Three Ways Institutional Investors Are Preparing for the Fallout of a Market Shift

1. Institutional investors are looking for opportunity in the uncertainty

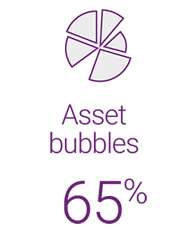

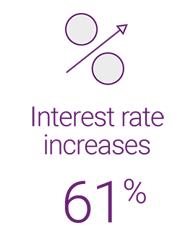

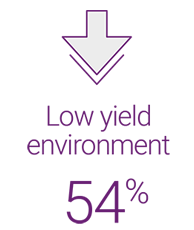

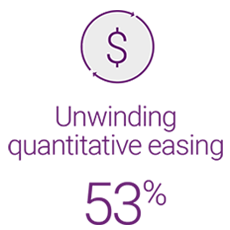

What will impact investment performance in 2018?

(% who said negative impact)

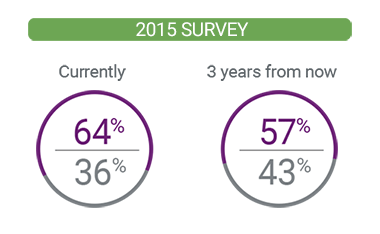

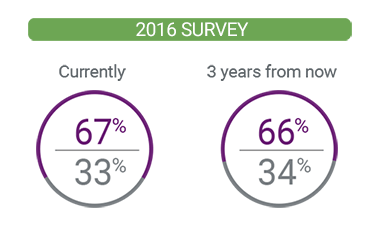

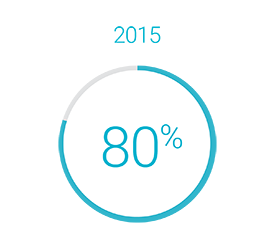

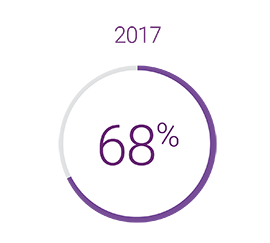

Active investments are on the rise

Institutional investors have been upping allocations to active investments for the last three years in anticipation of market volatility – a trend that looks likely to continue1.

• Active Investments • Passive Investments

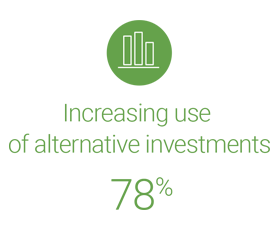

And so are alternatives

The majority of institutional investors are also looking to alternative investments to diversify, help manage mounting risks, and pursue potential returns.

See how institutions are using specific alternative classes. Download the report.

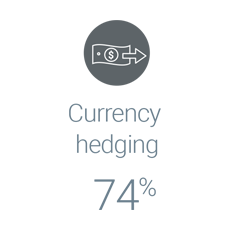

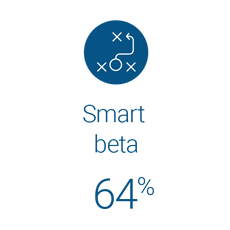

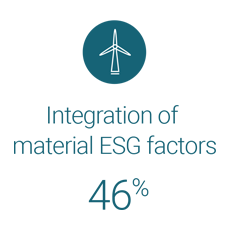

2. Risk management is in the spotlight again

With market volatility back in the picture, institutional investors are employing a range of strategies to help manage risk.

Learn more about how institutional investors are managing risk. Download the report.

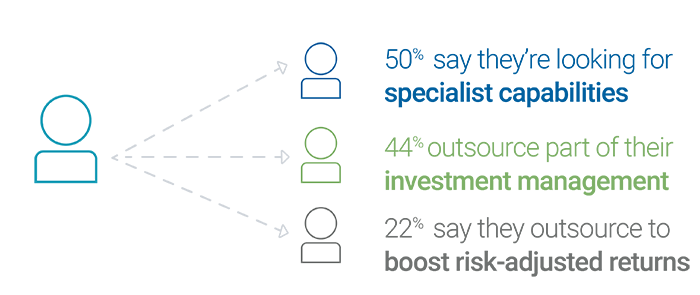

3. Regulatory controls are still top of mind

Institutional investors are still grappling with the impact of tighter regulatory controls – though it’s getting easier. Fewer institutional investors say complying with new regulations is a challenge.

Many institutions are looking to hire or outsource the specialized talent needed to fully deliver on investment expectations.

Get deeper insight into how institutions are approaching regulatory challenges and outsourcing. Download the report.

Read the full Report

The Natixis Investment Managers Global Survey of Institutional Investors was conducted by CoreData Research in September and October 2017. The survey included 500 institutional investors in 30 countries. Get the whole story.

Natixis Investment Managers, Global Survey of Institutional Investors conducted by CoreData Research in September and October 2017. Survey included 500 institutional investors in 30 countries.

Diversification does not guarantee a profit or protect against a loss.

Alternative investments involve unique risks that may be different from those associated with traditional investments, including illiquidity and the potential for amplified losses or gains. Investors should fully understand the risks associated with any investment prior to investing.

2024124.1.2

2024 Private Assets Report

2024 Private Assets Report

All About The Rates

All About The Rates

Do Smaller Asset ETFs Offer a Performance Advantage?

Do Smaller Asset ETFs Offer a Performance Advantage?

Credit Market Outlook: Solid Fundamentals and FOMO

Credit Market Outlook: Solid Fundamentals and FOMO