2023 Macro Outlook Event: Return to fundamentals?

Central banks responded by raising interest rates higher than they had been in 15 years, while the IMF revised its 2022 global growth projection from 3.59% in April to 2.5% in October – and its 2023 forecast from 3.55% to 2.7%.

“Inflation was completely underestimated by everyone,” said Mabrouk Chetouane, Head of Global Market Strategy at Natixis Investment Managers Solutions, speaking at a 2023 Macro Outlook event for the UK media in November. “We are now in a situation where we will have to live with this inflation for a long period of time.”

Exactly how long is anyone’s guess. But concerns that the worst inflation for 40 years will remain elevated while the economy is locked into a slow growth scenario has cast a long shadow over many market outlooks for the year ahead.

Forward guidance

In the UK, inflation figures showed that the annual rate of consumer price inflation climbed to a worse-than-expected 11.1% in October – its highest level since October 19811. Food inflation, at 16.5%2, was at a 45-year high.

The Office for National Statistics (ONS) said that without the Energy Price Guarantee – which protectsUK customers from increases in energy costs by limiting the amount suppliers can charge per a unit of energy used –, the headline inflation rate would have hit 13.7%. Core inflation, which strips out food and energy from the calculations, remained stable at 6.5%.

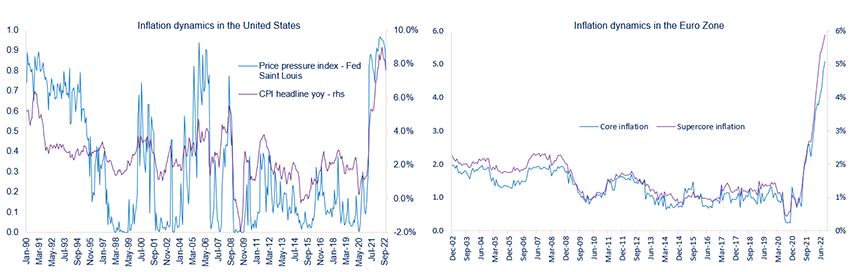

According to Mabrouk, different inflation stories are likely to unfurl between the US and Europe in the months ahead (see Figure 1). “For the US economy, we have good evidence that inflation will start to fade in the coming months. For the European economies, the story is completely different,” he said.

FIGURE 1: The eurozone will take the US’s lead on inflation, but there will be a lag (source: Natixis IM Solutions)

In Europe, inflation as a whole is measured using the Harmonised Index of Consumer Prices (HICP) and core inflation, which measures the change in prices excluding energy and food. But the ECB also produces several alternative measures of inflation, including a ‘super core’ index. This aims to help the ECB gauge whether the improvement in economic conditions generated by a more accommodative and effective monetary policy is passing through into price developments.

Mabrouk pointed out that, in Europe, super core inflation has increased faster than core inflation, meaning inflation has spread to all sectors and countries in the region. So, while the Fed can see inflation decelerating and therefore slow the pace of its rate hikes, the ECB cannot.

No time to die

Turning his attention to the bond market, Mabrouk explained that the extreme volatility we’ve seen in the bond markets has been created by the behaviour of central banks, commenting: “they abandoned their forward guidance and decided to pilot their monetary policy on a discretionary basis”. He added that the uncertainty around what the terminal rates of inflation might be, both for the Fed and the ECB, had also contributed to the volatility.

Mabrouk went on to predict that central banks will stop hiking rates by the end of the first quarter of 2023 and that the desired visibility will create opportunities in fixed income. “The US bond market is clearly I think a good place to be exposed,” he said. “Volatility is expected to stabilize in the coming quarter [in the US] and this will support an increase in duration exposure within diversified portfolios.”

Duration is a measure of a bond’s sensitivity to changes in interest rates. Monitoring it can effectively allow investors to manage interest rate risk in their portfolios. Interest rates have been low since central banks stepped in to stave off the Global Financial Crisis in 2008 and dropped even lower as bankers stepped in again to address the pandemic. This has left bonds yielding next to nothing for much of the past decade.

However, with rates being hiked to quell inflation, there’s the sense that investors might be a little more bullish on bond market performance in 2023. Higher bond yields are finally beginning to improve income opportunities within fixed income, and prospects for higher income are emerging across different market segments, including corporate bonds, government bonds and floating rate loans.

James Beaumont, Head of Multi Asset Portfolio Management at Natixis Investment Managers, who chaired the London event, said he’d been underweight relative to benchmarks in US and European government bonds all year, but that he’s likely to dip his toes back in the water, especially on the US side.

“We are adding back towards neutral and it’s a more attractive investment proposition, but we’re not even neutral yet,” he said. “Can I see us doing that next year? Yes, but not yet.”

Green horizons

In terms of what’s popular in the fixed income space, green bonds are seen by some as an investment area that could produce returns in the years ahead.

According to the latest Natixis Institutional Investor Survey3, half of those institutions that own green bonds globally plan to increase their investments, while almost the same number say they will maintain their current allocation. Only 4% plan to reduce their holdings.

The same report finds 62% believe there is alpha to be found in ESG investing more generally, irrespective of whether its green bonds, sustainable equity – or real assets.

“From an investor perspective, what we see is that there is a very strong interest for impact investing and for private assets,” said Anne-Laurence Roucher, Deputy CEO, Head of Private Equity and Natural Capital at sustainability specialist Mirova, part of the panel of Natixis’ affiliate investment specialists at the London event.

Anne-Laurence referenced how regulations in Europe were stimulating demand in the renewable energy sector in a way that they weren’t in the US or Asia.

For instance, under the EU’s’ REPowerEU plan – which aims to make Europe less beholden on Russian gas – energy from renewables is expected to double in the next eight years. A hugely ambitious goal, it requires massive investment: the European Commission estimates that the EU requires an additional $350 billion in investment each year to meet these targets, alongside another $130 billion for other environmental goals.

“There are massive secular growth drivers for the industry, while at the same time prices are coming down,” said Anne-Laurence. “Good entry points today alongside these secular growth trends will enable us to generate value over the long term on private assets.”

What’s more, in the search for decorrelated returns, intuitional investors aren’t the only ones looking to private markets. Anne-Laurence continued: “There is growing interest from retail and individual investors to approach private assets as a new asset class. The split between retail and institutional is more or less 95-5, so there really is an appetite to go to an asset class that is de-correlated to a certain extent from liquid assets.”

Private optimism

As private assets start to gain appeal for wider investor groups, institutional investors are also looking to them to provide relief on the equity side of the portfolios – not just to make up for low-yielding bonds, as they have done for much of the past decade.

The Natixis Institutional Investor Survey found that about half (48%) believe private markets will provide a safe haven in a recession3. Confidence in the asset class’s ability to fulfil this role has been rising steadily since the survey’s 2021 outlook when only 35% believed there was a safe haven in private assets – in 2022, 45% thought the same.

Nicole Downer, Managing Partner and Head of Investor Solutions at MV Credit, a direct lender into European private debt markets, who was also on the affiliate panel, said: “Private debt is an attractive asset class for investors as it is seen as a safe haven, low volatility, and still providing strong, stable returns. Valuations have stayed relatively stable in a situation where the public side has dropped significantly. We are seeing an almost over-allocation to private assets as a result.”

Having noticed a move into a more lender-friendly market midway through the year, Nicole has since seen a slowdown in private credit and in equities, likely due to investors taking a step back and reassessing their portfolios.

She added: “Everyone is expecting changes given the valuations that we have seen over the last few years are not sustainable; but we are in a period where there is a difference in view from people wanting to sell their companies to people wanting to buy.

“It will continue to be a market where that supply and demand is more in favour of the lenders through 2023 and that’s an opportunity for lenders with capital, like MV Credit.”

Insider innovation

So where does that leave equity investors? It’s no overstatement to say that 2022 has been something of an annus horribilis for the asset class. Between January and April this year alone, the S&P 500 suffered its worst quarterly start to a year since 1939, falling -13%.

That said, high-quality companies don’t become poorly performing overnight – even if valuations would seem to reflect as much.

Matthieu Rolin, portfolio manager of the Safety Funds at Thematics Asset Management, who completed the affiliate line-up at the London event, commented: “Clearly, we've seen a disconnect between prices and the growth perspective of the companies that belong to our investible universe. The market has been focusing on inflation, interest rates, central banks, macro indicators, but actually the market didn't really pay attention to the fundamentals of the company.”

Just as Anne-Laurence referenced the secular growth trends in private assets in the impact investment space, certain companies, too, will be better positioned for the future and less susceptible to the slings and arrows of market turbulence.

“We invest in secular growth themes,” Matthieu continued. “That means we try to invest in companies that aren’t so impacted by the economic cycle. So, while, in the safety theme, we don't invest in the automotive industry, which its highly cyclical, we do invest in companies that provide the digital safety equipment that you’d find in a brand new car.”

As we head into 2023 and continue to grapple with inflation, rising interest rates, the threat of recession, and geopolitical tensions, it’s clear that the days of investors making consistent returns on the back of constantly growing markets are a thing of the past.

Instead, we may be returning to the ‘old normal’, where money has a cost and scarcity rather than abundance is the name of the game. A return to focusing on cashflows and fundamentals might not actually be a bad thing either – especially for equity investors that are focused on quality.

As Matthieu concluded: “If investors can't find growth in the economy, they'll have to find growth in companies.”

2 Source: London School of Economics, https://blogs.lse.ac.uk/politicsandpolicy/food-inflation-and-monetary-policy-what-to-expect/ Release date: 5 December 2022.

3 Source: 2023 Natixis Institutional Outlook Survey Natixis Investment Managers, Global Survey of Institutional Investors conducted by CoreData Research in October and November 2022. Survey included 500 institutional investors in 30 countries throughout North America, Latin America, the United Kingdom, Continental Europe, Asia and the Middle East.

Thematics Asset Management

An affiliate of Natixis Investment Managers.

A French SAS (Société par Actions Simplifiée) with a share capital of €191 440. - 843 939 992

RCS Paris. Regulated by the AMF (Autorité des Marchés Financiers), under no GP 19000027.

20, rue des Capucines

75002 Paris

www.thematics-am.com

MV Credit Partners LLP

An affiliate of Natixis Investment Managers

Registered Number : OC397214

Authorised and Regulated by the Financial Conduct Authority (FCA)

45 Old Bond Street

London W1S 4QT

www.mvcredit.com

Mirova

Mirova is an affiliate of Natixis Investment Managers.

Portfolio management company - French Public Limited liability company

Regulated by AMF under n°GP 02-014

RCS Paris n°394 648 216

Registered Office: 59, Avenue Pierre Mendes France – 75013 – Paris.

www.mirova.com

Natixis Investment Managers

RCS Paris 453 952 681

Share Capital: €178 251 690

43 avenue Pierre Mendès France

75013 Paris

www.im.natixis.com

This communication is for information only and is intended for investment service providers or other Professional Clients. The analyses and opinions referenced herein represent the subjective views of the author as referenced unless stated otherwise and are subject to change. There can be no assurance that developments will transpire as may be forecasted in this material.

Copyright © 2022 Natixis Investment Managers S.A. – All rights reserved