Tax Management Update – Q3 2023

The recent market pullback created more opportunities for tax loss harvesting. These were relatively modest, however, given the generally small drawdowns after two quarters of fairly strong returns.

The possibility of a government shutdown dominated fiscal policy discussions, but there have also been some developments related to tax policy as several presidential candidates have started to share their positions with regard to taxes.

Potentially as significant as presidential tax policy platforms, the Moore vs. United States Supreme Court case looms this fall. While the stakes of the actual case are relatively small ($15,000 in taxes are in question), the implications could be far-reaching. Any new precedent established could affect other provisions of the tax code that involve the taxation of unrealized income. Existing taxes on partnerships and pass-through entities, zero-coupon bonds, constructive sales, futures contracts and any other mark-to-market accounting could be impacted.

Equity Market Pullback

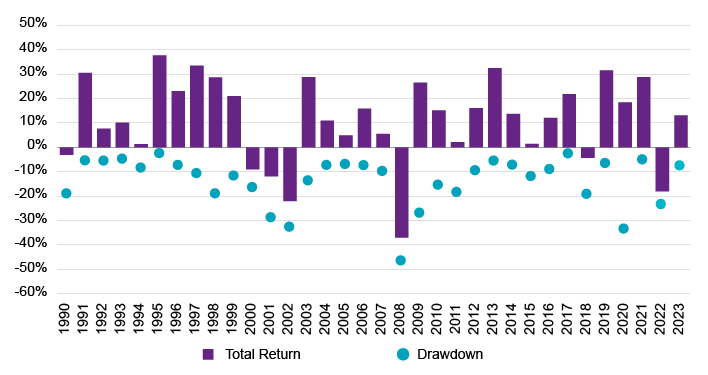

The equity markets pulled back a bit in the third quarter after a very strong start during the first six months of the year. The strong performance of a handful of US large cap growth stocks continues to have an outsized effect on the overall large cap index returns. Despite the negative return during the third quarter, the largest single drawdown remains the nearly 8% decline we saw earlier in the year. The second quarter saw two drawdowns of roughly 5% with a modest rebound in between. It is not uncommon to see several drawdowns of this magnitude in any given year.

Annual Total Return and Max Drawdown for the S&P 500® by Calendar Year

Source: FactSet, Natixis Investment Managers Solutions

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results.

Tax Loss Harvesting in Separate Accounts

The market pullback created more opportunities for tax loss harvesting. These were relatively modest, however, given the generally small drawdowns after two quarters of fairly strong returns. The number of stocks in the S&P 500® posting positive returns for the year dropped from 61% at the end of Q2 to just 50% at the end of Q3.

The concentrated market return has provided a great illustration of the benefits of separate accounts when it comes to tax management and tax loss harvesting. Although the market is up over 13% year to date, half of the index constituents have declined. An investor who bought a commingled vehicle at the beginning of the year would have no unrealized losses to harvest now. But with a separate account, where the client owns all of the individual securities directly, it is likely that half of their portfolio has unrealized losses available to harvest.

To learn more, please read the full Tax Management Update Q3 2023.

Resource

Tax Management Update Q3 2023

Read Full Update

Tax-Efficient Investing in Separately Managed Accounts (SMAs)

Direct Indexing SMAs can help address key issues facing tax-sensitive investors. All accounts are actively managed to optimize tax loss harvesting while providing beta exposure to an index. Our tax-managed SMAs include:

Learn More

Want more information on tax-managed investment strategies?

Contact Us

What Is Tax Loss Harvesting?

A portfolio can harvest its losses for tax purposes by selling investments when their current value is less than the price originally paid for the security. These losses can be used to offset other capital gains on an investor’s tax return. If there are excess losses, they can be used to offset up to $3,000 in ordinary income – or be banked for use in future years.

Capital gain is a rise in the value of a capital asset (investment or real estate) that gives it a higher worth than the purchase price.

CFA® and Chartered Financial Analyst® are registered trademarks owned by the CFA Institute.

S&P 500® Index is a widely recognized measure of US stock market performance. It is an unmanaged index of 500 common stocks chosen for market size, liquidity, and industry group representation, among other factors. It also measures the performance of the large-cap segment of the US equities market.

The views and opinions expressed may change based on market and other conditions. This material is provided for informational purposes only and should not be construed as investment advice. There can be no assurance that developments will transpire as forecasted. Actual results may vary.

Indexes are not investments, do not incur fees and expenses and are not professionally managed. It is not possible to invest directly in an index.

Investing involves risk, including risk of loss. Investment risk exists with equity, fixed income, and alternative investments. There is no assurance that any investment will meet its performance objectives or that losses will be avoided.

This document may contain references to copyrights, indexes and trademarks that may not be registered in all jurisdictions. Third-party registrations are the property of their respective owners and are not affiliated with Natixis Investment Managers or any of its related or affiliated companies (collectively “Natixis”). Such third-party owners do not sponsor, endorse or participate in the provision of any Natixis services, funds or other financial products.

5999616.1.1

Direct Indexing: Checking the Box

Direct Indexing: Checking the Box

Tax Management Update – Q1 2024

Tax Management Update – Q1 2024

All About The Rates

All About The Rates