Natixis Global Survey of Individual Investors

Six simple reasons why yesterday’s volatile markets are a wake-up call for investors today

When volatility struck in the fourth quarter of 2018, it was a wake-up call for investors. After a 10-year bull market marked only by periodic bouts of turbulence, the final three months brought sustained market volatility and lingering questions about the viability of the run-up. But after seeing nearly double-digit declines in the month of December alone, have investors risen to the occasion?

Or have they hit the snooze button and returned to dreams of high returns delivered with little or no risk?

Results from the 2019 Natixis Global Survey of Individual Investors show that while they have heard the alarm, many are still rubbing their eyes and contemplating a plan of action. Fielded at a time when the wounds of 2018 losses were fresh, the survey shows that investors are confused and conflicted about risk, return and what they can expect from their investments.

In the short term, their hesitation may have helped make up for some losses as the S&P 500 has climbed back into record territory since January. But in the long run there’s a lot to be learned from the downside of volatility.

One of the hardest-learned lessons for investors may simply be that their risk tolerance is much lower than they thought.

Table of Contents

- Knowing investment risk isn't the same as

feeling it

- Investors need to know how much risk they can actually

handle

- Investors expect more returns than professionals say is

realistic

- Assumptions about the risks of index funds need a

gut check

- Bonds are math. Math is hard.

- Investors see an alternative to stocks and

bonds

About the survey (click to reveal)

Total Respondents: 9,100

Germany: 400

Singapore: 400

Argentina/Uruguay: 300

Hong Kong: 400

Spain: 400

Australia: 400

Israel: 300

Sweden: 300

Canada: 300

Italy: 400

Switzerland: 400

Chile: 300

Japan: 400

Taiwan: 400

China: 400

Korea: 400

Thailand: 400

Colombia/Peru: 300

Mexico: 300

UK: 750

France: 400

Netherlands: 300

US: 750

1

Knowing investment risk isn't the same as feeling it.

Investors are conflicted about risk. More than half (54%) say they are comfortable taking risks in order to get ahead – a number that is on par with how investors felt in 2018. But in truth, they are far less comfortable than they think.

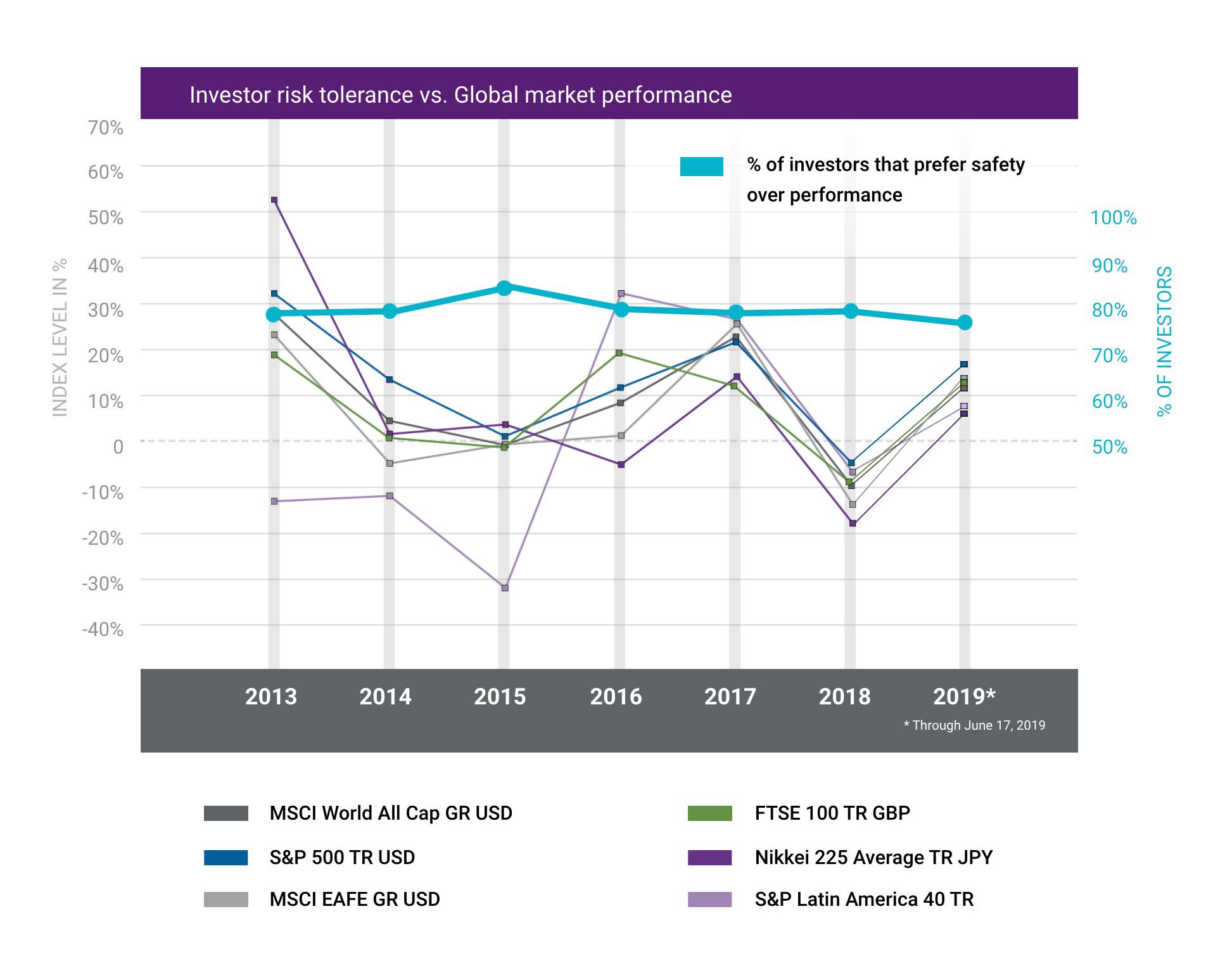

More than three-quarters of investors we surveyed worldwide admit that, if given the choice, they would take safety over investment performance. This preference is not driven solely by last year’s losses. The sentiment is persistent across eight years of Natixis surveys.

No matter what the markets are doing, investors consistently value safety over performance

Underneath it all, investors struggle to rationalize what they know about markets with what they feel about volatility. Two-thirds of investors know portfolio fluctuations of 10% are a normal occurrence when investing. But even though they recognize volatility as part of the equation, six in ten feel that volatility undermines their ability to achieve savings and investment goals.

As a result, many are looking for investments that can help mitigate the risks – along with their anxieties. Nine out of ten investors say it is important to protect their assets in volatile times. That feeling is so strong that, in an era in which fees on some passive investments1 have dropped to nearly zero, 56% of investors are willing to pay a premium price for an investment that could help protect them from volatility.

Investors say they are comfortable taking risks to get ahead, but if forced to choose, they continue to value safety over investment performance.

2

Investors need to know just how much risk they can actually handle.

The current bull market is the longest in history, and eight in ten financial professionals surveyed globally say investors have become complacent about risk.2 Investors, on the other hand, think they have a better handle on risk than the professionals give them credit for.

Eight in ten investors claim to understand the risks posed by the market environment in 2019. But a look back can show how shaky their understanding can be. Nearly two-thirds of investors felt like they were prepared for market risks at the start of 2018,3 but in hindsight only 59% say they were actually prepared for last year’s downturn.

So, if investors are wary of risk and large numbers (41%) are not prepared to handle market challenges, what is it they fear the most?

When asked what the biggest risks are in the year ahead, equal numbers are concerned about a global economic slowdown (50%) and market volatility (50%). Other risks on the minds of investors are regular fixtures in the news cycle: One-third cite political dysfunction as a rising concern, 30% worry about rising interest rates, and one-quarter express concerns about currency market volatility.

But macroeconomics alone do not explain investor risk aversion. In fact, there is another, more personal dimension contributing to a conservative outlook on risk. When asked about their financial fears, investors paint a picture of the challenges of keeping up in a fast-paced, growing economy.

Almost half (48%) of investors worldwide said one of their greatest fears is an unexpected expense – a surprising number considering respondents have a minimum of $100,000 in investable assets and 71% say they feel financially secure. Beyond unknown expenses, investors worry about maintaining their standard of living (34%), along with more defined issues such as healthcare costs (34%) and saving enough for retirement (33%).

While the recent volatility may have reinforced these risk concerns and fears, it has done nothing to dampen return expectations.

Regional look at financial fears

Global

1 An unexpected expense(48%)

2 Maintaining their standard of living(34%)

3 Healthcare costs(34%)

4 Taxes(33%)

5 Not having enough money to save(33%)

Asia

- An unexpected expense (54%)

- Healthcare costs (38%)

- Maintaining their standard of living (36%)

- Not having enough money to save (31%)

- Cash flow (29%)

EMEA

- An unexpected expense (43%)

- Taxes (34%)

- Maintaining their standard of living (33%)

- Not having enough money to save (32%)

- Healthcare costs (28%)

Latin America

- An unexpected expense (49%)

- Taxes (48%)

- Not having enough money to save (44%)

- Healthcare costs (34%)

- Maintaining their standard of living (31%)

North America

- An unexpected expense (47%)

- Healthcare costs (42%)

- Taxes (38%)

- Maintaining their standard of living (35%)

- Not having enough money to save (29%)

While the recent volatility may have reinforced investor risk concerns and fears, it has done nothing to dampen return expectations.

3

Investors expect more returns than professionals say is realistic.

Despite the jolt of volatility, we find that expectations that were already unrealistic by professional standards actually grew in the face of market losses. Investment professionals say return expectations of 5.5% above inflation are realistic.2 Of the 9,100 investors in our survey, 6,465 of them tell us their long-term return expectations are 11.7% above inflation. Short-term expectations are not much better, as investors expect 10.7% above inflation for 2019.

What’s most surprising about these numbers is that on the heels of one of the most challenging markets they have faced in a decade, investors expect higher returns than what they thought was needed to meet their goals in 2017 (9.9%) and 2018 (10.4%). In fact, these expectations represent the highest targets we’ve recorded since introducing questions about anticipated returns in 2014.

Of course, 11.7% is an average return expectation, but data shows strong regional differences in expectations. Asia (12.5%) and Latin America (12.8%) demonstrate the most optimistic assumptions. Investors in North America had more modest expectations of 10.6%. Europe’s average of 10.9% is unique in that the region presents the most diverse expectations ranging from highs in Sweden (12.6%) and Spain (13.6%) to the survey’s lowest, found in Germany (9.1%) and Italy (10.5%).

Bridging the gap between what investors think they need for returns and what professionals say they can expect

Individual investors: long-term return expectations (above inflation)

The expectation gap: The % difference between investor and professional expectation

Financial professionals: realistic long-term returns for clients (above inflation)2

Investors

Gap

Professionals

2 Natixis Investment Managers Global Survey of Financial Professionals conducted by CoreData Research in March 2018. Survey included 2,775 financial professionals in 16 countries.

But even as low as these figures are compared to the rest of the world, they represent a target that would require taking on high levels of risk. Assuming an inflation rate of 2%–3% means that investors with more moderate expectations are still looking for real returns of 11%–12%.

No matter where they are in the world, investors need to realize that pursuing this level of returns will likely mean investing at the higher end of the risk spectrum and significant exposure to the volatility they see as a threat to their savings goals.

This fundamental disconnect between risk tolerances and return expectations is a clear example of the conflict between what investors know and what they want. One critical example of the conflict between experience and expectations is clearly on display in the misconceptions investors have about the risks of index funds.4

What’s most surprising about investors’ return expectations is that on the heels of one of the most challenging markets they have faced in a decade, the returns investors say they need to meet their goals are even higher than the past two years.

4

Assumptions about the risks of index funds need a gut check.

With the turbulence of 2018 fresh in mind, two-thirds of investors said the volatility made them realize that index funds were riskier than they thought. As a result, it is surprising that 62% of investors ignore that experience and still say they believe index funds are less risky – a number that is virtually unchanged from survey results from both 20175 and 2018.3

With all the attention given to passive investments in recent years, investors have been inundated with messages extolling the virtues of investments that provide market exposure at a low fee. It’s no wonder two-thirds (68%) claim to know the difference between active6 and passive investments. But based on their perceptions about the merits of passive vs. active investing, it’s clear they are struggling to understand the truth, and their assumptions may run counter even to what they want out of their investments.

Most surprisingly, investors are forgetting the basic selling proposition of index funds: Only 68% recognize that index funds give them market returns, and only 55% say they’re cheaper. When it comes down to it, investors are truly confused about what they get from index funds. Not only do they wrongly assume these funds are less risky, but 64% believe they will help minimize losses, while another 57% believe index funds provide access to the best opportunities in the market.

Index funds give

me returns

comparable with

the market

True

An index fund is designed

to match or track a

financial market index.

68% of investors

understand this.

Index funds

are cheaper

True

Index funds are simply

replicating the performance

of a benchmark index and

therefore typically have a lower expense ratio.

55% of investors understand this.

Index funds will

help me

minimize losses

False

Index funds provide broad

market exposure and have

no built-in risk management.

64% of investors have this

misconception.

Index funds provide

access to the best

opportunities in

the market

False

Index funds provide access

to every opportunity in the

market. They follow their

benchmark index no matter

what the markets are doing.

57% have this misconception.

Investors should recognize that index funds aren’t less risky. Whether it’s up or down, index funds deliver market returns. The same logic holds for downside protection. For the most part, index funds have no built-in risk management, so there’s no protection from market declines. And in terms of opportunity, index funds generally provide access to every company in an index or sector, so investors get both the winners and the losers. This is how index funds deliver the market average.

For a majority of investors, index funds may actually run counter to their investment expectations. Seven in ten investors worldwide (71%) believe it is important that their investments give them a chance to beat the benchmark. Almost the same number say it’s important to have the ability to take advantage of short-term market movements (70%), and the same number again expect their mutual fund to have a portfolio that’s different from the index (68%). It’s important to remember that, based on their basic premise, index funds do not deliver on any of these fronts.

For a majority of investors, index funds may actually run counter to their investment expectations.

5

Bonds are math. Math is hard.

Half of investors worldwide (53%) say their investment knowledge is strong, but most need a refresher course in bonds. Giving investors the facts will be critical in a period when, as recent years have shown, any hint of an interest rate hike in the US can trigger volatility in markets across the globe. The challenge for many is that the math of bonds can get complicated.

Investors are wary about rising interest rates, ranking them among the top five market risks for 2019. But few actually know what a rate hike means for their fixed income investments. Few understand that interest rate increases can have a negative impact on their bond holdings in the short term. Fewer still understand that today’s rate hike could benefit them in the long term as future income from bonds would increase. One reason for their confusion may be the inverse relationship between interest rates and bond prices.

How do interest rates affect fixed income investments?

Traditionally, the way to illustrate how rates and bonds interact is to put one at each end of a seesaw. When rates increase, there has been a corresponding decline in the price of bonds. Conversely, when rates decrease, the price of bonds has historically increased. Only 28% of those surveyed were able to identify this relationship, while 24% incorrectly answered that bond prices would increase in a rising rate environment.

Investors may be further confused by the bond math because it is actually dependent on their investment horizon. In the short run, when rates rise, bonds lose market value. But, in the longer run, those now higher rates throw off more income for the investor over time.

In terms of what a rate hike means for future income, one in five of those surveyed (19%) incorrectly assume that lower rates would mean higher income today. Few (14%) recognized that current rate hikes could actually result in higher income down the road. Only 3% of survey respondents correctly understand how bonds and interest rates are related. Six in ten respondents did not understand the relationship at all.

Given this confusing math, it’s not surprising that one-third of investors simply answered “I don’t know.” Making this relationship clear before rates increase will be critical, especially considering that among the 77% of those surveyed who invest in bonds, 54% do so to generate income while 49% are looking to reduce risk.

But not all the news on the bond front is bad. Despite failing to understand the relationship between interest rates and bond investments, 64% believe a rate hike will be good for their investments overall. More telling, however, is their self-awareness about the problem: 59% say that uncertainty on rates makes them value an experienced bond manager.

Only 3% of survey respondents correctly understand how bonds and interest rates are related.

6

Investors see there's an alternative to stocks and bonds.

A rate increase isn’t the only risk on the minds of investors. Given the wake-up call received in the last quarter of 2018, investors also see market volatility as a pressing risk concern. And the sting of recent losses is translating into a renewed focus on alternative investments.7

Nearly six in ten (57%) investors report that volatility has them looking for investments other than stocks and bonds. Seven in ten say they are interested in finding strategies that can enhance the diversification of their portfolio. Another 65% say they want strategies that are less tied to the broad market.

In many instances these needs can be addressed with alternative investments, but few investors are getting alternatives in their portfolio. Just 38% of the investors surveyed worldwide report that they own alternative investments, a number that is consistent with the 40% who did in 2017. But this is an area that also demands better investor education about investments overall, and alternatives in particular. As many as 15% of investors don’t know if they own alternative investments, and that number is up 5% from 2017. Clearly investors need better education on what’s in their portfolio.

IDK is not OK.

15%

don’t know if they own

alternative investments

17%

don’t know if they

own index funds

12%

don’t know if they

own real estate funds

Clearly, investors need to better understand what’s in their portfolio. This is an area that demands better investor education about investments overall — and alternatives in particular.

Making the lessons stick.

The return of volatility in 2018 delivered a clear wake-up call on risk. But even though 86% of those surveyed believe it is important for their investments to deliver long-term results over short-term gains, history has shown that investors can have short-term memories when it comes to risk and volatility.

If investors are to be better equipped to achieve the long-term results, they will need better education on the reality of risk and volatility. They’ll also need tools to help them better determine how much of that risk they can actually take. They need to know more about the relationship between risk and return. And they need help setting return expectations based not just on how much they think they need, but on how much risk they can afford to take.

Beyond risk and return, they also need the facts about what they should and should not expect from their investments. They need more clarity about the difference between passive and active investments in order to have a better understanding of where the risks really lie in their portfolios. They’ll need to go back to math class and get the facts about what rising rates mean for bonds over both the long and short term. Finally, and maybe most importantly, they’ll need to be clear on what just they own and why exactly they own it.

Read the Executive Overview

The 2019 Global Survey of Individual Investors Executive Overview provides a summary of the report as well as the six report graphics.

1 Passive investing broadly refers to a buy-and-hold portfolio strategy for long-term investment horizons, with minimal trading in the market. Index investing is perhaps the most common form of passive investing, whereby investors seek to replicate and hold a broad market index or indices.

2 Natixis Investment Managers Global Survey of Financial Professionals conducted by CoreData Research in March 2018. Survey included 2,775 financial professionals in 16 countries, 300 of whom are in the US.

3 Natixis Investment Managers Global Survey of Individual Investors conducted by CoreData Research in February-March 2017. Survey included 8,300 investors in 26 countries.

4 An index fund is a type of mutual fund with a portfolio constructed to match or track the components of a financial market index.

5 Natixis Investment Managers Global Survey of Individual Investors conducted by CoreData Research in August-September 2018. Survey included 9,100 investors in 25 countries.

6 Unlike passive investments, there are no indexes that an active investment attempts to track or replicate. Thus, the ability of an active investment to achieve its objectives will depend on the effectiveness of the investment manager.

7 Alternative investments involve unique risks that may be different from those associated with traditional investments, including illiquidity and the potential for amplified losses or gains. Investors should fully understand the risks associated with any investment prior to investing.

The views and opinions expressed may change based on market and other conditions. This material is provided for informational purposes only and should not be construed as investment advice. There can be no assurance that developments will transpire as forecasted. Actual results may vary.

All investing involves risk, including the risk of loss. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

The data shown represents the opinion of those surveyed, and may change based on market and other conditions. It should not be construed as investment advice.

The MSCI World All Cap Index captures large, mid, small and micro-cap representation across 23 Developed Markets (DM) countries. With 11,910 constituents, the index is comprehensive, covering approximately 99% of the free float-adjusted market capitalization in each country. S&P 500® Index is a widely recognized measure of U.S. stock market performance. It is an unmanaged index of 500 common stocks chosen for market size, liquidity, and industry group representation, among other factors. It also measures the performance of the large-cap segment of the U.S. equities market. The MSCI EAFE Index (Net) is a free float-adjusted market capitalization index designed to measure large and mid-cap equity performance in developed markets, excluding the U.S. and Canada. The Index includes countries in Europe, Australasia, and the Far East. The FTSE 100 Index is one of the world’s most recognized indices and accounts for 7.8% of the world’s equity market capitalization. It represents the performance of the 100 largest blue chip companies listed on the London Stock Exchange, which meet the FTSE’s size and liquidity screening. The index represents approximately 85.2% of the UK’s market and is currently used as the basis for a wealth of financial products available on the London Stock Exchange, National Stock Exchange of India and others institutions globally. Japan's Nikkei 225 Stock Average is the leading and most-respected index of Japanese stocks. It is a price-weighted index composed of Japan's top 225 blue-chip companies on the Tokyo Stock Exchange. The Nikkei is equivalent to the Dow Jones Industrial Average Index in the U.S. In fact, it was called the Nikkei Dow Jones Stock Average from 1975 to 1985. The S&P Latin America 40 includes 40 leading, blue-chip companies that capture approximately 70% of the region's total market capitalization. Constituents are drawn from five major Latin American markets: Brazil, Chile, Colombia, Mexico and Peru.

You cannot invest directly in an index. Indexes are not investments, do not incur fees and expenses and are not professionally managed.

This document may contain references to copyrights, indexes and trademarks that may not be registered in all jurisdictions. Third party registrations are the property of their respective owners and are not affiliated with Natixis Investment Managers or any of its related or affiliated companies (collectively “Natixis”). Such third party owners do not sponsor, endorse or participate in the provision of any Natixis services, funds or other financial products.

The index information contained herein is derived from third parties and is provided on an “as is” basis. The user of this information assumes the entire risk of use of this information. Each of the third party entities involved in compiling, computing or creating index information disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to such information.

Diversification does not guarantee a profit or protect against a loss.

Natixis Distribution, L.P. is a limited purpose broker-dealer and the distributor of various registered investment companies for which advisory services are provided by affiliates of Natixis Investment Managers.

2554742.1.1

Top

Top

2024 Private Assets Report

2024 Private Assets Report

All About The Rates

All About The Rates