Bank Loan Basics: An Income Diversifier for All Times

Take a look at what bank loans are, how a floating interest rate structure works, and why investors should select experienced portfolio managers backed by deep research capabilities.

What Are Bank Loans and How Did They Originate?

Bank loans, also referred to as “senior loans” or “senior secured loans,” are loans issued to banks and other institutional creditors providing companies with access to debt capital. Just as the name suggests, they are the most senior, secured debt at the top of a borrowing company’s capital structure. Loans are combined, repackaged, and sold to investors as a financial product on which they receive interest payments as the return on their investment.

The asset class was introduced to investors in the 1980s as banks reduced their exposure to bank loans by offering them to non-bank institutions, with mutual funds and insurance companies being the early buyers. More loan funds were launched in the 1990s as pension managers and structured vehicle investors leaned toward the asset class. More recently, the loan market saw strong growth and returns in 2021 after lower default levels occurred than were predicted at the onset of the Covid-19 pandemic.

Today’s bank loan market is broadly syndicated, consisting of loans made by major commercial and investment banks. Companies issuing bank loan debt are typically large with most syndicated US bank loans having principal outstanding of roughly $100 million to $5 billion. Bank loans are actively traded in the secondary market by most financial firms, and generally rated by Moody’s and/or Standard & Poor’s.

Key Investment Benefits

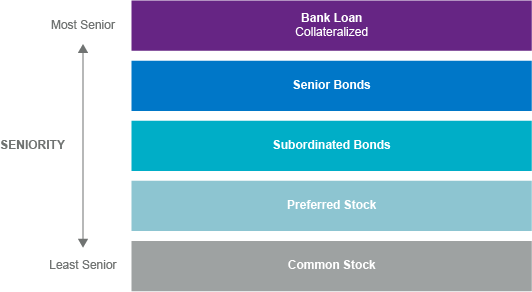

Given their seniority over a borrowing company’s other assets, as illustrated below, the holders of a company’s bank loans have a priority claim over the company’s assets in the event of default.

Corporate Capital Structure

Source: Loomis, Sayles & Company

A comparison to other fixed income assets further highlights their characteristics. Bank loan-issuing companies usually have below investment grade (or high yield) credit ratings, and bank loans tend to offer coupon income greater than investment grade bonds, but lower than high yield bonds. The greater yield versus investment grade reflects bank loans’ greater perceived credit risk, while the slightly lower yield relative to high yield is the result of bank loans’ higher position in the capital structure. For investment grade investors seeking more yield, bank loans can provide an intermediate step up in credit risk.

Why Bank Loans Now?

Bank loans are designed to be somewhat resistant to principal risk (risk that an investment will decline in value below the amount invested) thanks to collateral backing, and to interest rate risk (potential for investment losses resulting from interest rate changes) thanks to floating-rate coupons. Their senior and secured status generally provides more protection from a decline in the borrowing company’s enterprise value, unlike bonds that are lower in the capital structure. Rising interest rates accompanied by falling bond prices can significantly impact traditional bond portfolios as rates normalize. Their floating-rate coupons tend to allow bank loan prices to remain stable amid rising rates / falling bond prices.

In an uncertain economic environment, bank loans’ dual protection of principal and interest may be uniquely suited to certain market conditions.

… and for the Long Term?

The longer-term benefits of bank loans are driven by their behavior over a full credit cycle and their historically low correlation to other asset classes, providing diversification. The credit cycle is characterized by market conditions of rising rates or declining corporate credit conditions. Rates tend to rise in an improving economy, while corporate credit conditions tend to decline in a deteriorating economy. As economies tend to rise or fall more than they stay the same, one of the two tactical drivers for bank loans is often in effect. While most other asset classes are generally hurt by rising rates, declining corporate credit, or both, bank loans directly benefit from rising rates and are somewhat insulated from declining credit by their position in the capital structure.

What to Look for in a Bank Loan Strategy

As a bank loans portfolio manager generally creates a portfolio from hundreds of issues, broad and deep research is critical to an effective investment process. Portfolio managers typically select issues largely based on their creditworthiness, structure, and price. Key credit considerations include cash flow projections, capital structure, underlying asset values and collateral, market position, management strength, industry developments, political climate, and economic forecasts.

As with all investment opportunities, investors should consider the risks associated with bank loans, including credit quality, market liquidity, default risk and price volatility. Issuing companies are often rated below investment grade and may carry higher risk of default. The secondary bank loan market may suffer reduced liquidity, adversely affecting bank loan prices. Further, as they trade over the counter, and not on an exchange like most high yield bonds, bank loan trading is fairly manual, and trades can take longer to settle.

Investors should consider an experienced bank loans portfolio manager who is well versed in the specifics of the asset class, and backed by extensive research capabilities. Reach out to your financial advisor to explore how bank loans fit into your specific investment plan. An allocation to bank loans can be a strong addition for short-term and long-term investment needs.

All investing involves risk, including the risk of loss. Investment risk exists with equity, fixed income, and alternative investments. There is no assurance that any investment will meet its performance objectives or that losses will be avoided.

This material is provided for informational purposes only and should not be construed as investment advice. The views and opinions expressed may change based on market and other conditions.

Fixed income securities may carry one or more of the following risks: credit, interest rate (as interest rates rise bond prices usually fall), inflation and liquidity.

Floating rate loans are often lower-quality debt securities and may involve greater risk of price changes and greater risk of default on interest and principal payments. The market for floating rate loans is largely unregulated and these assets usually do not trade on an organized exchange. As a result, floating rate loans can be relatively illiquid and hard to value.

Credit risk is the risk that the issuer of a fixed income security may fail to make timely payments of interest or principal or to otherwise honor its obligations.

Liquidity risk exists when particular investments are difficult to purchase or sell, possibly preventing the sale of these illiquid securities at an advantageous price or time. A lack of liquidity also may cause the value of investments to decline.

Diversification does not guarantee a profit or protect against a loss.

4225249.1.3

60/40 Portfolio Simplicity

60/40 Portfolio Simplicity

3 Questions for Your Cash Management and Short-Term Investment Allocations

3 Questions for Your Cash Management and Short-Term Investment Allocations