US Inflation Tracker

The US Inflation Tracker captures the trends that provide context in today’s economy.

Why car insurance is driving up inflation

Motor vehicle insurance has been a thorn in the side of inflation for quite some time now. The most recent Consumer Price Index (CPI) print saw year-on-year prices rise over 22%, contributing a whopping 9.2bps to core CPI. Yes, more than 25% of the increase in core CPI this past month can be attributed to motor vehicle insurance prices. So what gives? The cycle of auto-related inflation.

First of all, the surge in insurance prices we’re experiencing now is the lagged catch-up of premiums due to the rise in new and used vehicle prices, parts, and repair costs over the past four years. Exacerbating these pressures has been an increase in loss frequency, particularly in California and Florida, due to natural disasters. But as we’ve seen disinflation and deflation take hold in these leading components, we should see the surge in insurance prices begin to run out of steam. But we should also expect less of an impact felt on the Personal Consumption Expenditures Index (PCE) favored by the Federal Reserve in its inflation analysis.

The methodological difference between PCE and CPI regarding auto insurance matters. CPI samples premiums but excludes dividends or payments made to policyholders that effectively reduce the cost of insurance, while PCE uses the Producer Price Index (PPI) as the input and nets out the amounts paid out to customers in the form of claims. Because we already know March’s PPI details, we estimate that auto insurance will take the monthly PCE change down by 10bps, a massive divergence from what we saw in CPI. Raising rates won’t help motor vehicle insurance prices come down either. And this line item is a major component of those arguing that inflation is sticky. It may be, but it certainly isn’t broadbased.

Motor Vehicle-Related Consumer Price Inflation (1/31/19–3/31/24)

Source: Natixis Investment Managers Solutions, Bloomberg

Wage pressures are easing and job market is cooling

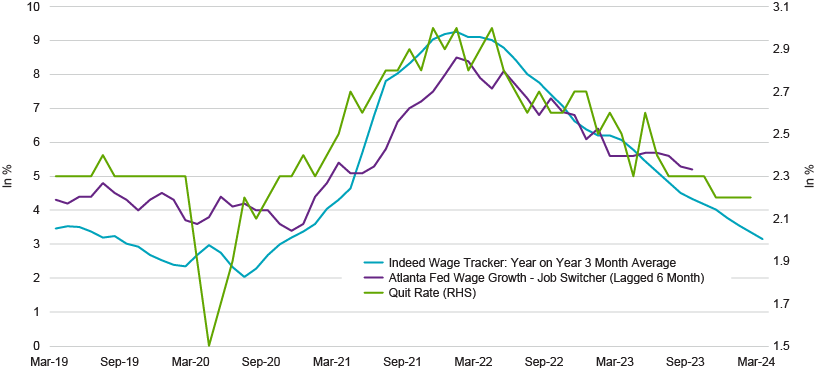

Wage pressures continue to cool however you want to slice it. The 3-month moving average for jobs posted on Indeed.com is now back to the pre-Covid trend, mirroring the move in the Quit Rate and Job Switcher as published by the Atlanta Fed. The latter two indicators are telling: workers quit their jobs when they feel secure in their prospects for either finding a new job or in their financial outlook. And while workers tend to switch jobs for several reasons, a main catalyst for such a move is higher compensation.

These two metrics returning to their pre-Covid levels provide further evidence that the labor market is easing and that wage pressures are falling. Helping to bolster the wage pressure story is immigration. Since the beginning of the pandemic, the number of foreign-born workers has jumped by almost 3.5 million, helping to fill supply shortages witnessed in many of the service segments of the economy. This increase in supply has also helped put downward pressure on wage growth, further easing the pressure on demand-driven inflation.

We should also note that consumers are spending more in places that are showing weaker price growth and less in areas of firming price growth – signs of a more discerning consumer who is now willing to pull back in the face of higher prices. More importantly, to get the sort of inflation that many are fretting over, you need to see general prices increase across the board. And we just don’t see that. The inflation reaccelerating story is an easy one to tell, but a hard one to support with the actual data.

Indeed.com Posted Wage Growth vs. Job Switcher Wage Growth and Quit Rates (3/31/19–3/31/24)

Source: Natixis Investment Managers Solutions, Bloomberg, Atlanta Federal Reserve Bank

Resource

US Inflation Tracker – April 2024

This in-depth chart deck highlights historical data related to:

• Personal consumption

• Inflation surprises

• Goods and services

• Base effects and surges

• Supply chain, shipping, and restocking

• Housing market pressures

• Wage pressures

• Inflation expectations

Read Full Presentation

Learn more

Want more information on inflation-fighting strategies?

Contact us

All investing involves risk, including the risk of loss. Investment risk exists with equity, fixed income, and alternative investments. There is no assurance that any investment will meet its performance objectives or that losses will be avoided. Investors should fully understand the risks associated with any investment prior to investing.

CFA® and Chartered Financial Analyst® are registered trademarks owned by the CFA Institute.

4743857.26.1

Portfolio Construction Fundamentals

Portfolio Construction Fundamentals