Including Alternatives Strategies in a Portfolio Can Help to Improve Performance Whilst Reducing Risk

The Portfolio Research & Consulting Group at Natixis Global Asset Management provides fully independent analyses of private and institutional investor portfolios, identifying sources of performance, risk concentration and diversification. In doing so, the group has highlighted the major contribution of alternative strategies.

Key Takeaways:

- The Portfolio Research & Consulting Group offers a completely free and personalized service, independent of the services offered by the sales and fund management teams.

- The Durable Portfolio Construction® approach is based on a number of principles, including the prioritization of risk management, improved diversification and the implementation of alternative investment strategies.

- Overlaying similar types of investment exposure is not synonymous with diversification.

- Alternative strategies may contribute additional sources of performance whilst reducing a portfolio’s average risk.

Overlaying similar types of investment exposure is not synonymous with diversification

This is why the Portfolio Research & Consulting Group established by Natixis Global Asset Management in the US in 2011, then in London in 2013, has the very specific role of providing in-depth portfolio analysis for investors, be they private or institutional (financial advisors, private banks, family offices, but also increasingly, retirement funds, insurance companies and pension funds). Its aim is not to make investment recommendations, but to study portfolio composition from the joint perspective of risk management and diversification, thus identifying risk concentration, analysing underlying securities and funds, applying stress tests and ranking the various performance contributors. Often the real degree of diversification in a portfolio is not as expected. Combining several funds, which aim to generate alpha in the same asset classes, leads to an overlay of similar exposures (e.g., in French small- and mid-caps) and not increased diversification. Similarly, an institutional portfolio often exhibits risk well below that of its benchmark (in terms of VaR or maximum drawdown): excessive caution, indicating incomplete appreciation of the sources of performance.

With a variety of academic and professional profiles, from risk management, fund management and quantitative analysis backgrounds, the thirty-six professionals making up the Portfolio Research & Consulting Group team (25 in Boston and 11 in London) offer a completely free and personalized service, independent of the services offered by the sales and fund management teams of the company’s affiliated asset managers. They aim to clarify investment processes for clients, so that investors can freely and in full confidence share their views on the impact of including securities, structured products, derivatives, currencies, ETF and competitor funds in their portfolios with these experts. Ultimately, this analysis either validates or invalidates investors’ beliefs about their risk exposure while revealing the truth about the sources of performance in a portfolio. This analysis can also be made in the context of the regulatory (Solvency II) and accounting constraints of certain institutions.

Using alternative strategies to contribute additional sources of performance whilst reducing a portfolio’s average risk

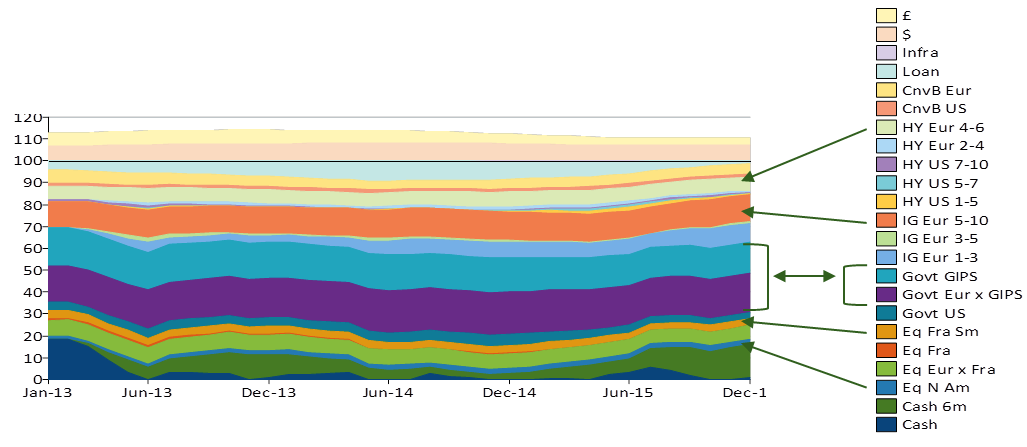

With data accumulated from five years worth of analyses of a large number of portfolios from across the world (4,500 in 2015 globally), the Portfolio Research & Consulting Group is able to make highly astute and contextualised comparisons between portfolios, while ranking the analysed elements. This process highlights the paramount importance of including non-traditional strategies, either liquid or illiquid, which can generate additional sources of performance whilst reducing the portfolio’s average risk. Comparisons of the weightings of the various positions in a portfolio can highlight extremely disproportionate contributions to performance and risk (as the chart below shows).

Natixis Global Asset Management. Analysis of a typical institutional portfolio between January 2013 and December 2015.

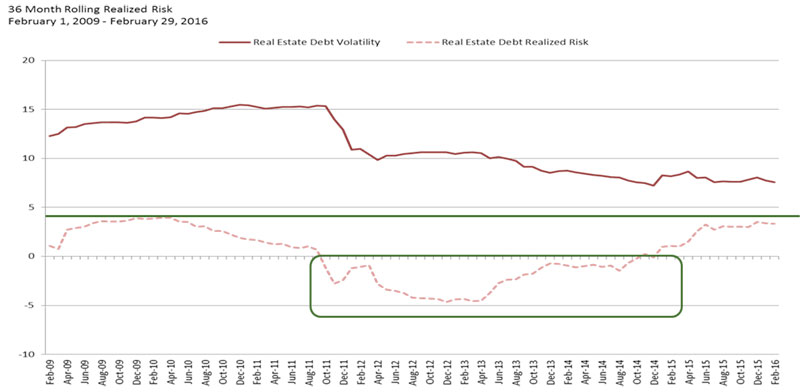

This is typically the case with Commercial Real Estate Debt as the chart below illustrates. Although Commercial Real Estate Debt’s volatility peaked to more than 15% on its own, when added to a typical institutional portfolio, its consistently low correlation with the institutional portfolio since 2006 means that the strategy would have even reduced the portfolio’s overall risk between August 2011 to February 2015.

Source: Natixis Global Asset Management. Based on the analysis of a typical institutional portfolio between February 2006 and March 2016, with Real Estate Debt represented by the DJ Global Select Real Estate Securities Corporate Bond Index.

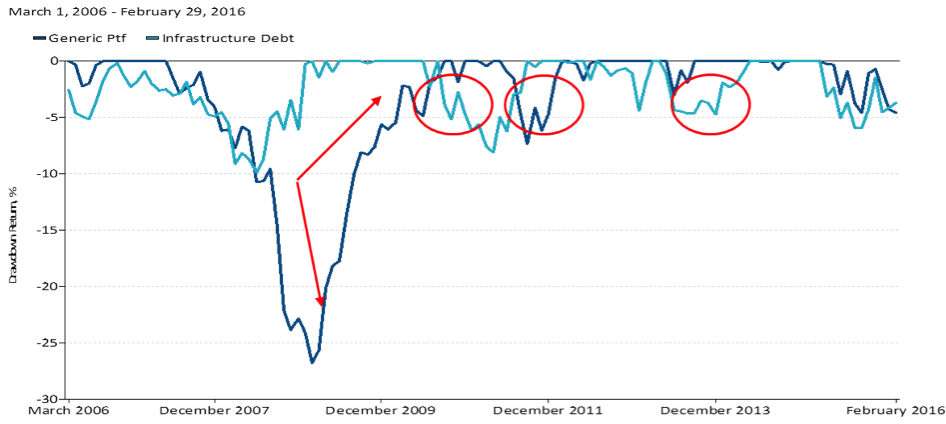

Source: Natixis Global Asset Management, March 2016. Infrastructure Debt represented by the MS Global Bond Infrastructure GR EUR.

Published in April 2016

NATIXIS GLOBAL ASSET MANAGEMENT S.A.

2, rue Jean Monnet,

L-2180 Luxembourg,

Grand Duchy of Luxembourg.

im.natixis.com

This communication is for information only and is intended for investment service providers or other Professional Clients. The analyses and opinions referenced herein represent the subjective views of the author as referenced unless stated otherwise and are subject to change. There can be no assurance that developments will transpire as may be forecasted in this material.

Copyright © 2016 NATIXIS GLOBAL ASSET MANAGEMENT S.A. – All rights reserved

2015 Global Survey of Institutional Investors

2015 Global Survey of Institutional Investors

Private Assets: Making the Retail Revolution a Reality

Private Assets: Making the Retail Revolution a Reality

LTAF Masterclass: Embracing Private Markets in DC Pensions

LTAF Masterclass: Embracing Private Markets in DC Pensions

Is it a Good Time for Subordinated Debt?

Is it a Good Time for Subordinated Debt?