A White Knight for Green Investing

Highlights

- Until now, governments and public entities have led the charge towards regulation and governance of ESG practices. It is now up to the industry to seize the agenda and genuinely add value for investors.

- The recently-launched Global ESG Disclosure Standards for Investment Products – launched by CFA Institute with input from Natixis – aim to standardise the information communicated by investment managers about their products.

- As adoption among investment firms increases, the new standards will provide an industry-led solution to a problem which has concerned investors for too long.

Resources

This ongoing lack of clarity heightens fears among investors of greenwashing.

Communication, not classification

Many investors are aware of ESG risks and seek information that helps them to manage this risk. In addition, investors increasingly seek to align their investments with their values.

It is difficult, however, for investors to understand, evaluate, and compare ESG approaches used in investment products because ESG disclosures are often incomplete, inconsistent, unclear, or difficult to access. “There is a lack of clarity on products across the board,” says Chris Fidler, a senior director in the Global Industry Standards team at CFA Institute.

This includes how ESG considerations are implemented, the terminology to describe it, the role of engagement and stewardship, proxy voting and evidence required to support claims of ESG considerations.

The inadequacies of current ESG disclosures have resulted in allegations of greenwashing, whereby marketing materials intentionally or inadvertently mislead investors about the ESG approaches used.

Take, for example, the terminology around impacting investing. “Impact as a term is in vogue,” says Fidler. “But does your product really have impact? Or is the term being used because it appears to show passion?”

Fidler believes the term is used indiscriminately and should be reserved for strategies which genuinely employ the philosophy and tools to make a tangible real-world difference. “What we are looking for via the standards is to get away from marketing and back to plain language,” Fidler adds. That may mean more words and a less eye-catching turn-of-phrase, but the strategy will be clearer to investors.

Regulators have tried to address greenwashing, but regulation has not always helped investors make informed choices. In the case of the EU’s Sustainable Finance Disclosure Regulation regulation, the rules have led to a race to achieve high ESG rankings, rather than to explain strategies to investors or improve ESG activities.

Standards are applicable to all asset classes and markets

The Global ESG Disclosure Standards for Investment Products, launched in November 2021, aims to fill the gap left by regulators. “It’s the first global standard for how fund managers communicate about ESG in their products,” says Fidler.

The standards avoid prescription, putting the onus on investment managers to fully and fairly explain their ESG efforts to investors.

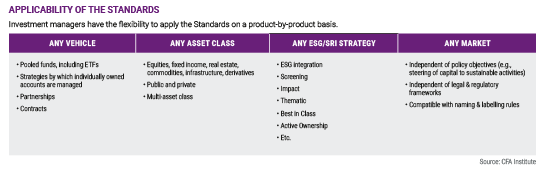

To enable the whole investment industry to adopt the standards, they can be applied to any vehicle, any asset class, any ESG strategy and in any market globally.

“Let’s be very clear what is being standardised here,” says Fidler. “It’s not the products themselves – the standards in no way restrict the types of products that managers can offer.” Instead, the standards aim to standardise the information communicated by investment managers about their products. “Everyone has their own processes, values and acronyms,” says Fidler. “We are saying, whatever you do and however you do it, communicate it clearly.”

Working with regulation, not against it

The standards are designed to work in tandem with existing national and regional regulations governing ESG products. This makes implementation of the standards friction free and relatively easy to apply.

“We view the standards as complementary to regulation,” says Fidler. “But we differ from regulation in that our sole aim is to create a level playing field and transparency.” This contrasts with the aims of some legislation or regulation, which can have a political aspect. SFDR for instance, is designed to improve transparency, but also has the politically-driven ambition to help transition Europe to a more sustainable economy.

“Our aim, as a standard setter in the investment profession, is to help investors understand how a product is put together,” Fidler adds. “We help develop best practices from a purely investor-centric and ethical viewpoint.”

The standards can help support the development of local regulations and identify under-researched areas relating to investor protection. Furthermore, when regulators are launching ESG disclosures rules, CFA Institute can provide input to help shape these rules, including by establishing principles aligned with the standards.

As big as GIPS?

Like the massively successful GIPS standards, which the CFA Institute launched in 1999 and are now a global standard for performance reporting, the Global ESG Disclosure Standards for Investment Products are voluntary.

Disclosures can be examined by third-party assurance providers but, to make sure that smaller investment houses and investment firms in some emerging markets are not disadvantaged, external examination is not mandatory.

The standards help by minimising the risk of greenwashing by clearly communicating products’ ESG objectives to clients, and also to sales teams, internal control and support functions. The standards will help to drive Natixis IM’s research, develop its range of sustainable solutions and support clients on their ESG journeys.

A recent initiative has been to establish a data governance group, which assesses ESG data needs for Natixis products. Natixis IM has also conducted global sales listening tours to understand market trends and investor needs, and offered climate transition training to all employees.

Investment industry steps up

In recent years, governments and public entities have led the charge towards regulation and governance of ESG practices. They have got the ball rolling. It is now up to the industry to seize the agenda and genuinely add value for investors.

Published in February 2023

RCS Paris 453 952 681

Share Capital: €178 251 690

43 avenue Pierre Mendès France

75013 Paris

www.im.natixis.com

This communication is for information only and is intended for investment service providers or other Professional Clients. The analyses and opinions referenced herein represent the subjective views of the author as referenced unless stated otherwise and are subject to change. There can be no assurance that developments will transpire as may be forecasted in this material.

Copyright © 2023 Natixis Investment Managers S.A. – All rights reserved

What Investors Should Know About SFDR

What Investors Should Know About SFDR

Real Estate: Investors Seek Smarter ESG

Real Estate: Investors Seek Smarter ESG