March Madness: Top Picks for Fixed Income Investing

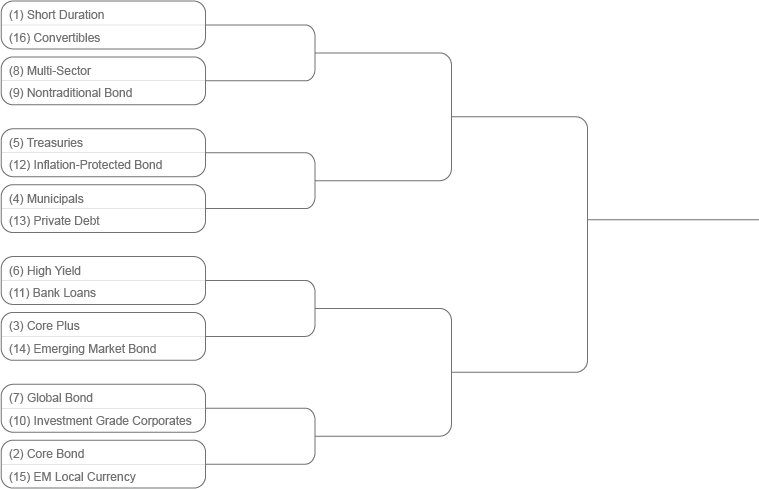

To help investors navigate the evolving risks and opportunities in bond markets, we present the second annual March madness fixed income investing tournament. Seeds are based on a difficult to replicate blend of assets under management, flows, sentiment, and optimizing storylines. Which category will cut down the nets in 2024? Take a look at my bond bracketology and overall picks for fixed income standouts.

To help investors navigate the evolving risks and opportunities in bond markets, we present the second annual March madness fixed income investing tournament. Seeds are based on a difficult to replicate blend of assets under management, flows, sentiment, and optimizing storylines. Which category will cut down the nets in 2024? Take a look at my bond bracketology and overall picks for fixed income standouts. Round 1

(1) Short Duration vs. (16) Convertibles

Convertibles can add value in volatile markets thanks to the embedded optionality to convert to common stock. The problem is when volatility meets risk-off. Then you can lose a quarter (Covid) or even a third (Global Financial Crisis) of your value. Do you know what else does well in volatility? Short-term, ultrashort and cash-like investments. Short Duration advances.

(8) Multi-Sector vs. (9) Nontraditional Bond

Both categories give you the active management to pick and choose your spots. Nontraditional Bond has lower duration and slightly higher credit quality, which should boost performance in a higher for longer rate environment. Go with the additional flexibility to add value across fixed income segments. Nontraditional Bond.

(5) Treasuries vs. (12) Inflation-Protected Bond

TIPS outperformed Treasuries in 16 out of 22 years before falling slightly short in 2023. Break-even inflation near 2.4% seems fair given the progress that’s been made, but would you rather earn 4.4% nominal yield in Treasuries? Or realized CPI + 2% in TIPS? A bit closer of a call. Inflation-Protected Bonds in an upset.

(4) Municipals vs. (13) Private Debt

For an investor with a 37% tax rate, a 3.4% muni yield becomes a 5.4% tax equivalent yield. Not too shabby. Taking on the credit risk and taxable income of private debt wouldn’t make a ton of sense unless you could earn a pre-tax yield of 6% or higher. Private debt could be nearly double that. Tough first round draw for munis. Private Debt advances.

(6) High Yield vs. (11) Bank Loans

The HY category has nearly 50% allocated to securities rated BB quality or higher, compared to loans at 32%. With loans senior in a company’s capital structure, perhaps the credit risk between the two categories is similar. If you think we avoid a major growth scare and want a carry trade for your bond portfolio, you might as well get the higher carry. Bank Loans.

(3) Core Plus vs. (14) Emerging Market Bond

One of the ways to address spread tightening in your portfolio is right-sizing your spread duration, or the sensitivity of a bond’s price to changes in credit spreads. Dollar-denominated EM bonds have a spread duration that is higher than nearly every other major bond category. I’m sending them to the bench. Core Plus.

(7) Global Bond vs. (10) Investment Grade Corporates

Imagine you had $1 to invest in fixed income eight years ago. After two major drawdowns, corporate bonds have eked out a 22% aggregate return. Not great, but it could have been worse. You could have invested in global bonds and still be underwater. No advanced analytics needed. Take the higher yield and lower volatility. IG Corporates.

(2) Core Bond vs. (15) EM Local Currency

The yield advantage between EMLC and core bonds compressed by almost 100 basis points since the start of 2023. It’s been a great place to invest, but where do we go from here? China, Thailand, Czech Republic and Malaysia all have sovereign debt yielding less than the US, providing somewhat of an anchor for return potential. Core Bond.

Round 2

(1) Short Duration vs. (9) Nontraditional Bond

If the Treasury yield curve ever normalizes AND we avoid recession, you’ll want some of the short end in your portfolio. But then what? A 5.5% T-Bill sounds great, but our 5-year expected return for cash is just 3.9%.1 Loading up on short duration is trying to build a big halftime lead and then running out of steam down the stretch. You play to win the game. Nontraditional Bond.

(12) Inflation-Protected Bond vs. (13) Private Debt

Both TIPS and private debt offer protection against unexpected inflation. Perhaps the best example of unexpected inflation was 2022. How did these categories fare? Private debt was up 3%.2 Inflation-protected bond was DOWN 14%.3 Private Debt.

(3) Core Plus vs. (11) Bank Loans

Do higher stock-bond correlations mean duration-sensitive categories like core plus won’t provide relief in a growth scare? No. Part of the reason correlations are high is that we haven’t actually had a growth scare. Loan yields are still attractive, but prices are at their highest levels since May 2022. I’ll take the better defense and a liquidity profile that can withstand SEC opposition. Core Plus.

(2) Core Bond vs. (10) Investment Grade Corporates

Tighter corporate spreads favor the inclusion of diversifying exposures from Treasuries and agency mortgage-backed securities in your portfolio. Core bonds come out on top, but corporates cover the spread. Core Bond.

Semi-Finals

(9) Nontraditional Bond vs. (13) Private Debt

Both do well in rising or rangebound yield environments. Both have outperformed the Bloomberg Aggregate Bond Index for each of the past three years. But with private debt you need to ask a few additional questions. Has the team managed risk in a more pronounced default cycle? How much leverage is hiding under the surface? Am I getting diversification from the rest of my bond portfolio? Nontraditional Bond advances.

(2) Core Bond vs. (3) Core Plus

Not a ton of differentiation at the moment. Duration around 6, yields above 4%, sector allocations somewhat in line. But some of the biggest return differences between the two categories occur after a spread event. In the year following the onset of Covid volatility, core plus outperformed by 4%.3 If you can’t time the market, how about something that looks similar today, with the flexibility to deploy dry powder later? Core Plus.

Finals

(3) Core Plus vs. (9) Nontraditional Bond

If it feels like the recession forecasts were pushed out a year, it’s because they have been. We find ourselves trying to probability weight the soft landing and hard landing once again. No matter which side you find yourself on, core plus has something for you. Duration to provide equity risk offset. Spread exposure and a big enough sandbox to generate returns from active management in any dislocation. And an attractive carry if we push this out even further and have another yield-like return in 2024. The Pick – Core Plus.

2 Source: State Street Global Markets, Private Equity Insights Q4 2022

3 Source: Morningstar

This material is provided for informational purposes only and should not be construed as investment advice. The views and opinions contained herein reflect the subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Natixis Investment Managers, or any of its affiliates. The views and opinions are as of March 7, 2024 and may change based on market and other conditions. There can be no assurance that developments will transpire as forecasted, and actual results may vary.

All investing involves risk, including the risk of loss. Investment risk exists with equity, fixed income, and alternative investments. There is no assurance that any investment will meet its performance objectives or that losses will be avoided. Investors should fully understand the risks associated with any investment prior to investing.

Fixed income securities may carry one or more of the following risks: credit, interest rate (as interest rates rise bond prices usually fall), inflation and liquidity.

Foreign and emerging market securities may be subject to greater political, economic, environmental, credit, currency and information risks. Foreign securities may be subject to higher volatility than US securities, due to varying degrees of regulation and limited liquidity. These risks are magnified in emerging markets.

High yield bond spread, also known as a credit spread, is the difference in the yield on high yield bonds and a benchmark bond measure, such as investment grade or Treasury bonds. High yield bonds offer higher yields due to default risk.

Liquidity refers to the ease with which an asset, or security, can be converted into ready cash without affecting its market price.

Interest rate risk is a major risk to all bondholders. As rates rise, existing bonds that offer a lower rate of return decline in value because newly issued bonds that pay higher rates are more attractive to investors.

Duration risk measures a bond's price sensitivity to interest rate changes. Bond funds and individual bonds with a longer duration (a measure of the expected life of a security) tend to be more sensitive to changes in interest rates, usually making them more volatile than securities with shorter durations.

Plus sectors refer to additional fixed income sectors some strategies invest in such as high yield bonds, emerging market bonds, floating rate bank loans, and non-US dollar bonds, to seek greater diversification or yield potential.

The yield spread is the difference in the expected rate of return between two investments.

Unlike passive investments, there are no indexes that an active investment attempts to track or replicate. Thus, the ability of an active investment to achieve its objectives will depend on the effectiveness of the investment manager.

CFA® and Chartered Financial Analyst® are registered trademarks owned by the CFA Institute.

This material may not be redistributed, published, or reproduced, in whole or in part. Although Natixis Investment Managers believes the information provided in this material to be reliable, including that from third party sources, it does not guarantee the accuracy, adequacy or completeness of such information.

This document may contain references to copyrights, indexes and trademarks that may not be registered in all jurisdictions. Third party registrations are the property of their respective owners and are not affiliated with Natixis Investment Managers or any of its related or affiliated companies (collectively “Natixis”). Such third party owners do not sponsor, endorse or participate in the provision of any Natixis services, funds or other financial products.

Provided by Natixis Distribution, LLC, 888 Boylston St., Boston, MA 02199. Natixis Investment Managers includes all of the investment management and distribution entities affiliated with Natixis Distribution, LLC and Natixis Investment Managers S.A. Natixis Advisors, LLC provides advisory services through its division Natixis Investment Managers Solutions. Advisory services are generally provided with the assistance of model portfolio providers, some of which are affiliates of Natixis Investment Managers, LLC.

5516490.2.1

60/40 Portfolio Simplicity

60/40 Portfolio Simplicity

3 Questions for Your Cash Management and Short-Term Investment Allocations

3 Questions for Your Cash Management and Short-Term Investment Allocations