Dynamic Risk Premia

KEY TAKEAWAYS:

- Alternative risk premia strategies do not always live up to investors’ expectations because back-testing does not always reveal recent underperformance of a factor. Also, many strategies allocate equally to all risk premia, including to factors that have small or negative performance

- A more rational approach is to start with the premise that risk premia change in value over time and have predictable “cycles.” The implication is that risk premia should be dynamically managed

- A dynamic alternative risk premia strategy has little in common with other forms of investing and almost no correlation with traditional asset classes. It can be tailored to address common client needs, such as absolute return, income, drawdown management and inflation hedging

Resources

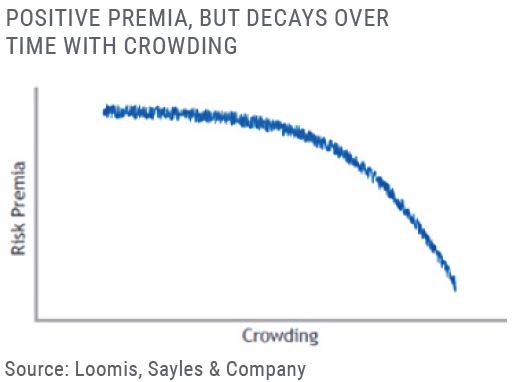

Why? Because the value that can be harvested from risk premia is not permanent. It can get crowded out or decay for other reasons. A passive investment in risk premia can therefore leave a lot of value on the table and expose investors to unnecessary drawdown. There must be a better way for investors to harness risk premia than through static allocations.

The problem with factor investing

Alternative risk premia, or factor strategies, have been growing in popularity as a complement to both passive and actively-managed portfolios. A key reason for this is that alternative risk premia strategies tend to have low correlations with traditional asset classes so offer investors low-cost diversification. Tried-and-tested alternative risk premia include carry, volatility, value, curve and momentum.

However, alternative risk premia strategies do not always live up to investors’ expectations for two principal reasons. First academic research based on back-testing over long time periods does not always reveal recent underperformance of a factor. This underperformance is typically due to the gradual over-crowding of trades in a wellrecognised factor.

In US equities, for instance, the value factor earned investors 700bps- 900bps annual outperformance 25 years ago. Over the last decade, that outperformance has fallen to just 100bps-200bps, hardly outperformance at all after costs and fees are extracted.

The second significant problem with most alternative risk premia strategies is in portfolio construction: many strategies equally weight all risk premia. Allocating equally to all factors, including factors that have small or negative performance, does not seem the most efficient way to deploy capital. “Why allocate to the value factor in US equities when the trade is so crowded and the potential upside so limited?” asks Harish Sundaresh, portfolio manager and head of systematic strategies for the Alpha Strategies team at Loomis Sayles, an affiliate of Natixis Investment Managers. The systematic strategies group is responsible for the firm’s alternative risk premia efforts.

Towards dynamic portfolios

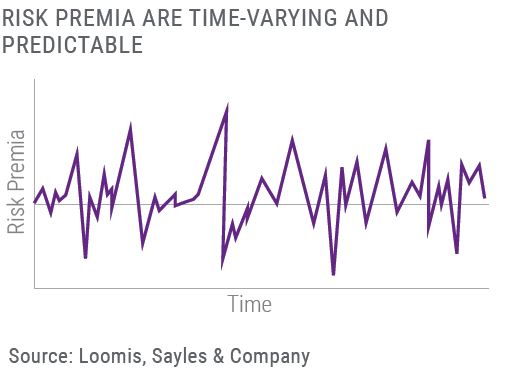

A more rational approach to factor investing is to start with the premise that risk premia change in value over time and have predictable cycles. A factor that is performing well this year may underperform next year, and vice-versa. The clear implication of this is that risk premia should be dynamically managed.

Loomis Sayles’ dynamic management of risk premia involves placing 25 well-known factors into four categories, or quadrants. Each quadrant represents a phase in the cycle of a risk factor: factors might be in recovery, in a normal state, in expansion or in crisis. The Alpha Strategies team focuses predominantly on identifying the probability that a factor is, or will be, in a crisis state. Machine learning techniques provide forward-looking input by assessing the probabilities of each factor moving into crisis and how the occurrence of a crisis would impact the strategy.

The resulting probabilities are combined with advanced optimization methods to decide weightings to each factor at a point in time. The optimisation process ensures that weightings are dynamic but also that huge, and expensive, swings in allocation do not take place which would reduce returns to investors.

It’s more than a crisis hedge

Because this dynamic allocation of factors is predicated on assessment of tail risk, it substantially reduces the probability of significant drawdown. “Even though the strategy is based on risk premia rather than on macro trends, the strategy performs particularly well in times of economic crisis,” says Sundaresh.

It is not a pure crisis hedge, however. The long-term correlation of the strategy to market beta is around -0.1, meaning it can deliver outperformance whatever the prevailing market conditions. In fact, dynamic alternative risk premia is an active, systematic approach with the potential for differentiated sources of return, which can be additive to all kinds of existing asset exposures.

Who’s it for?

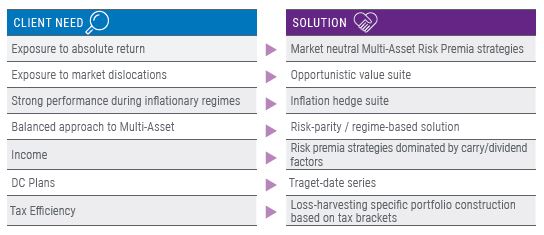

The strategy can be tailored to address a wide range of client needs, including absolute return, income, drawdown management and inflation hedging.

It has the potential to generate meaningful alpha, meaning it can be regarded as a highly-active, return-seeking component of a portfolio. It can also serve as a bond portfolio substitute given that it has a similar volatility profile to a basket of bonds. In a world of low, even negative rates, it is a viable alternative to a long-only fixed income allocation. Not only does it have low correlation to bonds, but in the potential case of reflation the interest rate risks are significantly lower than for fixed income assets, which could suffer significant losses.

Some investors view the strategy as a core holding, providing broad market exposure – through its exposure to many different assets and factors – with an alpha and risk-control focus. Equally it can be a standalone diversifier that aims to minimize volatility or drawdown. The ability to tailor the strategy to target a level of risk, to reduce drawdown or to hedge inflation, has attracted investors including insurers, banks, pension funds, endowments and high-net-worth individuals.

A strong creative streak

The creation and ongoing evolution of the strategy is based on leveraging the creative talents of the 22 members of the Alpha Strategy team, whose expertise spans across a wide variety of disciplines “Experience is important, but we place equal importance on creativity and have assembled a team of inventive problem solvers who have helped develop something truly differentiated in the market,,” says Sundaresh.

The Alpha Strategies team employs PhDs in innovative quantitative disciplines such as optimisation, machine learning and simulation, and matches them to experienced portfolio managers and analysts with asset class expertise and financial experience. The critical element in developing the strategy was being ultra conservative about over-fitting. In other words, the strategy must work in the real world, not just in theory.

Conclusion: putting it another way

For investors, a dynamic alternative risk premia strategy is a radically different, and more efficient, way of adding alpha to a portfolio. Performance is generated from allocations to factors depending on the prevailing regime for each of those factors. The strategy has little in common with other forms of investing and almost no correlation with traditional asset classes.

The identification of tail-risk probability, the unique portfolio construction and the exposure to all risk premia, give the strategy the best chance of capturing alpha across cycles and also allow it to be tailored to investors’ needs.

Loomis, Sayles & Company, L.P.

A subsidiary of Natixis Investment Managers

Investment adviser registered with the U.S. Securities and Exchange Commission(IARD No. 105377)

One Financial Center,

Boston, MA 02111, USA

www.loomissayles.com

Natixis Investment Managers

RCS Paris 453 952 681

Share Capital: €178 251 690

43 avenue Pierre Mendès France

75013 Paris

www.im.natixis.com

This communication is for information only and is intended for investment service providers or other Professional Clients. The analyses and opinions referenced herein represent the subjective views of the author as referenced unless stated otherwise and are subject to change. There can be no assurance that developments will transpire as may be forecasted in this material.

Copyright © 2020 Natixis Investment Managers S.A. – All rights reserved

Loomis on Loans – Q1 2022

Loomis on Loans – Q1 2022

2021 Preqin Global Hedge Fund Report: Risk Premia Investing Should Be Dynamic

2021 Preqin Global Hedge Fund Report: Risk Premia Investing Should Be Dynamic