Four Key Insights into Establishing the California Green Bond Market

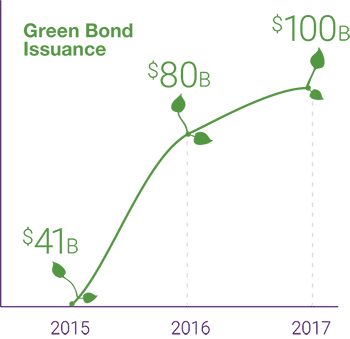

The green bond market is growing exponentially. Momentum is likely to continue as a growing number of states, counties, and municipalities look for ways to finance green projects, including sustainable energy, transportation, clean water, and forestry.

But while many California investors may be aligned with environmental, social and governance (ESG) investing principles in spirit, misconceptions and knowledge gaps may keep them out of green bonds.

Our recent survey of California residents, conducted in conjunction with the California State Treasurer’s Office, uncovered four key insights that matter to policy makers as they look to structure a bond market that will encourage individual participation.

1. Californians want their assets to make a difference

The California investors we surveyed have a strong personal connection to their assets. In fact, nearly eight in ten say they want their investments to reflect their personal values. This is consistent with what we’ve found in our global investor survey.

As California goes, so goes the nation |

CA | US* | |

|

Want their investments to reflect their personal values. | 77% | 75% |

|

Want to know that their assets are doing social good. | 76% | 69% |

|

Want to invest in companies with good environmental records. | 78% | 73% |

|

Want to invest in companies that have a positive social impact. | 77% | 68% |

|

Want to invest in companies that are ethically run. | 82% | 84% |

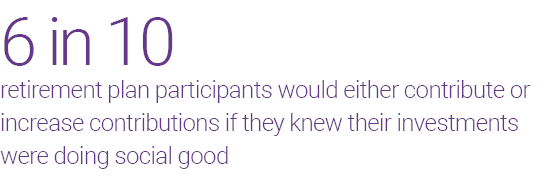

Can access to sustainable investments drive positive financial behaviors? Findings from our most recent survey of defined contribution plan participants1 also support this idea.

Learn more about how the values of California investors affect their investing habits. Download the report.

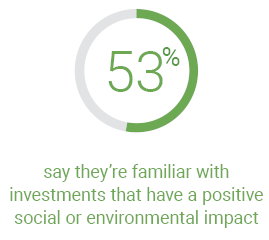

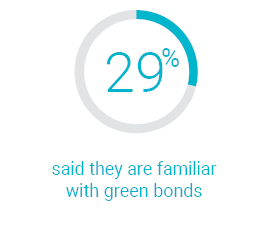

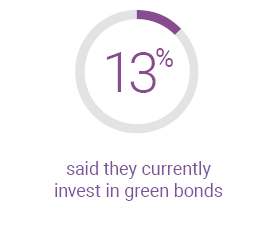

2. A lack of awareness may lead to misconceptions about green bonds

Even though global issuances are growing, green bonds are a relatively new investment concept for both institutions and individuals. In fact, many California residents don’t know what they are.

See how lack of awareness impacts how California residents feel about green bonds. Download the report.

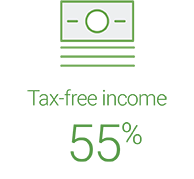

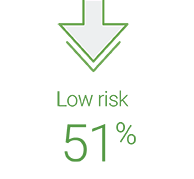

3. Personal benefits come before societal benefits

While Californians have strong convictions about sustainable investing, they’re not losing sight of financial goals and investment performance. In fact, they look at those first, just as they do with traditional municipal bonds.

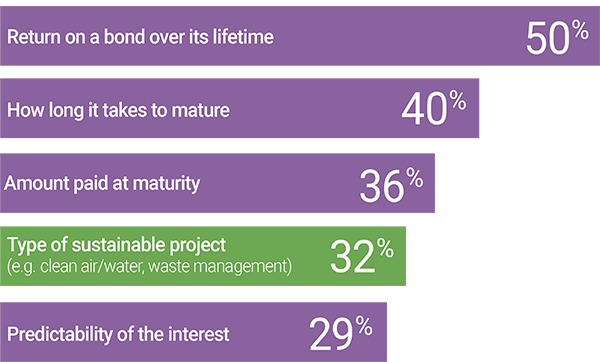

(% Yes, multiple answers allowed)

Take a deeper dive into what motivates California residents to invest in municipal bonds. Download the report.

4. Choosing green bonds is based on financial—and non-financial—factors

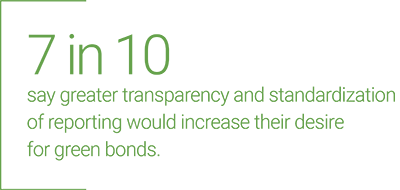

Like traditional municipal bonds, when California investors consider state-issued green bonds, they’ll likely want to be assured of the quality of the underlying investment.

(% Yes, multiple answers allowed)

Get insight into why California investors select green bonds--and learn which sources they use to inform their decision. Download the report.

Read the full Report

California green bond success with individual investors likely hinges on public outreach and education. Read the full report for deeper insight into how California residents would be likely to participate in a green bond market.

* Natixis Investment Managers, Global Survey of Individual Investors conducted by CoreData Research, February-March 2017. Survey included 8,300 investors from 26 countries, 750 of whom are US investors.

1 Natixis Investment Managers, Survey of US Defined Contribution Plan Participants conducted by CoreData Research, August 2016. Survey included 951 US workers, 651 being plan participants and 300 being non-participants.

This material is provided for informational purposes only and should not be construed as investment advice.

Green bonds are securities that finance projects that provide environmental benefits.

Municipal markets may be volatile and can be significantly affected by adverse tax, legislative or political changes and the financial condition of the issuers of municipal securities.

Sustainable investing focuses on investments in companies that relate to certain sustainable development themes and demonstrate adherence to environmental, social and governance (ESG) practices, therefore the universe of investments may be reduced. This could have a negative impact on performance depending on whether such investments are in or out of favor.

All investing involves risk including risk of loss.

2024374.2.1

2024 Private Assets Report

2024 Private Assets Report

Direct Indexing: Checking the Box

Direct Indexing: Checking the Box