Economic Well-Being of US Consumers in Decline?

Figure 1 – Excess US Consumer Savings (12/31/19–8/31/22)

Source: Natixis Investment Managers Solutions, U.S. Bureau of Economic Analysis, Bloomberg

This savings buffer is important, given the potential impact on household balance sheets from the Fed’s aggressive rate hikes to curtail inflation. After all, personal consumption drives close to 70% of US Gross Domestic Product (GDP).

In May, the Fed released its report on the “Economic Well-Being of U.S. Households in 2021,” compiled from survey responses from October and November 2021. The data indicated that 78% of adults said they were doing either OK or living comfortably financially, the highest level since the survey began in 2013.1

But there are signs that the consumer may not be in as strong a position compared to last fall. Since then, inflation has climbed another 3% and equity and bond markets have seen double-digit declines.

Mixed Messages?

Interestingly, the Fed’s survey also reported that 32% of adults couldn’t cover a $400 emergency expense with cash – they’d need to put it on a credit card, borrow from friends or family, or sell something to cover it.1 In other words, a portion of respondents did not have $400 to spare but also felt that they were doing OK financially.

More recently, 40% of households responding to the Census Household Pulse Survey for July/August 2022 reported difficulty paying for usual household expenses, up from 28% a year earlier.2 And Americans of all income levels are looking to keep expenses down. Discount retailer Dollar Tree recently reported that most of their new customers in the past year had an annual income over $80,000. Walmart echoed that sentiment, saying that their grocery segment’s growth was fueled by shoppers with annual household incomes over $100,000.

Higher Rates and Rising Delinquencies

Nearly two-thirds of Americans own their homes and have benefited from the past few years of accelerating real estate prices. This has created tappable equity that homeowners can extract as cash through refinancing or lines of credit. But with 30-year refi rates in the 6%-7% range and home equity loans/lines tied to rising short-term rates, these funding sources are relatively expensive. Consider that anyone buying or refinancing a home pre-2022 would have had multiple opportunities to lock in a rate sub-3.5%.

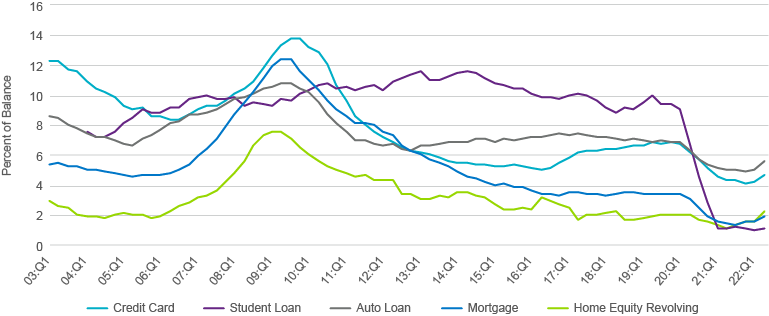

The labor market remains the key to the overall health of the US consumer, and right now it’s strong, with more job openings than job seekers. But it’s not about good and bad, it’s about better and worse. As the economy and consumers adjust to higher interest rates, we’re starting to see the impact on the margins with delinquency rates on the rise in all segments of consumer debt (Figure 2).

Figure 2 – Transition into delinquency (30+ days) by loan type, 2003–2022

Source: New York Fed Consumer Credit Panel/Equifax. NOTE: 4 quarter moving sum; student loan data not available prior to 2004.

To be sure, we’re nowhere near 2008 levels today, and we’re coming off very low numbers. But it’s worth paying attention to what consumers are saying and doing with their finances as we continue to transition away from a low-rate environment.

2 https://www.census.gov/data-tools/demo/hhp/#/?measures=EXPENSE&periodSelector=48

This material is provided for informational purposes only and should not be construed as investment advice. The views and opinions contained herein reflect the subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Natixis Investment Managers, or any of its affiliates. The views and opinions are as of October 11, 2022 and may change based on market and other conditions. There can be no assurance that developments will transpire as forecasted, and actual results may vary.

All investing involves risk, including the risk of loss. Investment risk exists with equity, fixed income, and alternative investments. There is no assurance that any investment will meet its performance objectives or that losses will be avoided. Investors should fully understand the risks associated with any investment prior to investing.

CFA® and Chartered Financial Analyst® are registered trademarks owned by the CFA Institute.

This document may contain references to copyrights, indexes and trademarks that may not be registered in all jurisdictions. Third party registrations are the property of their respective owners and are not affiliated with Natixis Investment Managers or any of its related or affiliated companies (collectively “Natixis”). Such third party owners do not sponsor, endorse or participate in the provision of any Natixis services, funds or other financial products.

4970758.1.1