Mirova Funds Kenyan Smallholder Farmers

The Land Degradation Neutrality investment team participated in Komaza’s $28m equity raising, which will help Komaza towards its goal of planting 1bn trees by 2030. Other participants in the financing round were Novastar LPs AXA Investment Managers and the Dutch development bank FMO.

Komaza plants trees at nearly double the rate of Kenya’s commercial tree planting sector. Its “microforestry” model relies on distributed partnerships with local farmers, distinguishing it from the larger, inefficient plantations found in many parts of Kenya.

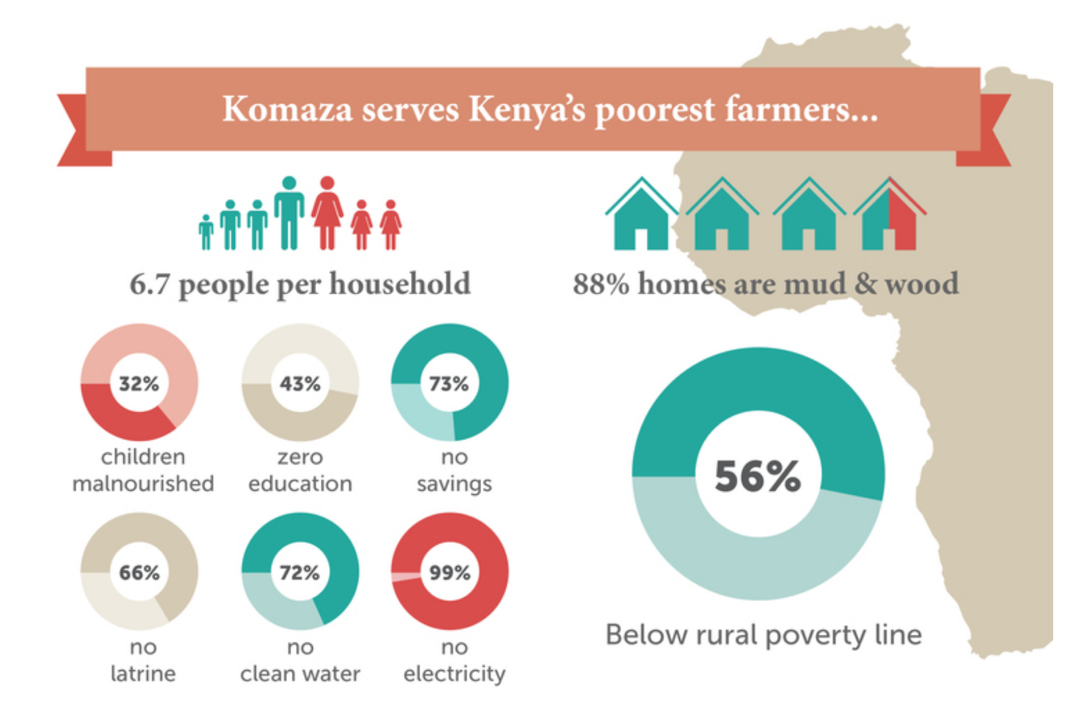

Komaza serves Kenya's poorest farmers…1

1 Source: from Komaza website

“Land restoration is a major challenge but also a real opportunity,” says Gautier Quéru, Investment Director of Mirova’s Land Degradation Neutrality strategy, at Mirova. “We need talented entrepreneurs such as Komaza to scale up innovative and attractive solutions able to deliver tangible positive impacts for nature and local communities.”

Komaza’s aim is to become Africa’s largest forestry company, by partnering with farmers to provide a sustainable and hyper-scalable domestic supply of wood. At the same time, local farmers get a climate-resilient, zero-risk, source of wealth creation for their families, and investors may receive commercial returns2 . In the process, the intense pressure on remaining natural forest is relieved.

Komaza represents a new, highly scalable approach to conservation - one that puts livelihoods and economic growth at the centre of environmental restoration and promotes the role of forestry as a solution for climate change.

Komaza plans to use the funding to expand from its first site on Kenya’s coast to two additional sites across East Africa. The company will invest in additional wood manufacturing facilities to expand its line of high quality, sustainable building materials. Komaza plans to add a new direct-to-farmer app to drive enrolment and increase farmer access to best practices. It will also build up its AI capabilities to create automated monitoring of its farms.

For further reading:

- First Investment and First Strategic Board Meeting for the LDN Fund

- Sustainable risk-adjusted returns, through sustainable land use and natural capital

- Finance Can and Must Play its Role in Fighting Land Degradation

- Mirova Among the ImpactAssets 50 for its Natural Capital Activities

- Acquisition of Althelia Ecosphere

- What is Natural Capital (VIDEO)?What is Natural Capital (VIDEO)?

Mirova is a partner of the UN in its efforts to help protect the natural world. Mirova’s Land Degradation Neutrality strategy was set up in conjunction with the United Nations Convention to make long-term investments in sustainable land management and in natural capital projects worldwide.

The strategy has attracted strong support from public investors including the European Investment Bank, Agence Française de Développement, Gouvernement du Grand-Duché de Luxembourg and UK Secretary of State for Environment, Food and Rural Affairs.

Mirova Natural Capital Limited

UK Private limited company

Company registration number: 7740692 – Authorized and Regulated by the Financial Conduct Authority ("FCA")

Registered office: 18 St. Swithin's Lane, London, England, EC4N 8AD.

The services of Mirova Natural Capital Limited are only available to professional clients and eligible counterparties. They are not available to retail clients. Mirova Natural Capital Limited is wholly owned by Mirova.

www.althelia.com

Mirova

Portfolio management company - French Public Limited liability company

Regulated by AMF under n°GP 02-014

RCS Paris n°394 648 216

Registered Office: 59, Avenue Pierre Mendes France – 75013 – Paris

Mirova is an affiliate of Natixis Investment Managers.

www.mirova.com

Natixis Investment Managers

Portfolio management company - French Public Limited liability company

RCS Paris n°453 952 681

Registered Office: 43, Avenue Pierre Mendes France – 75013 – Paris

Natixis Investment Managers is a subsidiary of Natixis.

www.im.natixis.com

This communication is for information only and is intended for investment service providers or other Professional Clients. The analyses and opinions referenced herein represent the subjective views of the author as referenced unless stated otherwise and are subject to change. There can be no assurance that developments will transpire as may be forecasted in this material.