Outlook: ETF Trends to Watch for in the Second Half of 2023

As we put the first half of 2023 behind us, we’ve analyzed the ETF investment space and identified three compelling trends we’ll be watching for the remainder of the year.

1. Continuing Investor Flows Into Fixed Income ETFs

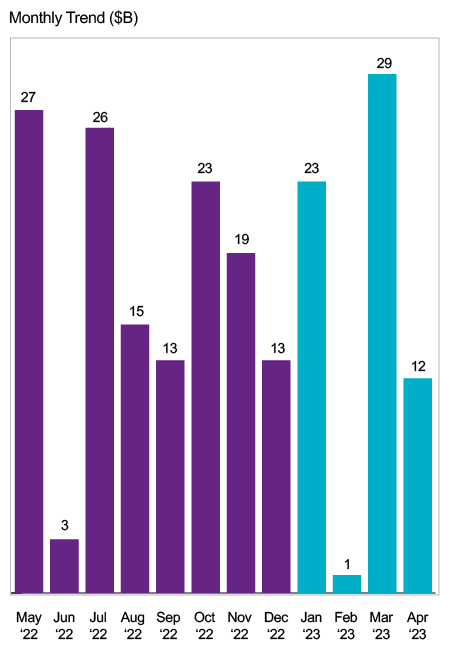

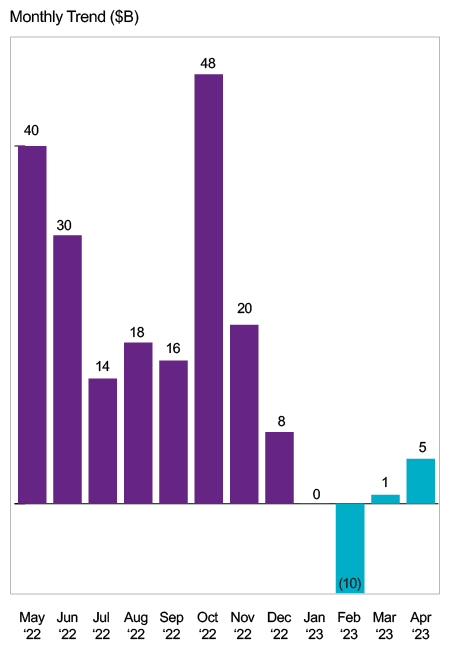

After examining monthly trended inflows data for key ETF investments, we’ve seen consistency throughout 2023 and 2022. Digging deeper into other areas – US Taxable Fixed Income ETFs and US Equity ETFs – reveals potentially telling insights.

As indicated below, equity ETF inflows have fallen off dramatically in 2023 from 2022’s more stable flow activity, while on the fixed income ETF side, 2023 net flows have remained consistently strong and positive. We expect this fixed income momentum to persist, as it’s driven by a combination of three ongoing factors: 1) investor fear of recession leading to a stock market decline, 2) highly attractive short-term interest rates, and 3) fear of bank failures.

US Taxable Bond ETF Net Flows

US Equity ETF Net Flows

Source: ISS MI Simfund. As of 4/30/23.

Short-term yields on the 2-year Treasury have generally been over 4% in 2023. This strong nominal yield has driven investors toward shorter-term fixed income ETFs. Another factor driving sales activity to fixed income ETFs is investor concern about bank deposits above the FDIC-insured $250K limit, along with general bank solvency. This is leading investors to rotate from bank products to fixed income ETFs.We expect both these factors could continue to lead investors to fixed income ETFs for the remainder of 2023.

2. Active Over Passive ETF Outperformance

The debate on investor preference between active vs. passive ETFs strategies isn’t likely to be resolved anytime soon. Nonetheless, current market conditions may well solidify the inclination of investors preferring active management, as significant market volatility has created opportunities for active managers.

One portfolio manager taking advantage of these opportunities is Scott Weber, manager of the Natixis Vaughan Nelson Select ETF (VNSE). Vaughan Nelson’s research-intensive approach aims to take advantage of temporary information and market inefficiencies across market caps to uncover companies at valuations well below their long-term intrinsic value. The team has traded astutely and nimbly – enabling them to react quickly to shifting market sentiment, and trim names when valuations became excessive. VNSE has outperformed the S&P 500® Index in 2021’s up market, 2022’s down-market, and thus far in 2023. Based on market performance, a passive product might not have been able to deliver such results.

3. Options Overlay ETF AUM Growth

As 2023 progresses, we expect to see more options-related ETF filings, launches, and assets. Data from Strategic Insight, Simfund, shows assets more than doubling since 2020. In our opinion, this indicates heightened investor interest in options overlays.

| Morningstar Category (MS) | Total Assets $MM [2020] |

Total Assets $MM [2021] |

Total Assets $MM [2022] |

Total Assets $MM [Ytd-4/23] |

|---|---|---|---|---|

| Derivative Income | 26,060 | 43,669 | 59,282 | 73,110 |

| Options Trading | 35,973 | 56,122 | 58,744 | 64,190 |

| Total | 62,033 | 99,791 | 118,026 | 137,300 |

Investors may be seeking return streams that options overlays can provide, particularly amidst recent market volatility. Should volatility endure through the remainder of 2023, we expect to see sustained investor attention in this area.

Natixis Active ETFs

Find out how actively managed bottom-up ETF strategies can help investors pursue growth opportunities and manage risk in all market environments.

Learn More

Visit our ETF homepage or contact your Natixis sales representative to learn more.

Contact Us

An exchange-traded fund, or ETF, is a marketable security that tracks an index, commodity, bond, or a basket of assets like an index fund. ETFs trade like common stock on a stock exchange and experience price fluctuations throughout the day as they are bought and sold. Short-term fixed income ETFs invest in fixed income securities with durations between one and five years.

All investing involves risk, including the risk of loss. Investment risk exists with equity, fixed income, money market, and alternative investments. There is no assurance that any investment will meet its performance objectives or that losses will be avoided.

The views and opinions expressed may change based on market and other conditions. This material is provided for informational purposes only and should not be construed as investment advice. There can be no assurance that developments will transpire as forecasted. Actual results may vary.

Unlike passive investments, there are no indexes that an active investment attempts to track or replicate. Thus, the ability of an active investment to achieve its objectives will depend on the effectiveness of the investment manager.

Diversification does not guarantee a profit or protect against a loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Asset allocation does not ensure a profit or protect against loss.

ETF General Risk: ETFs trade like stocks, are subject to investment risk, and will fluctuate in market value. Unlike mutual funds, ETF shares are not individually redeemable directly with the Fund, and are bought and sold on the secondary market at market price, which may be higher or lower than the ETF's net asset value (NAV). Transactions in shares of ETFs will result in brokerage commissions, which will reduce returns. Active ETF: Unlike typical exchange-traded funds, there are no indexes that the Fund attempts to track or replicate. Thus, the ability of the Fund to achieve its objectives will depend on the effectiveness of the portfolio manager. There is no assurance that the investment process will consistently lead to successful investing. Fixed Income Securities Risk: Fixed income securities may carry one or more of the following risks: credit, interest rate (as interest rates rise, bond prices usually fall), inflation, and liquidity. Below Investment Grade Securities Risk: Below investment grade fixed income securities may be subject to greater risks (including the risk of default) than other fixed income securities. Foreign and Emerging Market Securities Risk: Foreign and emerging market securities may be subject to greater political, economic, environmental, credit, currency, and information risks. Foreign securities may be subject to higher volatility than US securities, due to varying degrees of regulation and limited liquidity. These risks are magnified in emerging markets. Interest Rate Risk: Interest rate risk is a major risk to all bondholders. As rates rise, existing bonds that offer a lower rate of return decline in value because newly issued bonds that pay higher rates are more attractive to investors.

ALPS Distributors, Inc. is the distributor for the Natixis Loomis Sayles Short Duration Income ETF, the Natixis Vaughan Nelson Mid Cap ETF, the Natixis Vaughan Nelson Select ETF, and the Natixis Loomis Sayles Focused Growth ETF. Natixis Distribution, LLC is a marketing agent. ALPS Distributors, Inc. is not affiliated with Natixis Distribution, LLC.

Natixis Distribution, LLC (fund distributor, member FINRA|SIPC) and Loomis, Sayles & Company, L.P. are affiliated.

5708191.1.1

NTS000274

2024 Private Assets Report

2024 Private Assets Report

Investment Outlook: Loomis Sayles

Investment Outlook: Loomis Sayles