A Look Behind the Curtain – ETF Primary Markets

Exchange-traded funds (ETFs) can provide investors with superior liquidity, lower costs, and greater tax efficiency relative to other investment vehicles. A look “behind the curtain” at the workings of the primary markets helps to explain what enables ETFs to offer such distinctive characteristics for investors. Our primer below breaks it down.

The workings of the ETF primary market

ETF shares are created and redeemed in the primary market between the ETF and an Authorized Participant (AP). APs, large financial institutions with contractual ability to transact directly with an ETF, provide considerable underlying liquidity in the ETF market and increase market transparency by keeping ETF prices close to their net asset values.

Share creation transactions are conducted in-kind1 by exchanging ETF portfolio securities for ETF shares. As such, the AP bears trading costs for purchasing portfolio securities (in a share creation transaction) or selling securities received (in a share redemption transaction) in the open market. Since redemption trades are executed in-kind, and the Internal Revenue Code enables the ETF to forgo realization of a related taxable gain/loss, by extension ETFs can operate with lower costs and greater tax efficiency.

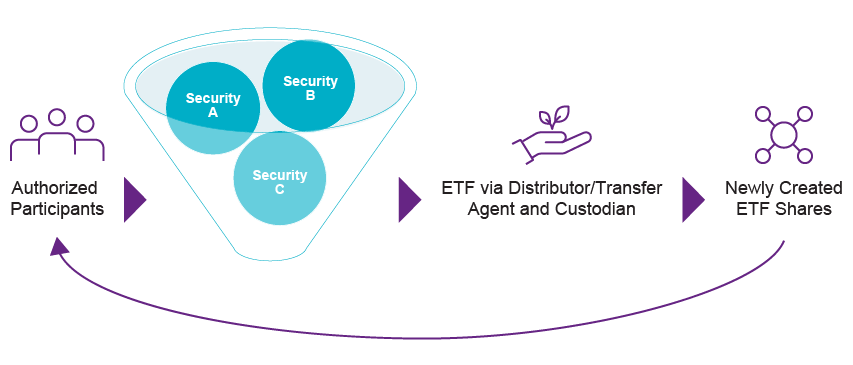

As illustrated below, trading in the primary market exists on an over-the-counter basis between the AP and ETF issuer and is facilitated through the ETF’s distributor, custodian, and transfer agent. Our primary market creation graphic (Figure 1) shows how the AP works with an ETF issuer, with the underlying securities delivered from the AP to the ETF, and the AP receiving newly created ETF shares in exchange. Conversely, for a primary market redemption order, the AP delivers existing ETF shares in exchange for the underlying ETF portfolio securities.

Figure 1: A Primary Market Creation Order

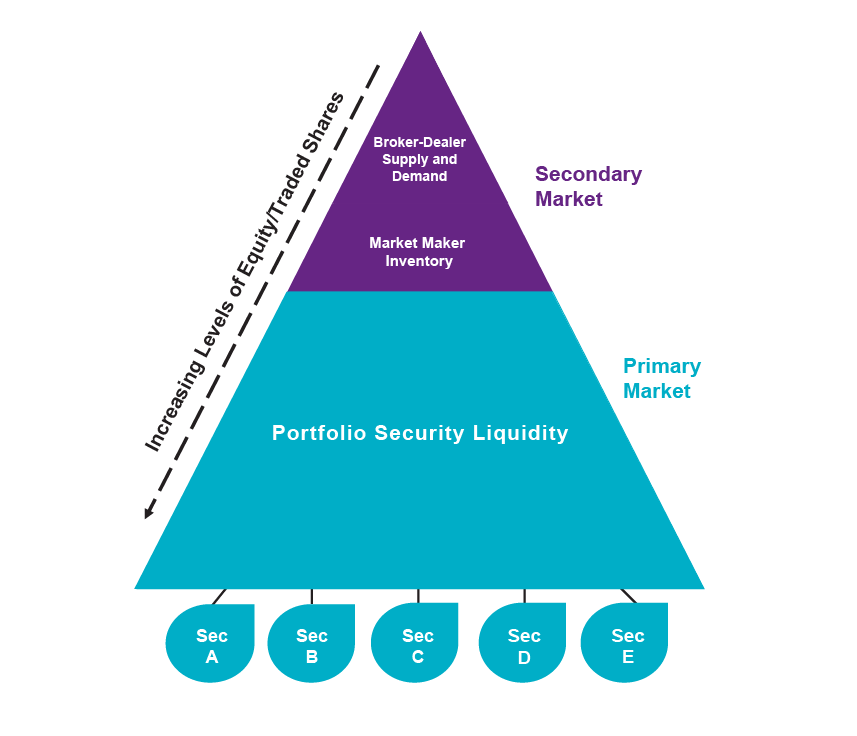

Appreciating the true liquidity for an ETF depends upon the liquidity of the underlying portfolio securities that an ETF holds. If that basket of securities is liquid, this makes the ETF itself liquid. Ultimately, an ETF is as solvent as its least liquid underlying holding. Since ETF shares can be continually created to meet demand, the ETF’s average trading volume and total assets do not fully determine liquidity.

The hierarchy of ETF liquidity illustration (Figure 2) shows the greatest liquidity levels are at the bottom of the pyramid, with secondary market orders on top, and primary market orders on the bottom.

The Hierarchy of ETF Liquidity

However, if a very large lot order were to be executed, it would likely trigger a transaction in the primary market and the available liquidity would be the result of the underlying portfolio securities that make up the creation basket.

How are ETF shares priced in the primary and secondary market?

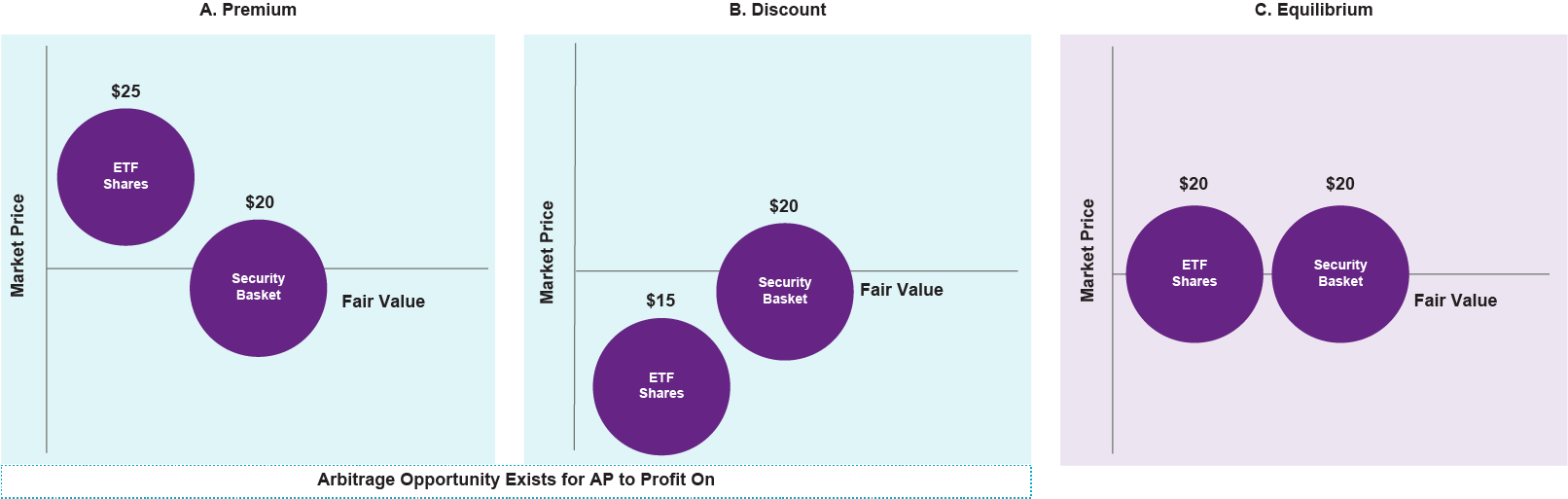

An AP transacting in the primary market benefits from the arbitrage opportunity that may arise when the ETF share price differs from the underlying security basket value. This arbitrage opportunity presents a risk-free way for the AP to realize a profit. An AP’s primary market participation may also enhance working relationships with market makers and ETF issuers.

With the ETF share price scenarios below, Figure A depicts ETF shares priced at a premium. The ETF is trading in the market at $25 and the value of the underlying security basket is $20. The AP steps in to buy the basket of securities at $20 in exchange for ETF shares in the primary market. The AP immediately sells the ETF shares in the secondary market to realize a profit of $5, which in turn puts downward price pressure on the ETF in the secondary market.

Figure B presents ETF shares priced at a discount. The ETF is trading in the market at $15 and the value of the underlying security basket is $20. Here, the AP purchases ETF shares in the secondary market, creating upward price pressure on the ETF shares in the secondary market. The AP immediately redeems these ETF shares on the primary market, receiving the underlying basket of securities worth $20. The AP can now sell these underlying securities on the open market, realizing a profit of $5.

Premium and discount pricing activity can be repeated until there is no arbitrage opportunity available. As illustrated in Figure C, the ETF is priced equivalent to its underlying security basket value, which is considered a price equilibrium where the ETF shares are fairly valued in the market.

ETF Share Price Scenarios

Natixis Active ETFs

Find out how actively managed bottom-up ETF strategies can help investors pursue growth opportunities and manage risk in all market environments.

- Natixis Loomis SaylesFocused Growth ETF (LSGR)*

- Natixis Loomis SaylesShort Duration Income ETF (LSST)

- Natixis Vaughan NelsonMid Cap ETF (VNMC)

- Natixis Vaughan NelsonSelect ETF (VNSE)

*This ETF is different from traditional ETFs – traditional ETFs tell the public what assets they hold each day; this ETF will not. This may create additional risks. For example, since this ETF provides less information to traders, they may charge you more money to trade this ETF’s shares. Also, the price you pay to buy or sell ETF shares on an exchange may not match the value of the ETF’s portfolio. These risks may be even greater in bad or uncertain markets. See the ETF prospectus for more information.

Learn More

Visit our ETF homepage or contact your Natixis sales representative to learn more.

Contact Us

This material is provided for informational purposes only and should not be construed as investment advice. The views and opinions contained herein reflect the subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Natixis Investment Managers, or any of its affiliates. There can be no assurance that developments will transpire as forecasted, and actual results may vary.

Investing involves risk, including the risk of loss. Before investing, consider the fund’s investment objectives, risks, charges, and expenses. Visit im.natixis.com for a prospectus or a summary prospectus containing this and other information. Read it carefully.

ETF General Risk: ETFs trade like stocks, are subject to investment risk, and will fluctuate in market value. Unlike mutual funds, ETF shares are not individually redeemable directly with the Fund and are bought and sold on the secondary market at market price, which may be higher or lower than the ETF's net asset value (NAV). Transactions in shares of ETFs will result in brokerage commissions, which will reduce returns.

Semi-transparent ETFs are different from traditional ETFs. Traditional ETFs tell the public what assets they hold each day. This ETF will not. This may create additional risks for your investment. For example: You may have to pay more money to trade the ETF’s shares. This ETF will provide less information to traders, who tend to charge more for trades when they have less information. The price you pay to buy ETF shares on an exchange may not match the value of the ETF’s portfolio. The same is true when you sell shares. These price differences may be greater for this ETF compared to other ETFs because it provides less information to traders. These additional risks may be even greater in bad or uncertain market conditions. The ETF will publish on its website each day a “Proxy Portfolio” designed to help trading in shares of the ETF. While the Proxy Portfolio includes some of the ETF’s holdings, it is not the ETF’s actual portfolio. The differences between this ETF and other ETFs may also have advantages. By keeping certain information about the ETF secret, this ETF may face less risk that other traders can predict or copy its investment strategy. This may improve the ETF’s performance. If other traders are able to copy or predict the ETF’s investment strategy, however, this may hurt the ETF’s performance.

Authorized Participant Concentration Risk: Only an authorized participant (“Authorized Participant”) may engage in creation or redemption transactions directly with the Fund. The Fund has a limited number of institutions that act as Authorized Participants, none of which are or will be obligated to engage in creation or redemption transactions. To the extent that these institutions exit the business or are unable to proceed with creation and/or redemption orders with respect to the Fund and no other Authorized Participant is able to step forward to create or redeem Creation Units, Fund shares may trade at a discount to NAV and possibly face trading halts and/or delisting. The Fund’s novel structure may affect the number of entities willing to act as Authorized Participants, and this risk may be exacerbated during times of market stress.

Trading Issues Risk: Trading in Fund shares on the NYSE Arca may be halted in certain circumstances. If 10% or more of the Fund’s Actual Portfolio does not have readily available market quotations, the Fund will promptly request that the NYSE Arca halt trading in the Fund’s shares. Such trading halts may have a greater impact on the Fund compared to other ETFs due to its lack of transparency.

Predatory Trading Practices Risk: Although the Fund seeks to benefit from keeping its portfolio holdings information secret, market participants may attempt to use the Proxy Portfolio and related Proxy Portfolio Disclosures to identify the Fund’s holdings and trading strategy. If successful, this could result in such market participants engaging in predatory trading practices that could harm the Fund and its shareholders.

Premium/Discount Risk: Shares of the Fund are listed for trading on the NYSE Arca, Inc. (the “NYSE Arca”) and are bought and sold in the secondary market at market prices that may differ from their most recent NAV. The market value of the Fund’s shares will fluctuate, in some cases materially, in response to changes in the Fund’s NAV, the intraday value of the Fund’s holdings, and the relative supply and demand for the Fund’s shares on the exchange.

Proxy Portfolio Structure Risk: Unlike traditional ETFs that provide daily disclosure of their portfolio holdings, the Fund does not disclose the daily holdings of the Actual Portfolio. Instead, the Fund discloses a Proxy Portfolio that is designed to reflect the economic exposure and risk characteristics of the Fund’s Actual Portfolio on any given trading day. Although the Proxy Portfolio and Proxy Portfolio Disclosures are intended to provide Authorized Participants and other market participants with enough information to allow them to engage in effective arbitrage transactions that will keep the market price of the Fund’s shares trading at or close to the underlying NAV per share of the Fund, while at the same time enabling them to establish cost-effective hedging strategies to reduce risk, there is a risk that market prices will vary significantly from the underlying NAV of the Fund.

Active ETF: Unlike typical exchange-traded funds, there are no indexes that the Fund attempts to track or replicate. Thus, the ability of the Fund to achieve its objectives will depend on the effectiveness of the portfolio manager. There is no assurance that the investment process will consistently lead to successful investing. There is no assurance that any investment will meet its performance objectives or that losses will be avoided. Diversification does not guarantee a profit or protect against a loss. Equity Securities Risk: Equity securities are volatile and can decline significantly in response to broad market and economic conditions. Foreign Securities Risk: Foreign securities may involve heightened risk due to currency fluctuations. Additionally, they may be subject to greater political, economic, environmental, credit, and information risks. Foreign securities may be subject to higher volatility than US securities, due to varying degrees of regulation and limited liquidity. Currency Risk: Currency exchange rates between the US dollar and foreign currencies may cause the value of the fund’s investments to decline. Small and Mid-Cap Stocks Risk: Investments in small and midsize companies can be more volatile than those of larger companies.

ALPS Distributors, Inc. is the distributor for the Natixis Loomis Sayles Focused Growth ETF, the Natixis Loomis Sayles Short Duration Income ETF, the Natixis Vaughan Nelson Mid Cap ETF, and the Natixis Vaughan Nelson Select ETF. Natixis Distribution, LLC is a marketing agent. ALPS Distributors, Inc. is not affiliated with Natixis Distribution, LLC.

This material may not be redistributed, published, or reproduced, in whole or in part. Although Natixis Investment Managers believes the information provided in this material to be reliable, including that from third party sources, it does not guarantee the accuracy, adequacy or completeness of such information.

This document may contain references to copyrights, indexes and trademarks that may not be registered in all jurisdictions. Third party registrations are the property of their respective owners and are not affiliated with Natixis Investment Managers or any of its related or affiliated companies (collectively “Natixis”). Such third party owners do not sponsor, endorse or participate in the provision of any Natixis services, funds or other financial products.

Provided by Natixis Distribution, LLC, 888 Boylston St., Boston, MA 02199. Natixis Investment Managers includes all of the investment management and distribution entities affiliated with Natixis Distribution, LLC and Natixis Investment Managers S.A. Natixis Advisors, LLC provides advisory services through its division Natixis Investment Managers Solutions. Advisory services are generally provided with the assistance of model portfolio providers, some of which are affiliates of Natixis Investment Managers, LLC.

4835406.3.1

3 Questions for Your Cash Management and Short-Term Investment Allocations

3 Questions for Your Cash Management and Short-Term Investment Allocations

Do Smaller Asset ETFs Offer a Performance Advantage?

Do Smaller Asset ETFs Offer a Performance Advantage?

Credit Market Outlook: Solid Fundamentals and FOMO

Credit Market Outlook: Solid Fundamentals and FOMO