The Year of Dis-consensus

It was meant to be the year of fixed income. It was meant to be the year recession finally hit. But much of what was anticipated didn’t happen in 2023. Instead, a sense of sticky pessimism pervaded markets for much of the year – a pessimism driven by geopolitical tensions, inflation worries and the continued presence of higher interest rates, which saw many investors stay on the sidelines of markets.

Despite this, however, and contrary to many forecasts, risk assets ended up posting strong numbers by the end of the year – although for many asset classes, much of that return came in the final two months of the year. On the equity front, growth returned to favor – but the real story was the extent to which that rise was dominated by the so-called ‘magnificent seven’, while on the fixed income side, hold-to-maturity bond funds were the best sellers.

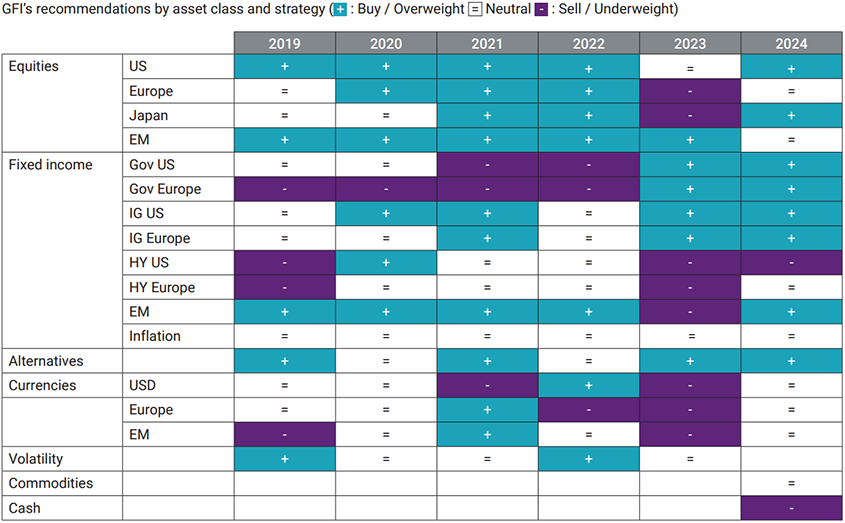

Which brings us to 2024. We aggregated the public outlooks of many of the world’s global financial institutions (GFIs) and the median view revealed a cautious optimism tempered by hard-won lessons over the past few years.

Median view of GFI recommendations by year

Source: Natixis IM Solutions, based on open information published by some of the largest Global Financial Institutions (‘GFI’) worldwide as identified by Natixis IM. Not every GFI has explicitly mentioned its allocation for each asset class shown in the matrix, in which case assumptions have been made based on the relevant GFI’s macro views. The main purpose of this matrix is to compare the asset allocation of GFI.

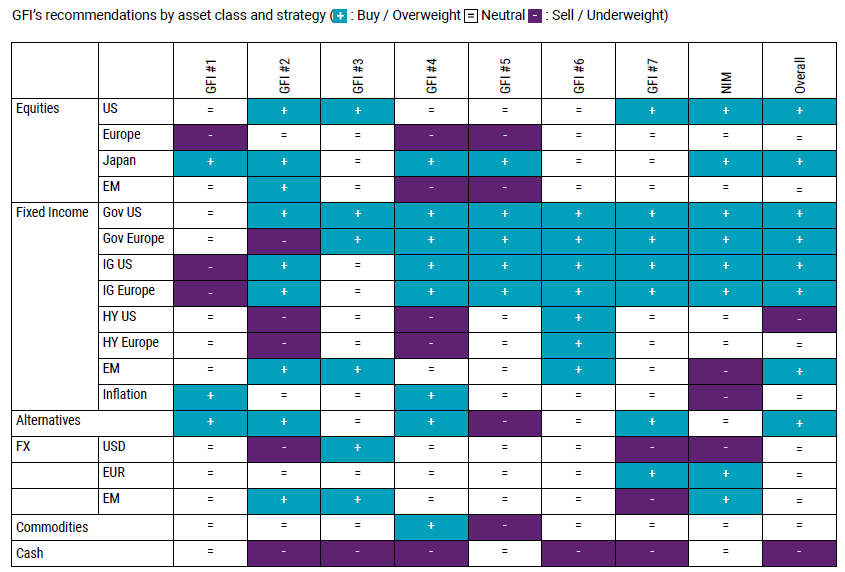

Taking the median view, GFI strategists are underweight only two asset classes – cash and US high yield. But perhaps more revealing is that they are neutral on eight asset classes, something not seen since the end of 2019, when they were putting out their views for 2020.

Caution is the watchword that runs through many of the 2024 outlooks, with ‘exceptional circumstances’ – an unprecedented rate-rising cycle, a tense geopolitical backdrop and the Covid debt backlog, among others – cited as the reason.

That is not to say there is a lack of excitement about the opportunities available, but rather that there are a lot of big calls to make and few clear answers. And having been burned in 2023, many GFIs have not tried to make short-term predictions, choosing instead to favor a longer-term view with a thematic investment approach (demographics, aging population, energy transition, green economy, artificial intelligence, digitalization, production onshoring, etc.) and middle-of-the-road economic forecasts.

And it would appear that this focus on the longer term may already have been vindicated because some of the shorter-term predictions have already come to pass, following the risk asset rally that took place in the last two months of 2023. This underlines not only just how quickly markets can move, but also how hard it is to get one’s timing right.

THE MEDIAN VIEW

Macro backdrop

At a macroeconomic level, the consensus among the GFI reports is fairly strong. While some are calling for a hard landing, most do not expect a broad-based economic collapse. In general, the expectation is for a slowing of the global economy, driven by the impact of higher interest rates, with some expecting a mild recession worldwide. At the same time, there is an expectation that central banks’ pivot to easier policies could set the stage for a risk-assets rally later in the year, but it is possible that the new target rates could be higher than those seen in the previous decade.

Its unexpectedly resilient performance in 2023 means that most expect the US to continue to lead the world economy, while most developed economies (particularly those in Europe) are expected to narrowly avoid a recession.

On the emerging market front, India is expected to take the lead, while many expect China to enter a 'new normal' of lower growth.

Equities

Within equities markets, the big call is what will happen to US stocks, in particular the so-called 'Magnificent Seven' (Apple, Alphabet, Amazon, Meta, Microsoft, Nvidia, Tesla) that drove much of the performance of US indices over the past year. While many missed out on the gains made in 2023, GFIs headed into 2024 quite upbeat about the performance of the technology mega-caps.

But this positivity is tempered by the fact that the US market is much more expensive than it usually is, when compared to other global stock markets. To put it in perspective, the S&P 500 is currently 34% more expensive than the MSCI All Companies Index ex US – a level that is two standard deviations greater than its long-term average.

Price:earnings ratio of the MSCI All Companies World Index vs the S&P 500

Source: NIM Solutions, Bloomberg. As at 01/15/2024.

Virtually all the GFI outlooks reviewed insist that quality is likely to be key to successful stock selection in the current economic environment. This insistence that could be perceived as a bearish signal – especially when combined with a focus on the importance of corporate earnings and the high level of dispersion among stocks, which, GFIs point out, further underlines the importance of security selection. As active investment managers the current environment excites us deeply; it presents opportunities for investors that have strong conviction and consistent processes with a fighting chance to demonstrate their expertise.

According to the GFI outlooks reviewed, investors should favor sectors such as utilities and consumer staples that tend to be negatively correlated to interest rates and are often considered defensive investments. Interestingly, share buybacks were almost never mentioned in GFI reports, but we believe may constitute an important force driving stocks in 2024.

Fixed income

Fixed Income remains the most preferred asset class going into the year. Many proclaimed 2023 to be the year of fixed income, and the reasons for that proclamation haven’t disappeared. But bonds didn’t perform as expected for much of the year. With interest rates expected to fall in 2024, GFIs are expecting investors to harvest yield from government bonds and many are looking to extend duration and cut elevated cash positions sooner rather than later.

With debt positions high, quality again is the watchword. Overall, GFIs are positive on investment grade credit globally and, in Europe, they are showing a preference for sustainable credit. Part of the reason for this is the view that the delinquency rate within the high yield market should rise during the year as economic growth slows down.

Linked to this is the fact that a significant amount of debt, both high yield and investment grade, is set to mature over the next few years and, as a result, many heavily indebted companies will need to reissue bonds at much higher interest rates. When this happens it could drive an increase in default rates. For these reasons, high yield debt is the sector on which GFIs are most bearish overall, especially US high yield.

Aggregated GFI views for 2024

Source: Natixis IM Solutions, based on open information published by some of the largest Global Financial Institutions (‘GFI’) worldwide as identified by Natixis IM. Not every GFI has explicitly mentioned its allocation for each asset class shown in the matrix, in which case assumptions have been made based on the relevant GFI’s macro views. The main purpose of this matrix is to compare the asset allocation of GFI. Overall GFI recommendations take into account European GFI views.

How to play 2024

With global inflation expected to land above the past decade’s average, the correlation between bonds and equities is likely to stay elevated. Such positive correlation can be good for markets, like in December 2023, when both bonds and equity prices rose, or bad, like 2022, or, more recently, August 2023.

Because of these expected correlations, virtually all the GFIs are calling for more diversification by sector, region and strategies in allocations. They point to the diversification benefits of infrastructure and private debt as banks continue to retreat from the market. And, while they are a little less bullish on private equity and real estate because of their expectations around interest rates, many saw benefits to a differentiated approach.

Correlations aren’t the only reason diversification is called for. The end of globalization and the advent of a multi-polar world (characterized by strategic reshoring and widespread protectionism) was often mentioned as a reason to be cautious, as was the importance of demographics in the shaping of tomorrow’s world.

Similarly, after four decades of neo-liberalism, there are many who see the rise of state-sponsored capitalism, epitomized by the Inflation Reduction Act in the US, as a trend that could up-end the status quo in unpredictable ways. And, as ever, new regimes bring shifts in the levers of power, in this case, from central banks to fiscal policy makers and market actors like bond vigilantes unhappy with the levels of debt that governments currently have on their books.

Some GFIs also discussed the beginning of an innovation super cycle driven by the convergence of multiple technologies, including generative artificial intelligence. Others focused on decarbonization and the green economy, which they felt could re-shape the financial world sooner rather than later as investors realize what the cost of not doing enough may be.

While these, and a host of other big shifts, were discussed in the outlooks, there was little consensus on which way the chips may fall. For this reason, we thought it would be more helpful to look at what the current big calls are and the bull and bear case for each, rather than try and aggregate the median view.

We think these are the questions investors will need to answer for themselves over 2024. There are no clear answers, but there will be winners and losers. And, from our perspective, it is a very exciting time: a world where active management can truly shine, but one in which expertise and multiple perspectives have never been more important.

| What could go wrong | Big calls to make in 2024 | What could go right |

|---|---|---|

| Resurgence of un-tamed inflation in some areas (e.g. Europe). | Can central banks win the battle against inflation? | Global inflation to cool off faster than expected (occurred in December when GFI reports got published). |

| Unexpected election outcomes and far higher geopolitical uncertainty trigger an inflationary shock, similar to what happened at the start of the war in Ukraine. | With 64 general elections in 2024, can democracy survive in 2024? | Geopolitical détente in the Middle East and peaceful election transitions leave the world far more stable than investors expect. |

| With global GDP1-to-debt ratio standing at 99% (up from 91% pre-Covid), bond markets might not continue to accept financing ballooning government debt and budget deficits. This culminates in a sovereign debt crisis possibly centered on the US. | Can corporations and consumers survive the ‘new’ interest rate environment? | Corporate balance sheets prove healthier and more resistant to elevated interest rates than expected. Fixed income and equity markets continue their steady march higher. |

| The US administration antitrust team cracks down on tech giants, and valuations fall precipitously back toward long-term averages. | Can US equities continue to outperform? | AI-related revenues of Magnificent Seven meet or even exceed estimates, and positive earnings and economic surprises help support current valuation levels. |

| AI-triggered securities sell-off. | Will AI be a force for good or bad? | Revolution of AI helps boost productivity and unleashes new levels of economic and corporate growth. |

This material is provided for informational purposes only and should not be construed as investment advice. The views and opinions contained herein reflect the subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Natixis Investment Managers, or any of its affiliates. The views and opinions are as of September 2023, and may change based on market and other conditions. There can be no assurance that developments will transpire as forecasted, and actual results may vary.

The provision of this material and/or reference to specific securities, sectors, or markets within this material does not constitute investment advice, or a recommendation or an offer to buy or to sell any security, or an offer of any regulated financial activity. Investors should consider the investment objectives, risks and expenses of any investment carefully before investing. The analyses, opinions, and certain of the investment themes and processes referenced herein represent the views of the portfolio manager(s) as of the date indicated. These, as well as the portfolio holdings and characteristics shown, are subject to change. There can be no assurance that developments will transpire as may be forecasted in this material. The analyses and opinions expressed by external third parties are independent and do not necessarily reflect those of Natixis Investment Managers. Past performance information presented is not indicative of future performance.

All investing involves risk, including the risk of loss. Investment risk exists with equity, fixed income, and alternative investments. There is no assurance that any investment will meet its performance objectives or that losses will be avoided. Investors should fully understand the risks associated with any investment prior to investing.

6409595.1.1

Investment Outlook: Loomis Sayles

Investment Outlook: Loomis Sayles

2024 Fund Selector Outlook

2024 Fund Selector Outlook