Is the Market Looking Past Lowered Earnings Estimates?

Sales for the companies in the S&P 500® Index are expected to grow by 10.4% in 2022 vs. 2021. Net income is expected to grow at a slower pace of 5.7% as higher costs from inflation take a bite out of earnings. At the start of 2022, before the Fed embarked on its current hiking cycle, sales and earnings were both projected to be up about 10%. Indeed, S&P 500® earnings growth expectations continued to rise for the first half of 2022, but they peaked in June when the market came to understand that the Fed was going to be more aggressive in tightening financial conditions – resulting in a bigger hit to the economy and corporate earnings.

Accounting for the Energy Factor

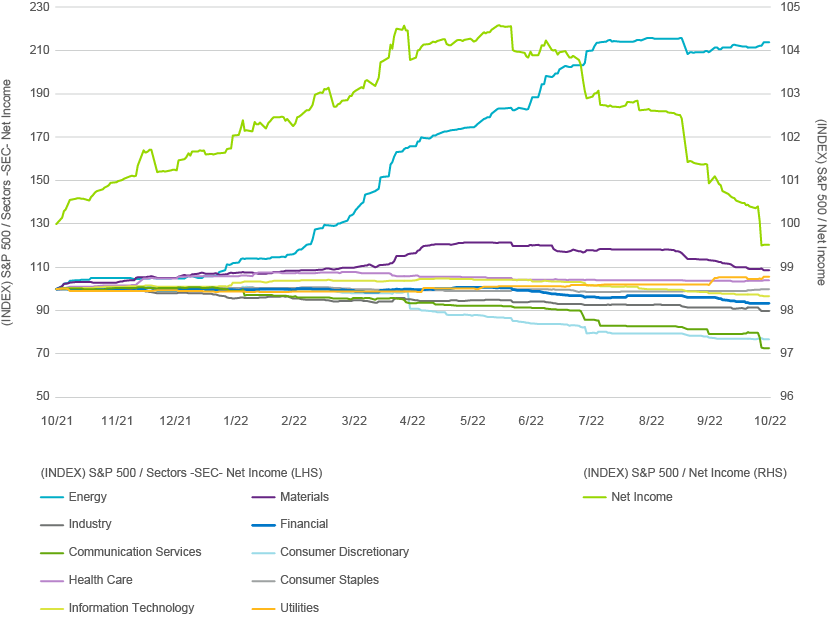

A simple comparison of current estimates with where they were at the start of the year doesn’t show much change. But that’s because Energy sales and profits have shot up so dramatically with the price of oil. This has masked the fact that, since June, net income growth expectations have come down meaningfully in every other sector except Energy. As Figure 1 shows, Energy earnings have been revised higher throughout the course of 2022, while earnings growth expectations have come down in every other sector.

Net income growth expectations for Consumer Discretionary and Communications Services have been revised lower by more than 20% since the start of the year, much of that happening in the last few months. Analysts have also lowered growth expectations for Technology and we just had some significant misses for Q3 earnings in this sector. Earnings for the Financials sector are now expected to be down 15.7% from 2021 as banks increase loan loss reserves to reflect an expected slowdown in the economy. Bottom line? Energy pulled up earnings expectations in the first half of the year, but practically every other sector has seen significant downward revisions in the last few months.

Figure 1 – S&P 500® 2022 Earnings Estimates by Sector, Trailing One-Year Period (10/29/21–10/31/22)

Source: FactSet; data reflects net income estimates by sector

Expectations Are Falling

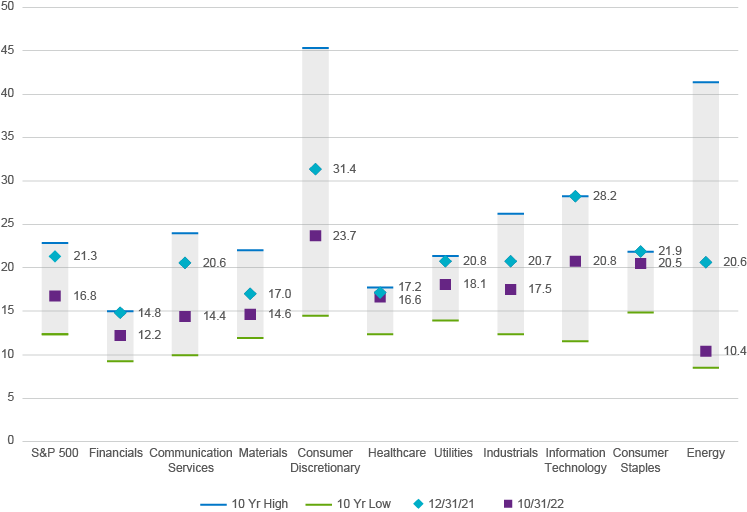

Looking at 2022 calendar year earnings expectations, the dollar amount of earnings for the S&P 500® is expected to be $1.983 trillion, but that number was $67 billion higher as of June. Figure 2 shows the next 12 months (NTM) Price Earnings multiples by sector, along with their 10-year ranges. Revisions lower for Financials alone have accounted for $11 billion of the decline in expectations, while Semiconductors have shaved $16 billion off that number. Analysts have also taken down earnings expectations for Alphabet (parent of Google) by over $9 billion, Meta (parent of Facebook) by $5.6 billion, and Amazon by more than $8 billion.

Figure 2 – NTM PE Multiples by Sector (10-year range, end of 2021, and as of 10/31/22)

Source: FactSet

Investors have clearly taken note. Not only have earnings expectations been lowered, but the prices investors are willing to pay for these lower earnings have also come down this year, albeit from an above average PE multiple. As we make our way through earnings season, we are seeing that some companies have been able to beat these lower expectations, although that’s not the case for all companies. In our view, however, the big tell is that even with disappointing earnings, we are seeing equities bounce off their October lows. In other words, the equity market may be starting to look past these downward earnings revisions and forward to a better 2023.

All investing involves risk, including the risk of loss. Investment risk exists with equity, fixed-income, and alternative investments. There is no assurance that any investment will meet its performance objectives or that losses will be avoided.

CFA® and Chartered Financial Analyst® are registered trademarks owned by the CFA Institute.

5071536.1.1

Tax Management Update – Q1 2024

Tax Management Update – Q1 2024

All About The Rates

All About The Rates