Mirova B(ey)ond Green - Sustainable bond investments: What's new?

Lucie Vannoye, CFA, Credit Analyst, Mirova

Launched in 2008, this market, particularly that of Green Bonds, grew continuously... until 2022, when the most violent interest rate increase in 40 years brought this expansion to a halt. In 2023, issuance struggled to regain momentum. Despite two promising first quarters, the end of the year, and particularly the third quarter, proved more complex, with issuers lacking visibility over the future path of interest rates. So, should one conclude that 2023 was a disappointment? It is not as simple as that, since there are various factors that shed a different light on the year’s performance when analysed closely.

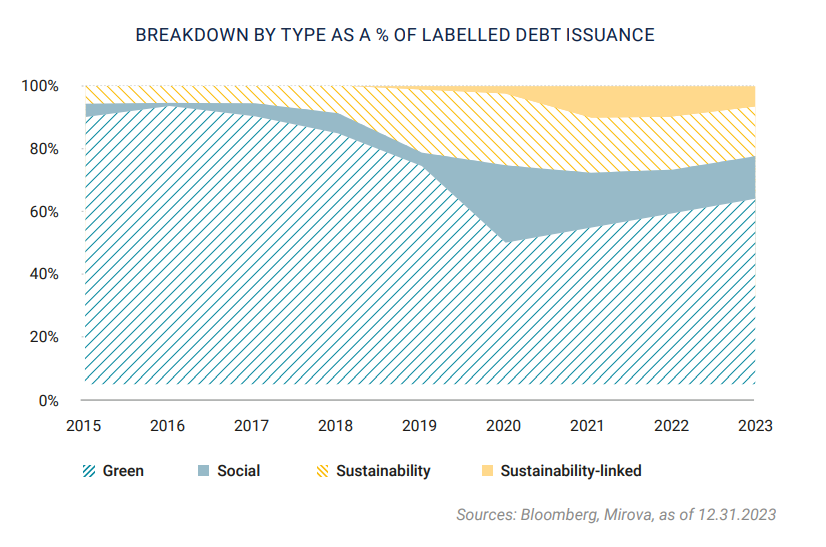

Firstly, the green bond format is consolidating its lead. We are delighted to see green bonds back on the rise, not only as a proportion of the total amount of labelled debt, but also in absolute terms, with a total amount issued up by 10% compared with 2022. We attribute this increase to sovereign issuers, who, as usual, preferred the green format to others. Governments continue to abandon the social format, with Chile and Colombia the only issuers on purely social impact programmes last year.

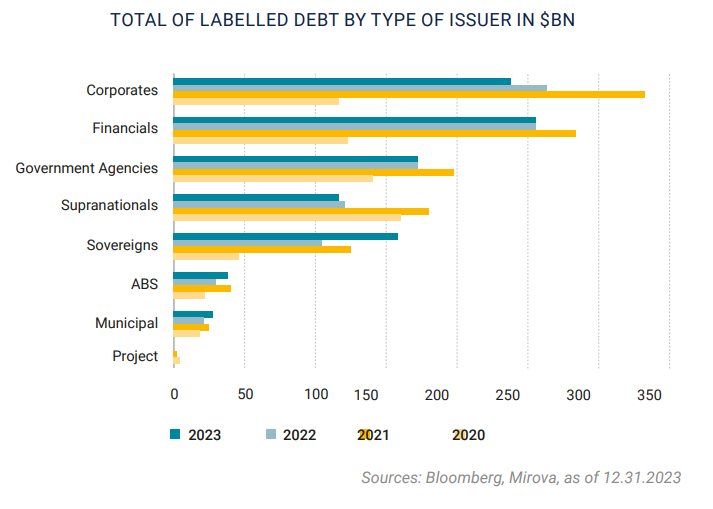

Sovereigns were the main contributors to growth in the green bond market for 2023. They issued $161 billion in green bonds, the highest level ever, a 50% increase on 2022.

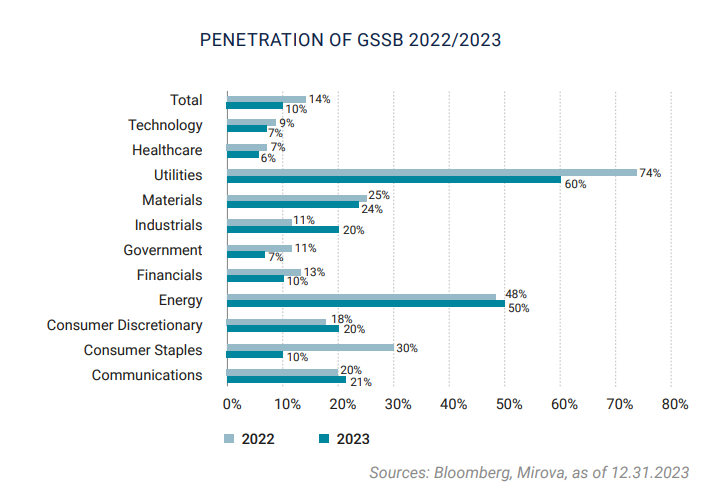

Corporate issuers, on the other hand, disappointed as they issued ‘just’ $238bn, 10% less than the previous year. They spurned sustainable formats as well as SLBs, although certain sectors with less experience of the GSSB market stood out, such as communications, consumer discretionary and industrials whose penetration rates rise.

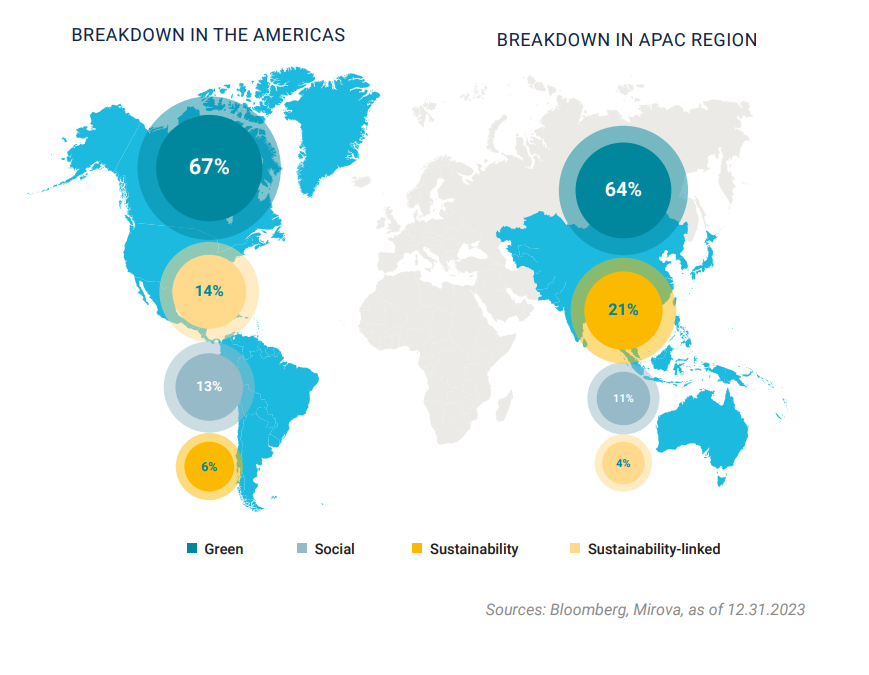

In geographical terms, EMEA remains the most heavily represented zone, while the APAC region’s level of issuance has remained flat for the past three years, at around $280 billion, and the Americas saw its issuance of labelled debt fall significantly in 2023, to $144 billion versus $224 billion in 2021. Turning to currencies, the euro and the US dollar, while they continue to dominate the market, together accounted for only 63% of total issuance, compared with 80% in 2020. Meanwhile, the yuan accounted for 10% of the total in 2023.

One last trend we are observing is the shortening of maturities. After 2019, the Global Green Bond index saw a sharp increase in duration relative to a conventional index, following the arrival on the GSSB market of sovereign issues with maturities exceeding 20 years. However, since 2022, and the rising interest rates imposed by central banks to combat inflation, issuers that favoured very long maturities to take advantage of exceptionally low rates have had to review their strategy and seek financing on shorter or intermediate maturities. This, combined with the need to accelerate energy transition and finance projects with shorter time horizons, has returned the Global Green Bond index to duration levels closer to those of a conventional universe. And lastly, insofar as rising interest rates exert mechanical downward pressure on durations, today’s bond market has a lower average duration than before.

Which new GSSB issuers joined the market in 2023?

Sovereigns were the life of the party this year, and no fewer than eight new issuers joined in 2023, mainly from emerging countries: Brazil and Cyprus issued sustainability-linked bonds, while India, Israel and Turkey opted for green issues.

Meanwhile, we listed about 120 new corporate issuers. Among them, a notable amount of green bonds issued by automotive firms such as Stellantis, Valeo, LG Energy Solutions and Autoliv. Mirova’s ESG Research teams particularly appreciate the green bond issued by East Japan Railway and that issued by packaging firm DS Smith, among others. 2023 also witnessed the entry of several Central European banks on the sustainable bond market, including Banca Transilvania and Bank Pekao.

New players were less common in the social bonds market, however a mention is due to the Natwest issue, in which 100% of Use of Proceeds will finance SMEs run and/or owned by women. However, once again last year, we had to turn down any number of programmes, primarily due to unambitious decarbonisation strategies on the part of the companies issuing them. We are thinking in particular of issuers in the areas of fast-fashion, mass retail and gas utilities.

Responsible investment opportunities have also arisen in the conventional universe. Indeed, of the 15 or so first-time issuers we identified in 2023 in the euro universe, two-thirds were eligible for Mirova's investment universe. Among the new issuers that we have deemed as having a strong positive impact is Veralto, the Danaher spin-off set up last September, which specialises in water and food quality control systems, as well as treatment systems with a positive impact on biodiversity.

Mirova is an affiliate of Natixis Investment Managers.

Portfolio management company – French Public Limited liability company

Regulated by AMF under n°GP 02-014

RCS Paris n°394 648 216

59, Avenue Pierre Mendes France – 75013 – Paris.

www.mirova.com

Natixis Investment Managers

Natixis Investment Managers is a subsidiary of Natixis.

Portfolio management company – French Public Limited liability company

RCS Paris n°453 952 681

43, Avenue Pierre Mendes France – 75013 – Paris.

www.im.natixis.com

This communication is for information only and is intended for investment service providers or other Professional Clients. The analyses and opinions referenced herein represent the subjective views of the author as referenced unless stated otherwise and are subject to change. There can be no assurance that developments will transpire as may be forecasted in this material.

All back to bonds?

All back to bonds?

Mirova B(ey)ond Green - How can the emergence of ‘transition finance’ boost the market for labelled bonds?

Mirova B(ey)ond Green - How can the emergence of ‘transition finance’ boost the market for labelled bonds?

Mirova B(ey)ond Green - Chemistry, the ugly duckling of ESG...shunned by markets in 2023

Mirova B(ey)ond Green - Chemistry, the ugly duckling of ESG...shunned by markets in 2023