Real Estate With A Conscience

Highlights

- The built environment has a huge influence on our lives. Impact real estate is increasingly in demand from investors, as it represents a compelling opportunity to create positive social and environmental impact, while also achieving financial return objectives.

- AEW’s impact approach is to invest in real estate that has a social use value, focusing on the most deprived areas of the UK with the explicit intention to contribute to positive impact creation, according to five measurable impact objectives.

- A diversified impact approach benefits from access to a wide range of investment opportunities across a variety of real estate sectors, whilst identifying mis-priced assets where value can be created and a positive impact made.

Resources

The built environment has a huge influence on people’s everyday lives and, as responsible property investors, we recognise our investment decisions have an impact on people, place and planet. Real estate comprises most of our community infrastructure from where we live, to where we work, where we shop and where we spend our leisure time. So real estate has a sizeable social impact, whether we realise it or not.

Social and environmental challenges such as poverty and climate change cannot be solved with a short-term mindset. Real estate provides an opportunity to allow change and contribute to long-term solutions.

We see the development of real estate assets as a partnership. We work with local authorities and the people who live and work within those authorities to create, renovate, refurbish and invest in real estate so it has the maximum positive social impact. We also want what we do to have positive environmental impact. Social and environmental impact investing as well as place-based impact investing are intrinsically linked, with real estate owners playing a natural role in both reducing carbon emissions from the built environment and providing social infrastructure that directly impacts the economic resilience of local communities.

How long have you been creating impact through real estate?

We have been doing this since 2016, but we didn’t call it impact investing back then.

We identified social and demographic needs in the UK and started to invest in the real estate that could respond to these needs: care homes, key worker accommodation, nursery schools, leisure assets and so on. In fact, it was some of our investors who pointed out that this approach was effectively impact investing. It was only then that we decided to focus solely on impact investing, embedding impact considerations into the investment process and adopting two objectives of equal importance: Financial and Impact.

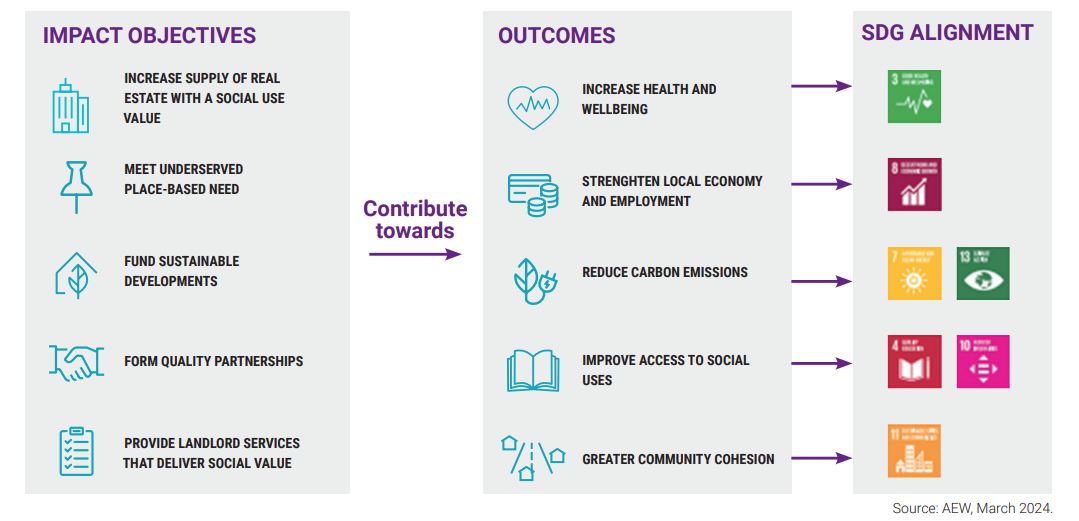

We think the concept of impact should go further than being a secondary outcome. We invest only in real estate that has a social use value, focusing on the most deprived areas of the UK and choosing our investments according to five impact objectives:

- Increase supply of real estate with a social use value;

- Meet underserved place-based needs;

- Fund sustainable developments;

- Form quality partnerships; and

- Provide landlord services that deliver social value.

Have you adapted your approach now you focus solely on impact?

Fundamentally our investment strategy has not changed. We still focus on reducing risk whilst driving income, with the goal of delivering secure and sustainable income streams through the acquisition of assets underpinned by strong fundamentals. However, we wanted to create a clear and transparent way to both invest and show our clients how we invest to generate a positive social and environmental impact. We have recently worked with The Good Economy, a market leader in impact consultation, to design a clear and thorough impact measurement and management framework (IMM) which ensure that impact considerations are integrated into the investment process. This involved consultation with the Financial Conduct Authority to meet the requirements of the upcoming Sustainable Disclosure Regulation (SDR). Of course, we needed investor agreement too to pivot to an impact strategy – we were happy to discover they were happy with the change and, in fact, encouraging of it.

Is it possible to measure social impact?

Definitely, albeit measurement is the hardest part of the process and is still evolving as the sector develops and matures. We measure all investments and asset management initiatives against a set framework of metrics, objectives and outcomes on an ongoing basis as set out in the IMM. This creates an impact score, reflecting the extent to which activities are contributing to positive change, both on a portfolio and scheme-specific basis. This score is reviewed annually by The Good Economy through an impact audit.

We then carry out data collection over the lifetime of each asset to monitor impact and identify new ways of creating impact. This occurs through the use of specific impact management tools which aim to prove and improve the level of impact creation. We also check we are not creating negative impacts alongside the positive ones. To provide a baseline for all future scoring, The Good Economy delivered our first independent impact report in September 2023, to provide a benchmark against which future impact performance can be compared and assessed. This report will be published on an annual basis moving forwards.

Can you measure your contribution to people’s lives?

We can’t pretend to provide an answer to all of society’s problems, impact outcomes are contingent on many factors. Measurement of our impact extends to activities we can control in relation to our Impact Objectives, and where we can detail how the actions taken lead to positive outcomes for people, place and planet. If we partner with a developer and the Local Authority to build a specialised supported housing asset, we can ensure the property is built to the highest standards, both from an environmental and sustainability perspective and in terms of quality, and ensure that we select the best quality tenants, meeting the Local Authority’s need. We can continue to work with and monitor the performance of our tenant however, ultimately we can't control how the care is delivered. So there are limits to how we create and measure impact.

Are there other real estate firms in this space?

There are many investment managers doing what we do, but those that do exist tend to operate in single sectors. That is, they invest solely in, say, key worker housing or in social housing. These sector specific solutions have grown rapidly in the last few years.

Our view is that real estate impact investments don’t need to be siloed. We prefer to be diversified and make as much positive social and environmental impact as possible. This has an additional benefit of improving performance: our diversified approach has consistently outperformed our reference benchmarks since 2016. With a diversified strategy, we have more opportunities to buy mispriced assets or to add value to existing ones. We are never forced buyers: we can buy cheap, rather than having to buy a particular sector even if that sector is expensive.

Is this an opportune time for your approach?

Our approach is not directly linked to economic factors, so can add value throughout the cycle. Now is particularly opportune, however, with the FCA’s Sustainability Disclosure Requirements (SDR) being phased in during 2024.

The key components of the SDR, applicable to all real estate firms in the UK, are an anti-greenwashing rule and a labelling regime. The anti-greenwashing policies aim to ensure that sustainability-related claims are fair, clear and not misleading. Firms must produce clear and concise consumer-facing disclosure for products with a label and/or products using sustainability-related terms without a label.

In this respect, our full conversion to impact investing is timely. We are ahead of the curve and, in fact, liaised extensively with the FCA to tick all the SDR boxes before the boxes even existed.

Who does real estate impact investing appeal to?

During the last two years we’ve seen a retrenchment of allocations to real estate, driven by significant market repricing, the increased cost of debt and the denominator effect impacting investors’ weightings.

However, we still see strong demand for impact investing. Clients are becoming increasingly aware of their responsibilities to invest responsibly, and we’re encouraged by the amount of engagement we’re having with existing clients and new prospects. Local government pension schemes in particular are enthusiastic about improving their local areas and place-based impact investing is a way for investors to put money to work in their own back yards. It is therefore an interesting time for a diversified sector portfolio to find mis-prised investment opportunities, given the current market cycle, where value can be created and a positive impact made.

The built environment has a huge influence on people’s everyday lives and we think there’s a compelling opportunity to invest in a way that creates both a tangible positive social and environmental impact, while also achieving return objectives for investors.

Published in March 2024

An affiliate of Natixis Investment Managers

Limited liability partnership registered in England and Wales with company number OC367686.

Authorized and regulated by the Financial Conduct Authority under firm reference number 57796233, 8 Bishopsgate, Level 42, London, EC2N 4BQ

www.aew.com

Natixis Investment Managers

RCS Paris 453 952 681

Share Capital: €178 251 690

43 avenue Pierre Mendès France

75013 Paris

www.im.natixis.com

This communication is for information only and is intended for investment service providers or other Professional Clients. The analyses and opinions referenced herein represent the subjective views of the author as referenced unless stated otherwise and are subject to change. There can be no guarantee that developments will transpire as may be forecasted in this material.

Copyright © 2024 Natixis Investment Managers S.A. – All rights reserved.

AEW Asia Pacific Research Perspective Q4 2023

AEW Asia Pacific Research Perspective Q4 2023

Borrowing Costs Come Down While Refinancing Challenges Remain

Borrowing Costs Come Down While Refinancing Challenges Remain

Seniors Housing Research Perspective

Seniors Housing Research Perspective

Confirmation of Our Private Real Estate Market Rebound Forecasts

Confirmation of Our Private Real Estate Market Rebound Forecasts