Flexible Access to Private Equity

Key Takeaways:

- A one-size-fits-all approach to private equity does not work for many investors, so they are starting to turn to tailor-made strategies, structured by specialist advisers.

- Private equity is a valuable asset class if investors choose the right strategy, access good managers, have proper legal and tax structuring, and perform administrative tasks efficiently. But mistakes in any of these steps put performance at risk.

- Benefitting from bespoke services, through an a la carte menu for investment strategy, research and selection, structuring, tax, accountancy and reporting, can help to enhance risk adjusted return in private equity portfolios.

Resources

Private equity has long shown itself to be a consistent performer, delivering higher returns relative to stock markets over extended periods. After fees, private equity investors, in aggregate, have beaten public markets comfortably. But the key phrase here is in aggregate. Why? Because the range of returns across the private equity spectrum is wide, with average returns hiding pockets of poor performance, even losses.

Getting this asset class right can lead to good or outstanding returns, while doing it poorly can produce mediocre or poor results. Getting it right entails gaining access to skilled managers, choosing the right strategy , establishing the right legal frame and tax efficient structure, and performing administration competently. Each part of the process must succeed and not all investors are capable of performing all these tasks to the necessary standard. Failure in any may lead to returns that are below expectations.

In search of a better fit

The world’s largest investors have the resources to manage their private equity allocations in-house, from investment to reporting. They tend to invest at the larger end of the spectrum, in big ticket sizes. There is also plenty of value in smaller deals, however, in the private equity mid-market. The small- and mid-market private equity sectors offer opportunities for outperformance across most phases of the economic cycle. Investors also tend to pay lower entry multiples than for larger funds. With the spread of mid-market returns being wider than for larger funds, the ability to pick the best funds can lead to significant outperformance. Institutional investors as well as family offices are attracted to these deals, but face the challenge that these kinds of deals require just as much skill and servicing as larger ones. They often turn to funds of funds to gain exposure.

That’s fine for some investors, but for others this one-size-fits-all approach does not respond to their particular needs. They are presented with a single prospectus and a single solution which does not allow for different risk tolerances, geographic preferences, return expectations and so on.

“Given that the full term of these investments can be typically a decade or more, it is important to get a good fit at the outset,” says Benoit Jacquin, managing partner at Flexstone Partners, an affiliate of Natixis Investment Managers. “Unlike for a publicly traded equity fund or a bond fund, changing your mind after a year or two may become a very costly decision.” For this reason, private equity investors are starting to turn to customized strategies, structured by specialist advisers in tailor-made vehicles.

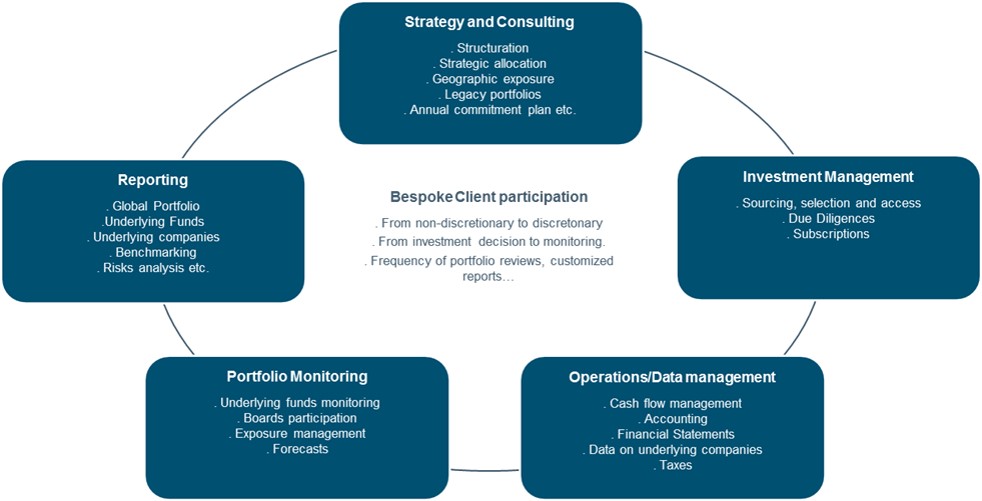

Five steps to a bespoke PE portfolio

To create a strategy that meets investors’ expectations over the long term, a specialist private equity adviser takes many factors into account. These factors can be grouped into five components, each of which is a part of the investment process:

1. Strategy and consulting

The first step is to assess the investor’s risk and return tolerances, and any legacy private equity assets. Then, how much can be committed and over what timeframe? The assessment leads to the strategic allocation, including the calibration of geographic exposure.

2. Investment management

This is research, sourcing and selection of investment managers, including due diligence. This asset class poses significant risks if the initial selection is poor. Issues such as local regulations, business practices, language and culture can be challenging to navigate so on-the-ground know-how and networks are important.

3. Operations and data management

Although the private equity industry is substantial in terms of investment volumes, it still has to develop “standards” and tools to manage data and operations more efficiently. Difficulties include the specificities of each transaction, variations in rules in different jurisdictions and lack of standardisation leading to challenges in accounting, reporting, issuance of financial statements and taxes administration. A tailored service can assist in the management of the operations and record all the relevant data onto hosted proper IT infrastructure to improve efficiency and transparency, and reduce risks of errors.

4. Portfolio monitoring

Portfolio monitoring is critical for a private equity portfolio as three levels of analysis are required: overall investment vehicle, underlying funds, portfolio companies. Specific tools must be used to perform this analysis, starting with the collection and then the aggregation of key information (available at different points in time with different formats). The next step is to slice and dice this information through specific angles to facilitate the overall analysis: number of companies, vintages, strategies, capital drawn, deployment rates, cash flows, etc. In addition, “ an advisor will also undertake regular investment reviews and on-site operational due diligences, attend annual general meetings, and participate to advisory boards” says Benoit Jacquin.

5. Reporting

With the information on the underlying funds and their portfolio companies in a single IT system, it is possible to report properly and diligently on the portfolio and all its components, and to customize reporting to the specific needs of the investor. Reports can also include benchmarking and risk analysis.

Hire a bigger team, without adding staff

The components above amount to the entire value chain in a private equity investment. Some investors need an adviser to provide all five components. Others have some experience, existing capabilities and, perhaps, legacy assets, so will require services for one or two of the components only.

“This is why we refer to our services as a la carte” says Caroline Gibert, Director, Investor Relations and Business Development, at Flexstone Partners. “We are not a product company, we set up expressly to offer bespoke services to enhance risk-return adjusted performance in private assets portfolios.” Flexstone Partners provides many core services, including strategy definition, fund research, selection and access, portfolio monitoring and reporting, while partnering with other best-in-class service providers in areas such as fund administration, tax and audit.

The adviser effectively becomes part of the private equity team of the investor, assessing individual needs and constraints. Even investors with some experience and in-house due diligence expertise often require help with their strategies and gaining access to the world’s best managers. Administration support is a key area of need. Migrating to a new, more scalable system is expensive if done alone, but much less costly when moving to a proven and shared infrastructure with flexible tools. One of Flexstone Partners’ institutional clients had invested in the US market for a number of years and had a small dedicated team making commitments. “After some successful investments, the investor significantly expanded its private equity portfolio and this made the portfolio hard to manage and monitor without more dedicated tools,” says Caroline Gibert. “For this client, we established a stronger system for monitoring, reporting and operational management and also started to advise the client on new investments.”

Another common area of need is geographical diversification. While some investors are proficient at allocating to private equity strategies focused on their home markets, looking beyond their own borders can stretch their resources and increase risks. Support from an adviser with global research and portfolio management capabilities can ensure access to overseas managers with strong track records. Just as the adviser’s services are a la carte, so are the fees and the way they are levied, depending mainly on the size of the relationship, the nature of the services provided, and the specific circumstances of each investor.

Conclusion

Private equity advisory can add value to a majority of investors’ portfolios. “Our clients include large and global institutional investors, such as insurers, pension funds, state entities as well as private banks and family offices” says Caroline Gibert. Some investors prefer to retain a degree of discretion over the services out-sourced in a mandate, but nearly all can benefit from expert help with at least one of the five type of services described earlier.

Flexstone Partners

An affiliate of Natixis Investment Managers

www.flexstonepartners.com

Flexstone Partners SAS

Flexstone Partners SAS is an asset management company regulated by the Autorité des marchés financiers. It is a simplified stock corporation under French law with a share capital of 1,000,000 euros

Under n° GP-07000028 –Trade register n°494 738 750 RCS Paris – VAT: FR 56 494 738 750.

5/7, rue Monttessuy,

75007 Paris

Flexstone Partners Sàrl.

Flexstone Partners Sàrl. is an independent (unregulated) asset manager, under Swiss Federal Act on Collective Investment Schemes (“CISA”), supervised by Commission de haute surveillance de la prévoyance professionnelle (“CHS PP” and regulated by the Swiss Financial Market Supervisory Authority (“FINMA”) under Anti Money Laundering requirements. It is a limited liability company with a share capital of 750 000 CHF.

Trade register n° CH-660-0180005-1 – VAT: CHE-112.212.153–

Chemin du Pavillon 5.

CH – 1218 Le Grand Saconnex, Switzerland

Flexstone Partners, LLC

Flexstone Partners, LLC is a Delaware corporation, registered with the United States Securities and Exchange Commission as an investment adviser. It is located on the 28th floor of 745 Fifth Avenue

New York, NY 10151.

Flexstone Partners PTE Ltd.

61 Robinson Road, #08-01A Robinson Centre

Singapore 068893

Natixis Investment Managers

RCS Paris 453 952 681

Share Capital: €178 251 690

43 avenue Pierre Mendès France

75013 Paris

www.im.natixis.com

How to Eradicate the J-Curve in Private Equity?

How to Eradicate the J-Curve in Private Equity?

Hop Aboard the US Growth Engine

Hop Aboard the US Growth Engine

The Five Myths of “Illiquids”

The Five Myths of “Illiquids”