A Low Volatility Approach to Emerging Markets

Highlights

- The perception that emerging market companies are lower quality, have higher levels of debt, and suffer more defaults than their developed market counterparts is not borne out in reality.

- Emerging market corporate bonds have offered a persistent and sizable premium over developed market bonds

- Shorter-dated emerging market credit can be an effective asset for investors who seek yield pick-up and lower volatility.

Yields are high, but allocations remain low

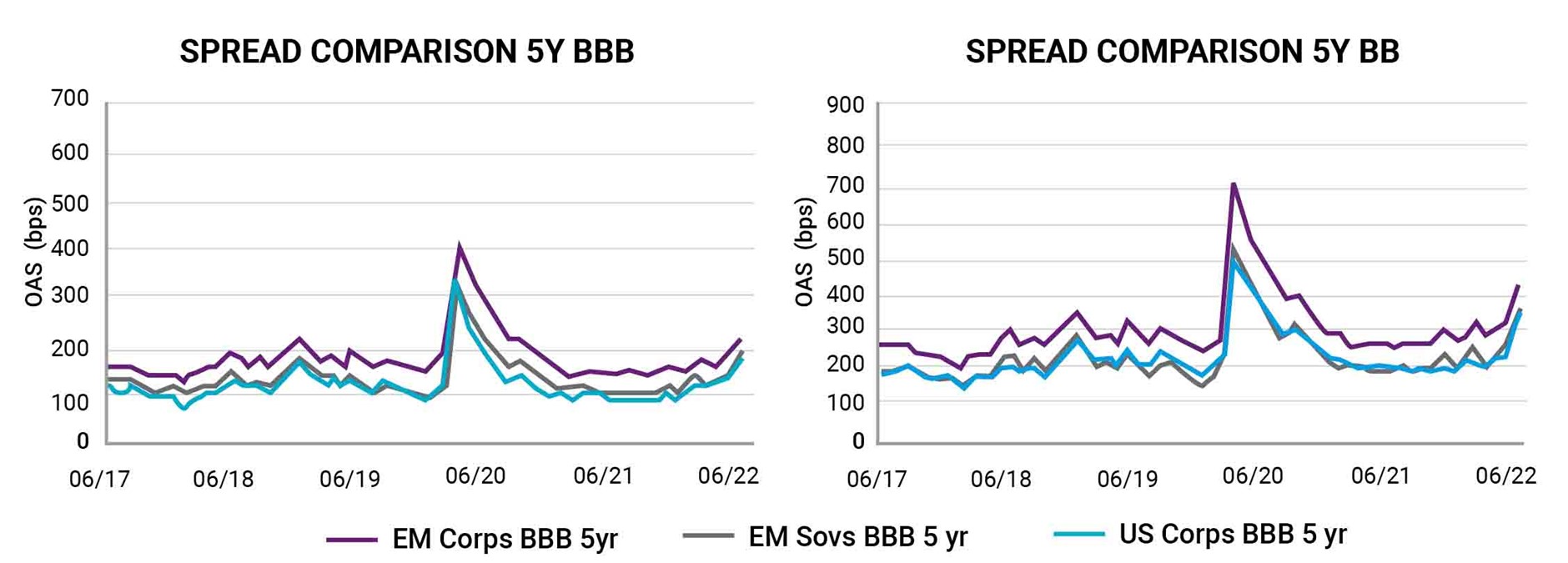

Spreads for emerging market corporate bonds are considerably higher than in developed markets. We can see this persistent and sizeable premium available for comparable BB and BBB bonds in the chart below. We would find the same premium in the single A and singe B ratings bands.

Importantly, EM corporates also offer a spread advantage to EM sovereigns. The EM sovereign space, which can offer attractive diversification benefits, offers little spread pickup on a maturity and ratings matched basis to US corporates. For that reason, the value proposition resides within the EM corporate space.

Source: Loomis Sayles, as of end June 2022

Many institutional investors, however, remain underweight emerging market debt, given the required specialized knowledge and lack of in-house expertise. For the top 50 US life insurers, for instance, the median allocation to emerging market credit is just 2.7%, and that includes exposure to emerging market sovereigns.

So are investors justified in eschewing emerging market debt?

Debunking the myths

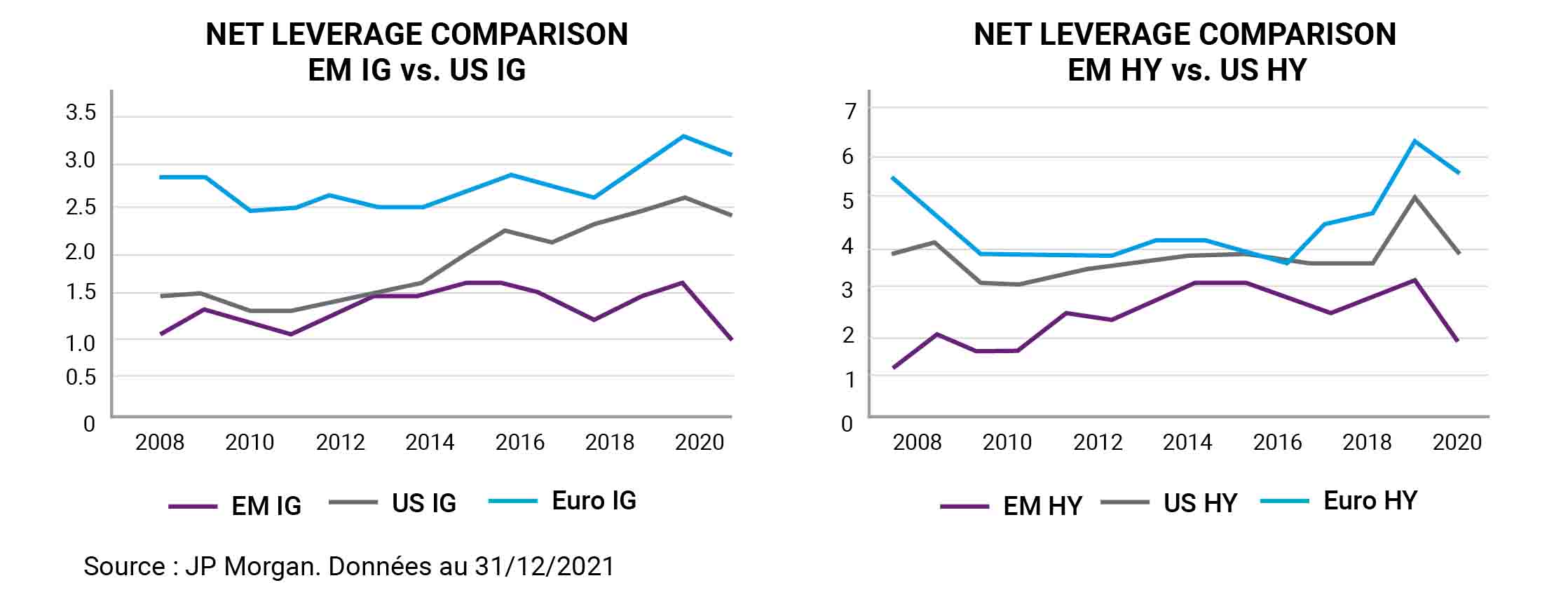

One common misperception about emerging market companies is that they are lower quality, have higher levels of debt, and suffer more defaults than their developed market counterparts. In fact, EM corporates typically have more conservative balance sheets and historical default rates are on par with developed market peers.

Consider debt levels: in both the investment grade and high yield segments, emerging market companies have well under half the net leverage of US and European companies.

The lower leverage levels often reflect prudent financial management. “Emerging market companies have different motivations,” says Elisabeth Colleran, portfolio manager for emerging markets debt portfolios at Loomis Sayles. “Unlike developed market companies, they tend not to borrow to create the optimal capital structure to drive their stock price.”

Rather, emerging market companies tend to borrow mostly for productive reasons– to improve and expand plants and mines, or build ports and telecoms towers. “They have a healthy fear of long-term borrowing and its effect on the downside,” Colleran adds.

Now let’s examine the idea that defaults in emerging markets are high. This idea seems to stem from the media attention given to sovereign defaults – such as Argentina, Venezuela and Sri Lanka.

Colleran says: In fact, default rates for emerging market high yield bonds over the last 15 years are little different to those of developed markets.

Default risk can be further mitigated by tilting towards higher-quality bonds. Loomis Sayles, an affiliate of Natixis Investment Managers, creates a crumple zone around default risk by maintaining an average portfolio rating of no lower than BBB-. “Lower ratings can produce huge returns in risk-on years, but horrible returns in risk-off years,” says Colleran. “We want to avoid that volatility in our returns.”

What about geopolitical risk?

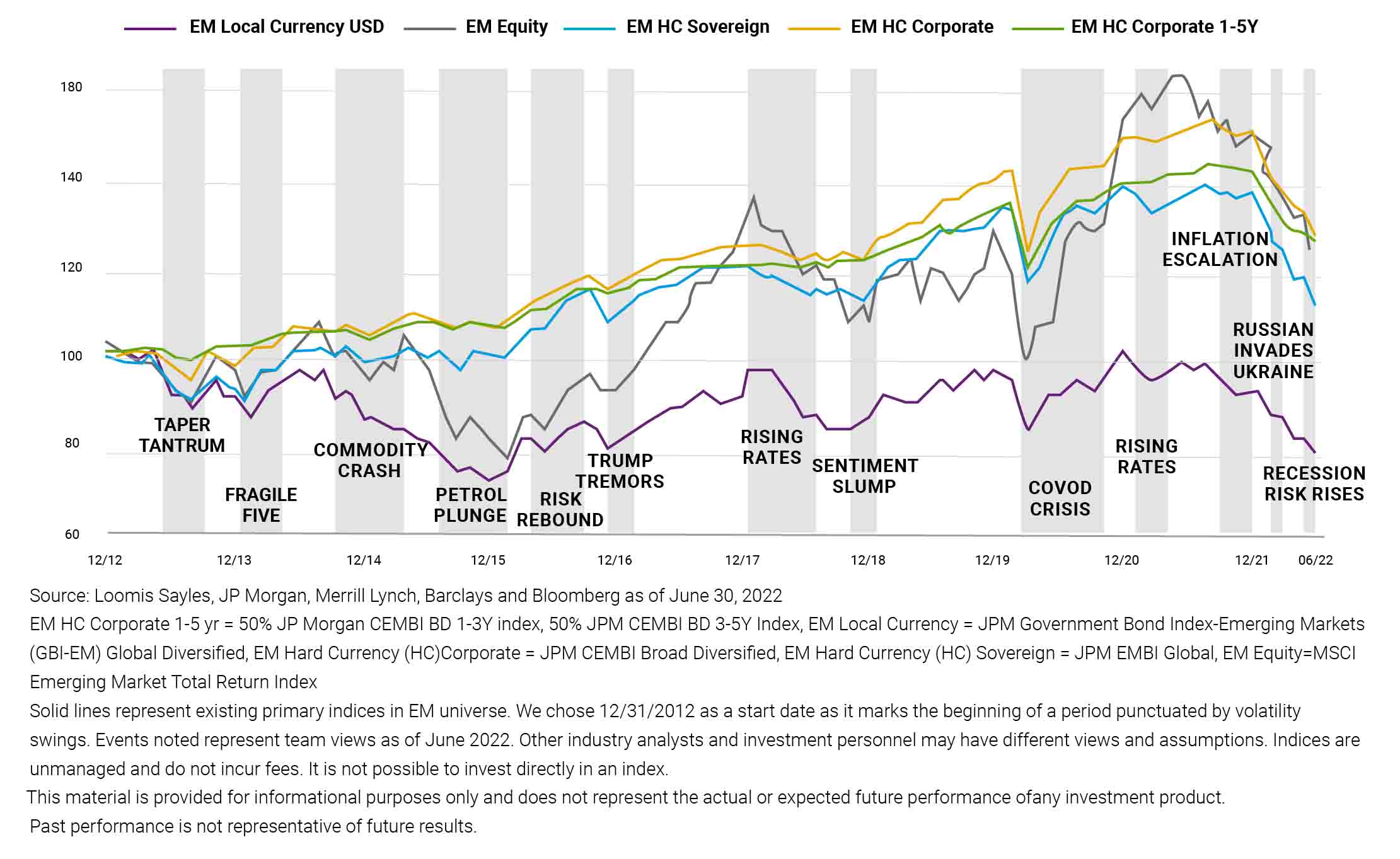

Investors who are cautious on emerging markets often cite geopolitical risk and volatility. Both of these risks exist, as Russia and China have demonstrated in 2021 and 2022, albeit for different reasons. But, once again, this perception of emerging markets is misguided.

First, media headlines tend to focus on the impact of geopolitical risk on more volatile emerging market equities and local currencies. Hard currency bonds tell a different story, however, showing a much smoother performance over time, with lower drawdown.

Second, emerging markets are often incorrectly portrayed as a unified block. “People see the stories about Russia and China and assume all emerging markets are in bad shape,” says Colleran. “While there are certainly global factors to consider, every emerging markets is different; each is in its own phase of the economic cycle, each is impacted uniquely by geopolitical factors, and each has an independent central bank.

The Loomis Sayles Emerging Market Debt team decomposes emerging markets, assessing volatility and returns along the spectrum. By diversifying with around 125-150 issuers, investing only in hard currency bonds and by focusing on high-quality names, it aims to significantly reduce volatility. “In good years for emerging market bonds, we don’t achieve the highest returns,” says Colleran, “but in bad years we should outperform a broader EM credit universe. From positive country and corporate allocations, we expect some capital appreciation too.”

Shorter duration and deep research buffers volatility

Another way of reducing volatility is by shortening the duration of the portfolio. As rising interest rates have emerged as a significant risk to bond prices, holding shorter dated bonds reduces price volatility.

A strong top down view of country and sector risk drives portfolio positioning, “This approach has helped us deal with a variety of headwinds, by adjusting commodity exposure, and altering country exposure on geopolitical concerns and opportunities,” says Colleran. “And, from a security selection angle, our analyst team provides deep, forward looking security recommendations with the goal of minimizing credit losses.”

EM & ESG

Another misconception is that ESG risks can be harder to manage in emerging markets.

Colleran states: “Companies in emerging markets can be more focused on making positive societal change than their Western peers,” says Colleran. Some companies that are large enough to issue bonds see it as a duty to help build schools and even whole towns. Other companies are increasing financial inclusion by developing processes and apps that allow users without formal bank accounts to send and receive funds.

Loomis Sayles started deploying ESG factors 12 years ago at a corporate level and has used a materiality mapping approach for the last several years to help it select and monitor its credit positions.

With growing ESG expectations from investors and regulators – notably the SFDR regulation – the data points are expanding and feed into the fundamental case for investing.

Colleran says: “We had already done a lot of the work integrating ESG considerations into our risk analysis, but what SFDR does is force you to be more explicit about how you assess and categorise ESG risks, which improves internal and external transparency.”

Attractive Sharpe ratio suits portfolio of many investors

Shorter-dated emerging market credit can be an effective asset for investors who want yield pick-up and lower volatility.

Sometimes the approach is employed in tandem with more volatile assets such as emerging market local currency debt. It can equally be allied to a high yield allocation. These combinations have the potential to further increase yield pick-up without raising the volatility to unacceptable levels.

Some investors have made the strategy their core bond allocation. As Colleran says: “It has a nice Sharpe ratio, which makes it attractive to a wide range of investors as the foundation of their bonds allocation.”

Published in October 2022

A subsidiary of Natixis Investment Managers

Investment adviser registered with the U.S. Securities and Exchange Commission(IARD No. 105377)

One Financial Center,

Boston, MA 02111, USA

www.loomissayles.com

Natixis Investment Managers

RCS Paris 453 952 681

Share Capital: €178 251 690

43 avenue Pierre Mendès France

75013 Paris

www.im.natixis.com

This communication is for information only and is intended for investment service providers or other Professional Clients. The analyses and opinions referenced herein represent the subjective views of the author as referenced unless stated otherwise and are subject to change. There can be no assurance that developments will transpire as may be forecasted in this material.

Copyright © 2022 Natixis Investment Managers S.A. – All rights reserved

2022 Sector Outlook

2022 Sector Outlook

Loomis Sayles – Investment Outlook – July 2022

Loomis Sayles – Investment Outlook – July 2022

Natixis IM Solutions – Market Review – September 2022

Natixis IM Solutions – Market Review – September 2022

Investing in Volatile Times

Investing in Volatile Times