Absolute Return Bonds? Absolutely.

Highlights

- Investors who survived 2022 unscathed typically had a core fixed income allocation which could take advantage of both rising and falling rates.

- DNCA Finance’s absolute return approach has a negative correlation with classic fixed income portfolios, making it a complementary component within a core fixed income bucket.

- Combining a quant model with discretionary macro provides usually more stability in alpha generation in our view. The combination tends to provide better risk-reward profile than core fixed income portfolios, and lower volatility.

Resources

The investors who survived unscathed typically had a core fixed income allocation which was focused on absolute return approaches. That is, approaches that can take advantage of both rising and falling rates.

Arbitraging highly-liquid fixed income assets

The absolute return approach of DNCA Finance, an affiliate of Natixis Investment Managers, traces its roots back to the last major bonds crisis, which erupted in Europe in the aftermath of the Great Financial Crisis.

“We had been investing in government bonds for a long time and it became clear to us of the importance of managing bonds in a way that had little or no correlation to markets,” says François Collet, portfolio manager and deputy CIO at DNCA Finance.

DNCA Finance selects assets from the entire spectrum of liquid fixed income securities and arbitrages between them depending on the assessment of value at any given time. The emphasis is on asset allocation, as opposed to security selection, with a particular focus on finding value in government bonds – including inflation-linked bonds.

DNCA Finance does not invest in ABS or CLOs, and is cautious about credit too. “We are very conservative,” says Collet. “The volatility of credit is much higher than government bonds, so credit markets are too unstable for a low risk profile absolute return portfolio.”

The volatility of high yield, he notes, can vary between 10% and 2% from year to year. Collet says: “This means you potentially face five times the risk this year compared to last year. That doesn’t happen in government bonds, where it’s easier to calibrate risk.”

The emphasis on government bonds also plays to the strengths of the three principal portfolio managers (Collet, Pascal Gilbert and Fabien Georges) at DNCA Finance, who have traded government bonds for a combined 72 years.

Another advantage of investing in government bonds is they are highly liquid, which gives DNCA Finance the flexibility to change course swiftly and at relatively low cost. Liquidity proves its worth when markets alter their course rapidly.

Macro and quant in tandem

The asset allocation of Collet and his colleagues is the output of a process that allies macro views with a quant process. Even Central Banks can get the macro outlook wrong, so the DNCA Finance team prefers to second-guess its predictions, combining discretionary views with a quant process. “This combination is our competitive edge in this market,” says Collet. “Our quant process has almost never disappointed us in 10 years of using it.”

The discretionary component harnesses the experience and knowledge of the three portfolio managers and relies on four pillars of research and analysis: growth, inflation, monetary policy and fiscal policy.

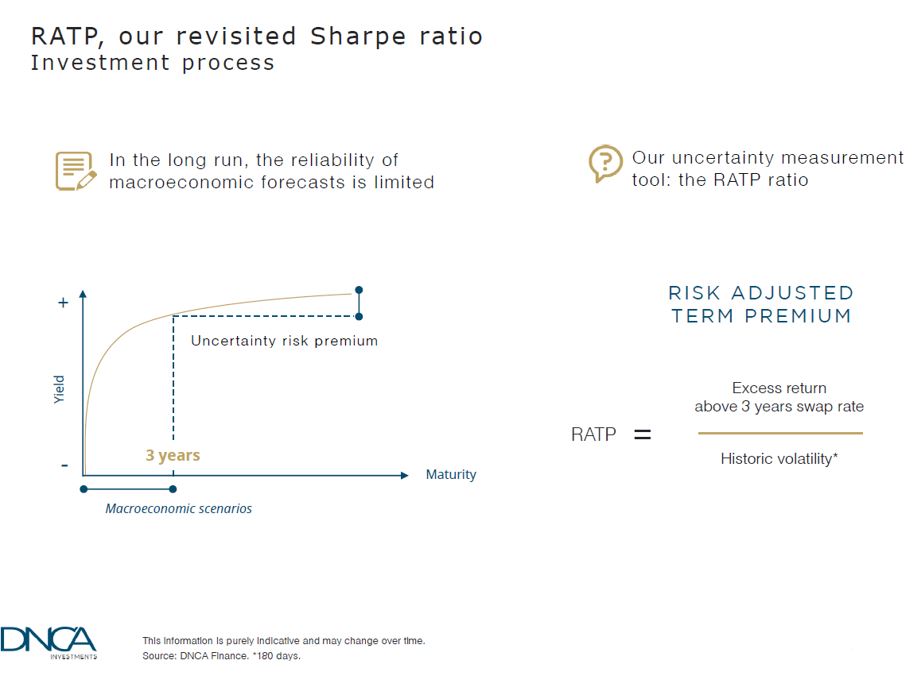

The quant analysis is performed by an uncertainty measurement tool, known as the RATP (Risk Adjusted Term Premium). The RATP is DNCA Finance’s revisited sharpe ratio, and is used to assess the attractiveness of duration risk premium, inflation, foreign exchange and other key measures of value.

The key difference between the RATP model and the classic sharpe ratio is that the RATP has a horizon of more than three years. “Monetary policy expectations only go out three years,” says Collet. “It was evident to us that no-one has a clue about the macro environment beyond that horizon. This is where the model comes into its own.”

The model has reliably harvested the long-term uncertainty risk premium (see below) since the team started to use it more than a decade ago.

Only if the team’s discretionary views and the model’s output are in synch will a position be adopted. If there is a divergence of views, the trade is abandoned.

Collet says: “Combining our quant model with macro insights means we are neither simply macro discretionary nor a quant manager. We are both, and that gives us more stability in alpha generation.”

Given that many potential trades are eschewed, focusing on a single geographic area would limit the potential of the approach. For this reason, DNCA Finance considers the full universe of bonds, across both developed and emerging markets. “The wider the universe, the more opportunities you have and the more stable the performance,” Collet adds.

Nimble approach was productive in 2022, an extraordinary year

Thanks to its macro/quant integration, DNCA Finance was able to take a net short duration position at the start of 2022 amid expensive valuations, rapidly-rising inflation and fast-moving monetary policy expectations. The short position turned out to be the main contributor to performance in 2022.

In the wake of the rate hiking cycle during 2022, DNCA is no longer net short duration, but it is not yet bullish on long-term rates either. In in the first quarter of 2023, it sees no reason to buy long-term bonds, and its main exposure is to real rates rather than nominal rates.

It does see value in emerging markets, where Central Banks were quicker to raise rates amid the pandemic, creating tailwinds for emerging market currencies. In fact, the RATP is currently signalling that remuneration of currency risk is the most appealing risk in the fixed income space.

“We have built a basket of currencies on the basis that you can get 8.5% of carry for just 5% volatility,” says Collet. “Of course, this is a high beta approach and we have strict risk limits.”

Sudden reversals of economic momentum can test the team. Recent examples of reversals include summer 2019, the start of the pandemic and summer 2022. All led to drawdowns.

Collet says: “We don’t change our views from day to day, it takes time for us to have sufficient data to be convinced of a shift. But as we are cautious in our positions, we are hardly or rarely forced sellers. All our drawdowns have been fully recovered within a few months.”

Decision-making is helped by the compactness of the DNCA Finance team. “There are three of us, all with strong economic backgrounds, which creates a straightforward decision-making process,” says Collet. This is advantageous compared with large teams, where dozens of portfolio managers contribute their views at monthly committees. “Large structures can mean value is lost before you are able to shift position in the market,” says Collet.

Low correlation, low volatility

The approach has a low correlation according to our assessment with core fixed income portfolios, making it a valuable component of a core fixed income bucket.

DNCA Finance’s investors range from ultra-cautious insurers to more risk-seeking endowments and family offices, so the team tailors portfolios according to the desired levels of risk and return, geographical areas, asset class limits, and so on.

Collet says: “We can manage to whatever the client wants, but we won’t increase risk and volatility too high. We are at heart conservative investors and there are limits to what we will do.”

Outperformance versus classic fixed income indices is likely to be less spectacular in 2023 given that core fixed income was down 10%–20% in 2022. However, with money market rates rising, overall returns should be similar to 2022 and with lower risk and lower volatility than classic fixed income in our view.

Target returns are money market rates plus 200bps net of fees, and with volatility of less than 5% in normal market conditions. “The idea is seeking to offer a better risk-reward profile than core fixed income portfolios,” says Collet.

Published in March 2023

Affiliate of Natixis Investment Managers.

DNCA has been approved as a portfolio management company by the French Financial Market Authority

(Autorité des Marchés Financiers) under number GP00-030 since 18 August 2000.

19, place Vendôme 75001 Paris, France.

www.dnca-investments.com

Natixis Investment Managers

RCS Paris 453 952 681

Share Capital: €178 251 690

43 avenue Pierre Mendès France

75013 Paris

www.im.natixis.com

This communication is for information only and is intended for investment service providers or other Professional Clients. The analyses and opinions referenced herein represent the subjective views of the author as referenced unless stated otherwise and are subject to change. There can be no assurance that developments will transpire as may be forecasted in this material.

Copyright © 2023 Natixis Investment Managers S.A. – All rights reserved

Value And Growth: Two Sides Of The Same Coin?

Value And Growth: Two Sides Of The Same Coin?

Value vs Growth

Value vs Growth

Loomis Sayles - Investment Outlook - April 2024

Loomis Sayles - Investment Outlook - April 2024

Natixis IM Solutions - Market Review - March 2024

Natixis IM Solutions - Market Review - March 2024