How Well Will the Private Equity Markets Withstand the Crisis?

How Well Will the Private Equity Markets Withstand the Crisis

- Concerned private equity investors should consider that, for around 25 years, no buyout vintage has ever failed on average to produce positive returns . But only funds with certain characteristics will prosper in this crisis.

- Leverage in Flexstone’s co-investment funds’ portfolio companies is low (and null at the level of the funds). In times of crisis, this cautious approach may really pay off.

- Active small and middle market buyout funds have built out their operational teams and are more hands-on with their portfolio companies. Experience of crises informs operational specialists about what to change and what to leave alone. Cut too deep or change strategy too fast, and the remedies may actually destroy value.

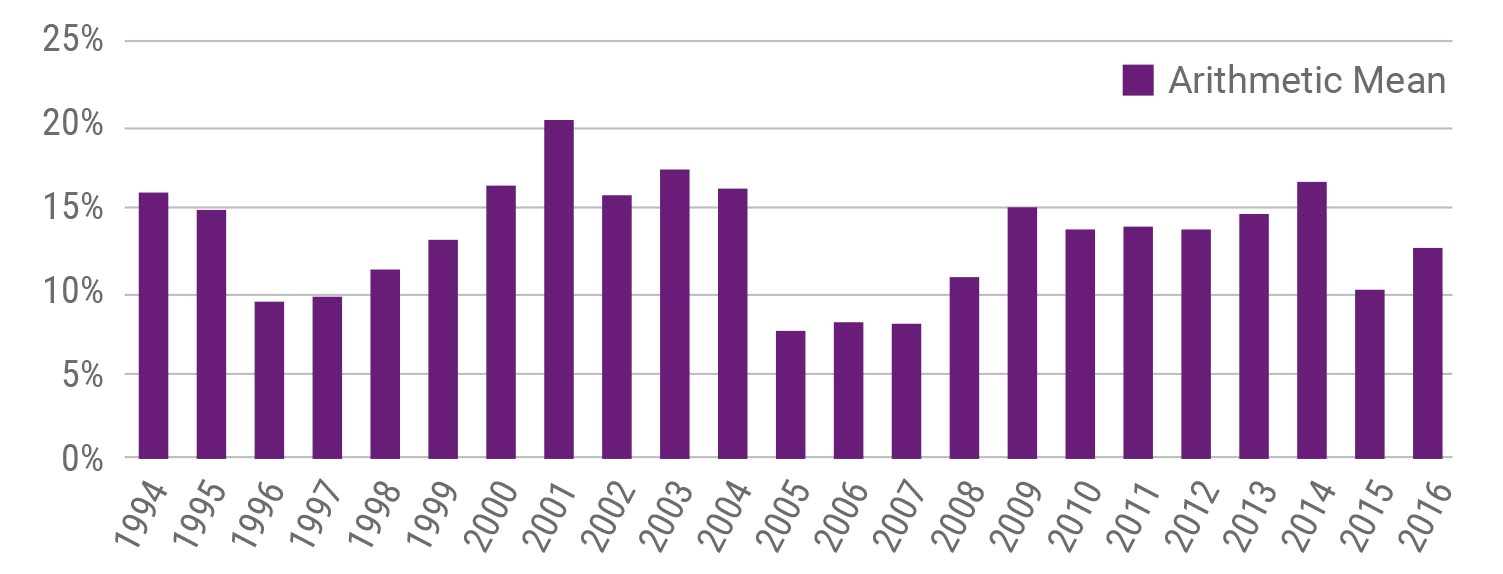

The long-term perspective may be some consolation to private equity investors. Put simply, for around 25 years, no buyout vintage has ever failed, on average, to produce positive returns on capital, no matter how severe the downturn. Even vintages launched in the years immediately before the Great Financial Crisis (GFC) produced positive median IRRs .

IRR of Private Equity Funds Since Inception - Net to Limited Partners1

1 Source: Cambridge Associates (CA), Private Equity Index and Benchmark Statistics, as of September 2019. Based on data compiled from 2,024 private equity funds, including fully liquidated partnerships, formed between 1994 and 2017. Internal rates of returns are net of fees, expenses and carried interest. CA research shows that most funds take at least six years to settle into their final quartile ranking, and previous to this settling they typically rank in 2-3 other quartiles; therefore fund or benchmark performance metrics from more recent vintage years may be less meaningful.

Only funds with certain characteristics are likely to prosper. Flexstone, a co-investment buyout specialist, believes key attributes of its funds make its investments well equipped to navigate the current crisis.

These attributes are:

- Below market acquisition multiples.

- Low leverage and sound financial structuring.

- Investing alongside GPs with active management and enhanced operational capabilities.

- Private equity partners who are sector specialists, and stick to what they know.

- A focus on the mid-market, with more potential to add value and flexibility over exits.

- As a co-investor, Flexstone diversifies its portfolios over many Sponsors and companies.

Widespread fear has led to reductions in both consumer and business spending in most sectors. Some otherwise stable businesses in vulnerable sectors such as leisure, consumer, travel and hospitality may take a long time to recover, if they recover at all.

We believe the private equity buyout market is better equipped than more liquid assets to manage its way through the crisis. There is no daily mark to market, meaning there is less price volatility. Then there is the multi-year investment holding period, which allows the underlying companies time to recover in a measured fashion rather than trying to find short-term fixes and potentially destroying value.

Currently a majority of PE backed companies is intently focused on preserving liquidity. This may entail tapping revolving credit facilities, better managing working capital, and delaying or reducing rent payments. These companies are also cutting expenses and any non-essential capital expenditures, and freezing or reducing merit-based compensation.

At the macro level, the fiscal response has been faster and more aggressive than during the GFC. Many governments offer schemes to furloughed staff and some companies qualify for state assistance, such as grants and loans. In some countries, banks have been told to offer debt repayment holidays to individuals and companies.

The buyout landscape has evolved in the years since the GFC and managers have exercised more caution over using leverage. Managers who have been aggressive in valuations and debt multiples are encountering additional difficulties in the current environment.

General Partners are also more cautious about retaining cash for challenging times. “Many of the GPs we work with were in business when Lehman Brothers collapsed,” says Nitin Gupta, Managing Partner at the New York office of Flexstone Partners, an affiliate of Natixis Investment Managers. “The lesson they took was to have enough money in the bank or put in place contingency financing to support portfolio companies for several months if required.”

Leverage in Flexstone’s co-investment funds and portfolio companies is considerably lower than the industry standard. In strong economic conditions, this may be a disadvantage for the financial performance, but in lean years this cautious approach really pays off, enabling portfolio companies to better withstand even a pronounced downturn.

Across the buyout landscape there is plenty of “dry powder” which will also be helpful in shoring up portfolio companies. Gupta says this dry powder should be used wisely to boost company balance sheets, and enhance the reputation of the private equity industry. “This is the chance to show that the private equity industry really stands behind ESG values,” he says. “Workers and livelihoods need to be protected as well as companies.”

Operational skills for rapid strategy changes

In addition to having deep financial capabilities and flexible financial structures, weathering the downturn will depend on active portfolio management and the operational skills of the sponsor. “The managers we work with have inhouse capabilities which have real impact at company level, and can evolve the business model as the operating environment changes,” says David Arcauz, Managing Partner at the Geneva office of Flexstone.

These capabilities were strengthened by Flexstone’s buyout partners after the GFC and are being strengthened further today. Operational teams are consequently more hands-on with their portfolio companies, including helping to build business scenarios to protect and enhance revenues. Distribution chains that are dependent on single sources are being expanded to diversify the risks. “Some of our portfolio companies identified this issue early on in the current crisis and have diversified,” says Arcauz.

Portfolio companies which had sub-optimal online distribution are now upscaling their web presence as a vital new channel in a world where physical interaction is more challenging. Other potential ways of adding operational value include identifying and scoping add-on acquisitions, or supporting senior management who become overwhelmed during a crisis period. Keeping the workforce safe and motivated is another key tool.

Where experience of crises really comes in is knowing what to adjust and what to leave alone, what costs to cut and which must be borne. “When you are cutting costs to stay alive, the risk is you might cut too deep,” says Arcauz. “This too could be fatal.”

The value of sector specialists

Buyout funds succeed or fail on their asset selection. For this reason, the choice of GP and the assets the GP purchases is paramount for co-investors such as Flexstone. The soundness of GP selection becomes very apparent when a storm hits.

Flexstone co-invests with sector specialist GPs who are disciplined and buy only companies they thoroughly understand in sectors in which they have direct experience. “We like top-quartile performing GPs who have an angle and don’t use leverage,” says Gupta. “In times of dislocation, having a defined strategy and the discipline to stick to it really pays off.” Sector specialists may not be able to sidestep a negative revaluation of their portfolio companies, but they have a better chance of doing so.

Part of the discipline is to understand that cheap valuations do not necessarily lead to outperformance. At the start of economic cycles many companies seem cheap, and only sector specialists will have the experience and foresight to understand whether a particular company has the profile to outperform across the cycle. A cheap company with a poor product or strategy is unlikely to become as valuable as higher-quality competitors.

Mid-market offers more value and flexible exits

The lower mid-market, in which Flexstone invests, should be better positioned during a downturn than other private equity buyout segments. Because the lower mid-market is less crowded, purchase multiple are lower, implying less leverage and a valuation cushion when market conditions head south.

There is also a larger investment opportunity set, with over three-quarters of all buyout deals taking place in the small and middle markets (deal size less than $500 million). This allows for greater diversification within portfolios and access to a greater number of high-quality companies.

There are various ways to add value to smaller companies compared with large companies, which have more cumbersome infrastructure and can be slow to evolve. And there are a greater number of exit alternatives for mid-caps compared with large caps, which tend to overly rely on IPOs. Sales to strategic or financial buyers and secondary deals are on the table in the mid-market, even in turbulent times. We are convinced that the secondary market is considerably more robust than during the GFC and volumes now dwarf those seen in 2008.

Conclusion: learning from each crisis

The fear gripping company executives and investors alike is palpable, and not dissimilar to the height of the GFC, when many believed that financial markets could collapse and that capitalism itself was under threat.

“This is our fourth major global crisis and we always try to draw lessons from previous crises,” says Gupta. “This one appears different because it is more than just a financial crisis or an economic crisis.

“But just as in 2008-10, when we didn’t suffer significant portfolio losses, we expect our current vintages to perform well,” he adds.

To commit or not commit?

- For investors squeamish about committing capital during a crisis, the lessons of the GFC are instructive, with the 2009 vintage being one of the best recorded in the buyout universe. “Some of the best vintages in private equity tend to be those raised during market dislocations where pricing is more favourable and the investment opportunity set much larger,” says Nitin Gupta. Waiting for an upturn often means missing out on the best vintages, so market timing can be costly. Price discovery – the balance of buyer and seller expectations – will be challenging for the rest of 2020. While there may be attractive opportunities right now, GPs are likely to take their time to identify targets and draw down capital from investors. The co-investment market, in which non-specialists have started to play in recent years, should be less crowded. “Unless investors have a dedicated co-investment strategy, they will likely withdraw post-crisis,” says Arcauz. “The opportunists will largely disappear, opening up opportunities for us.” Value may emerge in the secondary market too, as overleveraged or overstretched GPs seek to rationalise their portfolios.

Flexstone Partners

An affiliate of Natixis Investment Managers

Flexstone Partners, SAS – Paris

Investment management company regulated by the Autorité des Marchés Financiers. It is a simplified stock corporation under French law with a share capital of 1,000,000 euros Under n° GP-07000028 –Trade register n°494 738 750 (RCS Paris)

5/7, rue Monttessuy,

75007 Paris

www.flexstonepartners.com

Flexstone Partners, SàRL – Geneva

Independent (unregulated) asset manager, under Swiss Federal Act on Collective Investment Schemes (“CISA”), supervised by Commission de haute surveillance de la prévoyance professionnelle (“CHS PP” and regulated by the Swiss Financial Market Supervisory Authority (“FINMA”) under Anti Money Laundering requirements. It is a limited liability company with a share capital of 750 000 CHF.

Trade register n° CH-660-0180005-1

8 chemin de Blandonnet

Vernier 1214 Geneva

Switzerland

Flexstone Partners, LLC - New York

Delaware corporation, registered with the United States Securities and Exchange Commission as an investment adviser

28th floor of 745 Fifth Avenue, New York, NY 10151.

Flexstone Partners, PTE Ltd - Singapore

61 Robinson Road, #08-01A Robinson Centre

Singapore 068893

Natixis Investment Managers

RCS Paris 453 952 681

Share Capital: €178 251 690

43 avenue Pierre Mendès France

75013 Paris

www.im.natixis.com

This communication is for information only and is intended for investment service providers or other Professional Clients. The analyses and opinions referenced herein represent the subjective views of the author as referenced unless stated otherwise and are subject to change. There can be no assurance that developments will transpire as may be forecasted in this material.

Copyright © 2020 Natixis Investment Managers S.A. – All rights reserved

Mid-Market Private Equity: 2.0

Mid-Market Private Equity: 2.0

Flexible Access to Private Equity

Flexible Access to Private Equity

How to Eradicate the J-Curve in Private Equity?

How to Eradicate the J-Curve in Private Equity?

Hop Aboard the US Growth Engine

Hop Aboard the US Growth Engine