Real Estate Debt Helps Investors Ride out Crisis

Key Takeaways:

- In an environment with both uncertain capital values and income streams, real estate debt investors can be comforted by the fact they don’t require capital gains to secure expected return.

- Real estate debt brings a degree of certainty by offering strong visibility, through stable cash-flows from senior secured debt.

- Loans are backed by high-quality real estate, and sound documentation, providing strong protection for investors.

Real estate private debt is a mature and stable market worth some $1 trillion, and with around $250bn of supply a year1 . Real estate debt benefits from strong risk reducers such as lower rate risk, visibility of future cash flows, priority access to rent payments, and a protective equity cushion. These characteristics proved their worth during the Great Financial Crisis and are doing so again during this global pandemic.

Benefits of risk reduction in difficult times

Let’s take a closer look at these risk reducers.

First, real estate debt has low exposure to interest rates risk given its floating rate nature which results in low sensitivity to rates and contributes to a low valuation volatility. By contrast, liquid bonds experience greater volatility due to their fixed rate nature.

Real estate debt coupons are composed of a variable IBOR rate reference so the coupon moves alongside the IBOR rates reference. Any rise in rates will lead to a higher coupon, while the impact of falling rates will be limited thanks to a zero-floor feature that applies at the IBOR rate.

Second, the premise behind real estate debt investing is cashflows and these are predictable, to an extent, even in times of crisis. “The rent payable by tenants is a known quantity,” says Arnaud Heck, co-head of the AEW/Ostrum Asset Management real estate debt platform. “Of course, tenants can get into trouble and may struggle to pay the rent, but this is generally the last thing you stop paying, whether it’s for a corporate data centre or your own home.”

Third, in downside scenarios, the recovery of real estate debt is protected by the equity cushion. The average loan-to-value for transactions by AEW/Ostrum AM, both affiliates of Natixis Investment Managers, is below 60%. “This gives us room to live with swing pricing until there is a full recovery,” says Heck. “Even if predicted value corrections strongly impact the equity part of the financing, the loan-to-value should still be well below 100%.” This allows for the full recovery of the capital invested, even in a highly-stressed scenario.

In addition, senior debt benefits from priority ranking over other stakeholders. And one of the advantages of being an illiquid asset is that even in crisis-hit markets values are slow to move and investors can sit tight until recovery takes place.

Why diversification matters

Diversifying away from cyclical segments, more speculative locations or those impacted by high operational gearing is also key to maintaining strong credit quality in the portfolio.

In challenging markets, the value of asset diversification becomes apparent. “We are lightly exposed to asset types such as cyclical retailers and hotels, where recovery will take more time, especially for properties which rely on international visitors. But even there, we have a strong track record,” says Cyril Hoyaux, co-head of the AEW/Ostrum AM real estate debt platform. The real estate debt strategy is diversified across a large range of sectors including residential, offices, senior housing, logistics, data centres, and light industrials.

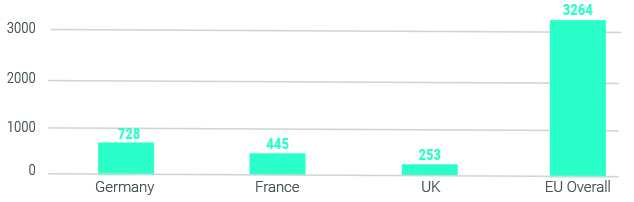

Expected cumulative impact of lost retail sales caused by the coronavirus outbreak in UK, Germany, and France (from March 9, 2020 to April 20, 2020) in million British pounds2

2 Source: Statista, New York Times, Zencargo, information as of April 2020

Lending to real estate projects in core countries, such as Germany, France, Benelux and Spain, reinforces stability in the portfolio. These are all relatively mature and deep real estate markets, operating within financial and political systems that have remained stable over time. This means investors can be confident that the rule of law will be upheld in times of difficulty, and refinancing risk is reduced. After all, the most important aspect of any debt investment is that the capital is repaid.

“In our line of business you tend to lend for about seven years,” says Heck. “After that, you need to find another lender to replace you, so having a financial system with strong and stable domestic players is crucial to lowering refinancing risk.”

What about the future?

Mid-2020, the outlook for new debt transactions appears to be predicated more on epidemiology than on market fundamentals. However, in contrast with the Global Financial Crisis a decade ago, when deals came to a shuddering halt, transactions are still taking place amid this pandemic.

“A strong insight into real estate markets and the team expertise will be even more key in the times to come,” says Heck. Our existing investors are supportive as they have seen our know-how and capacity to arbitrate and solve complex situations,” Hoyaux adds.

So, while debt investors are predominantly focused on monitoring their existing portfolios, they are also starting to eye future opportunities. “We anticipate potential deals in certain sectors, such as residential and data centres,” says Hoyaux.

Residential is a particularly stable investment for real estate debt given it is an essential asset. Despite some rent deferrals, swings in valuations of residential real estate in core countries tend to be minimal in economic downturns. “It’s a very defensive sector. For senior secured lending to the residential sector, the interest cover ratio is three or even four times. So, even if there were to be a large wave of unpaid rental payments it should not severely impact overall returns from residential debt”, says Hoyaux.

Rent from data centres and other critical infrastructure will also continue to be paid, underpinning investment in that segment. However, sectors such as office space may take more time to stabilise. Hoyaux adds: “We don’t expect a fall in office values in prime locations where vacancy rates are very low. But we would expect vacancies to rise in “B” locations, putting pressure on debt strategies focused on the non-core office segment.”

Conclusion: visibility, that rarest of things in today’s markets

At a time of huge uncertainty, there is a reassuring certitude to real estate debt investing. By investing in senior secured loans, investors have visibility over the cashflows due to them. This is denied to investors in most other asset classes.

Senior secured debt, backed by high-quality real estate and sound documentation, should maintain the cashflows investors need. And, of course, the full and prompt repayment of capital when the debt matures.

Published in September 2020

AEW

An affiliate of Natixis Investment Managers

Privately-held French "Société anonyme à conseil d’administration"

Real-estate investment manager under n°T 8324 delivered by the Prefecture de police de Paris

Share capital: €17,025,900

RCS Paris: B 409 039 914

8-12 rue des Pirogues de Bercy 75012 Paris, France

www.aeweurope.com

AEW Ciloger

A simplified joint-stock company with capital of € 828,510

Registered under the RCS number Paris 329 255 046

Licensed by the Autorité des Marchés Financiers on July 10, 2007 under number GP-07000043.

22 rue du Docteur Lancereaux 75008 PARIS.

www.aewciloger.com

Ostrum Asset Management

43, avenue Pierre Mendès-France CS 41432 75648 Paris cedex 13 France

Limited company with a share capital of 27 772 359 euros

Trade register n°525 192 753 Paris

VAT: FR 93 525 192 753

Register office: 43, avenue Pierre Mendès France 75013 Paris

www.ostrum.com

Natixis Investment Managers

RCS Paris 453 952 681

Share Capital: €178 251 690

43 avenue Pierre Mendès France

75013 Paris

www.im.natixis.com

This communication is for information only and is intended for investment service providers or other Professional Clients. The analyses and opinions referenced herein represent the subjective views of the author as referenced unless stated otherwise and are subject to change. There can be no assurance that developments will transpire as may be forecasted in this material.

Copyright © 2020 Natixis Investment Managers S.A. – All rights reserved