How ESG Engagement Boosts Corporate Sustainability

Highlights

- Value investors can be the catalyst for real change in companies’ sustainability profiles. By engaging with companies to reform business practices, value investors can uncover substantial long-term value.

- One of the great benefits of deep fundamental analysis is that it captures underlying changes in the economy, such as the fast-paced shift to ESG-aware consumers and markets.

- Active engagement can be effective when conducted privately, taking meaningful stakes and working with companies to improve the sustainability of their business model.

Finding Quality at a Discount

The way Harris Associates invests in equities is unchanged since the firm was founded in 1976. “We aim to find good businesses, assess their true value, and then buy them at a discount to our estimate of value,” says Daniel Nicholas, client portfolio manager at Harris.

In practice, this means assigning large teams of analysts to figure out the future free cash flows of a business, while engaging with that business to assess the quality of its management team. “We are like a private equity house in that we do very deep due diligence on companies and invest to long-term time horizons,” Nicholas adds.

This is a different approach compared with most other value investors, who screen on price first, using various quantitative filters. “We don’t believe quant techniques using ratios will uncover all the value there is out there,” says Nicholas. “We prefer to fish in a bucket of businesses we want to own and wait until we can buy them at our price.”

The aim is to buy at around a 30% discount to our estimate intrinsic value. Discounts often materialise through corporate missteps and negative headlines. Nicholas says: “As investors become shorter term in their outlooks, they are influenced by the news cycle and that opens up opportunities for us.” The desired outcome is that the stock price reflects Harris’ estimate of intrinsic value within three years.

Fundamental Analysis can Capture Hidden ESG Value

The investment process employed by Harris Associates, an affiliate of Natixis Investment Managers, dates from 1934 when Benjamin Graham published his renowned Security Analysis book.

One of the great benefits of deep fundamental analysis is that it captures underlying changes in the economy, such as the move from a manufacturing to a knowledge/service economy and to ESG-aware consumers and markets.

Tangible assets used to represent 83% of the value of a business, Nicholas notes, but only 10% of corporate value is derived from tangible assets now1. “If 90% of the average company’s value is derived from intangible capital, such as R&D and patents, then traditional measurements of book value will not capture this,” says Nicholas. “In the end, the usefulness of book value to forecast future stock returns and fundamental business growth has deteriorated over time2.”

This hidden value tends to emerge over time in the shape of higher revenues and profits, so that share prices eventually coincide with intrinsic value. The same is true of a company’s ESG profile.

As part of its corporate analysis, Harris performs deep ESG due diligence on each of its prospective and existing portfolio companies. Rather than having a team of ESG-dedicated professionals working alongside the analysts, the analysts own the ESG integration and engagements with management teams. Nicholas says: “We don’t have a separate ESG filter, the ESG evaluation is baked into the investment process and integrated into the estimated intrinsic value.”

Whereas ESG filters may automatically exclude certain companies, no company is immediately excluded from Harris portfolios for poor ESG performance, as long as it has the potential and a plan to improve that performance.

To identify whether companies have potential for significant competitive edge in ESG, Harris is active in engaging management. It prefers to engage rather than simply divest. Nicholas notes: “The first, and most important, step is engagement. Then escalation. Then divestment. It’s a different way of doing ESG than assigning a rating and using that to guide investment and divestment.”

How Engagement Improves Sustainability (and Value)

Most of Harris’ active engagement is conducted privately, by working with companies to improve the sustainability of their business model. In this respect, sustainability refers to the sustainability of the company itself as well as its ESG practices.

“All material risks and opportunities must be factored into our intrinsic values, which encompasses E, S and G factors,” says Nicholas. “We believe it’s not only the responsible thing to do, but it’s required to thoroughly analyse the sustainability of a business.”

Harris takes meaningful stakes in companies, meaning it readily gains access to company managements, carrying out around 1,500 management meetings a year.

Nicholas says: “In most cases, they welcome us as a shareholder, because although we seek improvements, they know we are long-term oriented and will work with them to create value.”

The case of Daimler, an investee company, highlights this approach. As Daimler’s fourth-biggest shareholder, Harris was invited in 2019 to speak to around 100 senior level managers at Daimler’s headquarters in Stuttgart. David Herro, deputy chairman, chief investment officer-international equities and portfolio manager, gave a presentation titled: “Building Shareholder Value Via Sustainable Performance.” Herro stressed that for Daimler to create streams of future free cashflow, it must create long-term value in a responsible manner.

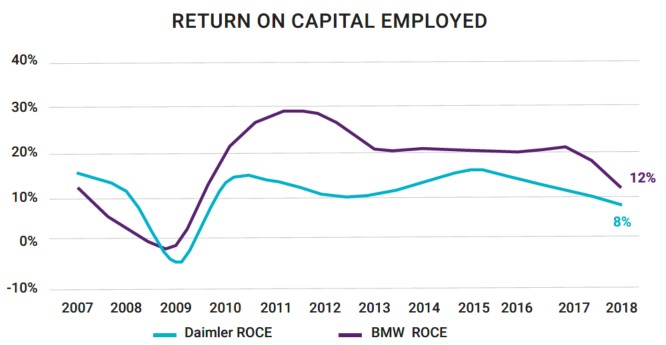

Daimler’s management has since dramatically turned around the operational and financial performance of the company. “At the time, Daimler’s returns were significantly lagging its peers, but have since laid the groundwork for long-term value creation,” says Nicholas.

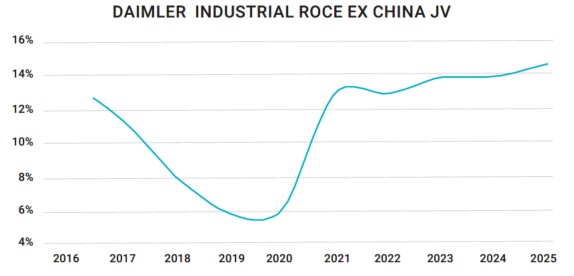

The management launched a six-pillar strategy tied to financial performance and cashflow generation. This strategy included improving its profile as a luxury brand and spinning out its truck business, which did not position the company as a luxury brand. It resolved to better engage its customer base to create recurring revenues. This included upgrading technology in the cars to provide on-road updates. Daimler also worked on the S of ESG, improving relations with its own workforce and providing more targeted incentives.

In addition, prudent investments are turning electrification into an opportunity. It is envisaged that 25% of unit sales will be electric vehicles (EV) by 2025. Production of internal combustion engine sales will cease completely by 2029.

The result is a more sustainable business model, which is based on improved ESG practices. The impact on Daimler’s return on capital has been tangible:

“Now that the sustainability of the business model is fortified, we are comfortable keeping Daimler as a holding, even though the stock has seen strong total returns in 2021,” says Nicholas.

Value Investors as Catalysts for Change

Value investors can be the catalyst for real change in companies’ sustainability profiles. By engaging with companies and working with them (rather than in conflict with them) to reform business practices over the long term, value investors have the potential to both unearth and create substantial long-term outperformance.

Published in January 2022

2 Source: Choi, Ki-Soon and So, Eric C. and Wang, Charles C. Y., Going by the Book: Valuation Ratios and Stock Returns (August 26, 2021). Available at SSRN: https://ssrn.com/abstract=3854022 or http://dx.doi.org/10.2139/ssrn.3854022

Harris Associates

An affiilate of Natixis Investment Managers.

Investment adviser registered with the U.S. Securities and Exchange Commission (IARD No. 106960), which is licensed to provide investment management services in the United States.

The company conducts all investment management services in and from the United States.

Two North LaSalle Street, Suite 500

Chicago, Illinois 60602, Etats Unis

www.harrisassoc.com

Natixis Investment Managers

RCS Paris 453 952 681

Share Capital: €178 251 690

43 avenue Pierre Mendès France

75013 Paris

www.im.natixis.com

This communication is for information only and is intended for investment service providers or other Professional Clients. The analyses and opinions referenced herein represent the subjective views of the author as referenced unless stated otherwise and are subject to change. There can be no assurance that developments will transpire as may be forecasted in this material.

Copyright © 2021 Natixis Investment Managers S.A. – All rights reserved

Value Investing – Is It Different This Time?

Value Investing – Is It Different This Time?

Passive is Good for Active

Passive is Good for Active

Diversification, the Blind Spot of Equity Markets

Diversification, the Blind Spot of Equity Markets