Corporate Bond Shortage on the Horizon?

For one, the flurry of issuance the week after Labor Day was not entirely unexpected, given typical seasonal patterns in prior years. And when you consider that IG corporate bond customers are often just high-quality bond customers, many were likely selling Treasuries in order to buy the corporates. This could explain the upward pressure on Treasury yields. Economic data has surprised to the upside for the last several months, and if you’re constructive on the economy, you might as well take on some additional risk for the additional yield you can earn with corporate bonds vs. Treasuries.

Corporate Bond Scarcity Supports Spreads

It's a good reminder that supply/demand dynamics can affect both Treasury yields and credit spreads. As a result of quantitative tightening, the Federal Reserve is no longer providing a steady bid for Treasuries as it allows maturing Treasury holdings to run off. So demand has decreased, while supply has continued to increase. It’s one of the many reasons why the path of least resistance for Treasury yields has been higher recently. However, the Fed is not transacting in corporate bonds. And new corporate supply has not kept pace with new Treasury supply. Once the flurry of early-Covid-era corporate issuance began to slow, the proportion of corporate bonds in the Bloomberg Aggregate Index declined and sits at just under 25% today.

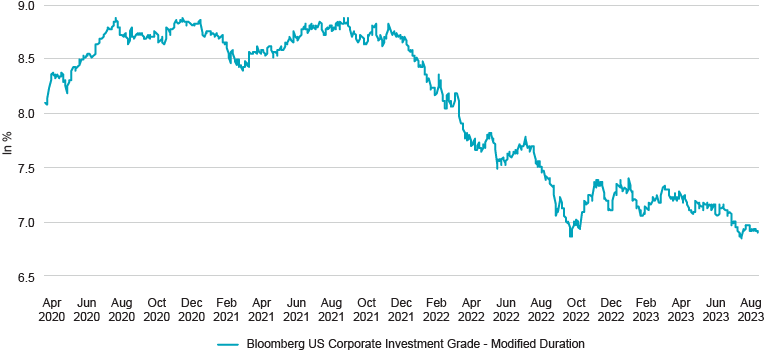

Decline in Supply – and Duration

The relative decline in corporate bond supply is particularly true for longer duration issues. Broad IG corporate duration was nearly 9 years as recently as 2021. It’s now down to 6.9. New issuance in 2023 has had the lowest average time to maturity in years. More companies are preferring to issue debt with shorter maturities, making a bet that interest rates will have normalized by the time the bonds mature.

Investment Grade Duration Growing Shorter

Source: FactSet

Percentage of US Investment Grade Supply by Tenor

Source: FactSet

Do They Really Need the Cash?

And for those companies that do have debt maturing, are their cash needs still the same? Many issued bonds over the past few years because it was nearly free money, not because they desperately needed the cash. If you had the opportunity to roll over debt but were forced to pay a 6% coupon instead of 2%, wouldn’t you think twice about it? To be fair, certain borrowers, particularly financial institutions, might be more sensitive to spread levels narrowing vs. overall yield (still high). For them the increase in borrowing costs isn’t as drastic, and the decision to issue more debt might be less painful. For everyone else, you’re only rolling over debt if you absolutely need to. And even then, you’d probably elect to take it on a short-term basis as opposed to locking in 6% longer-term.

On balance, we probably aren’t going to match the torrid issuance pace of 2020–21 anytime soon. When it comes to supply, early September was likely the exception, not the rule. But just as we saw on that day, demand for corporate bonds may be increasing. Additional confidence in the soft landing begets higher risk tolerance. Higher risk tolerance leads to more preference for credit vs. Treasuries. Excess demand can continue to push spreads lower than credit fundamentals would suggest. IG corporate spreads have already dipped below the 20-year median level of 128 bps. The all-time tights of 51 bps occurred in July 1997. If we continue to move toward a soft landing, those levels could even be in play. Investors tend to bid up what’s scarce, and in this outcome corporate bonds could become the scarce investment.

What About 2024?

Looking ahead over the next year, the market currently expects short rates to fall 50 bps or so by the end of 2024. All else equal, that is an environment where intermediate rates stay range-bound or even fall slightly. For an IG corporate investor, you might earn your nearly 6% yield or even do a little bit better. But consider two scenarios where the market’s rate forecast could be wrong:

- The Fed cuts more as growth moderates and inflation cools more rapidly than expected. You get a quicker, larger decline in yields and earn a nice price return. Take that scenario a bit further to include a mild recession, and that’s a great environment for bonds in general.

- Or you have “higher for longer” and continued hesitation on the part of US corporations to issue additional debt at expensive yields. That means favorable supply/demand dynamics and additional downward pressure on spreads. Great for IG corporates relative to other fixed income.

This material is provided for informational purposes only and should not be construed as investment advice. The views and opinions contained herein reflect the subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Natixis Investment Managers, or any of its affiliates. The views and opinions are as of September 22, 2023 and may change based on market and other conditions. There can be no assurance that developments will transpire as forecasted, and actual results may vary.

All investing involves risk, including the risk of loss. Investment risk exists with equity, fixed income, and alternative investments. There is no assurance that any investment will meet its performance objectives or that losses will be avoided. Investors should fully understand the risks associated with any investment prior to investing.

This material may not be redistributed, published, or reproduced, in whole or in part. Although Natixis Investment Managers believes the information provided in this material to be reliable, including that from third party sources, it does not guarantee the accuracy, adequacy or completeness of such information.

This document may contain references to copyrights, indexes and trademarks that may not be registered in all jurisdictions. Third party registrations are the property of their respective owners and are not affiliated with Natixis Investment Managers or any of its related or affiliated companies (collectively “Natixis”). Such third-party owners do not sponsor, endorse or participate in the provision of any Natixis services, funds or other financial products.

Provided by Natixis Distribution, LLC, 888 Boylston St., Boston, MA 02199. Natixis Investment Managers includes all of the investment management and distribution entities affiliated with Natixis Distribution, LLC and Natixis Investment Managers S.A. Natixis Advisors, LLC provides advisory services through its division Natixis Investment Managers Solutions. Advisory services are generally provided with the assistance of model portfolio providers, some of which are affiliates of Natixis Investment Managers, LLC.

5979696.1.1

60/40 Portfolio Simplicity

60/40 Portfolio Simplicity