Loomis Sayles Growth Equity Strategies Team Reopens Growth Fund to Investors

BOSTON, April 25, 2023 – Natixis Investment Managers and affiliate Loomis, Sayles & Company today announced the reopening of the Loomis Sayles Growth Fund (LSGRX) to all investors, effective immediately. Prior to this announcement the Fund remained open only for retirement plans (defined contribution and defined benefit plans), new clients of registered investment advisers and registered representatives trading through intermediaries where the Fund is already available, and existing investors for capital additions.

The Loomis Sayles Growth Fund is among a suite of growth equity products managed by Aziz V. Hamzaogullari, CIO and founder of the firm’s Growth Equity Strategies (GES) Team, all of which employ the exact same philosophy and process. The longest-dated strategies, including the Large Cap Growth strategy which is employed by the Fund, will cross their 17-year anniversaries this June. Collectively, the Growth Equity Strategies Team manages $59.5 billion in assets under management.

The $10 billion fund was closed to most new investors in November 2016 in order to ensure the team’s ability to efficiently manage future cash flow growth in the best interests of our investors. Cash flow has subsequently subsided and market conditions have changed since the fund’s closing.

“Our ongoing evaluation of capacity constraints, flow trends and overall market conditions, among other factors led us to the conclusion that the Growth Fund has ample alpha-generating capability,” said Hamzaogullari.

Loomis Sayles and the GES team remain committed to thoughtfully and proactively managing capacity as needed to ensure portfolio management flexibility.

Loomis Sayles Growth Fund

Since Aziz Hamzaogullari assumed management of the Loomis Sayles Growth Fund on June 1, 2010, it has generated an annualized net return of 14.83% as of March 31, 2023, ranking ahead of 90% of Morningstar large cap growth funds (82 out of 960). Under Hamzaogullari’s management, the fund has generated 0.43% of alpha, ahead of 94% of Morningstar large cap growth funds (52 out of 960).

A differentiated investment philosophy – supported by a proprietary seven-step research framework – underpins the GES team’s long-term, private equity approach. The team seeks to invest in those few high-quality businesses with sustainable competitive advantages and profitable growth only when they trade at a discount to the GES estimate of intrinsic value.

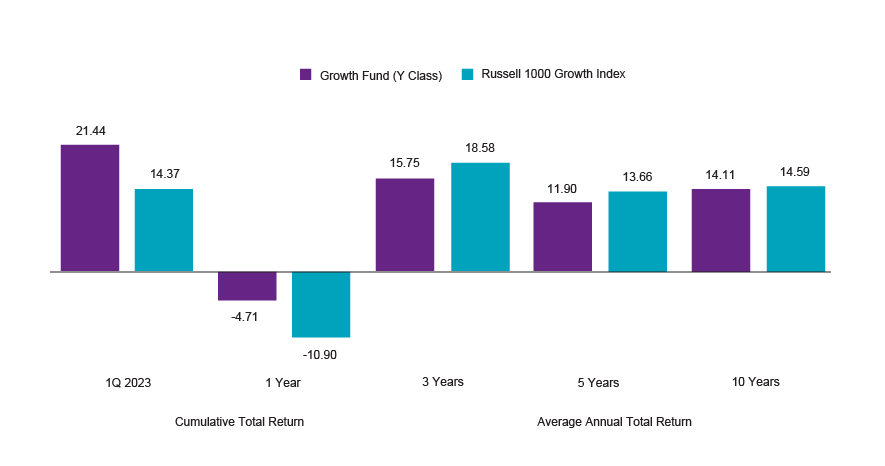

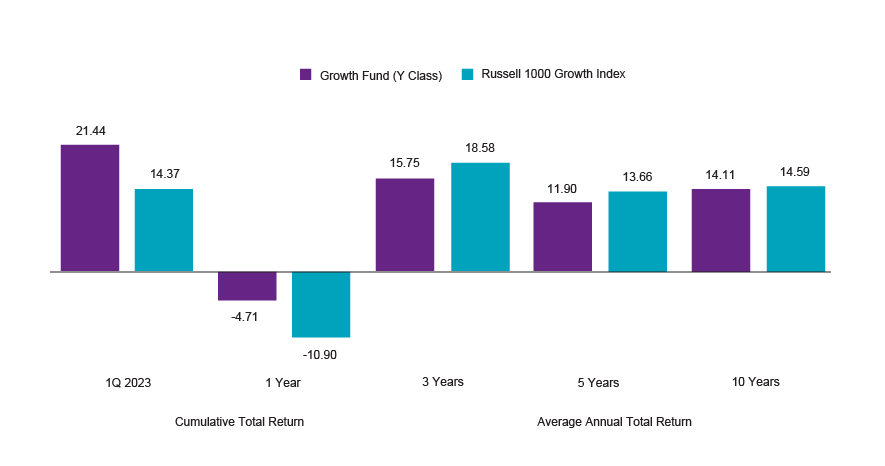

Loomis Sayles Growth Fund (Y Class) Performance (%) as of March 31, 2023

Morningstar Large Cap Growth Funds

Data Sources: Natixis Distribution, LLC and Russell

Total returns reflect Fund fees and expenses and assume reinvestment of dividends and capital gains distributions. Returns include the expenses of the Fund's Class Y shares and assume reinvestment of dividends and capital gains distributions. Performance data reflects certain fee waivers and reimbursements. Without such waivers, performance would be lower. Y shares are only available to certain institutional investors with a minimum initial investment of $100,000. Performance for multi-year periods is annualized. Indices are unmanaged and do not incur fees. It is not possible to invest directly in an index. Past performance is no guarantee of future results. Total return and value will vary and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit www.loomissayles.com. Loomis, Sayles & Company, L.P. (“Loomis Sayles”) is an independent advisory firm registered under the Investment Advisors Act of 1940. For additional information on this and other Loomis Sayles strategies, please visit our website at www.loomissayles.com.

About Natixis Investment Managers

Natixis Investment Managers’ multi-affiliate approach connects clients to the independent thinking and focused expertise of more than 15 active managers. Ranked among the world’s largest asset managers1 with more than $1 trillion assets under management2 (€1 trillion), Natixis Investment Managers delivers a diverse range of solutions across asset classes, styles, and vehicles, including innovative environmental, social, and governance (ESG) strategies and products dedicated to advancing sustainable finance. The firm partners with clients in order to understand their unique needs and provide insights and investment solutions tailored to their long-term goals.

Headquartered in Paris and Boston, Natixis Investment Managers is part of the Global Financial Services division of Groupe BPCE, the second-largest banking group in France through the Banque Populaire and Caisse d’Epargne retail networks. Natixis Investment Managers’ affiliated investment management firms include AEW; DNCA Investments;3 Dorval Asset Management; Flexstone Partners; Gateway Investment Advisers; Harris Associates; Investors Mutual Limited; Loomis, Sayles & Company; Mirova; MV Credit; Naxicap Partners; Ossiam; Ostrum Asset Management; Seventure Partners; Thematics Asset Management; Vauban Infrastructure Partners; Vaughan Nelson Investment Management; and WCM Investment Management. Additionally, investment solutions are offered through Natixis Investment Managers Solutions and Natixis Advisors, LLC. Not all offerings are available in all jurisdictions. For additional information, please visit Natixis Investment Managers’ website at im.natixis.com | LinkedIn: linkedin.com/company/natixis-investment-managers.

Natixis Investment Managers’ distribution and service groups include Natixis Distribution, LLC, a limited purpose broker-dealer and the distributor of various US registered investment companies for which advisory services are provided by affiliated firms of Natixis Investment Managers, Natixis Investment Managers S.A. (Luxembourg), Natixis Investment Managers International (France), and their affiliated distribution and service entities in Europe and Asia.

1 Cerulli Quantitative Update: Global Markets 2022 ranked Natixis Investment Managers as the 18th largest asset manager in the world based on assets under management as of December 31, 2021.

2 Assets under management (“AUM”) of affiliated entities measured as of December 31, 2022 are $1,151.3 billion (€1,078.8 billion). AUM includes AlphaSimplex Group, LLC ($8.2 billion / €7.7 billion), which was acquired by Virtus Investment Partners, Inc., effective April 1, 2023. AUM, as reported, may include notional assets, assets serviced, gross assets, assets of minority-owned affiliated entities and other types of non-regulatory AUM managed or serviced by firms affiliated with Natixis Investment Managers.

3 A brand of DNCA Finance.

About Loomis Sayles

Since 1926, Loomis, Sayles & Company has helped fulfill the investment needs of institutional and mutual fund clients worldwide. The firm’s performance-driven investors integrate deep proprietary research and risk analysis to make informed, judicious decisions. Teams of portfolio managers, strategists, research analysts and traders collaborate to assess market sectors and identify investment opportunities wherever they may lie, within traditional asset classes or among a range of alternative investments. Loomis Sayles has the resources, foresight and the flexibility to look far and wide for value in broad and narrow markets in its commitment to deliver attractive, risk-adjusted returns for clients. This rich tradition has earned Loomis Sayles the trust and respect of clients worldwide, for whom it manages $302.1 billion* in assets (as of 31 March 2023).

* Includes the assets of both Loomis, Sayles & Co., LP, and Loomis Sayles Trust Company, LLC. ($35.7 billion for the Loomis Sayles Trust Company). Loomis Sayles Trust Company is a wholly owned subsidiary of Loomis, Sayles & Company, L.P.

About Risk:

Equity securities are volatile and can decline significantly in response to broad market and economic conditions. Foreign and emerging market securities may be subject to greater political, economic, environmental, credit, currency and information risks. Foreign securities may be subject to higher volatility than US securities, due to varying degrees of regulation and limited liquidity. These risks are magnified in emerging markets. Investments in small and mid-size companies can be more volatile than those of larger companies. Growth stocks may be more sensitive to market conditions than other equities as their prices strongly reflect future expectations. Currency exchange rates between the US dollar and foreign currencies may cause the value of the fund's investments to decline.

Before investing, consider the fund's investment objectives, risks, charges, and expenses. Please visit www.loomissayles.com or call 800-225-5478 for a prospectus and a summary prospectus, if available, containing this and other information. Read it carefully.

Natixis Distribution, LLC (fund distributor, member FINRA|SIPC) and Loomis, Sayles & Company, L.P. are affiliated.

The Morningstar Analyst Rating is not a credit or risk rating. It is a subjective evaluation performed by the mutual fund analysts of Morningstar, Inc. Morningstar evaluates funds based on five key pillars, which are process, performance, people, parent, and price. Morningstar’s analysts use this five pillar evaluation to identify funds they believe are more likely to outperform over the long term on a risk-adjusted basis. Analysts consider quantitative and qualitative factors in their research, but the assessment and weighting of each of the five pillars is driven by the analyst’s overall assessment and overseen by Morningstar’s Analyst Rating Committee. The approach serves not as a formula but as a framework to ensure consistency across Morningstar’s global coverage universe. The Analyst Rating scale ranges from Gold to Negative, with Gold being the highest rating and Negative being the lowest rating. A fund with “Gold” rating distinguishes itself across the five pillars and has garnered the analysts’ highest level of conviction. A fund with a “Silver” rating has notable advantages across several, but perhaps not all, of the five pillars – strengths that give the analysts a high level of conviction. A “Bronze” rated fund has advantages that outweigh the disadvantages across the five pillars, with sufficient level of analyst conviction to warrant a positive rating. A fund with a “Neutral” rating isn’t seriously flawed across the five pillars, nor does it distinguish itself very positively. A “Negative” rated fund is flawed in at least one if not more pillars and is considered an inferior offering to its peers. For more detailed information about Morningstar’s Analyst Rating, including this methodology, please go to http://corporate.morningstar.com/us/documents/Methodology/Documents/AnalystRatingsFundsMethodology.pdf. The Morningstar Analyst Rating should not be used as the sole basis in evaluating a mutual fund. Morningstar Analyst Ratings are based on Morningstar’s current expectations about future events; therefore, in no way does Morningstar represent ratings as a guarantee nor should they be viewed by an investor as such. Morningstar Analyst Ratings involve unknown risks and uncertainties which may cause Morningstar’s expectations not to occur or to differ significantly from what we expected.

© 2023 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

The Loomis Sayles Growth Fund is among a suite of growth equity products managed by Aziz V. Hamzaogullari, CIO and founder of the firm’s Growth Equity Strategies (GES) Team, all of which employ the exact same philosophy and process. The longest-dated strategies, including the Large Cap Growth strategy which is employed by the Fund, will cross their 17-year anniversaries this June. Collectively, the Growth Equity Strategies Team manages $59.5 billion in assets under management.

The $10 billion fund was closed to most new investors in November 2016 in order to ensure the team’s ability to efficiently manage future cash flow growth in the best interests of our investors. Cash flow has subsequently subsided and market conditions have changed since the fund’s closing.

“Our ongoing evaluation of capacity constraints, flow trends and overall market conditions, among other factors led us to the conclusion that the Growth Fund has ample alpha-generating capability,” said Hamzaogullari.

Loomis Sayles and the GES team remain committed to thoughtfully and proactively managing capacity as needed to ensure portfolio management flexibility.

Loomis Sayles Growth Fund

Since Aziz Hamzaogullari assumed management of the Loomis Sayles Growth Fund on June 1, 2010, it has generated an annualized net return of 14.83% as of March 31, 2023, ranking ahead of 90% of Morningstar large cap growth funds (82 out of 960). Under Hamzaogullari’s management, the fund has generated 0.43% of alpha, ahead of 94% of Morningstar large cap growth funds (52 out of 960).

A differentiated investment philosophy – supported by a proprietary seven-step research framework – underpins the GES team’s long-term, private equity approach. The team seeks to invest in those few high-quality businesses with sustainable competitive advantages and profitable growth only when they trade at a discount to the GES estimate of intrinsic value.

|

Learn more about the Loomis Sayles Growth Equity Strategies team and the Loomis Sayles Growth Fund, which earned a Morningstar Analyst RatingTM of Gold (as of 9 January 2023). |

| Period | 1Q 2023 | 1 Year | 3 Years | 5 Years | 10 Years |

| Net Return | 21.44 | -4.71 | 15.75 | 11.90 | 14.11 |

| Benchmark Return | 14.37 | -10.90 | 18.58 | 13.66 | 14.59 |

| Excess Return | 7.07 | 6.19 | -2.83 | -1.76 | -0.48 |

| Peer Group Percentile | 3rd | 5th | 45th | 26th | 13th |

| Rank/Count | 19 out of 1,272 | 44 out of 1,255 | 446 out of 1,177 | 258 out of 1,130 | 115 out of 1,038 |

Data Sources: Natixis Distribution, LLC and Russell

Total returns reflect Fund fees and expenses and assume reinvestment of dividends and capital gains distributions. Returns include the expenses of the Fund's Class Y shares and assume reinvestment of dividends and capital gains distributions. Performance data reflects certain fee waivers and reimbursements. Without such waivers, performance would be lower. Y shares are only available to certain institutional investors with a minimum initial investment of $100,000. Performance for multi-year periods is annualized. Indices are unmanaged and do not incur fees. It is not possible to invest directly in an index. Past performance is no guarantee of future results. Total return and value will vary and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit www.loomissayles.com. Loomis, Sayles & Company, L.P. (“Loomis Sayles”) is an independent advisory firm registered under the Investment Advisors Act of 1940. For additional information on this and other Loomis Sayles strategies, please visit our website at www.loomissayles.com.

Natixis Investment Managers’ multi-affiliate approach connects clients to the independent thinking and focused expertise of more than 15 active managers. Ranked among the world’s largest asset managers1 with more than $1 trillion assets under management2 (€1 trillion), Natixis Investment Managers delivers a diverse range of solutions across asset classes, styles, and vehicles, including innovative environmental, social, and governance (ESG) strategies and products dedicated to advancing sustainable finance. The firm partners with clients in order to understand their unique needs and provide insights and investment solutions tailored to their long-term goals.

Headquartered in Paris and Boston, Natixis Investment Managers is part of the Global Financial Services division of Groupe BPCE, the second-largest banking group in France through the Banque Populaire and Caisse d’Epargne retail networks. Natixis Investment Managers’ affiliated investment management firms include AEW; DNCA Investments;3 Dorval Asset Management; Flexstone Partners; Gateway Investment Advisers; Harris Associates; Investors Mutual Limited; Loomis, Sayles & Company; Mirova; MV Credit; Naxicap Partners; Ossiam; Ostrum Asset Management; Seventure Partners; Thematics Asset Management; Vauban Infrastructure Partners; Vaughan Nelson Investment Management; and WCM Investment Management. Additionally, investment solutions are offered through Natixis Investment Managers Solutions and Natixis Advisors, LLC. Not all offerings are available in all jurisdictions. For additional information, please visit Natixis Investment Managers’ website at im.natixis.com | LinkedIn: linkedin.com/company/natixis-investment-managers.

Natixis Investment Managers’ distribution and service groups include Natixis Distribution, LLC, a limited purpose broker-dealer and the distributor of various US registered investment companies for which advisory services are provided by affiliated firms of Natixis Investment Managers, Natixis Investment Managers S.A. (Luxembourg), Natixis Investment Managers International (France), and their affiliated distribution and service entities in Europe and Asia.

1 Cerulli Quantitative Update: Global Markets 2022 ranked Natixis Investment Managers as the 18th largest asset manager in the world based on assets under management as of December 31, 2021.

2 Assets under management (“AUM”) of affiliated entities measured as of December 31, 2022 are $1,151.3 billion (€1,078.8 billion). AUM includes AlphaSimplex Group, LLC ($8.2 billion / €7.7 billion), which was acquired by Virtus Investment Partners, Inc., effective April 1, 2023. AUM, as reported, may include notional assets, assets serviced, gross assets, assets of minority-owned affiliated entities and other types of non-regulatory AUM managed or serviced by firms affiliated with Natixis Investment Managers.

3 A brand of DNCA Finance.

About Loomis Sayles

Since 1926, Loomis, Sayles & Company has helped fulfill the investment needs of institutional and mutual fund clients worldwide. The firm’s performance-driven investors integrate deep proprietary research and risk analysis to make informed, judicious decisions. Teams of portfolio managers, strategists, research analysts and traders collaborate to assess market sectors and identify investment opportunities wherever they may lie, within traditional asset classes or among a range of alternative investments. Loomis Sayles has the resources, foresight and the flexibility to look far and wide for value in broad and narrow markets in its commitment to deliver attractive, risk-adjusted returns for clients. This rich tradition has earned Loomis Sayles the trust and respect of clients worldwide, for whom it manages $302.1 billion* in assets (as of 31 March 2023).

* Includes the assets of both Loomis, Sayles & Co., LP, and Loomis Sayles Trust Company, LLC. ($35.7 billion for the Loomis Sayles Trust Company). Loomis Sayles Trust Company is a wholly owned subsidiary of Loomis, Sayles & Company, L.P.

About Risk:

Equity securities are volatile and can decline significantly in response to broad market and economic conditions. Foreign and emerging market securities may be subject to greater political, economic, environmental, credit, currency and information risks. Foreign securities may be subject to higher volatility than US securities, due to varying degrees of regulation and limited liquidity. These risks are magnified in emerging markets. Investments in small and mid-size companies can be more volatile than those of larger companies. Growth stocks may be more sensitive to market conditions than other equities as their prices strongly reflect future expectations. Currency exchange rates between the US dollar and foreign currencies may cause the value of the fund's investments to decline.

Before investing, consider the fund's investment objectives, risks, charges, and expenses. Please visit www.loomissayles.com or call 800-225-5478 for a prospectus and a summary prospectus, if available, containing this and other information. Read it carefully.

Natixis Distribution, LLC (fund distributor, member FINRA|SIPC) and Loomis, Sayles & Company, L.P. are affiliated.

The Morningstar Analyst Rating is not a credit or risk rating. It is a subjective evaluation performed by the mutual fund analysts of Morningstar, Inc. Morningstar evaluates funds based on five key pillars, which are process, performance, people, parent, and price. Morningstar’s analysts use this five pillar evaluation to identify funds they believe are more likely to outperform over the long term on a risk-adjusted basis. Analysts consider quantitative and qualitative factors in their research, but the assessment and weighting of each of the five pillars is driven by the analyst’s overall assessment and overseen by Morningstar’s Analyst Rating Committee. The approach serves not as a formula but as a framework to ensure consistency across Morningstar’s global coverage universe. The Analyst Rating scale ranges from Gold to Negative, with Gold being the highest rating and Negative being the lowest rating. A fund with “Gold” rating distinguishes itself across the five pillars and has garnered the analysts’ highest level of conviction. A fund with a “Silver” rating has notable advantages across several, but perhaps not all, of the five pillars – strengths that give the analysts a high level of conviction. A “Bronze” rated fund has advantages that outweigh the disadvantages across the five pillars, with sufficient level of analyst conviction to warrant a positive rating. A fund with a “Neutral” rating isn’t seriously flawed across the five pillars, nor does it distinguish itself very positively. A “Negative” rated fund is flawed in at least one if not more pillars and is considered an inferior offering to its peers. For more detailed information about Morningstar’s Analyst Rating, including this methodology, please go to http://corporate.morningstar.com/us/documents/Methodology/Documents/AnalystRatingsFundsMethodology.pdf. The Morningstar Analyst Rating should not be used as the sole basis in evaluating a mutual fund. Morningstar Analyst Ratings are based on Morningstar’s current expectations about future events; therefore, in no way does Morningstar represent ratings as a guarantee nor should they be viewed by an investor as such. Morningstar Analyst Ratings involve unknown risks and uncertainties which may cause Morningstar’s expectations not to occur or to differ significantly from what we expected.

© 2023 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

5653269.1.1