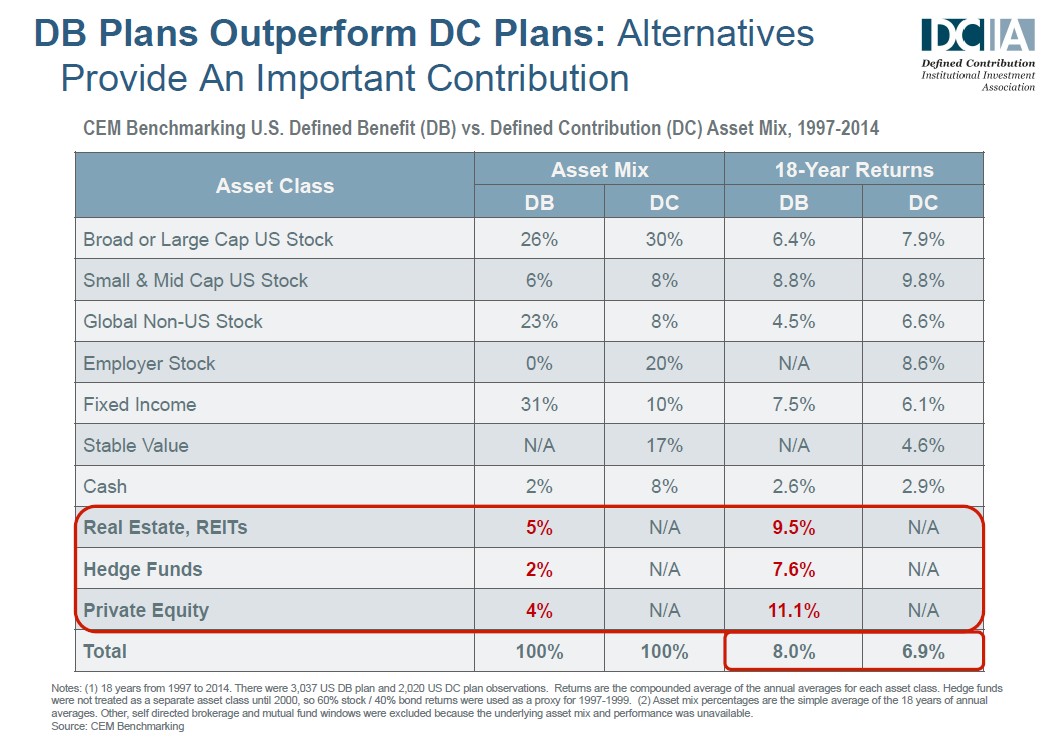

Private market investments have historically been an integral part of the success of a Defined Benefit (“DB”) investment strategy and strong returns from private equity, private debt, and real estate have been critical in lifting DB returns in recent years.

Returns from private equity of over 11% p.a. over nearly two decades, and 9.5% p.a. from real estate over the same timeframe, helped to deliver 8% annual returns for US DB plans, with just an 11% allocation to illiquid/private markets. On the other hand, DC schemes, which had no exposure to illiquid assets, returned just 6.9% a year.

Despite this compelling evidence, most DC schemes are unwilling to include illiquid investments on their roster of eligible investments. The adoption of potentially return-enhancing illiquid assets has been hampered by what we believe are common misconceptions.

Below are five myths about illiquidity which are holding DC schemes back and which, we believe, should be explored.

Dispelling the myths about illiquidity

Myth 1. They expose schemes to excessive risk

In fact, illiquid assets are not that risky when they are well-sourced, when the investment team has considerable experience of investing in and managing illiquid assets, and when the reputation of the sourcing team allows access to a robust and diverse pipeline.1

Take private equity: investing in it is not so very different from investing in publicly-listed companies. Notwithstanding in some cases there isn’t the same governance, transparency, liquidity and access, the premise of buying companies is the same and both of these investment strategies involve accessing both small caps and large caps and diversifying the portfolio across geographies and sectors. In other words, the risks and how these risks are approached, are more or less the same.

Myth 2. They are too complex

Illiquid investments are really no more complex than publicly-traded financial securities, in spite of the jargon which has been built up around them. A private debt corporate strategy, for example, will focus on identifying companies which have an attractive credit profile. The same is true of investing in public bond markets. The key, as for exchange-traded assets, is to buy an asset for the right reason which is down to a strong fundamental analysis. The premium on illiquid assets relates partly to the complexity and speed of accessing private markets, not to the complexity of the assets themselves. Accessing private markets is down to experience and skill, not the dark arts.

Myth 3. Closed-ended funds and DC don’t mix.

New solutions now exist that allow multiple closed-ended funds to run in parallel or consecutively, creating structures that are similar to open-ended funds. We see more and more “evergreen” funds, which means funds that are always open to subscriptions. However, this doesn’t change the fact that the underlying strategy is structured to invest in assets over multiple years. With future cash-flows set to continue over a number of generations, the evergreen approach is likely to be more attractive, therefore managers need to make closed-ended funds open for business.

Myth 4. DC funds are retail-focused so need to be liquid

All assets have a degree of illiquidity and even publicly listed equities sometimes need three days to clear. There is a trade-off between additional performance and illiquidity which most DC members would be prepared to live with. Portfolios need liquidity for different reasons, the portfolio itself needs to be nimble to take advantage of market dislocations and mispriced assets but also for members to access their savings. However, as long as the allocation to private markets is carefully sized, DC schemes should be well positioned to face any difficulties associated with extreme scenarios. In addition, investing in private markets assets is ultimately a long-term commitment, which is well aligned with the objective of DC savers who, whether viewed as a scheme or an individual, are long-term investors.1

Myth 5. Valuations are impossible for illiquid assets

Valuations of assets are critical to define performance over time periods and particularly at times of redemption. Valuations of illiquid assets are not as simple to calculate as for publicly-quoted ones, but the issue is far from insurmountable. Mark to market valuations do not have to be performed on a daily basis to allow members to know how much their pension pots are worth. Valuations can be averaged between points, with costs and income reflected as well as any known events, and this can give a daily price to allow fund values within a narrow range to be calculated.

The benefits of illiquids

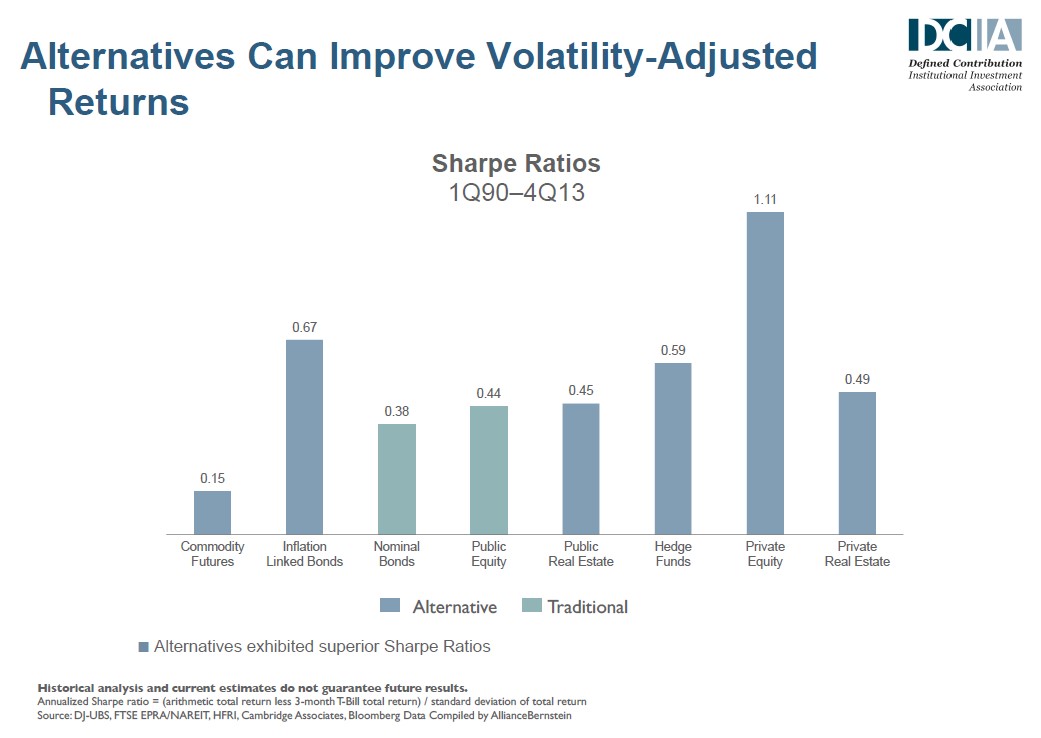

If UK DC schemes do manage to put aside their fears and concerns, the potential benefits for members are considerable. The clearest of these benefits is the opportunity to access real, income-producing assets such as buildings, bridges, tunnels and aircraft. These kinds of assets can produce risk-adjusted returns that are considerably above those available in public markets.

In addition, some parts of the economy are underrepresented in the stock market because they remain privately owned. Investing in these privately owned companies can provide opportunities to capture market growth otherwise unavailable. In addition to superior return, portfolio including private assets benefit from other increased diversification, thanks to reduced correlations in the overall portfolio to traditional equity and bond markets. Illiquid assets can also be shown to reduce overall portfolio volatility. For institutional investors with predominantly income requirements, illiquid assets can also offer steady yields through regular distributions.

UK government sees the opportunity

The signs are that the tide may be about to turn. In 2018 the UK government announced it would encourage the use of illiquid assets within DC schemes.2 The Department for Work and Pensions (DWP) said it would find a way of incorporating performance fees – levied on some illiquid strategies – within the 0.75% charge cap that is in place for default funds.

The government’s primary aim, it would seem, is to stimulate investment in the real economy. By doing so, it also allows DC schemes to increase portfolio diversification and reduce volatility within members’ portfolios.

However, the pensions industry is not waiting for the government to take the issue further. NEST, which facilitates workplace pension schemes, has already started to incorporate illiquid strategies into its fund offerings. Other master trusts, which combine the resources and assets of multiple employers, are likely to follow suit as the opportunity becomes better recognised.

Where there is a will, there is a way

Many stewards of UK DC pension schemes do not yet consider illiquid investments, reasoning they have enough to do without tackling an asset class which (many argue) is just too complex to work in DC. Well, they should reconsider.

Helped by the recent government shift in stance, UK DC Schemes have the opportunity to rethink the potential impact of illiquid investments in their portfolios. Their members would surely thank them. Why? For offering asset classes which reduce concerns about public markets and offer potentially new streams of income and capital growth.

As the UK DC market begins to look for solutions to incorporate real assets, scheme sponsors and trustees need to encourage the fund platforms and administrators to find ways to make this work, because however much they resist, it’s happening, and happening now.

And let’s face it, DC is for Life not just for Christmas!

2 s. 'UK government seeks to open up illiquid assets to DC funds' IPE (6 February 2019)

Published in May 2019

Natixis Investment Managers

RCS Paris 453 952 681

Share Capital: €178 251 690

43 avenue Pierre Mendès France

75013 Paris

www.im.natixis.com

This communication is for information only and is intended for investment service providers or other Professional Clients. The analyses and opinions referenced herein represent the subjective views of the author as referenced unless stated otherwise and are subject to change. There can be no assurance that developments will transpire as may be forecasted in this material.

Copyright © 2019 Natixis Investment Managers S.A. – All rights reserved

CDC Pensions and the Future of UK Retirement

CDC Pensions and the Future of UK Retirement

Time to Re-invent the Default Wheel?

Time to Re-invent the Default Wheel?

Redefining Defined Contribution

Redefining Defined Contribution