Time to Cash into Stocks?

3 Reasons to Get Your Cash Off the Sidelines

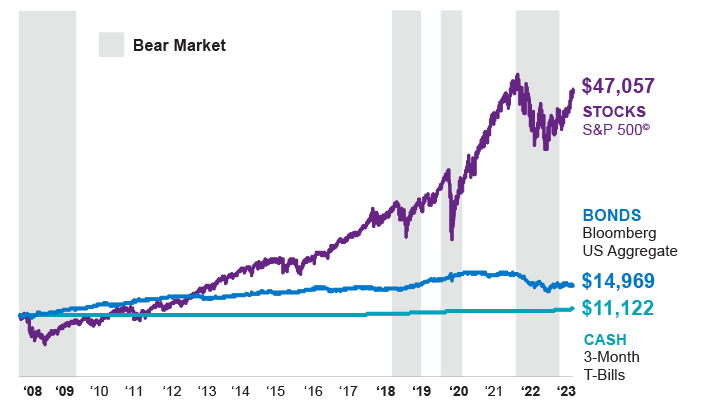

But while monthly interest payments are a nice perk, they mask an important truth: Savings accounts, money markets, T-bills and Certificates of Deposit are not a long-term savings strategy. Over longer time periods, investments in the stock market have outperformed cash by significant margins despite the ups and downs. See how $10,000 would have grown in stocks over the past 15 years compared to cash and bonds – a period that included four bear markets.

Cash returns can’t compete with stocks over the long run

Growth of $10,000 from July 1, 2008 to June 30, 2023

Source: Natixis Investment Managers Solutions; Bloomberg

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results.

But what about down markets?

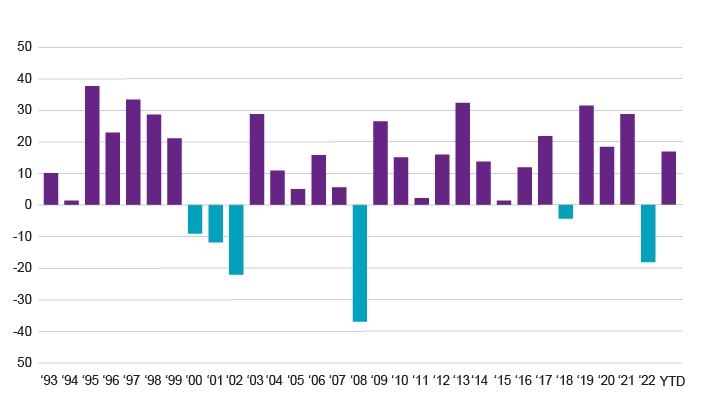

Down markets are always a risk. Many investors lost money in 2022 – but worse, many lost their investment momentum. Investors who moved money to the sidelines last year may be finding it difficult to get back in now. But as we’ve already seen, investing in stocks over long periods of time is the most effective strategy for building wealth.

Although stock market returns vary from year to year, they’ve maintained a consistent upward trend over time – and that benefits investors who can learn to stomach a bumpy ride. Let’s look at the returns of the S&P 500® in each of the past 30 calendar years. Annual returns were positive in 24 years – that’s 80% of the time – as well as year-to-date through June 30, 2023.

Stock market returns were positive in 24 of the past 30 years

S&P 500® annual returns % 1/1/1993–6/30/2023

Source: Natixis Investment Managers Solutions; Bloomberg

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results.

If you’re leaving your money in cash, you’re likely missing out. This chart shows four different results of $10,000 invested in the S&P 500® over the past 15 years. Left untouched, it would have grown to $47,057. But if you missed the market’s best days by being on the sidelines, the returns were very different. Missing out on just the 5 best trading days would have been a $17,000 mistake.

Missing even a few trading days can erode long-term gains

Growth of $10,000 in S&P 500® Index July 1, 2008 – June 30, 2023

Source: Natixis Investment Managers Solutions; Bloomberg

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results.

If you’re keeping your investment money in a cash account, you’ve been missing out. While you may not be ready to go all in just yet, making regular monthly investments could be a good way to start. See if one of these strategies might help get your momentum back.

Natixis Distribution, LLC is located at 888 Boylston Street, Suite 800, Boston, MA 02199.

All investing involves risk, including the loss of principal.

Indexes are not investments, do not incur fees and expenses and are not professionally managed. It is not possible to invest directly in an index.

Making regular monthly investments, also known as dollar cost averaging, does not ensure a profit and does not protect against loss in declining markets.

Unlike passive investments, there are no indexes that an active investment attempts to track or replicate. Thus, the ability of an active investment to achieve its objectives will depend on the effectiveness of the investment manager.

5858161.1.1

Direct Indexing: Checking the Box

Direct Indexing: Checking the Box

Tax Management Update – Q1 2024

Tax Management Update – Q1 2024

All About The Rates

All About The Rates