CDC Pensions and the Future of UK Retirement

Collective defined contribution (CDC) is part of the fabric of Dutch society. Could it be exported to the UK?

Key Takeaways:

- Collective defined contribution (CDC) – a structure of pension scheme that offers a middle ground between defined benefit and defined contribution – has been popular in the Netherlands since the early 2000s. Natixis Investment Managers hosted a roundtable in Amsterdam with some of the UK and the Netherlands’ foremost CDC experts for an exchange of ideas.

- In the UK, the introduction of freedom and choice has been well received and presented many opportunities for pensions providers to innovate, but there’s a concern that CDC might be at cross purposes with this philosophy.

- UK companies that decide to introduce CDC will be starting from scratch. They will need to set initial contribution and indexation levels for benefits, while bearing in mind that if markets take a downturn and assets no longer match liabilities, the liabilities will need to be cut.

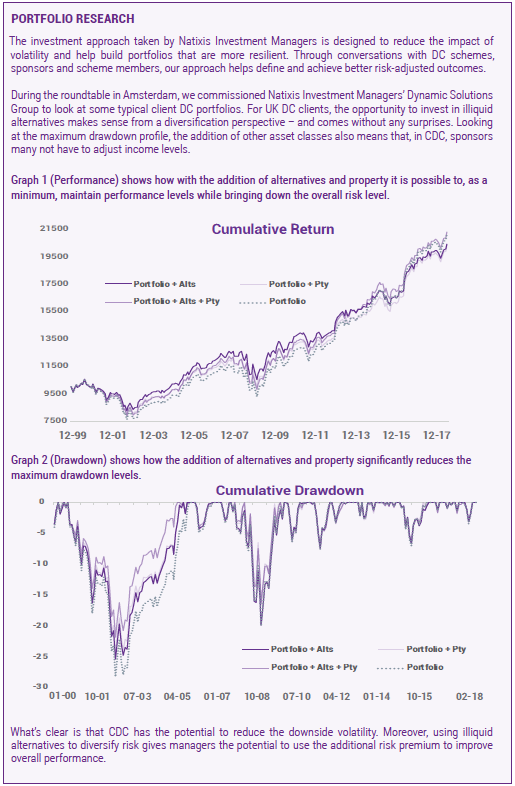

- There’s the potential for sponsors using CDC to invest in illiquid alternatives, which provides diversification across the portfolio and allows managers to use the additional risk premium to improve overall performance.

The panel featured distinguished Dutch and UK industry professionals from global consultancies, law firms, industry bodies, master trusts and high-profile pension schemes.

The Dutch system

Having gained popularity in the Netherlands in the early 2000s, CDC has become part of the fabric of Dutch society. Some CDC schemes were created from scratch while others evolved in CDC vehicles, often bringing with them some inclusion of legacy entitlements or agreements with scheme sponsors.

The relative success of the Dutch system has hinged on its ability to foster trust among the pensions community. Alwin Oerlemans, Head of Pension Strategy at asset management firm APG, said: “Pension funds [in the Netherlands] are very transparent about cost – they release cost data that are used in rankings which appear in the newspapers.

The pension funds have to explain why if their funds present higher costs compared to peers.

In 2002, the Dutch regulator made pension funds aware they had to communicate effectively about the conditionality of indexation – some pension schemes had forgotten about that, although it was in their design.

Under Dutch CDC rules, pension entitlements are a target, not a promise – so, if the level of funding falls, Dutch scheme decision-makers are entitled to cut indexation levels, which means the benefits paid out will also decline.

“In 2008, they found out they had forgotten to communicate effectively about the ultimate risk mitigation, which could include the cutting of pension benefits,” continued Oerlemans. “Only a few funds really had financial situations that were so vulnerable that they had to cut benefits, and the average cut was only around 1-2%.

“However, these two factors – schemes failing to be explicit about the conditionality of indexation and also the risk of cutting pensions – really hurt trust in the system.”

Like many countries, the Netherlands is also grappling with an ageing population – the pensionable age is now 68. Then there’s the rise of the self-employed.

Jobert Koomans, Founder of SBZ Pensioen, the pension fund provider for the Dutch health insurance sector, commented: “We see a new generation of self-employed people who can make their own choices, and don’t chose to invest for their future, either because they don’t have the money or the interest.”

CDC in the UK

CDC came to the fore in the UK in 2013. Former pensions minister Steve Webb proposed legislation to make the introduction of CDC possible in the UK, although those plans were shelved when he subsequently left office. Then, in early 2018, Royal Mail reached an agreement with the Communication Workers Union to allow a CDC scheme to replace its DB scheme, which closed at the end of March 2018.

Many in the pensions and investment industry see CDC offering a middle ground between DB – which has proved unaffordable for most employers – and defined contribution. The theory goes that DC puts too much onus on individuals and, depending on contribution levels, may not provide savers with comfortable retirements.

Furthermore, while most DC schemes have good accumulation strategies, decumulation remains an unsolved puzzle. CDC could offer a way of collectively sharing the risk of people outliving their pension savings.

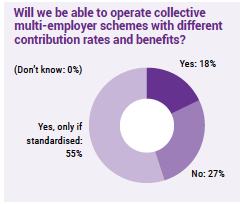

In the result of our poll (see chart), the answer is clearly not binary, as there are significant differences between the two systems. In particular, the myriad benefit structures in the UK system could be difficult to implement at a collective employer level. In the Netherlands, in most cases, the government sets the contribution structure and income rate in retirement.

Kevin Wesbroom, Senior Partner at professional services firm Aon, said: “No UK market participants have got a structure which enables you to have an investment portfolio with elements of security, growth, flexibility and a plan in case you live for too long. Could a collective annuity be part of a retirement solution? We are trying to structure the legislation in the UK so that it encompasses these issues.”

Freedom and choice

In 2014, the UK government introduced freedom and choice, which allows retirees to take their money in whatever way they want from the age of 55, rather than solely as an annuity. Freedom and choice has created many opportunities for providers that are already developing decumulation products, but it will be challenging for the pensions industry to meet people’s varied retirement income needs in a CDC scheme.

Tim Phillips, Head of Pension Markets at the UK DC master-trust pension scheme Smart Pension, commented: “The fact is that a lot of people don’t have a flat income requirement in retirement… Some have a U-shaped retirement where they want to go travelling at the start, their income needs taper out in the middle and then there are things like care which are more expensive.”

The lack of choice that CDC offers could be its biggest advantage, because in today’s retirement market, the missing piece of the jigsaw is advice. And that is where CDC offers advantages, because you aren’t required to engage absolutely.

Savers with pensions worth less than £50,000 are quite likely to take their money as cash, through uncrystallised funds pension lump sum (UFPLS) payments, while those with more than £500,000 may well have an individual wealth adviser. However, those in the middle, who have savings of £50,000 to £500,000, do not want to make retirement choices and simply want an income for life. Here, CDC could logically fill the gap.

Yet, not everyone is convinced that combining freedom and choice with CDC will work. As some have pointed out, you are effectively losing one of the key benefits if you add freedom and choice to CDC: the simplicity and the predictability.

Jeremy Goodwin, Partner and Head of Pensions at global law firm Eversheds Sutherland, added: “Designing CDC means you will have to… consider the people who will transfer out the money as cash.”

Is there the appetite for CDC?

Questions persist around the collective desire to bring CDC to the UK. The reality is that any form of CDC that UK companies introduce will most likely look different to overseas counterparts. Imran Razvi, Public Policy Adviser at the Investment Association, the trade body that represents UK investment managers, said: “Nothing suggests there is a huge amount of appetite to do anything but move to DC. We have seen significant growth in the master trust market and contract-based schemes have also continued to grow at pace. That will carry on, particularly among small employers.

“[With CDC], you are looking at some big, unique schemes that will be the first movers. As ever, people will look at those decisions and make theirs based on them.”

Wesbroom commented: “In the UK, we don’t have the regulatory appetite to change existing benefits. UK CDC is going to be future benefits only.

There will be no conversion of accrued pension rights. That is a big differentiator between us and the Dutch and Canadian systems, where CDC evolved as a derivation of existing schemes.”

UK companies that decide to introduce CDC will be starting with a blank sheet. They will need to set initial contribution and indexation levels for benefits while bearing in mind that if markets take a downturn and assets no longer match liabilities, the liabilities will need to be cut.

Intergenerational unfairness?

A key risk to members of a CDC scheme is one of intergenerational fairness, whereby the first cohort of members in receipt of a pension may receive more or less than subsequent generations.

In the Netherlands, there’s been plenty of public criticism of CDC where schemes have been forced to cut benefits in recent years – the Dutch Central Bank even mooted ending CDC and replacing it with individual DC. While in the UK, there has been a momentous intergenerational shift in pensions, with older people benefitting from DB schemes and younger savers offered much less generous DC arrangements.

Clearly, there needs to be a good definition of what fairness means. Wesbroom suggests writing this down from the outset: “Do you want to be nicer to retired members than young working members? If you want to treat everyone the same, write that in the rules. Then they will hold you to account on your decisions.”

Yet, as some have pointed out, there will always be an element of unfairness. In the UK we have cross-subsidies in many walks of life. If you think about the NHS for example, the younger people are subsidising this huge tenet of the welfare state. Why would CDC be any different?

Investment approach

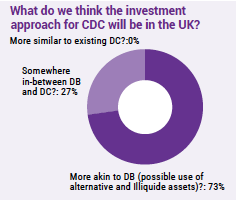

Critics of UK DC argue that a preoccupation with daily liquidity has led to a proliferation of less sophisticated investment models, which could adversely affect savers. With their ability to hold illiquid asset classes over the longer-term, DB schemes have significantly more sophisticated investment strategies in place, often to savers’ benefit.

Advocates of CDC argue that the structure’s long-term horizons allow for a more diversified range of assets, creating an investment strategy that is more akin to DB. Alternative asset classes that tend not to fit within the UK DC investment framework, like hedge funds and property, tend to add value over time, net of fees. Clearly, pension schemes are providers of capital with a role to play in the wider market. In DC, we are not really exploiting that to its full potential. If we stick in this DC, retail world, then nothing changes. Maybe as scale eventually takes hold, things may change. However, the introduction of CDC might trigger a change in attitudes.

Nevertheless, there are advantages to using a less risk-intensive strategy in CDC, as Wesbroom pointed out: “By choosing less aggressive, less volatile assets, this means you have a better chance of never triggering a reduction of 5% or more in pensions. However, that means a trade-off, as you might be less likely to achieve your investment goals.”

Costs and charges have been a key consideration for the UK Government when introducing auto-enrolment, having opted to introduce a cap on charges in 2014. But it is unclear how the charge cap would interact with CDC in the UK.

In the Netherlands, no cap exists. However, market pressures, public scrutiny and economies of scale mean that fees remain low. Oerlemans said: “Our tariffs are much lower than the UK charge cap for diversified portfolios. The larger funds are really far below it.”

Communication is key

Individual DC has been struggling with member engagement since its inception. The lack of available advice for those who cannot afford it – but often who need it the most – is part of the problem. Yet nothing of note for communicating to the masses has emerged that brings us any closer to that aspiration.

An earlier article explained the use of cohort analysis to enable better information about members, and provide the ability to create targeted defaults with appropriate risk targets. Clear communication is the way forward – and CDC is one possible answer to this conundrum. Naturally, the communication will need to be different, potentially less complex, and possibly more akin to the messaging around DB.

Everyone agreed that CDC presented a communications challenge. Jim Doran, UK Governance Leader, DC & Financial Wellness at Mercer, said: “On the one hand, we are going to have to tell members that their benefits could be cut in certain circumstances. On the other hand, that needs to be balanced with the need for CDC not to be seen as the system that cuts benefits.”

Goodwin added: “From a legal perspective, one of the key things is ensuring that CDC is not seen as guaranteed. If people do not understand that point, it could result in negative attention from the press and political intervention. Getting the communication piece right is key for many reasons, but especially to keep that point sacrosanct. It should be emphasised in every interaction.”

In summary

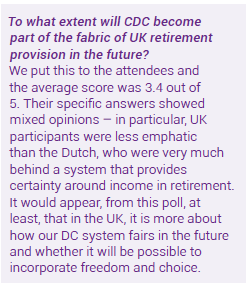

CDC in the UK looks set to become the fabric of our pensions society too. And we can certainly learn from our Dutch counterparts about how to manage these schemes, the pitfalls to look out for and how to approach communications – as well as how to deal with performance downturns and funding levels as examples.

In the UK, we have moved, in most cases, to individual DC. This is possibly irreversible, apart from where schemes have existing accrual for members and can fortunately still move to the ‘half way house’ of CDC. The Department for Work and Pensions will present its CDC framework in the autumn, and this will be an interesting read for those considering the option. They believe it will be mainly for single employer trusts, but we’ll have to see if collective multiemployer schemes can exist when the benefit structures are so varied. Perhaps the master trusts set up purely for auto enrolment, which have consistent contribution structures, could be more able to revert to CDC in the future?

The perennial challenge of employee engagement, notwithstanding the efforts of the industry to combine behavioural science with machine learning and artificial intelligence, could be resolved in one go with the pragmatic, paternalistic and almost DB–like approach of CDC.

And what of the investment process? In the UK we have a huge number of default funds that are barely fit-for-purpose for members in a scheme, where the platforms block us out of anything that doesn’t work on a daily basis. Yet CDC could indeed harness the illiquidity and complexity premia while reducing risk through better diversification, which could be spent elsewhere and improve the overall performance.

Natixis Investment Managers

RCS Paris 453 952 681

Share Capital: €178 251 690

43 avenue Pierre Mendès France

75013 Paris

www.im.natixis.com

This communication is for information only and is intended for investment service providers or other Professional Clients. The analyses and opinions referenced herein represent the subjective views of the author as referenced unless stated otherwise and are subject to change. There can be no assurance that developments will transpire as may be forecasted in this material.

Copyright © 2018 Natixis Investment Managers S.A. – All rights reserved

Diversification, the Blind Spot of Equity Markets

Diversification, the Blind Spot of Equity Markets

Mirova Monthly Market Review & Outlook - April 2024

Mirova Monthly Market Review & Outlook - April 2024

Russia-Ukraine: The Beginning of the End?

Russia-Ukraine: The Beginning of the End?

Natixis IM Solutions - Pulse - The US dollar mirrors its economy

Natixis IM Solutions - Pulse - The US dollar mirrors its economy