Retirement Strategies and Solutions

- A full range of retirement products representing every asset class, from equities and fixed income to alternatives and ESG (Environmental, Social, Governance).

- Asset allocation and risk modeling, to evaluate and improve upon the durability of retirement portfolios to help them withstand market, inflationary, longevity, and sequence of return risks.

- Guidance for plan sponsors and retirement advisors to help them support their clients’ needs during the critical phases of accumulation and post-retirement distribution.

- Global plan survey research and plan sponsor education, which can help identify gaps and opportunities, improve participant understanding and allow for better engagement with plan sponsors.

Investments

Retirement Products for Every Asset Class and Portfolio Application

Natixis offers a wide variety of traditional and multisector fixed income, global equity, and alternative investment options well suited for retirement planning and retirement spending.

Explore sustainable target date funds for plan participants who want to invest in companies with good environmental, social, and governance practices.

View our comprehensive range of funds sorted by asset class.

View our funds sorted by investment concerns, including growth, income, ESG investing, alternatives, equity volatility, and taxes.

Portfolio Construction

As the responsibility for funding retirement continues to shift to individuals, plan sponsors and financial professionals are increasingly challenged to help investors understand and measure the impacts of their allocation decisions on their portfolios.

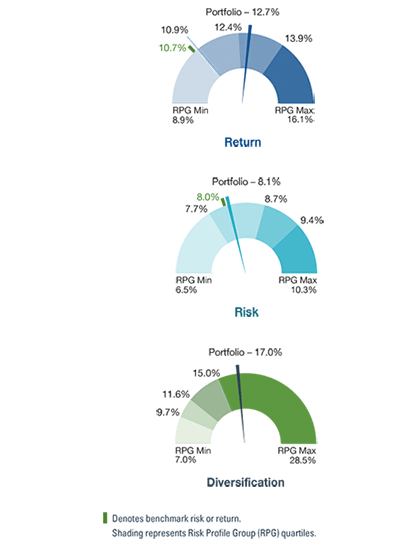

Our Portfolio Analysis & Consulting team of independent and highly qualified portfolio analysts can provide you with a comprehensive risk audit of your client’s portfolio to identify gaps, deficiencies, redundancies, and hidden risks.

Our comprehensive portfolio solutions can be used to evaluate risk and plan menu design with services including:

- Interest rate stress tests

- Active share metrics

- Analytics to help prepare for retirement distributions

- Custom research, modeling, and glidepath analysis

Natixis Center for Investor Insight

A Research Program with Global ReachThe Natixis Center for Investor Insight is a global research initiative focused on the critical issues shaping today’s investment landscape. The Center examines sentiment and behavior, market outlooks and trends, and risk perceptions of institutional investors, financial professionals and individuals around the world. Our goal is to fuel a more substantive discussion of issues with a 360° view of markets and insightful analysis of investment trends.

Learn more

Related Articles

With the economic picture evolving from low rates and high growth higher rates and recessionary fears that have yet to be realized, investors continue to turn to private assets in 2024.

Gateway Investment Advisers CEO Mike Buckius discusses the Natixis Gateway Quality Income ETF (ticker GQI) on the floor of the New York Stock Exchange.

Fund selectors see an unfamiliar investment landscape in 2024.

Contact Us

Would you like more information?

1613197.6.1