Natixis Strategists and Affiliated Managers Identify Key Market Risks for Remainder of 2020

Highlights

- Findings from Natixis’s Strategist Outlook survey reveal split concern on risk assets, with roughly half anticipating a selloff and expecting a continued equity rally through December.

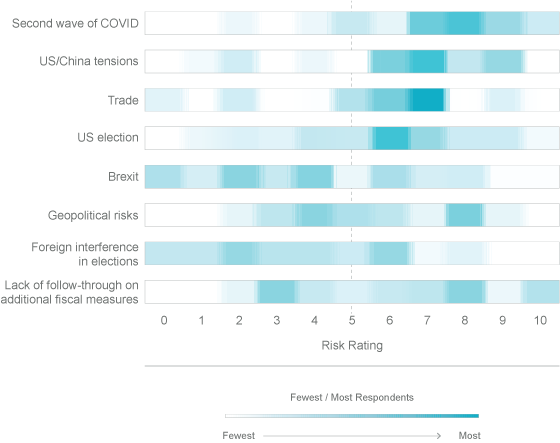

- COVID second wave tops list of concerns, followed by US/China trade tensions and the upcoming US elections.

- Over three-fourths (78%) of respondents predict a Biden win in US presidential election.

- Natixis strategists see two critical risks posed by fiscal measures enacted to shore up economy: rapidly rising public debt levels and the low-yield environment.

- Most experts (91%) say ESG investing will be a market “winner” post-crisis.

The report, which explores the findings of 36 strategists, economists and portfolio managers representing Natixis Investment Managers, 14 of its affiliated asset managers and Natixis Corporate & Investment Banking, shows broad agreement on the risks ahead and some likely long-term consequences from the COVID crisis, but are split in their views on what this means for risk assets over the coming months.

The Road to Recovery

Despite the rebound so far and the unprecedented fiscal and monetary support provided to date, one-third of strategists anticipate a W-shaped recovery, in effect projecting another economic decline. This sentiment is shared by respondents who anticipate a rally (47%) and those who see a selloff (53%), making the second dip a question of when, not if, for them.

As a result, nearly half (44%) believe that while the recovery is under way, the initial impetus is likely to stall. And despite the stock market’s swift recovery, few experts (2.8%) anticipate the economy will follow suit.

COVID Dominates Market Risks

With public health experts reporting that risks could increase as a potential second wave ripples across the globe in the fall and early winter with flu season, 86% of those surveyed give COVID the leading high risk rating “above 5” for an average risk rank of 7.5.

Although the survey respondents are generally unconcerned about the market risks posed by foreign interference in the upcoming US presidential election (average score 3.5), Natixis strategists are anticipating political volatility and election drama.

“We know investors are bearish on fundamentals. And plenty are questioning the sustainability of the rally, making the technicals bullish, which is why the ‘pain trade’ is for the market to grind higher,” says Jack Janasiewicz, Portfolio Manager & Strategist at Natixis Investment Managers.

All Eyes on US Election

Although respondents are optimistic nominee Joe Biden will win the US presidential election (78%), there is concern over how any result will be received by the American public. Half of respondents (50%) expect the results will be contested regardless, and half predict the election will result in social unrest (50%).

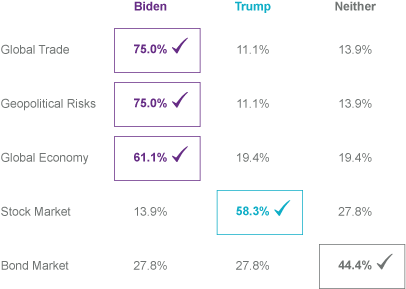

The majority of participants believe that a Biden election will be better for global trade and geopolitical risk (75% and 75% of respondents, respectively), while 61% of those surveyed give the advantage to the Democratic Party on the global economy. Despite showing confidence in a Biden win, more than half (58%) believe that Donald Trump’s reelection would be better for equities, given prospects for lower corporate taxes and a pro-business perception correlated with Trump. When it comes to bonds, strategists offer little opinion, which likely reflects the might of the Fed and a view that rates will be even lower for longer, regardless of who sits in the Oval Office.

Winners and Losers; Positive ESG Forecast

Strategists are unanimous in declaring technology a clear market winner. Similarly, 94% expect healthcare to become an even stronger sector for policymakers going forward, and stay-at-home businesses are a close third (91%). Most surprising, though, is what the pandemic reveals about the resiliency of environmental, social, governance (ESG) investing.

With ESG investment strategies proving mostly defensive in the first six months of the year, interest in ESG investing has grown substantially, giving this investment approach a strong proof point that makes it a winner for 91% of strategists, with 75% of this group indicating they believe that ESG investing will become more prominent/mainstream as a result of this crisis.

With millions staying home and projections for a slow path to economic recovery, traditional entertainment (85%) and travel (83%) rank among the top losers. Energy, which has experienced its own unique challenges since Q1 2020, is also a likely loser for 77% of respondents.

“Looking ahead, we’ve identified global retirement security as a longer-term issue that could be compromised as a result of the COVID public health crisis and subsequent market crisis,” said Dave Goodsell, Executive Director of the Natixis Center for Investor Insight. “Whether you look at retirees trying to generate income, pensions working to meet liabilities, or policy makers struggling with funding decisions, low rates and high levels of debt could create higher than normal risks for those seeking retirement security.”

About the Natixis Strategist Outlook

The Natixis Strategist Outlook is based on responses from 36 experts, including 24 representatives from 14 of Natixis’ affiliated investment managers, 6 representatives from Natixis Investment Managers and 6 representatives from Natixis Corporate & Investment Banking.

- Michael Acton, CFA®, Managing Director, Head of Research, AEW Capital Management

- Carl Auffret, CFA®, Fund Manager, European Growth Equity, DNCA Investments3

- Pierre Barral, Head of Absolute Return Portfolio Management, Natixis Investment Managers Solutions

- Benito Berber, Chief Economist for Latin America, Natixis Corporate & Investment Banking

- Axel Botte, Global Strategist, Ostrum Asset Management

- Michael Buckius, CFA®, Chief Investment Officer, Gateway Investment Advisers

- Craig Burelle, Macro Strategies Research Analyst, Loomis Sayles

- Rafael Calvo, Managing Partner, Head of Senior Debt and Co-Head of Origination, MV Credit

- François-Xavier Chauchat, Global Economist and member of the Investment Committee, Dorval Asset Management

- Isaac Chebar, Fund Manager, European Value Equity, DNCA Investments3

- Elisabeth Colleran, CFA®, Portfolio Manager, Emerging Markets Debt Team, Loomis Sayles

- Mounir Corm, Deputy Chief Executive Officer and Founding Partner, MV Credit

- Carmine de Franco, PhD, Head of Fundamental Research, Ossiam

- Esty Dwek, Head of Global Market Strategy, Natixis Investment Managers Solutions

- Alicia García-Herrero, Chief Economist for Asia Pacific, Natixis Corporate & Investment Banking

- James Grabovac, CFA®, Investment Strategist, Municipal Fixed Income Team, Loomis Sayles

- Alexander Healy, PhD, Chief investment Officer and Portfolio Manager, AlphaSimplex Group

- Jack Janasiewicz, CFA®, SVP, Portfolio Manager & Portfolio Strategist, Natixis Investment Managers

- Kathryn Kaminski, PhD, CAIA, Chief Research Strategist & Portfolio Manager, AlphaSimplex Group

- Brian P. Kennedy, Portfolio Manager, Full Discretion Team, Loomis Sayles

- Karen Kharmandarian, Chairman and Partner, Thematics Asset Management

- Ibrahima Kobar, Deputy CEO, Global CIO, Ostrum Asset Management

- Troy Ludtka, US Economist, Cross Asset Research, Natixis Corporate & Investment Banking

- Garrett Melson, CFA®, Portfolio Strategist, Natixis Investment Managers

- Jean-Charles Mériaux, Chief Investment Officer and Fund Manager, DNCA Investments3

- Jens Peers, CFA®, CEO and CIO, Mirova US

- Alex Piré, CFA®, Market Strategist and Head of Client Portfolio Management, Seeyond3

- Cyril Regnat, Head of Research Solutions, Natixis Corporate & Investment Banking

- Jean François Robin, Global Head of Research, Natixis Corporate & Investment Banking

- Lynne Royer, Portfolio Manager, Head of Disciplined Alpha Team, Loomis Sayles

- Dirk Schumacher, Head of European Macro Research, Natixis Corporate & Investment Banking

- Lynda L. Schweitzer, CFA®, Portfolio Manager, Co-Team Leader of Global Fixed Income Team, Loomis Sayles

- Christopher Sharpe, CFA®, SVP, Portfolio Manager, Natixis Investment Managers

- Nuno Teixeira, Head of Diversified Beta Portfolio Management, Natixis Investment Managers Solutions

- Hans Vrensen, CFA®, MRE, Managing Director and Head of Research & Strategy, AEW Europe

- Chris D. Wallis, CFA®, CPA, CEO, CIO, Senior Portfolio Manager, Vaughan Nelson Investment Management

About Natixis Investment Managers

Natixis Investment Managers serves financial professionals with more insightful ways to construct portfolios. Powered by the expertise of more than 20 specialized investment managers globally, we apply Active Thinking® to deliver proactive solutions that help clients pursue better outcomes in all markets. Natixis Investment Managers ranks among the world’s largest asset management firms1 with more than $1 trillion assets under management2 (€906.0 billion).

Headquartered in Paris and Boston, Natixis Investment Managers is a subsidiary of Natixis. Listed on the Paris Stock Exchange, Natixis is a subsidiary of BPCE, the second-largest banking group in France. Natixis Investment Managers’ affiliated investment management firms include AEW; Alliance Entreprendre; AlphaSimplex Group; DNCA Investments;3 Dorval Asset Management; Flexstone Partners; Gateway Investment Advisers; H2O Asset Management; Harris Associates; Investors Mutual Limited; Loomis, Sayles & Company; Mirova; MV Credit; Naxicap Partners; Ossiam; Ostrum Asset Management; Seeyond; Seventure Partners; Thematics Asset Management; Vauban Infrastructure Partners; Vaughan Nelson Investment Management; Vega Investment Managers;4 and WCM Investment Management. Additionally, investment solutions are offered through Natixis Investment Managers Solutions, and Natixis Advisors offers other investment services through its AIA and MPA division. Not all offerings available in all jurisdictions. For additional information, please visit Natixis Investment Managers’ website at im.natixis.com | LinkedIn: linkedin.com/company/natixis-investment-managers.

Natixis Investment Managers’ distribution and service groups include Natixis Distribution, L.P., a limited purpose broker-dealer and the distributor of various U.S. registered investment companies for which advisory services are provided by affiliated firms of Natixis Investment Managers, Natixis Investment Managers S.A. (Luxembourg), Natixis Investment Managers International (France), and their affiliated distribution and service entities in Europe and Asia.

About Natixis Investment Institute

The Natixis Investment Institute applies Active Thinking® to critical issues shaping the investment landscape. A global effort, the Institute combines expertise in the areas of investor sentiment, macroeconomics, and portfolio construction within Natixis Investment Managers, along with the unique perspectives of our affiliated investment managers and experts outside the greater Natixis organization. The goal is to fuel a more substantive discussion of issues with a 360° view of markets and insightful analysis of investment trends.

2 Assets under management (“AUM”) as of June 30, 2020 is $1,017.7 billion. AUM, as reported, may include notional assets, assets serviced, gross assets, assets of minority-owned affiliated entities and other types of non-regulatory AUM managed or serviced by firms affiliated with Natixis Investment Managers.

3 A brand of DNCA Finance.

4 A wholly-owned subsidiary of Natixis Wealth Management.

All investing involves risk including the risk of loss.

CFA® and Chartered Financial Analyst® are registered trademarks owned by the CFA Institute.

Equity securities are volatile and can decline significantly in response to broad market and economic conditions.

Fixed income securities may carry one or more of the following risks: credit, interest rate (as interest rates rise bond prices usually fall), inflation and liquidity.

Sustainable investing focuses on investments in companies that relate to certain sustainable development themes and demonstrate adherence to environmental, social and governance (ESG) practices; therefore the universe of investments may be limited and investors may not be able to take advantage of the same opportunities or market trends as investors that do not use such criteria. This could have a negative impact on an investor's overall performance depending on whether such investments are in or out of favor.

This material is provided for informational purposes only and should not be construed as investment advice. The views and opinions expressed are as of July 2020 and may change based on market and other conditions. There can be no assurance that developments will transpire as forecasted, and actual results may vary.

3233223.1.1