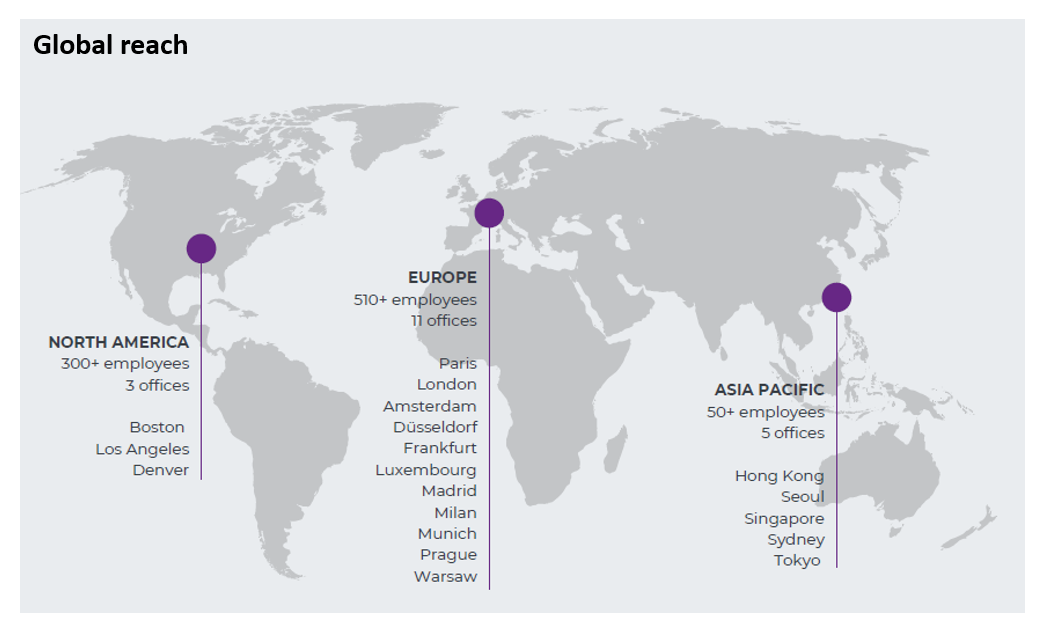

For over 40 years, AEW has actively managed portfolios in both the listed and direct property markets across the risk/return spectrum providing access to the real estate asset class through a broad platform of separately managed accounts and open- and closed-end strategies. AEW’s investment management platform spans across North America, Europe and the Asia Pacific regions.

AEW’s investment strategies are implemented by experienced and knowledgeable teams that focus on targeted areas in the public and private markets. AEW’s investment professionals benefit from the street-level insights of the property experts resident in each of AEW’s offices across the globe, as well as the top-down economic perspective of AEW Research.