What’s Next for Europe’s Natural Gas Dilemma and Economy?

Key Takeaways

- In opposition to EU support of Ukraine, Russia cut off 90% of natural gas supply to Europe in September 2022 – threatening countries, like industrial powerhouse Germany, with crisis.

- A combination of quick response to drive imported new supply and innovative ways to decrease demand, along with a warmer winter, helped curb the issue.

- This example highlights how economic expectations for Europe have shifted, and why we are finding opportunity in that market.

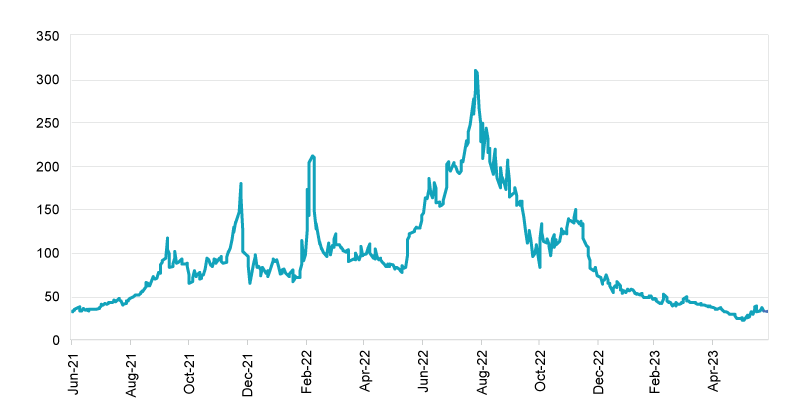

Benchmark European Natural Gas Price (TTF, 1mo-fwd)

Source: Bloomberg as of June 27, 2023

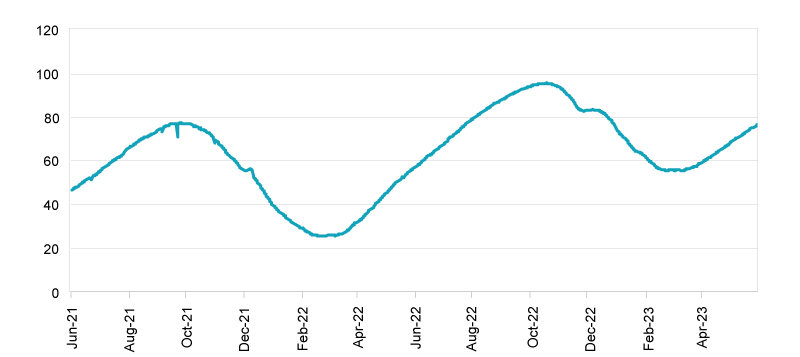

Another impressive figure is the fill rate of storage within the EU: It exited the winter season at a historical high and currently nears 71%. Gas prices are volatile, but the market is now pricing a fairly benign outcome next winter even without the resumption of Russian gas supply.

GIE European Natural Gas Storage (% full)

Source: Bloomberg as of June 25, 2023

Weather partly helped – a warmer than usual winter provided a natural reduction in gas demand, but most estimates peg this at less than a third of the total effect. Rather, the answer is more Economics 101: supply responded and demand responded.

On the supply side, the EU imported liquefied natural gas (LNG) in greater volumes than most expected from suppliers like Qatar and the US even as Chinese demand weakened. Bidding for the cargoes wasn’t enough, however. LNG is imported as a liquid but needs to be turned back into gas before it goes into the pipes. Setting up this infrastructure takes time, often three to five years. In a remarkable feat of engineering, Germany set up significant import terminals in a matter of months. By 2030, the country is predicted to grow from zero LNG import capacity to become the world’s fourth largest importer that is able to import enough gas not only to cover its domestic needs but to re-export to landlocked neighbors.

On the demand side, companies scrambled to find ingenious ways to make the same output with less gas. The solutions varied industry-by-industry, but they switched fuel supplies or began to import gas-intensive components from abroad where possible. Hours during which commercial and industrial buildings were heated were shortened and the temperature reduced. One of the biggest surprises was the degree to which residential demand, traditionally not very sensitive to price, responded to public campaigns to turn down the thermostat, shut off heat to empty rooms and save on energy use. These efforts were seen as a way, all at once, to save costs, to help sustainability and to display European solidarity with Ukraine.

What Does It Mean?

Looking back, what lessons can we draw? Perhaps the biggest one is: People adjust. Particularly in a crisis, behavior does not continue along its status quo path but adapts to face the challenges at hand. Europe’s energy challenges are real and risk is never out of the system, but pessimistic forecasts about the imminent “deindustrialization” of the continent failed to materialize. In asset markets, betting on the human capacity to rebound and adapt to a challenge when others are wary can provide an attractive entry point into an investment – a pillar of Harris Associates’ value investing philosophy – whereas simply extrapolating the recent past can lead investors to miss the dynamic nature of economic systems.

Harris Associates View: The Opportunity in Europe

While gas markets are volatile, we believe the steps Europe has taken to both build up its reserves and conserve energy overall will carry them through the coming winter and beyond. The market has been discounting European stocks due to concerns about the war in Ukraine, a European energy crisis and record high inflation. In reality, though, Europe has been resilient through all of this.

There are numerous examples of European-based companies (luxury goods, global industrials, consumer product companies, etc.) that are global operators selling at extremely depressed valuations because of the postal code of their corporate headquarters. When the market doesn’t separate the macro from the micro, there is an exploitable opportunity for long-term investors, such as ourselves, who measure value generally based on corporate performance and specifically through cash flow generation through time, versus on macro events.

Our analysts at Harris Associates remain laser focused on valuing the impact, if any, to the cash flow generation of the business. Traders tend to focus on the short term, but as investors we keep our sights on the horizon. We believe that both our intensive research process and our focus on the long term help us find opportunities despite the short-term market noise.

The information, data, analyses, and opinions presented herein (including current investment themes, the portfolio managers’ research and investment process, and portfolio characteristics) are for informational purposes only and represent the investments and views of the portfolio managers and Harris Associates L.P. as of the date written and are subject to change and may change based on market and other conditions and without notice. This content is not a recommendation of or an offer to buy or sell a security and is not warranted to be correct, complete or accurate.

Certain comments herein are based on current expectations and are considered “forward-looking statements”. These forward-looking statements reflect assumptions and analyses made by the portfolio managers and Harris Associates L.P. based on their experience and perception of historical trends, current conditions, expected future developments, and other factors they believe are relevant. Actual future results are subject to a number of investment and other risks and may prove to be different from expectations. Readers are cautioned not to place undue reliance on the forward-looking statements.

There can be no assurance that developments will transpire as forecasted. Actual results may vary.

Investing in value stocks presents the risk that value stocks may fall out of favor with investors and underperform growth stocks during given periods.

Natixis Distribution, LLC (Member FINRA|SIPC) is a marketing agent for the Oakmark Funds, a limited purpose broker-dealer and the distributor of various registered investment companies for which advisory services are provided by affiliates of Natixis Investment Managers.

5930866.1.1

Direct Indexing: Checking the Box

Direct Indexing: Checking the Box

Tax Management Update – Q1 2024

Tax Management Update – Q1 2024