Sustainable Global Equities: The Final Frontier

Key Takeaways:

- Investors are increasingly looking for their core global equities portfolio to align with their ESG beliefs. They also want their equities to outperform broad market indices over the long term.

- Sustainability and economic growth are converging so by investing in long-term trends that will drive the economy, investors could both enhance ESG in their portfolios and receive market-beating returns.

- Mirova has a three-pronged approach to sustainable global equities: investing in companies which provide solutions to global ESG challenges; investee companies must have good ESG risk mitigation practices; companies must have very strong fundamentals to ride market cycles.

Many investors are increasingly seeking their entire equities portfolio to align with their ESG needs. More than that, they want ESG integration into their core equities portfolio to help it outperform broad market indices over the long term.

For ESG strategies to move to the mainstream, companies in the core portfolio should have three key characteristics, according to Mirova, a sustainability specialist: 1) the company’s products present solutions to global sustainability challenges; 2) it is committed to managing ESG risks; 3) it has demonstrably strong fundamentals, enabling it to outperform financially.

Combining these characteristics in portfolios requires specialist skills and resources which few sustainable investment firms possess. Jens Peers, CEO of Mirova US, a sustainability specialist investment firm, says: “In our global sustainable equities strategy, we seek outperformance by investing in trends that are sustainably shaping the world.”

And by creating ESG portfolios from stocks worldwide, accessing the most innovative and best-managed companies across the globe, Mirova also provides the diversification that investors demand in their core equities portfolio.

Tomorrow’s themes, today

By investing in long-term trends that will drive the economy, investors can achieve the twin aims of outperformance and ESG integration in their portfolios.

“There are significant tailwinds behind certain parts of the economy,” says Peers. “We want to invest in companies and sectors that will be more important in the future. We don’t merely construct our portfolios around current benchmarks, which would stop us seeking out the winners of tomorrow.”

Mirova, an affiliate of Natixis Investment Managers, has identified four long-term trends, or themes, which it believes will drive the economy in the coming years. The first, demographics, focuses on the ageing population but also urbanisation, quality of life issues and the growth of middle classes in emerging markets.

The second is technology, including data proliferation, automation, artificial intelligence and cloud computing. The third is the environment, including the transition to a low-carbon economy and more efficient use of natural resources such as water. The fourth is governance, including innovation, fairness and new infrastructure.

These themes are broadly in line with the issues that investors read about and face in their everyday lives. “We think it is logical to build our global sustainable equities portfolios around themes and ideas that are close to people’s hearts,” says Peers.

Nuanced ESG analysis

Next, Mirova assesses the extent to which companies measure and manage their ESG risks. ESG analysis, ostensibly assessing non-financial impacts, is a key element in assessing financial risk. “We believe there is a mismatch between market valuations and valuations that take into account sustainability risks,” says Hua Cheng, co-manager of Global Sustainable Equities at Mirova. Examples of companies which have underperformed in recent years because of unrecognised ESG risks are almost too many to mention.

The starting place for Mirova’s ESG assessment is the UN Sustainable Development Goals (SDGs), which were adopted by 193 countries in 2015. Mirova looks for companies which actively integrate SDG issues right across the entire value chain from raw material inputs to a product’s end-of-life.

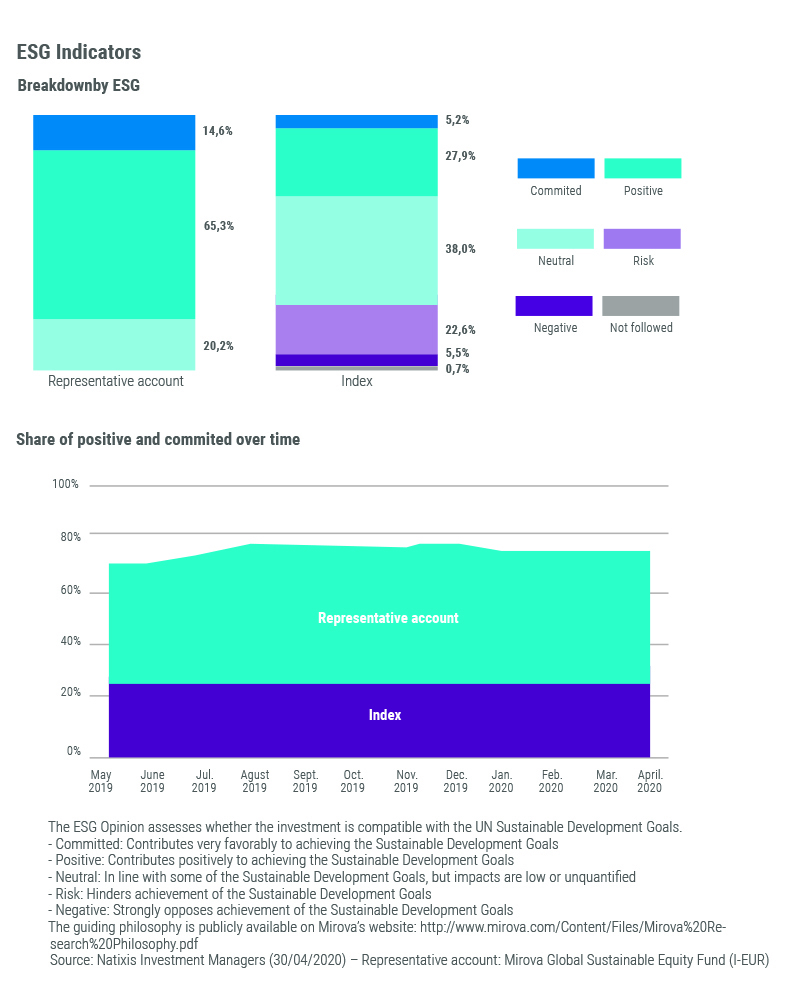

Mirova has a five-tier rating mechanism based on the SDGs. The two highest ratings tiers are “Committed” and “Positive”, where companies contribute to achieving the SDGs. The middle tier is “Neutral” which means some SDGs are achieved, but the impact is low or unquantified. The two lowest tiers are “Risk” and “Negative”, where companies are believed to not manage their ESG risks adequately, or where a company’s actions run contrary to the SDGs.

“As much as possible we want to be exposed to positive and committed companies,” says Cheng. Whereas around a third of constituents of the MSCI World index are rated “Positive” or “Committed” to the SDGs, this rises to around 80% of the companies in Mirova’s global sustainable equities portfolios.

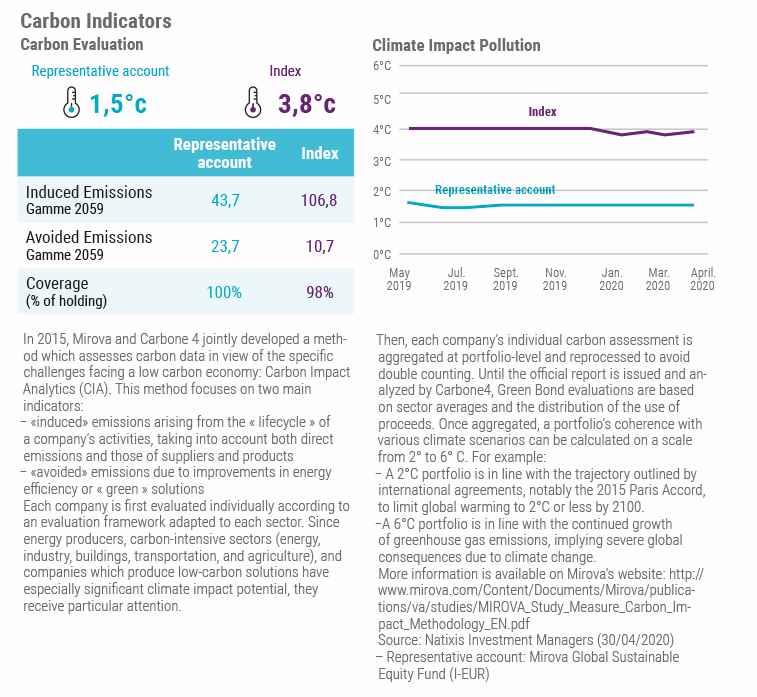

Mirova’s strategy also measures corporate carbon footprints and translate these footprints to global warming alignment. The strategy is designed to be aligned with an economy which would lead to a maximum 2oC global temperature rise above pre-industrial levels (as set out by COP 21 in 2015). This compares with carbon emissions for companies in the MSCI World index which combined are projected to lead to temperature rises of 3.7oC above pre-industrial levels.

The product of Mirova’s global sustainable equities strategy is a portfolio of companies which have a better ESG risk profile than broad indices and achieve higher positive sustainability impact than those indices too.

Fundamental analysis underpins ownership mentality

As important in an ESG strategy as the investment themes and ESG management, is the fundamental business case. Fundamental analysis underpins the selection of companies that can deliver over the long term.

Mirova’s team of analysts and portfolio managers focuses closely on the quality of management, meeting companies at least once a year, testing their vision and how they are executing it. Financial analysis evaluates the quality of strategic positioning, as well as financial strength. Corporate earnings are projected five to seven years into the future using discounted cashflows with the aim of finding companies in which Mirova can be a long-term shareholder.

“We have an ownership mentality, we invest only in companies we really believe in,” says Amber Fairbanks co-manager of Mirova’s global sustainable equities strategy. “Higher-quality companies particularly help our portfolios when there is trouble in the markets.”

Portfolios contain some surprising holdings

The three-pronged stock selection process leads to a concentrated portfolio of around 50 companies. The portfolio includes companies which may not be widely viewed as sustainability champions.

Take Microsoft and Mastercard. Both are at the heart of trends that are reshaping the global economy, including demographic changes, the gig economy, big data, digital payments and urbanisation. “These holdings show that our process is not black or white, like some other ESG strategies,” says Fairbanks.

During the pandemic, Microsoft, Mastercard and other technology companies have proved their worth, helping to enable people to work collaboratively and efficiently from safe, home environments. They manage ESG risks well too, becoming leaders in data security and privacy, as well as energy management. Microsoft has even announced it will become carbon-negative by 2030, offsetting all its carbon emissions since the company was created in 1975. As large, liquid stocks, these companies also sit well in a core, global equities portfolio.

Other sectors with high weightings in the Mirova global sustainable equities portfolio include materials, healthcare and utilities. Northern European companies have a high representation in the portfolio too. These countries often have scarce natural resources so have become adept at preserving and enhancing them. This has the secondary effect of making Northern European economies innovative and technology-driven, with additional support from government and regulators. Importantly, many of the larger companies are family-controlled, meaning they have longer-term investment horizons which are better aligned with sustainable values.

Financial companies are under-represented in the portfolio because many have complex risk exposures. And few financial companies are predominantly active in local economies, helping communities and delivering local jobs.

Outperformance in turbulent times

The themes identified by Mirova play out over multi-year periods, so cashflow is discounted for five to seven years for valuation purposes. Quarterly performance numbers are virtually ignored.

But investment performance is not limited to the long term: companies in Mirova’s global sustainable equities strategy are expected to perform over three-year periods. Since the inception of the strategy in 2013, the portfolio has outperformed the broader index, putting it in the top decile among its peers.

The strategy is given a head start by the practice of buying companies at a 20% discount to what the team believes to be their intrinsic value. The strategy performs well in most environments although it underperformed in 2016 with the election of Donald Trump and the subsequent rerating of oil, gas and coal stocks. But this was more than offset in 2017, the strategy’s best calendar year, when economics reasserted themselves and alternative energy assets, in particular, rebounded.

The global sustainable equities strategy has also performed well in turbulent markets. “Because of our quality bias, we tend to do well in big crisis moments,” says Fairbanks. The strategy comfortably outperformed the market in the first quarter of 2020, for example. “One of the reasons is we don’t hold fossil fuels or financials which underperform in severe market stress,” Fairbanks adds. The strategy also avoids tourism, aviation and transportation stocks.

On the other hand, it holds outsized positions in healthcare, which is defensive during downturns, and in technology companies, which are cash-rich and so resilient to downturns and credit squeezes1.

Conclusion: ESG moves to the core

A core ESG equities strategy can be seen to generate superior financial performance to the broad index, and much stronger ESG performance.

This kind of strategy requires a range of skills which reside only in investment houses with specialist resources. “We have got a long-term track record in this kind of investing,” says Jens Peers. “As a firm, our focus is purely on sustainable investments. It’s our reason for being and applies across all our assets.”

For investors, this means ESG investments no longer need to languish in a dark corner of the portfolio, adding only marginal gains to returns and to sustainable impact. It is now possible to make ESG investments the core of the portfolio, doing social and environmental good, reducing risks and, aiming for outsized returns.

Published in July 2020

Mirova US

888 Boylston Street, Boston, MA 02199; Tel 857-305-6333

Mirova US is a US- based investment advisor that is a wholly owned affiliate of Mirova. Mirova is operated in the US through Mirova US. Mirova US and Mirova entered into an agreement whereby Mirova provides Mirova US investment and research expertise, which Mirova US then combines with its own expertise when providing advice to clients.

Mirova

Affiliate of Natixis Investment Managers

French Public Limited liability company

Share Capital: €8,813,860

Regulated by the Autorité des Marchés Financiers (AMF) under n° GP 02014.

RCS Paris n° 394 648 216

59 avenue Pierre Mendès France

www.mirova.com

Natixis Investment Managers

RCS Paris 453 952 681

Share Capital: €178 251 690

43 avenue Pierre Mendès France

75013 Paris

www.im.natixis.com

This communication is for information only and is intended for investment service providers or other Professional Clients. The analyses and opinions referenced herein represent the subjective views of the author as referenced unless stated otherwise and are subject to change. There can be no assurance that developments will transpire as may be forecasted in this material.

Copyright © 2020 Natixis Investment Managers S.A. – All rights reserved

Sustainability Investing Beyond COVID-19

Sustainability Investing Beyond COVID-19

Aligning Portfolios with the Paris Agreement

Aligning Portfolios with the Paris Agreement