The Alternative Outlook for 2024

|

|---|

|

|

|---|

|

Private assets – real estate, infrastructure, private equity and private debt – are regarded by many as the biggest growth area for asset management today. Boston Consulting Group says they have accounted for half of the industry’s global revenues.1 And while traditional stocks and bonds saw net outflows in the second half of 2023, these alternative investments are expected to grow by some 7% in the next five years.1

Historically, the attraction of private assets stems from diversification, new forms of income, the potential for long-term value creation without the volatility of public markets, and the potential for higher returns. And looking at the next 12 months, the 500 institutional investors included in the Natixis 2024 Outlook Survey see private assets are one of the few asset classes to remain bullish about: specifically, 64% see growth on private equity and 60% on private debt.2

According to Julien Dauchez, Head of Portfolio Consulting & Advisory at Natixis Investment Managers Solutions, private credit is particularly popular at the moment. He says: “The tighter credit conditions in recent months, retrenchment of banks from the lending space, and the growing opportunity for financing of leveraged buy-out mezzanine loans have created plenty of opportunities for expertise in private credit.”

There’s also plenty of debate about the ‘democratisation’ of private assets, whereby frameworks are evolving to allow retail investors to enjoy access to ever expanding markets – specifically the revitalisation of the new European Long-Term Investment Fund (ELTIF) directive, referred to as ELTIF 2.0.

In basic terms, ELTIF is a closed-end fund in Europe that allows retail investors access to illiquid assets. Investors cannot request redemptions until the end of the fund’s life. However, under the newly revised rules, ELTIFS can also be structured as open-ended funds and can allow redemptions under certain conditions.

Compared to the US, there is considerable growth potential from retail investors in Europe, where the region has historically lagged behind its US counterpart.3 A recent study by S&P revealed that Business Development Companies (BDCs) in the US manage nearly $300 billion in assets.4 In contrast, ELTIF 1.0 vehicles held assets totalling €11.5 billion as of March 2023. This discrepancy suggests that BDCs in the US possess 26 times more assets than ELTIFs in Europe, indicating substantial room for expansion.

Certainly, the stakes are high: a 2023 survey by PwC found that firms expect private markets to represent up to half of asset and wealth management revenues by the end of 2027, compared with 37.6% at the end of 2020.5

Julien comments: “We’re still waiting for the ink to dry on the EU’s ELTIF 2 format, so it’s too early to gauge the level of uptake and potential flows – but interest is very strong from wealth managers internationally. However, over the next couple of years, we expect the traditional 60/40 portfolio to reflect the demand for private assets and the need for increased diversification, potentially taking as much as 15% from the equity portion and perhaps 5% from fixed income, depending on the region.

“Remember, investors’ inflation expectations may be higher over the next coming years than in the past decade, so we’re likely to see a higher correlation between stocks and bonds again. That means the democratisation of private assets comes at just the right moment for wholesale investors, as private assets will offer them true diversification when they need it most.”

We asked three investment specialists from our Expert Collective to understand where they’re seeing the future opportunities across private equity, private debt and real estate.

Following a challenging first half of 2023 for mergers and acquisitions (M&A), we are presently witnessing a resurgence in transactions as despite a recent drop in fundraising, private assets, in particular, are anticipated to exhibit robust growth rates from 2024 onward.

This trend is particularly pronounced in private debt, with certain industry experts forecasting a 15% annualised growth rate for the next five years. This trajectory is expected to result in the doubling of the current market size by the year 2028.6

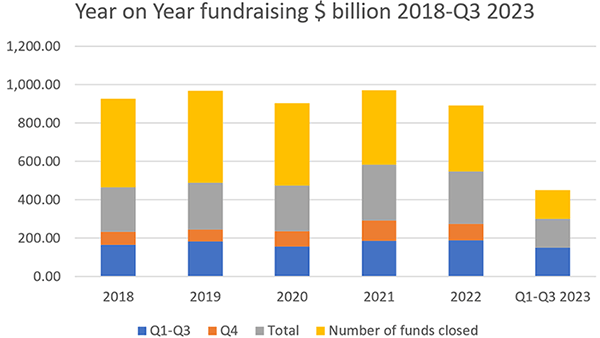

Private debt, and more specifically, direct lending funds, continues to seize market share from conventional sources of financing, such as banks. A primary driver for this shift is the deliverable, efficient, and reliable financing solutions offered by direct lending funds, making them increasingly attractive to private equity sponsors and this, in spite of a challenging year for fundraising in 2023.

Source: Private Debt Investor/Chart created by MV Credit; data period: 2018–Q3 2023

Against the backdrop of the prevailing interest rate environment, new financings will exhibit lower leverage multiples compared to those observed in the past decade. Consequently, there is a shift in focus towards structuring based on interest cover multiple ratios and the ability of companies to generate adequate cash flows for debt servicing. This trend is expected to perpetuate the prevalence of substantial equity contributions and enhanced documentation practices, as witnessed in recent years.

Following a period characterised by heightened uncertainty, we also foresee that a normalisation in the broader leveraged finance market will serve as a catalyst for a resurgence in M&A activity by the close of this year and throughout the next. An early indicator of this shift was evident in September, marked by an uptick in the initiation of early-stage M&A processes for robust and well-performing companies within counter-cyclical sectors, notably healthcare, software, and business services.

We anticipate that a substantial proportion, ranging from 30% to 40% of our existing portfolios will engage in financing activities, encompassing both refinancing and new financings, often associated with a third-party sale.

The bigger picture

Given the closed-ended nature and extended life span of funds dedicated to private debt, typically spanning a minimum of seven years but often longer, prudent selection of less cyclical industries poised for sustained growth becomes paramount. Our preference leans towards industries such as healthcare, software, and education. The rationale behind this strategic approach is rooted in the understanding that economic cycles can unfold unexpectedly.

For instance, no one embarking on fund investments in late 2019 would have foreseen three distinct economic cycles within three years, encompassing the Covid-19 downturn, the subsequent boom following extensive monetary stimulus, the induced cooling through current Western hemisphere monetary policies, and a war in Ukraine followed by a conflict between Israel and Gaza.

Navigating investments under such dynamic circumstances is inherently challenging. Therefore, it is imperative for managers to demonstrate consistent performance throughout various economic cycles.

Key factors to watch

Investor sentiment indicates we will continue to see long-term investment plans increase allocation to private debt. For instance, we have seen large investors increasing private debt target allocation from 5% to 8%.

This was also reflected in recent research among investors where private Debt emerged as the only asset class for which most respondents stated they intend to increase long-term allocations. However, several factors will determine asset class choice including geography where we see North America and Europe still being important investment choices for family offices for example.

Probably one of the most important factors to consider is risk. As we saw earlier, geopolitical tensions create uncertainties for investors and borrowers alike. But even with the most robust and least cyclical of business if there is channel or production disruption then the impact on borrowing and more critically repayments could be significant. This is where an experienced asset manager who understand the sector dynamics can make a difference and help navigate a prudent risk-based approach.

Overall, we’re optimistic for the year ahead as we are seeing a downward trend in inflation. From a private market perspective, the overall economic environment is very important for the success of private investments, a large majority of these, are being made in secular growth industries like Healthtech, software applications, business services, agrifood and education. Businesses in these sectors are historically not as exposed to economic headwinds. But this does not mean it will all be plain sailing.

In our experience through multiple cycles since 2000, it is not just the economic and inflationary environment that might represent a risk for the business, the main risk is investing in companies where there is a significant shift of demand, and where the management is unable to react on time, leaving the company in a dire cashflow situation. We expect 2024 to be a strong year for repayments in the current portfolios, which in turn will provide with higher opportunities for new investments compared to 2023.

The global private equity market has settled into a more cautious pace in recent quarters. Fund managers are now operating in a different environment than the one they had become accustomed to before the pandemic, namely an environment that for more than a decade was defined by low rates, low inflation, and a generally stable geopolitical environment.

Starting in 2022, the market environment changed drastically with a rapid rise in inflation, historic pace of interest rate increases, supply chain challenges, inventory destocking, and growing geopolitical tensions. This led to significant readjustment in public and private markets.

More specifically, in the private equity market in 2023, the industry was stuck in a vicious circle that included decreasing M&A activity, due to higher rates and disconnect between buyers and sellers due to private market valuations not adjusting meaningfully relative to public markets. We also saw slowing exit activity, and limited partners (LPs) impacted by the denominator effect – due to the public market downturn, although markets have been stronger more recently – along with a decrease in distributions.

And we experienced a tougher fundraising environment with funds taking longer to reach their target fundraise. Furthermore, on the fundraising front, larger funds continue to account for majority of capital raised as LPs continue to allocate to branded and larger managers.

However, economic signals suggest macro pressures may be easing, in spite of persistent yield curve inversions. A more stable outlook should equate to more acquisitive strategic buyers, potential opening of the IPO market, and lenders being more accommodative leading to increase in PE deal activity. And inflation has begun to ease in most markets, a sign that central bank policy is having its desired effect and that interest rates will not increase further.

Small is beautiful

In this environment, we’re looking at 2024 and seeing that the small and middle private equity markets continue to offer very attractive opportunities. This includes the fact that it represents a large target pool as the number of publicly traded companies continues to shrink, and that it offers more near-term levers for value creation – professionalization, scale, operational improvement, sales/marketing, and so on – relative to larger companies. Moreover, with lower leverage and good cash flow characteristics, small and middle-sized companies can better navigate financial markets with tightening conditions.

Based on recent survey by SS&C, only 9% of investors intended to decrease their allocation to alternative investments with 75% of the LPs saying that their alternatives performance met or exceeded their expectations over the past 12 months. However, the pace of new commitments may depend on the ability of the general partners (GPs) to exit existing portfolio companies and demonstrate their capacity to return capital to their LPs.

In that respect, we have provided liquidity to our investors across most of its programs in 2023 and expects more realizations in 2024. We continue to advocate that our LPs maintain a consistent pace of commitments as historically down markets have produced the best vintages in private equity.

Hence, we intend to actively raise funds for our main investment strategies and to open them to a larger demography with the setup of alternative vehicles open to individual investors, a type of investors who currently do not have easily access to the private equity markets.

In 2024, we will also continue to be active on the secondary markets to benefit from the increased activity in GP-led transactions that provide liquidity windows to their LPs.

While it may feel a bit surprising and premature to most investors, as many continue to grapple with valuation declines and refinancing challenges, we expect almost all prime European real estate markets to offer an attractive revival and broad-based cyclical recovery opportunity from 2024.

Indeed, our 2024-28 forecast shows a significant improvement in our relative value assessment with an over 200 bps positive excess spread when comparing the 9.1% per annum Expected Rates Return (ERR) and the 6.9% per annum Required Rates of Return (RRR), which is partly due to excluding 2023 in the analysis.

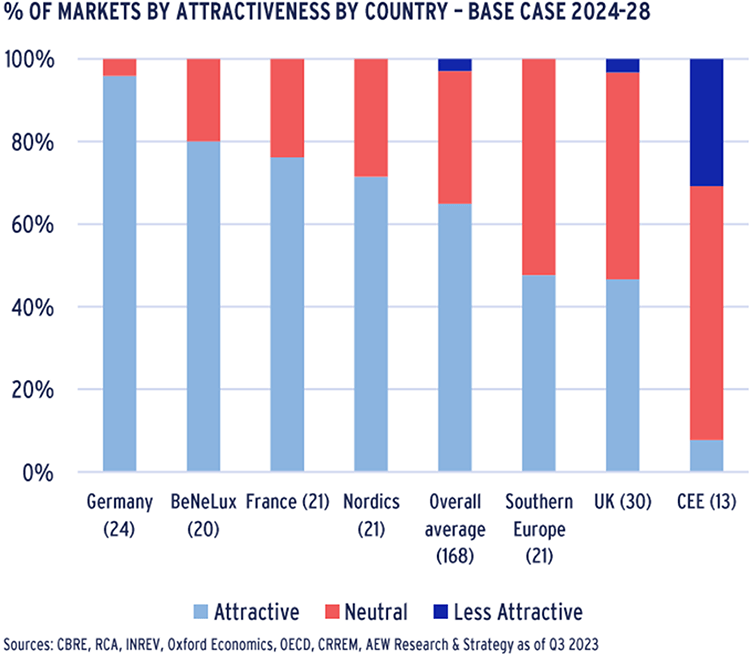

It is a clear positive signal for investors to return to European markets with 97% of the 168 covered European markets now classified as neutral (54) or attractive (109), as shown in the chart below.

Across countries, Germany ranks top in terms of relative value, with the most markets classified as attractive, while from an individual market perspective, logistics in Benelux, France and Spain come out on top. Dutch and Spanish residential, Belgian high street retail and German and UK shopping centres also make it to the top 10 most attractive relative value markets.

Demand and supply

Drivers of real estate demand, such as employment and consumer spending expected to remain supportive, regardless of base case or downside scenarios, driven by the continued limited and, in many markets, reducing supply of new space, with demand and supply remaining broadly balanced.

As a result, and coupled with positive GDP growth, AEW’s base case prime rental growth has been upgraded to 2.2% per annum. for 2024-28 across all sectors in Europe (from 2.0% in Mar-23), with prime logistics and residential retaining the joint top rental growth ranking at 2.5% per annum.

We expect a 50% year-on-year drop in European investment volumes to €140bn for 2023, as higher interest rates locked out traditionally leveraged investors and pushed prime yields out. AEW’s base case now predicts a tightening of prime yields with a 20 basis points (bps) for retail and 60 bps for offices over the next five years, given recent re-pricing and lower bond yields. As a result, prime total returns have been revised up to 9.2% per annum on average, across all sectors and 196 markets for 2024-28, underpinned by projected yield tightening combined with solid rental growth.

The UK offers the best predicted total returns at 10.7% per annum for 2024-28, with Benelux coming second at 9.5% per annum. Furthermore, average prime capital value growth across Europe is forecasted to turn positive at 2% in 2024, after a cumulative value decline of 17% to end of 2023 since peaking mid-2022, despite a few individual markets still showing some downside.

In terms of refinancing legacy loans, the continued challenge in refinancing maturing real estate debt is quantified by AEW’s updated debt funding gap (DFG) analysis, which shows a €90 billion DFG for 2024-26 and now included all 20 European countries. The loan-to-value (LTV) ratio – an assessment of lending risk that financial institutions and other lenders examine before approving a mortgage – remains the dominant restrictive factor, despite the inclusion of the interest coverage ratio (ICR) – which measures a company's ability to handle its outstanding debt – and debt yields as refinancing criteria.

Refinancing of legacy loans has been a challenge as interest rates are settling at higher levels and capital values have come down. On a relative basis – as a share of the original origination amounts – 16% of all 2018-21 loans are now expected to face a DFG, down from 22% in AEW’s Aug-23 estimate. Despite this decline, refinancing challenges could delay the revival across the European markets.

Unlocking dry powder

Liquidity in 2024 might benefit from the unlocking of more dry powder capital for real estate investment as the denominator effect reverses, based on year-to-date total returns across asset classes. This denominator effect had restricted many investors from expanding real estate investments in 2023, as 2022 declines in stocks and bonds pushed real estate above its typical target allocation of 10%.

The downward adjustment for property, combined with the rebound in stocks and bonds in 2023, should be bringing the real estate allocation of many multi-asset investors back in line with their targets, freeing up some restrictions for multi-asset investors.

AEW, MV Credit and Flexstone are affiliates of Natixis Investment Managers, and form part of our Expert Collective.

2 Source: Natixis Investment Managers, ‘Brave New World’, December 2023, https://www.im.natixis.com/intl/research/2024-institutional-outlook

3 Source: https://www.scopegroup.com/dam/jcr:86d7c25a-3208-4332-a102-dbc68457951c/Scope%20ELTIF%20Report%202023.pdf

4 Source: S&P Global Ratings, October 2023, https://www.spglobal.com/ratings/en/research/articles/231002-credit-trends-business-development-companies-assets-provide-a-glimpse-into-the-private-credit-market-12865113#:~:text=BDCs'%20assets%20have%20expanded%20rapidly,growth%20(see%20chart%202)

5 Source: PwC, July 2023 https://www.pwc.com/gx/en/news-room/press-releases/2023/pwc-2023-global-asset-and-wealth-management-survey.html?sfid=0036M00002vv58FQAQ&utm_medium=email&utm_source=INTL-EN_W_N_Expert_Collec_Oct_2023

6 Source: Bloomberg, October 2023, https://www.bloomberg.com/news/articles/2023-10-26/blackrock-says-private-debt-will-double-to-3-5-trillion-by-2028

Viewpoint - Where are the Opportunities in Private Assets?

Viewpoint - Where are the Opportunities in Private Assets?

Private Assets and Innovative Allocation

Private Assets and Innovative Allocation

2024 Institutional Outlook

2024 Institutional Outlook