Fixed Income Dashboard

The good news continues on the inflation front, particularly with respect to the Fed’s preferred inflation gauge, the Personal Consumption Expenditures (PCE). In fact, Core PCE is now annualizing at 1.86% over the past six months and just 1.52% over the past three months. Inflation has definitively downshifted to a pace consistent with, or even below, the Fed’s 2% target. We believe it is now just a matter of stringing together more of those prints until the year-over-year figure converges toward that 2% target from its current level of 2.93%.

While there remains concern that resilient growth will eventually feed back into an inflationary impulse, this common viewpoint dismisses the pipeline of disinflation yet to arrive. It may be slow to manifest, but shelter costs, which makes up more than 40% of the Core Consumer Price Index (CPI) basket and nearly 18% of the Core PCE basket, in our view, are set to cool materially over the course of 2024. But more importantly, the recovery in productivity growth we’ve highlighted for some time now is indeed coming to fruition. While it remains to be seen how long this productivity renaissance will last, for now it remains a powerful buffer to any inflationary impulse from robust growth.

Inflation Continues Downward Trend (as of 12/31/23)

Source: Natixis Investment Managers Solutions, Factset.

When will the Fed’s rate cut cycle commence?

Although market participants continue to debate the timing and the exact number of interest rate cuts the Fed will enact, it should be of little importance to all but short-term interest rate traders. The Fed is shifting to an easing bias, growth is holding up, and both tails of the distribution for Fed policy are getting clipped as the odds of either a recession or sticky inflation necessitating further rate hikes continue to fade.

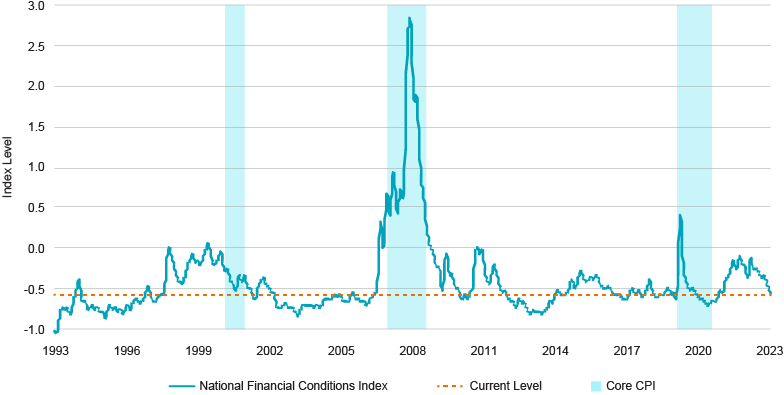

Chicago Fed National Financial Conditions Index (as of 12/31/23)

Source: Natixis Investment Managers Solutions, FactSet.

Source: Natixis Investment Managers Solutions, FactSet.As long as we remain firmly in the middle of that distribution, it matters little when, and by how much, the Fed cuts rates. We believe the bias for risk assets should be higher.

Resource

Fixed Income Dashboard – Q4 2023

This in-depth chart deck highlights historical data related to:

• Asset class valuations

• Relative valuations

• Credit conditions

• Distress ratios and defaults

• Inflation trends

• Yield curve

• Treasury yields

• Asset flows

Read Full Presentation

Investment Ideas

Consider these options for your fixed income allocation:

Learn More

Curious to learn how the fixed income markets are evolving?

Contact Us

All investing involves risk, including the risk of loss. Investment risk exists with equity, fixed income, and alternative investments. There is no assurance that any investment will meet its performance objectives or that losses will be avoided. Investors should fully understand the risks associated with any investment prior to investing.

CFA® and Chartered Financial Analyst® are registered trademarks owned by the CFA Institute.

4789638.9.1

2024 Private Assets Report

2024 Private Assets Report

Investment Outlook: Loomis Sayles

Investment Outlook: Loomis Sayles